Aetna generally offers these Medicare Supplement Insurance plans for any Medicare member: Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

- Medicare Advantage HMO plans. ...

- Medicare Advantage HMO-POS plans. ...

- Medicare Advantage PPO plans. ...

- Medicare Advantage Dual Special Needs plans (D-SNP)

What Medicare plans does Aetna offer?

Oct 01, 2021 · A reliable way to limit your out-of-pocket costs. Medicare provides you with coverage for health-related expenses, but it doesn’t cover everything. There may be some gaps in Medicare coverage. A Medicare Supplement Insurance plan can help you with out-of-pocket …

What are the different types of Medicare supplement insurance plans?

Mar 11, 2022 · Aetna generally offers Medigap Plan A, Plan B, Plan G and Plan N for all Medicare members, plus Plan F for those who qualify. Some states have additional options. For popular plans like Plan G and...

What is the best Medicare supplement insurance plan in 2021?

Oct 01, 2021 · The following plans are available to all applicants: Plan A; Plan B; Plan D; Plan G* Plan N * High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid. The following plans are available only to those who are first eligible for …

Do I have to pay Part B for Aetna Medicare Advantage plans?

May 04, 2022 · Aetna sells seven of the 10 types of Medicare Supplement Insurance plans available in most states. Each Medigap plan is referred to by a plan letter. ... However, each …

Which Medicare supplement plan has the highest level of coverage?

What is Aetna plan G?

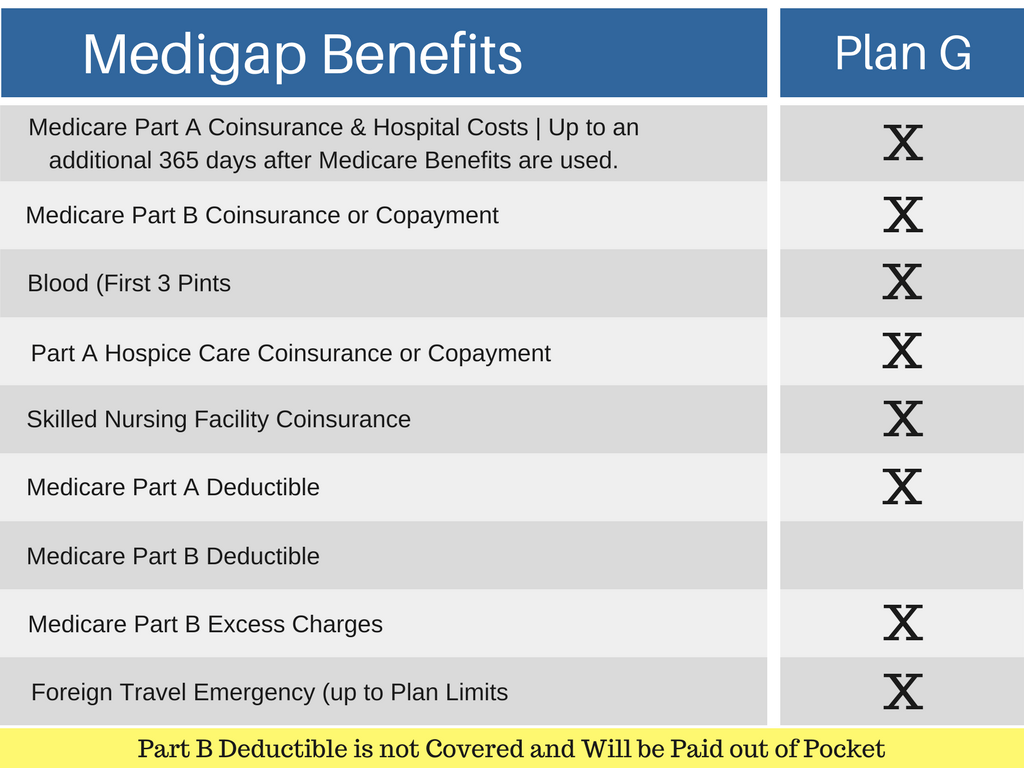

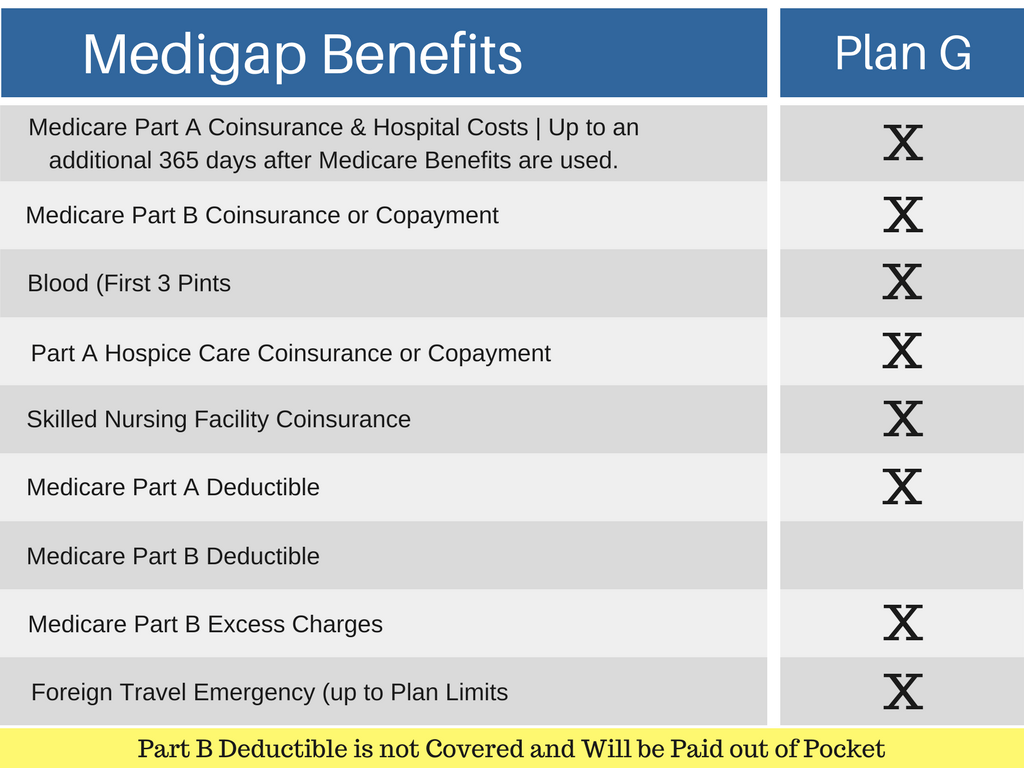

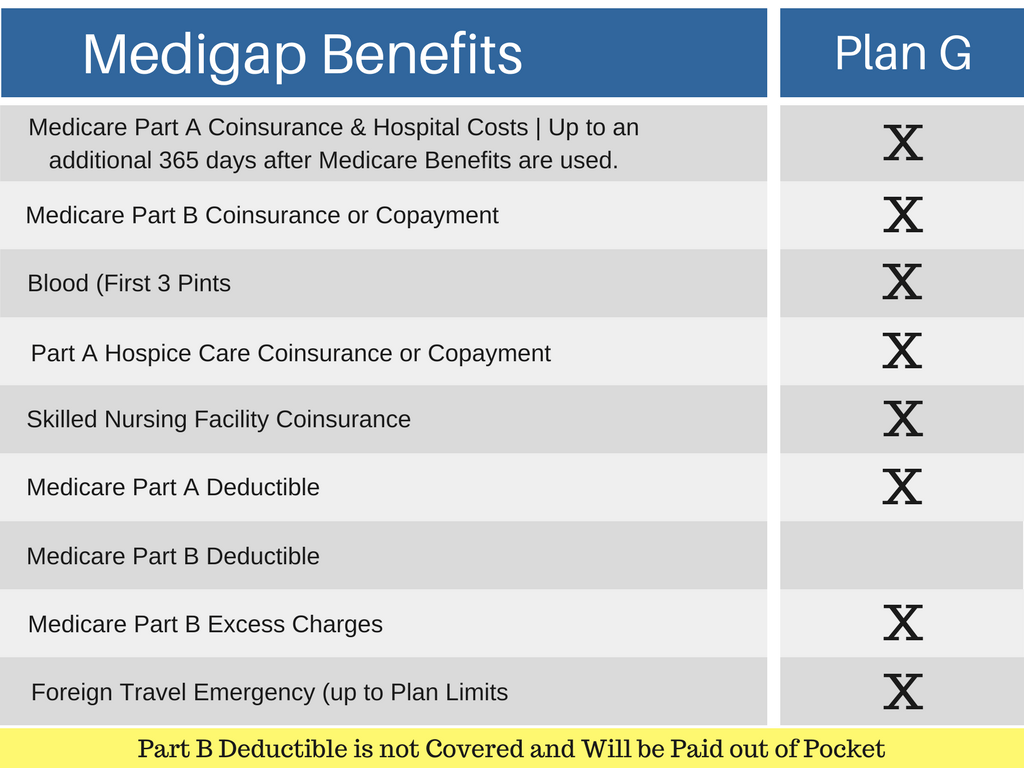

This plan is perfect for those looking for great coverage that won't break the bank with monthly premium costs. On Medigap Plan G, you pay the Medicare Part B deductible yourself, and then Medigap Plan G covers the rest.Feb 9, 2022

Does Aetna have a supplement plan?

Aetna offers five Medigap plans, including Plan A, Plan B, Plan F, Plan G, and Plan N. A high-deductible version of Plan F is available in some ZIP codes.

What Medicare supplement plans are no longer available?

What is Plan F Medicare supplement?

What is Plan N Medicare supplement?

Is Aetna Medicare the same as Medicare?

How much do Medigap plans increase each year?

The average Medicare Supplement Plan G rate increase can average between 2%-6% annually. It's important to discuss with your licensed Medicare agent the rate increase history for the carrier with which you choose to enroll.Feb 4, 2022

What is Aetna accendo?

What is the difference between Plan F and Plan G?

Why is Plan F being discontinued?

Why do doctors not like Medicare Advantage plans?

Medicare Supplement Insurance has you covered

Your coverage can’t be changed or canceled when you move anywhere within the United States, as long as you pay your premiums on time.

A variety of plans to choose

There are many different Medicare Supplement Insurance plans, so it’s important to understand what each plan covers and how federal law affects your eligibility.

See an outline of coverage

Select your state to view a PDF summary of Medicare Supplement coverage.

Does Aetna offer Medicare?

Aetna offers affordable supplement plans for Medicare subscribers. Aside from affordability Aetna promotes wellness and health within communities by offering grant programs and through the support of non-profit organizations. They are considered top tier within the Medicare Supplement market.

Is Medicare Supplement Plan a good option?

With Medicare, you may feel as though you are paying more out-of-pocket expenses than you initially thought you would be. To help cover these costs, a Medicare Supplement plan can be a great option.

Does Medicare cover Plan G?

Plan G covers all additional expenses Medicare does not, with the exception of the deductible paid by Part B beneficiaries. With Plan F unavailable new enrollees, Plan G is a popular replacement option for people who opt for supplemental coverage.

Is Plan N still popular?

The popularity of Plan N has risen so far in 2020 and is expected to become even more popular. The popularity of this plan is in part due to low monthly premiums and sought-after benefits.

Does Aetna have Medicare?

As a Medicare beneficiary, you may have many coverage options available to you through Aetna, including Medicare Advantage plans for those who want an alternative way to receive their benefits under Original Medicare (Part A and Part B) and stand-alone Medicare Prescription Drug Plans (Part D). Medicare Supplement (Medigap) plans are also available ...

Does Aetna have Medicare Advantage?

Aetna Medicare Advantage plans. As mentioned, Medicare Advantage plans are another way for you to get your Part A and Part B benefits. However, instead of getting your Medicare benefits through the federal program, you’ll get them directly through your Medicare Advantage plan.

What is Medicare Supplement?

Medicare Supplement (Medigap) plans are also available for those who are looking for coverage to supplement their Original Medicare benefits. Here’s a look at some of the Aetna Medicare plans you may be eligible for in your area.

Who does Medicare contract with?

Original Medicare is administered by the federal government, but Medicare contracts with private insurance companies like A etna to offer Medicare Advantage and Medicare Part D Prescription Drug Plans.

Does Medicare cover prescription drugs?

Medicare Prescription Drug Plans are meant to work alongside Original Medicare to help with prescription drug costs; they aren’t meant to provide stand-alone coverage. You’ll need to stay enrolled in Original Medicare for your hospital and medical coverage.

Does Aetna have a prescription drug plan?

If you’re enrolled in Original Medicare, you may also be eligible to enroll in a stand-alone Aetna Medicare Part D Prescription Drug Plan for prescription drug coverage to supplement your Part A and Part B benefits. These plans also require a separate monthly premium in addition to your Part B payment.

What is an HMO plan?

Depending on where you live, you may be eligible to enroll in one of the following types of Aetna Medicare Advantage plans: Aetna MedicareAdvantage Health Maintenance Organization (HMO) plans, which use a network of providers to lower costs and require a referral from your primary care doctor for specialist care.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.

Which Supplemental Medicare Plans Does Aetna Sell in Montana?

Aetna Health and Life Insurance Co offers 6 different Medigap plans in Montana . Each plan covers the gaps in Original Medicare#N#Original Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage.

REVIEW: Aetna Medicare Supplements in Montana

Aetna scored 3.0 out of 5.0 based on our scoring method. Aetna has a good financial rating from A.M.

Aetna Medicare Supplement Plan F Compared to Top Ten

Medicare Supplement F is the most popular plan sold in Montana. The following table shows how Aetna stacks up with the competition.

Contact Aetna Medigap Sales

For more information about this Medicare Supplement carrier, and other plans on this site, call 1-855-728-0510 (TTY 711). You may also start your Medicare Supplement enrollment online. You can contact the plan directly at:

Eligibility

Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care....

Availability

Aetna services Medicare supplement insurance in Billings, Missoula, Great Falls, Bozeman, Butte, Helena, and most other Montana cities.