How much is Medicare Part B annual deductible?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

Does Medicare Part B have a deductible?

What Is the Medicare Part B Deductible? The Medicare Part B deductible is $203 for 2021 and $233 for 2022. 7 Most Medicare participants also pay a monthly premium for Part B, which is $148.50 for 2021 and $170.10 for 2022. Medicare Part B covers doctor's visits, tests, flu shots, physical therapy, and even chemotherapy.

What is the current deductible for Medicare Part B?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What was the Medicare B premium in 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the monthly deduction for Medicare Part B?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What was the Medicare deduction for 2018?

The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

What is the 2016 deductible for Medicare Part B?

($166 in 2016)Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

What is the deductible for Medicare Part B 2021?

$203.00 per yearThe standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

What is the Medicare deductible for 2019 Part B?

$185 in 2019On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What is the Irmaa for 2017?

If Your Yearly Income Is2017 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$53.50$107,001 - $160,000$214,000 - $320,000$133.90$160,001 - $214,000$320,000 - $428,000$214.303 more rows•Jul 31, 2016

What is the Part B deductible for 2019?

$185 in 2019The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

What is the Medicare Part B deductible for 2017?

2017 Medicare Part B (Medical) Monthly Premium & Deductible. CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166.

How much is the 2017 Medicare Part D deductible?

The 2017 standard Part D plan deductible is $400, however the actual plan deductible can be anywhere from $0 to $400 . Use our 2017 Part D Plan Finder to see plan premiums, deductibles, and features in your state. use our 2016/2017 Part D plan comparison to see annual changes for each Medicare Part D plan.

What percentage of Medicare beneficiaries will see no change in their 2017 Medicare Part B premiums?

You can read more about the 2017 Medicare Part A & B premiums and deductibles in our article: CMS Press Release: Due to 0.3% COLA, 70% of Medicare beneficiaries will see no change in their 2017 Medicare Part B premiums.

How much is Medicare Advantage 2017?

The 2017 Medicare Advantage plan premiums range from $0 to $364. Use our 2017 Medicare Advantage Plan Finder to see plan premiums, deductibles, ...

How long can you get Medicare Part A if you are disabled?

(If you’re under 65 and disabled, you can continue to get premium-free Part A for up to 8 1/2 years after you return to work.) The chart below shows the annual Medicare Part A deductible and the Medicare Part A monthly premium for people who do not ...

How much does a Part A premium go up?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. Read more under Medicare Part A Special Enrollment Period.

How much does Medicare Part D cost?

The 2017 Part D plan premiums range from $12 to $179.

How much is Part B premium?

Exact increases will be tied to a person’s actual Social Security benefits, so Part B premiums will be larger than $109 for high-income beneficiaries and lower for those with below-average benefits.

How much did Medicare increase in 2017?

Last week, as the shock and awe over Donald Trump’s election victory continued to consume us, Medicare announced roughly 10 percent increases in 2017 rates for many Part B premiums and the program’s annual deductible. This is a very big deal, because the increases ...

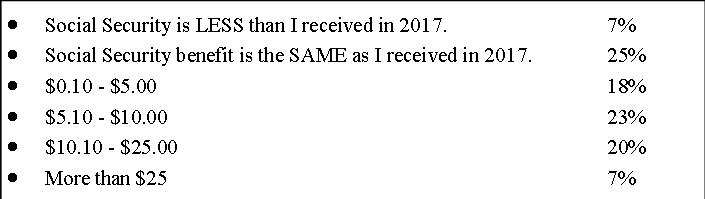

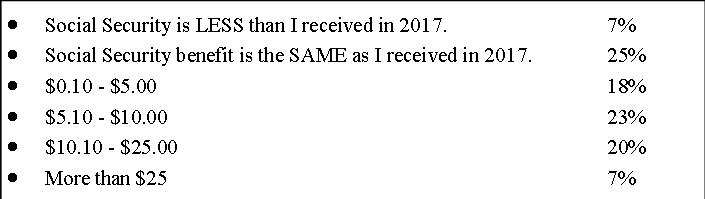

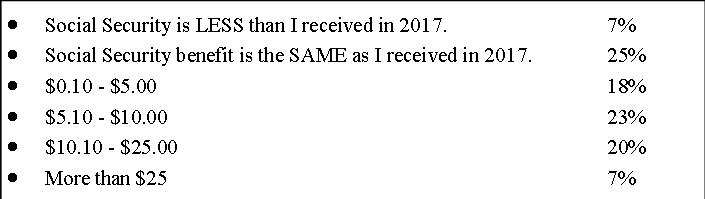

How much did Social Security premiums rise in 2017?

For people who had to pay $121.80 a month this year but are now held harmless for 2017, their premiums will also rise by an average of about 4 percent. Again, specific changes will be tied to their actual Social Security payments. For people who are not held harmless in 2017, the standard monthly Part B premium will rise from $121.80 to $134.00.

How much will Social Security increase Part B?

The average amount of that increase will raise Part B premiums by an average of about 4 percent, from $104.90 to about $109.00 a month.

Can Social Security payments decrease?

Under a Social Security provision known as the “hold harmless” rule, Social Security payments cannot decline from one year to the next. Higher Part B premiums normally are funded by Social Security’s annual cost of living adjustment, or COLA.

Does Medicare Advantage cover Part B?

Premiums and deductibles next year for Medicare Advantage and Part D prescription drug plans already have been set and are not affected by the Part A and Part B changes. Part B primarily covers expenses for doctors, other outpatient care and durable medical equipment.

Does Part A have a deductible?

Part A charges no premiums to anyone who has worked long enough to qualify for Social Security benefits. However, it does have an annual deductible and daily coinsurance charges. Here are details of the changes to Part A expenses:

How much is Medicare Part B deductible?

In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

What is the hold harmless provision in Medicare?

This difference in premium amounts is due to a federal law which is commonly called the “hold harmless” provision. This provision prevents about 70 percent of beneficiaries from seeing major increases in Medicare Part B premiums when Social Security cost of living adjustments (COLAs) are nonexistent or very small.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

How much is the Part B premium in 2018?

The 30 percent of all Part B enrollees who are not subject to the “hold harmless” provision will pay the full premium of $134 per month in 2018. Part B enrollees who were held harmless in 2016 ...

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When did Medicare Part A and B premiums come out?

2018 Medicare Parts A & B Premiums and Deductibles. On November 17, 2017 , the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.