The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, increases to 7.65 percent for 2012. The information in the following table shows the changes in Social Security and Medicare withholding limits from 2011 to 2012. The new limits are effective January 1, 2012.

How much did Medicare premiums increase in 2012?

Nov 17, 2011 · The maximum limit is changed from last year. The Social Security Tax Rate is 6.2 percent. The tax rate is also changed from last year. The resulting maximum Social Security Tax for 2012 is $6,826.20. There is still no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax. The Medicare Tax Rate applies to all taxable wages and remains at …

What are the 2012 Social Security and Medicare tax withholding limits?

Jun 13, 2021 · The Social Security tax (OASDI) rate is 4.2 percent for employees and 6.2 percent for employers. For self-employed individuals, the Social Security tax rate is 10.4 percent (since they are liable for both portions) The employee Social Security tax rate of 4.2 percent is only temporary and will return to 6.2 percent in 2012 unless a proposed extension is approved.

How much will Medicare Part B cost in 2012?

Oct 27, 2011 · The standard Medicare Part B monthly premium will be $99.90 in 2012, a $15.50 decrease over the 2011 premium of $115.40. However, most Medicare beneficiaries were held harmless in 2011 and paid $96.40 per month.

What is the current tax rate for Social Security and Medicare?

Estimated Average Monthly Social Security Benefits Payable in January 2012: All Retired Workers Aged Couple, Both Receiving Benefits Before 3.6% COLA $1,186 $1,925 Widowed Mother and Two Children $2,455 Aged Widow(er) Alone Disabled Worker, Spouse andOne or More Children All Disabled Workers $1,143 $1,826 $ 1,072 After

What was the Social Security tax rate in 2012?

What was average Social Security check in 2014?

But on average, monthly retirement payments will rise from $1,275 to $1,294, an increase of $19, Social Security says. Disabled workers will receive an average of $17 more a month, while the average widowed mother with two children will see her benefits grow by $39 a month.

What percentage is Social Security and Medicare tax?

What was the maximum Social Security benefit in 2012?

$2,513/mo.

What was the average Social Security check in 1975?

| Year | Retired workers | Disabled workers |

|---|---|---|

| Total | Total | |

| 1970 | 123.82 | 139.79 |

| 1975 2 | 196.42 | 220.60 |

| 1980 2 | 321.10 | 352.10 |

How much Social Security will I get if I make 60000 a year?

When was the last time Social Security tax was raised?

What was the Social Security tax rate in 1980?

| Year | FICA | Self-Employment |

|---|---|---|

| 1980 | 6.13% on first $25,900 | 8.1% on first $25,900 |

| 1979 | 6.13% on first $22,900 | 8.1% on first $22,900 |

| 1978 | 6.05% on first $17,700 | 8.1% on first $17,700 |

| 1977 | 5.85% on first $16,500 | 7.9% on first $16,500 |

What is the COLA for 2022?

What was the Social Security rate in 2011?

a. Recent legislation reduced the 2011 OASDI tax rates by two percentage points for employees (from 6.2 percent to 4.2 percent) and for the selfemployed (from 12.4 percent to 10.4 percent).

Is there really a $16728 Social Security bonus?

What was the maximum Social Security benefit in 2013?

How much did Social Security increase in 2012?

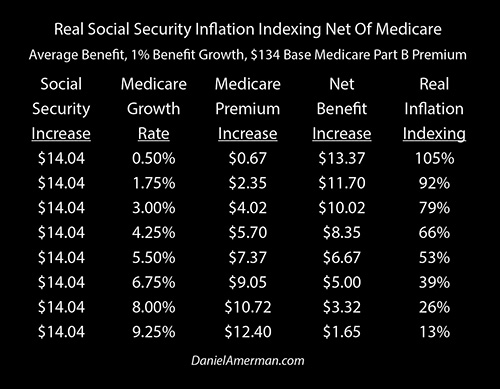

In 2012, Social Security monthly payments to enrollees will increase by 3.6 percent. The dollar increase in benefit checks is expected to be large enough on average to cover the increase in the Part B premium of $3.50 that most beneficiaries will experience.

How much lower was Medicare in 2012 than 2011?

On average, Medicare Advantage premiums will be 4 percent lower in 2012 than in 2011, and plans project enrollment to increase by 10 percent. Of people with Medicare, 99.7 percent continue to enjoy access to a Medicare Advantage plan, and benefits remain consistent with those offered in 2011.

How much will Medicare premiums increase?

Medicare Part A premiums will be increasing by just $1 per month, and the deductible will increase by just $24. For Medicare Part A, which pays for inpatient hospital, skilled nursing facility, and some home health care, about 99 percent of Medicare beneficiaries do not pay a premium since they or their spouses have at least 40 quarters ...

What is Medicare Part B?

Medicare Part B covers a portion of the cost of physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items. By law, the standard premium is set to cover one-fourth of the average cost of Part B services incurred by beneficiaries aged 65 and over, plus a contingency margin.

How much is Medicare Part B in 2012?

MEDICARE PART B: The standard Medicare Part B monthly premium will be $99.90 in 2012, a $15.50 decrease over the 2011 premium of $115.40. However, most Medicare beneficiaries were held harmless in 2011 and paid $96.40 per month. The 2012 premium represents a $3.50 increase for them. Medicare Part B covers a portion of the cost ...

How to contact Medicare for low income?

Medicare provides similar assistance with premiums and cost-sharing for low-income Part D enrollees. Information is available at 1-800-MEDICARE (1-800-633-4227) and, for hearing and speech impaired, at TTY/TDD: 1-877-486-2048. Previous.

What is the average Part D premium for 2012?

The estimate for the average 2012 Part D premium for basic coverage is $30. This is slightly lower than the actual average for 2011 of $30.76. The estimate for the average 2012 Part D premium for supplemental coverage is $8. The estimate for the average 2012 total Part D premium is $38.

When was Medicare first introduced?

When first implemented in 1966 , Medicare covered most persons aged 65 or older.

When did Medicare pay for inpatient hospital care?

1989. The spell of illness and benefit period coverage of laws before 1988 return to the determination of inpatient hospital benefits in 1990 and later. After the deductible is paid in benefit period, Medicare pays 100 percent of covered costs for the first 60 days of inpatient hospital care.

How much does Medicare pay for prescriptions?

Beginning in 1991, Medicare pays 50 percent of the cost of outpatient prescription drugs above $600. When fully implemented in 1993, Medicare will pay 80 percent of prescription drug costs above a deductible that assumes that 16.8 percent of Part B enrollees will exceed the deductible.

How many days are covered by Medicare?

The number of SNF days provided under Medicare is limited to 100 days per benefit period (described later), with a copayment required for days 21 through 100.

What is Medicare Advantage?

Medicare Advantage plans are offered by private companies and organizations and are required to provide at least those services covered by Parts A and B, except hospice services. These plans may (and in certain situations must) provide extra benefits (such as vision or hearing) or reduce cost sharing or premiums.

What is fee for service in Medicare?

Since the inception of Medicare, fee-for-service claims have been processed by nongovernment organizations or agencies under contract to serve as the fiscal agent between providers and the federal government. These entities apply the Medicare coverage rules to determine appropriate reimbursement amounts and make payments to the providers and suppliers. Their responsibilities also include maintaining records, establishing controls, safeguarding against fraud and abuse, and assisting both providers and beneficiaries as needed.

How many days of inpatient hospital care can you use for Medicare?

If a beneficiary exhausts the 90 days of inpatient hospital care available in a benefit period, the beneficiary can elect to use days of Medicare coverage from a nonrenewable "lifetime reserve" of up to 60 (total) additional days of inpatient hospital care. Copayments are also required for such additional days.

What is the Medicare deductible for 2012?

In 2012 the Medicare Part B (medical insurance) deductible will be $140. This is an annual deductible amount. The Medicare Part B monthly premium rate charged to each new beneficiary or to those beneficiaries who directly pay their premiums quarterly for 2012 will be $99.90 a month, although higher-income consumers may pay more. For those receiving Social Security benefits, this premium payment is deducted from your monthly benefit check. Individuals who remain eligible for Medicare but are not receiving Social Security benefits because of working, must directly pay the Part B premium quarterly—one payment every three months. Like the Part A premiums mentioned above, Part B is also available for at least ninety-three months following the trial work period, assuming an individual wishes to have it and, when not receiving SSDI, continues to make quarterly premium payments.

What changes are made to Social Security in 2012?

The changes traditionally include new tax rates, higher exempt earnings amounts, and SSDI and SSI cost-of-living increases, as well as alterations to deductible and coinsurance requirements under Medicare. Below are the updated facts for 2012.

What is Medicare Part A?

Medicare Deductibles and Coinsurance: Medicare Part A coverage provides hospital insurance to most Social Security beneficiaries. The coinsurance amount is the hospital charge to a Medicare beneficiary for any hospital stay. Medicare then pays the hospital charges above the beneficiary's coinsurance amount.

What is the FICA rate for self employed?

FICA and Self-Employment Tax Rates: The FICA tax rate for employees and their employers remains unchanged at 7.65 percent. This rate includes payments to the Old Age, Survivors, and Disability Insurance (OASDI) Trust Fund of 6.2 percent and an additional 1.45 percent payment to the Hospital Insurance (HI) Trust Fund, from which payments under Medicare are made. Self-employed people continue to pay a Social Security tax of 15.3 percent, which includes 12.4 percent paid to the OASDI Trust Fund and 2.9 percent paid to the HI Trust Fund.

Does QMB pay for Medicare?

Under the SLMB program states pay only the full Medicare Part B monthly premium. Eligibility for the SLMB program may be retroactive for up to three calendar months.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.