In one particularly cruel irony, a single retiree with an AGI of below $85,000 first claiming Social Security benefits in 2016 will pay a Medicare premium of $159.30 a month, compared to the $104.90 paid by someone who started receiving benefits in 2015 or earlier.

Will Medicare premiums and deductibles increase in 2016?

Nov 10, 2015 · Part B Premiums/Deductibles. As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

How many Americans are enrolled in Medicare Part B in 2016?

Aug 25, 2016 · If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90. Your 2016 monthly premium is typically $121.80 if any of the following is true for you: You enrolled in Medicare Part B in 2016 for the first time. You don’t receive Social Security benefits. You get a bill for the Part B premium.

How many people receive Social Security benefits each year?

Feb 25, 2016 · Most Social Security recipients will pay the same Medicare Part B premium in 2016, as they did in 2015. That amount is $104.90 per month. Increases in Medicare Part B premiums are tied to increases...

What is the average monthly Social Security benefits payable?

Feb 25, 2016 · Most Social Security recipients will pay the same Medicare Part B premium in 2016, as they did in 2015. That amount is $104.90 per month. Increases in Medicare Part B premiums are tied to increases in Social Security benefits due to cost-of-living adjustments which did not occur this year.

What were Medicare premiums in 2016?

...

- Annual income $85,000 or less: $104.90 ($121.80 if the conditions above apply to you)

- Annual income $85,001-$129,000: $316.70.

- Annual income above $129,000: $389.80.

What was the Medicare Part B premium in 2017?

What were Medicare premiums in 2015?

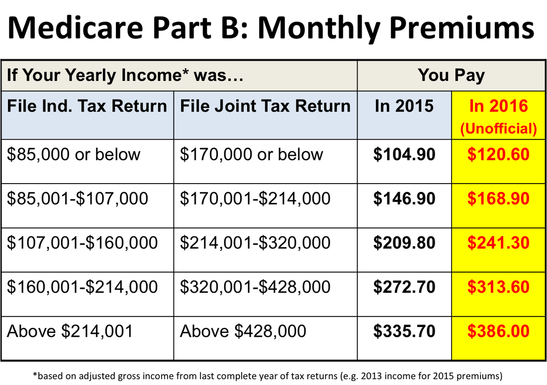

| If Your Yearly Income is | ||

|---|---|---|

| $85,000 or below | $170,000 or below | $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $146.90* |

| $107,001 - $160,000 | $214,001 - $320,000 | $209.80* |

| $160,001 - $214,000 | $320,001 - $428,000 | $272.70* |

What was the Medicare Part B premium for 2018?

What was the Medicare Part B premium for 2019?

How much are Medicare premiums for 2019?

What was the Medicare Part B premium for 2014?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

Are Medicare premiums based on income?

What is the cost of Medicare Part D for 2018?

Deductibles for prescription drug plans increased, from $292 in 2018 to $308 in 2019. Medicare sets limits on the annual deductible for Part D plans. In 2019, the limit is $415 and in 2022, the limit increases to $435.Dec 30, 2021

What is the Irmaa for 2017?

| If Your Yearly Income Is | 2017 Medicare Part B IRMAA | |

|---|---|---|

| $85,000 or below | $170,000 or below | $0.00 |

| $85,001 - $107,000 | $170,000 - $214,000 | $53.50 |

| $107,001 - $160,000 | $214,000 - $320,000 | $133.90 |

| $160,001 - $214,000 | $320,000 - $428,000 | $214.30 |

What are the Irmaa brackets for 2017?

| If Your Yearly Income Is | 2017 Medicare Part B IRMAA | |

|---|---|---|

| $85,000 or below | $170,000 or below | $0.00 |

| $85,001 - $107,000 | $170,000 - $214,000 | $53.50 |

| $107,001 - $160,000 | $214,000 - $320,000 | $133.90 |

| $160,001 - $214,000 | $320,000 - $428,000 | $214.30 |

What are the Irmaa brackets for 2019?

| IRMAA Table | 2019 |

|---|---|

| More than $267,000 but less than or equal to $320,000 | $352.20 |

| More than $320,000 but less than $750,000 More than $750,000 | $433.40 $460.50 |

| Married filing separately | |

| More than $85,000 but less than $415,000 More than $415,000 | $433.40 $460.50 |

What was the Medicare premium in 1970?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

How much is the 2016 Medicare premium?

Your 2016 monthly premium is typically $121.80 if any of the following is true for you:

How much does Medicare cost a month?

If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, or $411 per month if you’ve worked and paid Social Security taxes for fewer than 30 quarters.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

What is the maximum Social Security tax for 2016?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2016 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA tax rate for 2016?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2016 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

When did Medicare withholding change?

Note: The Patient Protection and Affordable Care Act signed into law March 23, 2010, created the “additional Medicare Tax” that changed Medicare withholding computations effective January 1, 2013. All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of ...

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.

How many people received Social Security in 2015?

65.1 million people received benefits from programs administered by the Social Security Administration ( SSA) in 2015. 5. 4 million people were newly awarded Social Security benefits in 2015. 61% of aged beneficiaries received at least half of their income from Social Security in 2014.

What percentage of Social Security beneficiaries were women in 2015?

55% of adult Social Security beneficiaries in 2015 were women.

How many times did private pensions increase?

Over the 52-year period, receipt of private pensions increased by four times, and receipt of government pensions nearly doubled. The proportion of couples and nonmarried persons aged 65 or older who had earnings was smaller in 2014 than it was in 1962. Percentage of aged units receiving income, by source.

What percentage of Social Security income was in 1962?

In 1962, Social Security, earnings, income from assets, and government employee and private pensions made up only 85% of the aggregate total income of couples and nonmarried persons aged 65 or older, compared with 96% in 2014. The shares from Social Security, earnings, government employee pensions, and private pensions increased after 1962, while the share from asset income declined.

When can disabled widows receive reduced benefits?

Disabled widow (er)s can receive reduced benefits at age 50. Spouses, children, and parents receive a smaller proportion of the worker's PIA than do widow (er)s. Average monthly benefit for new awards and for benefits in current-payment status (in dollars) Beneficiary. New awards.

Is Social Security universal in 1962?

Social Security benefits—the most common source of income for married couples and nonmarried persons aged 65 or older in 1962—are now almost universal. The proportion of the aged population with asset income—the next most common source—was greater in 2014 than it was in 1962.

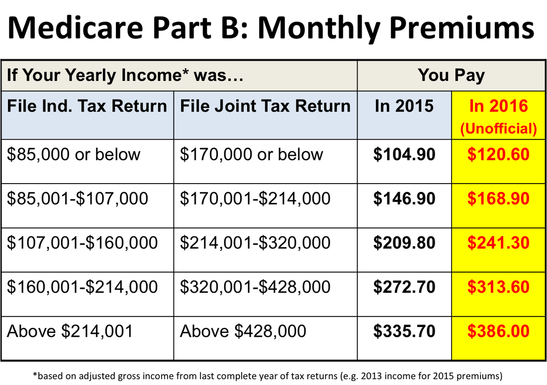

Medicare costs increased in 2016 and are set to rise further in 2017

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work! Follow @TMFMathGuy

Medicare got more expensive in 2016

Medicare got more expensive in 2016, in terms of both premiums and deductibles, although some of the changes didn't affect all beneficiaries.

What cost increases are taking effect in 2017?

Since Social Security beneficiaries received a COLA for 2017, albeit a small one, Medicare Part B premiums are increasing for everyone. The 70% of beneficiaries who pay their premiums from Social Security will see an increase to $109, about $4 more than the current level. The other 30% can expect a 10% increase in their Part B premiums to $134.

What could change under the Trump administration?

The changes that could be made to Medicare during 2017 (if any) depend on who gets their way -- President-elect Donald Trump or the Republican-controlled Congress. It's no secret that Medicare isn't in the best financial shape, and both parties have different ideas of how the problem should be fixed.