Are Medicare premiums deducted from Social Security payments?

Your Medicare Part B premiums will be automatically deducted from your Social Security benefits. Most people receive Part A without paying a premium. You can choose to have your Part C and Part D premiums deducted from your benefits. Medicare allows you to pay online or by mail without a fee.

Is there a deductible for Medicare Part A?

The Qualified Medicare Beneficiary Program pays your premiums, deductibles, coinsurance and copayments for Parts A and B and Medicare Advantage plans. For those in original Medicare, it operates like a Medigap plan. In most states, you can qualify if your gross monthly income in 2021 doesn’t exceed $1,094 for individuals or $1,472 for couples.

Is Medicare Part B deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is Medicare deductible?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be ]

What is the Medicare deductible for 2019?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018. Part A coinsurance amounts will also increase in 2019 as shown in this table.

What is the deductible for Medicare each year?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

What is the standard deduction for Medicare Part B?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How do I find out my Medicare deductible?

Deductibles for Original Medicare You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

Do prescription drugs count towards deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount. This doesn't mean your prescriptions will be free, though.

Can you write off Medicare Part B premiums from your taxes?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

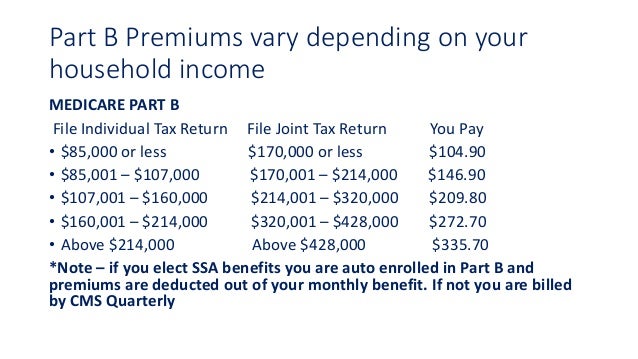

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What is the deductible for Medicare Part B 2021?

$203.00 per yearPart B: (Medical Insurance) Premium You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

What is the Medicare Plan G deductible for 2022?

$2,490$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

What is CMS eMedicare?

As announced earlier this month, CMS launched the eMedicare Initiative that aims to modernize the way beneficiaries get information about Medicare and create new ways to help them make the best decisions for themselves and their families.

How much does Medicare pay for inpatient hospital admission?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

Is Medicare deductible finalized?

Premiums and de ductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Last month, CMS released the benefit, premium, and cost sharing information for Medicare Advantage plans in 2019.

How much will Social Security increase in 2019?

The Social Security Administration recently announced a 2.9% cost-of-living adjustment for 2019. The SSA estimated that benefits for the average retired worker will rise by around $39 per month, making this one of the largest cost of living increases since 2012.

Does Medicare have cost sharing?

Just like insurance that you’ve participated in during your working years, Medicare has cost-sharing that you pay as you use your benefits. These come in the form of deductibles, copays and coinsurance.

What is the Medicare deductible for 2019?

Deductibles will also go up in 2019. The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and other outpatient services, will see a mild bump from $183 to $185.

How much does Medicare pay in 2019?

Answer: The Centers for Medicare & Medicaid Services announced that most people will pay $135.50 per month for Medicare Part B in 2019, up slightly from $134 per month in 2018.

Why do Medicare beneficiaries pay less?

A small group of Medicare beneficiaries (about 3.5%) will pay less because the cost-of-living increase in their Social Security benefits is not large enough to cover the full premium increase. The “hold-harmless provision” prevents enrollees’ annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security ...

How much is the premium for singles?

And premiums for singles earning $133,501 to $160,000 ($267,001 to $320,000 for joint filers) will rise from $348.30 to $352.20. If you had higher income than that, your monthly premium for 2018 was $428.60. In 2019, there will be an extra surcharge tier for people with the highest income.

How much is Social Security going up in 2019?

Social Security benefits are increasing by 2.8% in 2019, which will cover the increase in premiums for most people. Premium increases are also minor for most higher-income beneficiaries—those with adjusted gross income plus tax-exempt interest income of more than $85,000 if single or $170,000 if married filing jointly.

How much is the 2019 tax surcharge?

If your income is between $160,001 and $499,999 ($320,001 to $749,999 for joint filers), you’ll pay $433.40 per month. Single filers with income of $500,000 or more ($750,000 or more for joint filers) will pay $460.50 per month.

Can you contest a Medicare surcharge?

If you’ve experienced certain life-changing events that have reduced your income since then, such as retirement, divorce or the death of a spouse, you can contest the surcharge. For more information about contesting or reducing the high-income surcharge, see Save Money on Medicare.

What is the Medicare deductible for 2019?

A deductible is the money you will pay before your benefits kick in. For 2019, the Medicare Part B deductible is $185. This is an amount you pay once per year. Some Medigap plans will cover the Part B (medical insurance) deductible, but if they don’t, you will have to pay this amount.

How much is the deductible for Medicare Part A?

For Part A (hospital insurance), the deductible is $1,364 per benefit period. A benefit period in Part A begins on the first day you are admitted to the hospital and ends after you have spent 60 days in a row out of the hospital. Some Medicare Advantage and Part D prescription drug plans come with an annual deductible as well.

What is the maximum out of pocket limit for Medicare?

The maximum out-of-pocket limit is the dollar amount beyond which your plan will pay for 100% of healthcare costs. Copayments and coinsurance go toward this limit, but monthly premiums don’t. Here are the details on maximum out-of-pocket limits: 1 Original Medicare – no out-of-pocket limit. 2 Medigap plans – help to pay Part A and B deductibles and coinsurance so that your out-of-pocket costs don’t get too high. 3 Medicare Advantage plans – most have an out-of-pocket maximum of $6,700 (may differ by plan but can’t be higher than $6,700).

What is coinsurance in Medicare?

Coinsurance. Coinsurance is the percentage of your medical bill that you pay. For example, under Medicare Part B, after you meet your deductible you will pay 20% of each medical bill, and Medicare will pay 80%. For Part A, coinsurance is a set dollar amount that you pay for covered days spent in the hospital.

How much does a day 91 cost?

Day 91 on – $682 per day until you have used up your lifetime reserve days (you get 60 lifetime reserve days over the course of your life); after that you pay the full cost. Skilled nursing facility coinsurance – $170.50. Medigap plans can help you cover 365 additional hospital days. YouTube. Medicare World.

What is a Part D plan?

Part D plans have different tiers as part of the Part D formulary, in which different types of drugs incur lower or higher copays. These will differ according to your individual Part D plan. Copayments in Part D are when you pay a set cost (for example, $10) for all drugs in a certain tier.

How much is catastrophic coverage in 2019?

Catastrophic coverage in Part D for 2019 – $5,100. Once you have paid $5,100 in medications, your costs for medications will be $3.40 per generic drug, and $8.50 or 5% (whichever is greater) per brand-name drug.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

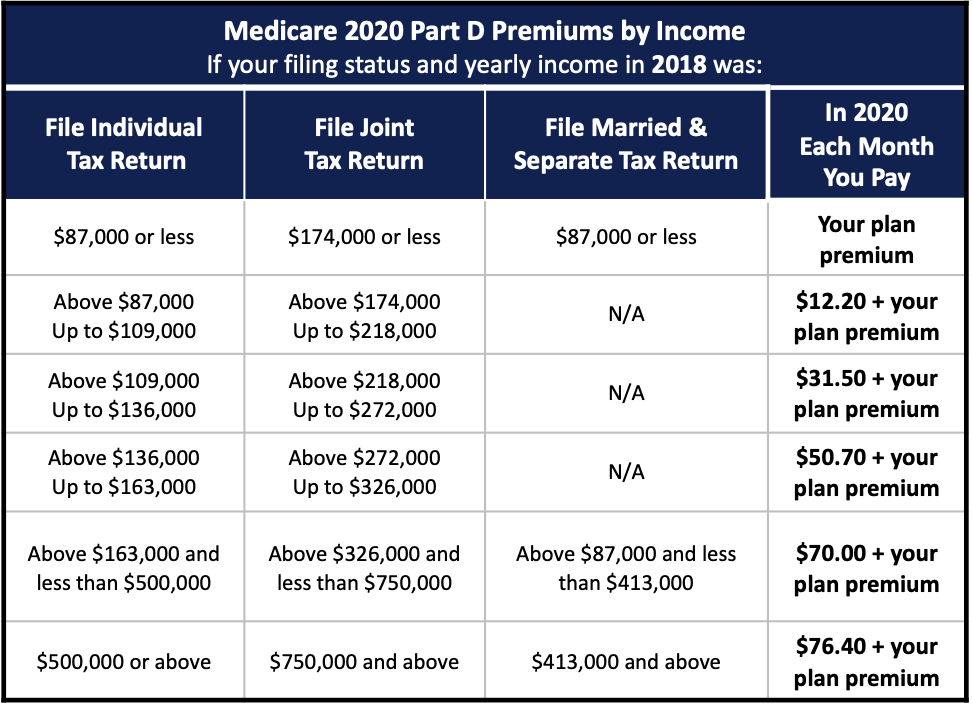

Will Medicare IRMAA increase in 2020?

It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020. This means that fewer people may have to pay the IRMAA, and the adjustment will delay when other beneficiaries are required to pay more for their 2020 Part B premiums.

How much is Medicare Part D deductible?

Most Part D plans require you to satisfy an annual deductible of up to $415 for 2019. Once you've satisfied this deductible, you'll need to pay 25% of the next $3,405 of your prescription costs, which is up to $851.25 out of pocket. And your Medicare drug plan will pay 75%, which would be up to $2,553.75. After that, there's a coverage gap known as ...

How much does Medicare cost?

How much you pay for Medicare drug coverage depends on which plan you choose. But in general most plans charge a monthly premium that averages $33.50, according to the Centers for Medicare and Medicaid Services. Those with higher incomes will be required to pay higher Part D premiums.

How long do you have to enroll in Medicare?

If you're new to Medicare, you have seven months to enroll in a drug plan: three months before, the month of, and three months after becoming eligible for Medicare. If the initial enrollment period is missed, you will be able to enroll during the annual election period.

How much does Medicare cover for prescriptions?

You'll need to pay 100% of your prescription drugs until you've spent an additional $3,833.75. However, once your prescription costs total $7,653.75, you've paid $5,100 and Medicare has paid $2,553.75, then your Medicare drug plan will generally cover 95% of any further prescription costs. For the rest of the year you'll pay ...

What is the discount on generic drugs?

In 2019, if you have spending in the coverage gap, you'll receive a 75% discount on covered brand-name drugs and a 63% discount on covered generic drugs.

How many drugs does Medicare cover?

The key elements of the basic plan are that it must generally cover at least two drugs in each drug class, and have drugs available in what are known as the six primary drug categories.

What is Medicare Part D?

Medicare Part D is a federal prescription drug coverage program for seniors offered by private companies through stand-alone plans for members who have Medicare ...

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What can you deduct from your federal tax return?

You can deduct contributions or gifts you gave to organizations that are reli-gious, charitable , educational, scientific, or literary in purpose. You can also de-duct what you gave to organizations that work to prevent cruelty to children or animals. Certain whaling captains may be able to deduct expenses paid in 2019 Federal, state, and local govern-ments if the gifts are solely for public purposes.

What line do you deduct dental expenses on?

You can deduct only the part of your medical and dental expenses that ex-ceeds 7.5% of the amount of your adjus-ted gross income on Form 1040 or 1040-SR, line 8b.

What is Schedule A for federal income tax?

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized de-

Can I deduct health insurance premiums on my W-2?

You can't deduct insurance pre-miums paid by making a pre-tax reduc-tion to your employee compensation be-cause these amounts are already being excluded from your income by not being included in box 1 of your Form(s) W-2 . If you are a retired public safety officer, you can't deduct any premiums you paid to the extent they were paid for with a tax-free distribution from your retire-ment plan.

Can you deduct sales tax in 2019?

Generally, you can deduct the actual state and local general sales taxes ( in-cluding compensating use taxes) you paid in 2019 if the tax rate was the same as the general sales tax rate.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.