The different parts of Medicare help cover specific services:

- Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

- Medicare Part D (prescription drug coverage) Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

How to Choose Medicare benefits?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

What benefits are covered by Medicare?

Medicare Part B provides coverage and benefits related to general medical care from doctors such as checkups, exams, and necessary durable medical equipment. In addition to the full coverage Medicare Part A and B provide, individuals can enroll in Medicare Part D and take advantage of the programs prescription drug benefits.

What are the benefits of traditional Medicare?

- Part A covers hospital care (hospital care, skilled nursing facility care, home health care and hospice care)

- Part B covers medical insurance (e.g. doctor visits, medical equipment, outpatient procedures, home health care, lab tests, x-rays, ambulance services and some preventive services). ...

- Part D provides outpatient prescription drug coverage. ...

Which Medicare plan is best for me?

- Medicare Advantage, also known as Part C is an alternative to Original Medicare.

- Medicare Advantage is run by private Medicare-approved insurance companies.

- Medicare Advantage is a bundle of Original Medicare, but provides more benefits than just Part A, Part B, and Part D (most plans), such as dental, hearing and vision, which ...

What type of benefits does Medicare provide?

Many Medicare Advantage plans offer the following benefits:hospitalization.some home healthcare services.hospice care.doctor's visits.prescription drug coverage.preventive care.dental.vision.More items...

What three types of coverage are provided by Medicare?

The different parts of Medicare help cover specific services:Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.Medicare Part B (Medical Insurance) ... Medicare Part D (prescription drug coverage)

What are the five types of Medicare plans?

Medicare Advantage Plans: HMO, PPO, Private Fee-for-Service, Special Needs Plans, HMO Point of Service Plans, Medical Savings Account Plans.

What are two types of coverage provided by Medicare?

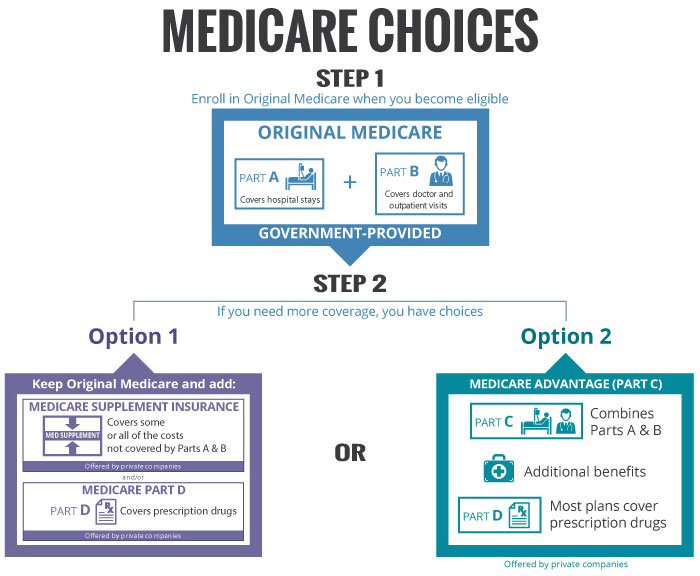

Your Medicare coverage choices Learn about the 2 main ways to get your Medicare coverage — Original Medicare or a Medicare Advantage Plan (Part C).

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What's the difference between Medicare Part A and Part B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

What is Medicare A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Which type of care is not covered by Medicare?

does not cover: Routine dental exams, most dental care or dentures. Routine eye exams, eyeglasses or contacts. Hearing aids or related exams or services.

Does Medicare pay for everything?

In general, Medicare does not cover long-term care. There are insurance policies that cover it, although they can be pricey. And the older you are, the more they cost.

What is the benefit of Medicare?

One of the primary benefits of Medicare as a social program is that the financial risk is distributed across the working population. This means that the nation as a whole assumes financial risk for factors that might raise someone’s premiums substantially.

How much does an employer pay for Medicare?

For people who work for an employer, the employer pays half of the Medicare tax while the worker pays the other half. The Medicare tax rate is 2.9 percent, which means that an employer pays 1.45 percent while the remaining 1.45 percent is deducted from the employee’s wages.

What is HMO in healthcare?

Lawmakers approved the cooperation between Medicare and health maintenance organizations (HMOs). HMOs act as liaisons between healthcare providers and beneficiaries. People who subscribe to HMO plans usually have to go to a select list of providers that has been approved by the HMO administrators.

How long did it take for Medicare to become law?

However, the path to Medicare wasn’t always smooth sailing. A bill for socialized healthcare was first introduced in 1957, and it took eight years for Medicare to become law. The Johnson administration and lawmakers at the time debated extensively on the concept.

What changes have affected Medicare?

One of the changes that had the biggest impact on Medicare was the decision to include people with certain disabilities as beneficiaries of the program. People with end-stage renal disease (ESRD) or Lou Gehrig’s disease can receive Medicare benefits if they also receive Social Security Disability Insurance.

How is Medicare funded?

While Medicare is funded primarily through taxes, there are actually several sources of funding. It’s important to understand the financing behind Medicare because the future of the program largely depends on continued funding from individual taxes and other sources. Social programs only succeed in light of their perceived benefit versus the amount of money it takes to sustain them. These programs fail when they lose financial and moral support. In this section, we’ll give you a basic overview of how Medicare is funded so that you’re familiar with its impact on the economy and the healthcare industry as a whole.

What is Medicare's coverage for speech therapy?

These forms of care help seniors, particularly those with disabilities, to achieve alternate forms of medical treatments.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What age does Medicare cover?

Medicare provides healthcare coverage to people over age 65 and those with disabilities or certain health conditions . This complex program has many parts, and it involves the federal government and private insurers working together to offer a wide variety of services and products.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) is a private insurance product that gives you all the coverage of Medicare parts A and B, plus extra services. Most of these plans offer prescription coverage in addition to inpatient and outpatient services. Benefits like dental and vision coverage can be added too.

What is a Medigap plan?

Coverage. Plan A. Medicare Part A coinsurance and the costs of 365 days’ worth of care after Medicare benefits are exhausted, Part B coinsurance or copayments, the first 3 pints of a blood transfusion, and hospice care coinsurance or copayments. Plan B.

How much will Medicare cost in 2021?

Under Medicare Part B, you can expect to pay the following costs in 2021: a premium of at least $148.50 per month (this amount increases if your individual income is above $88,000 per year or $176,000 per year for married couples) a $203 deductible for the year.

How much is coinsurance for a 61 day stay?

a $1,484 deductible for each benefit period. daily coinsurance costs based on the the length of your inpatient stay: $0 for days 1 to 60, $371 per day for days 61 to 90, and $742 per day for days 91 and beyond.

Does Medicare cover outpatient prescriptions?

some outpatient prescription medications. To be sure Medicare Part B covers your appointment, service, or medical equipment, ask if your doctor or service provider accepts Medicare. You can also use the Medicare coverage tool to determine whether your appointment or service is covered.

Is Medicare Advantage a private insurance?

Premiums and copayments apply, but they’re usually income-based and may be subsidized. Medicare Advantage (Part C) plans are private insurance plans. These plans combine multiple elements of Medicare, like parts A and B , with other services, such as prescription, dental, and vision coverage.

The Four Types of Medicare

While this process may seem overwhelming at first, the most important first question to ask is: What are the four types of Medicare? Here is a quick breakdown of Medicare the various coverage options available:

What Does Medicare Part A Cover?

Original Medicare coverage is regulated according to federal and state laws. As such, when you enroll in Medicare, you automatically receive Medicare Part A. There typically is not a monthly premium for this coverage, but you likely will have a deductible.

What Does Medicare Part B Cover?

The second component of Original Medicare is Medicare Part B. Just like with Part A, recipients automatically receive Medicare Part B coverage as soon as they enroll in Medicare. Recipients will, however, pay Part B premiums monthly.

What Does Medicare Part C Cover?

Medicare Part C, or Medicare Advantage, offers the same coverage as Original Medicare, but bundles the covered benefits with additional services. Medicare Advantage plans are available through private health insurance companies, which means that specific coverage varies.

What Does Medicare Part D Cover?

Medicare Part D is a prescription drug plan that is available to anyone with Medicare. These plans are offered through private insurance companies. Beneficiaries can enroll in a standalone Part D plan with Original Medicare, or obtain drug coverage through Medicare Advantage plans.

How Do You Choose a Medicare Plan?

As with any healthcare decision, your final choice ultimately will be determined by finding the best option to suit your individual needs. When comparing Medicare options, it is important to consider a range of factors, including premiums, out-of-pocket costs, provider availability, referrals and extra benefits.

Does Medicare pay for health care?

Under Original Medicare, the government pays directly for the health care services you receive . You can see any doctor and hospital that takes Medicare (and most do) anywhere in the country. In Original Medicare: You go directly to the doctor or hospital when you need care.

Does Medicare Advantage have network restrictions?

On the other hand, Medicare Advantage Plans typically have network restrictions, meaning that you will likely be more limited in your choice of doctors and hospitals.

Does Medicare Advantage Plan cover Part A?

Each Medicare Advantage Plan must provide all Part A and Part B services covered by Original Medicare, but they can do so with different rules, costs, and restrictions that can affect how and when you receive care. It is important to understand your Medicare coverage choices and to pick your coverage carefully.

Do you have to pay coinsurance for Medicare?

You typically pay a coinsurance for each service you receive. There are limits on the amounts that doctors and hospitals can charge for your care. If you want prescription drug coverage with Original Medicare, in most cases you will need to actively choose and join a stand-alone Medicare private drug plan (PDP).

Medicare Advantage (Part C)

You pay for services as you get them. When you get a covered service, Medicare pays part of the cost and you pay your share.

You can add

You join a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

Most plans include

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services)

Medicare drug coverage (Part D)

If you chose Original Medicare and want to add drug coverage, you can join a separate Medicare drug plan. Medicare drug coverage is optional. It’s available to everyone with Medicare.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.