When will Medicare increase?

The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month. The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021.

How much is Medicare increasing?

Medicare's Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month. In addition to the standard premium, the deductible for Part B will also increase next year, from $203 to $233. That's a 14.8% increase from 2021 to 2022. The Medicare Part A deductible is also on the rise and will go up by $72 to $1,556.

Will Medicare increase this year?

Workers pay 6.20% of their income to Social Security, with an additional 1.45% to Medicare ... was the dramatic increase in the annual cost-of-living adjustment. Every year, the Social Security ...

Are Medicare costs increasing?

The cost of Medicare keeps rising, and many seniors struggle to keep up. There are steps you can take to better manage your healthcare costs in retirement. Late last year, seniors on Social Security got some great news -- their benefits would be getting a 5.9% increase, representing their largest raise in decades.

Is there an increase in Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Will there be a price increase for Medicare in 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

How much will Medicare be raised next year?

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

What percentage are Medicare premiums going up in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Why is Medicare Part B going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

Will Social Security get a raise in 2022?

Cost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022.

What income increases Medicare premiums?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Medigap First-Dollar Coverage Plans Will Be Discontinued for New Medicare Beneficiaries in 2020

January 1, 2020, is a key date for many newly eligible Medicare beneficiaries.

What Is the Medicare Access and CHIP Reauthorization Act (MACRA)?

The new rule that discontinues Plan F and Plan C enrollment for new Medicare beneficiaries in 2020 is a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

High-Deductible Medigap Plan G Will Be a New Plan Option in 2020

Beginning in 2020, Medigap Plan G will feature a new high-deductible plan option.

The Medicare Part D Donut Hole Will Shrink in 2020

The Medicare Part D “donut hole” is a temporary lapse in Part D prescription drug coverage once your out-of-pocket prescription drug spending has reached a certain amount for the year.

Medicare Advantage plans continue to add additional benefits

Medicare Advantage (Medicare Part C) plans provide the same benefits as Original Medicare, and some plans may offer a number of benefits not found in Original Medicare.

Find 2019-2020 Medicare Supplement Plans in Your Area

You can call today to speak with a licensed insurance agent who can help you compare the costs, benefits and coverage of Medicare Supplement plans that are available where you live.

When will Medicare announce the 2020 rate announcement?

2020 Medicare Advantage and Part D Rate Announcement and Final Call Letter. Fact Sheet. On April 1, 2019 , the Centers for Medicare & Medicaid Services (CMS) released final policy and payment updates to the Medicare Advantage (MA) and Part D programs through the 2020 Rate Announcement and Call Letter. The Advance Notice was posted in two parts: Part ...

What is CMS finalizing for 2020?

Given the urgency and scope of the continuing national opioid epidemic, CMS is finalizing a number of additional policies for 2020 to help Medicare plan sponsors prevent and combat prescription opioid overuse.

What is the 2020 star rating?

The 2020 Star Ratings is the final year when all changes to the methodology for calculating the ratings and any changes in the measurement set will be addressed using the Call Letter. CMS is finalizing a policy to adjust the 2020 Star Ratings in the event of extreme and uncontrollable circumstances, such as major hurricane weather events. ...

When will CMS accept comments?

CMS accepted comments on all proposals through March 1, 2019. The final updates will continue to maximize competition among Medicare Advantage and Part D plans, as well as include important actions to address the nation’s opioid crisis.

Can MA health insurance be supplemental?

Traditionally, MA plans have only been allowed to offer “primarily health related” supplemental benefits and must offer these benefits uniformly to all enrollees. Beginning with the 2019 plan year, CMS determined that plans can provide certain enrollees with access to different supplemental benefits.

Does Puerto Rico have Medicare Advantage?

Puerto Rico. In Puerto Rico, a far greater proportion of Medicare beneficiaries receive benefits through Medicare Advantage than in any state or territory. The policies finalized for 2020 will continue to provide stability for the Medicare Advantage program in the Commonwealth and to Puerto Ricans enrolled in MA plans.

What is the Medicare premium for 2020?

The monthly premium, which almost all Medicare beneficiaries pay, is increasing to $144.60 in 2020 from $135.50 in 2019. Since Social Security is getting a COLA increase of 1.6% in 2020, nearly all Part B beneficiaries are going to be paying $144.60 monthly for Part B.

What is Medicare Part A?

Part A covers hospital services for Medicare beneficiaries. Most people do not have to pay anything for Part A; you or a spouse working for at least 40 quarters will qualify you for premium-free Part A. If you do have to pay for Part A, your rate is going to be increasing. If you have worked at least 30 quarters, you will be paying $252/month for Part A in 2020, an increase of $12. If you have worked less than 30 quarters, you will pay $458/month in 2020, a $21 increase.

What is the donut hole in Medicare?

The donut hole is when consumers have to pay higher prices for their drugs due to having hit the initial coverage limit, which is increasing to $4,020 in 2020. It used to be that when you hit the donut hole, you would pay 100% of your drug costs. This percentage has been steadily reduced, but now, in 2020, the price for both brand name and generic drugs will be at 25% max both before and in the donut hole until you reach catastrophic coverage. In 2020, once you have paid $6,350 for your drug costs, you will move into the catastrophic coverage stage and you will pay significantly less for the rest of the year.

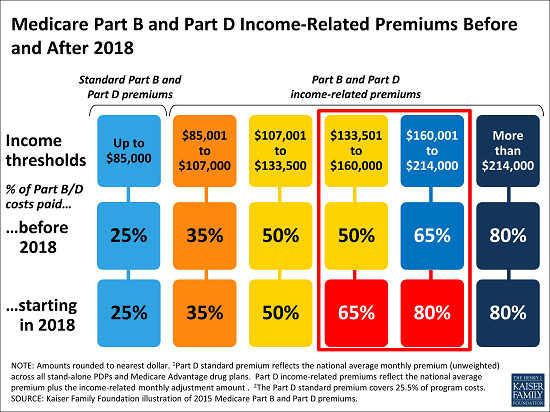

What is IRMAA in Medicare?

IRMAA, or the Income Related Monthly Adjustment Amount, is a surcharge high income Medicare beneficiaries pay for their Part B and Part D premiums. Currently, less than 5% of Medicare beneficiaries are charged IRMAA. IRMAA is tiered depending on your income and if you are married or single. The amount each tier pays in 2020 is increasing. The chart below breaks it down. The surcharge will be paid in addition to the Part B premium ($144.60 in 2020) and the Part D premium (varies by the plan you choose).

What is Medicare IRMAA 2020?

The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums.

When will Medicare plan F and C be available?

This means that Medigap Plan F and Plan C will not be available to beneficiaries who became eligible for Medicare on or after January 1, 2020. Beneficiaries who became eligible before this date may still apply for Plan F or Plan C, if either plan is available where they live.

What is the IRMAA bracket for 2020?

The chart below shows the IRMAA brackets for both individual and joint filers for 2020, based on their income from 2018. 2020 Medicare IRMAA Brackets. 2020 (based on 2018 individual tax return) 2020 (based on 2018 joint tax return) $86,000 or less. $172,000 or less.

When will IRMAA inflation increase?

For the first time in a decade, the income levels that determine IRMAA costs were indexeded according to inflation, using the consumer price index (CPI) from September 2018 to August 2019. Inflation rose 1.7% during that 12-month span. IRMAA income brackets will also increased 1.7% from 2019 to 2020.

How much is Medicare Part B?

The standard premium for Medicare Part B was $144.60 per month in 2020. This represented a $9.10 increase from the 2019 standard premium of $135.50 per month.

How much is the Part D coverage gap?

The initial coverage limit (the amount of money you will spend on covered prescription drugs before reaching the Part D “donut hole” coverage gap) increased from $3,820 in 2019 to $4,020 in 2020.

Does Medicare have to pay a surcharge in 2020?

In 2020, a Medicare beneficiary filing a 2018 modified adjusted gross income of $85,000 would now not meet the threshold requiring them to pay a higher Part B and/or Part D premium. Other beneficiaries might still have to pay the IRMAA surcharge, but they will likely now do so at a lower rate.

What are the life changing events that can be appealed to Social Security?

You can appeal to Social Security for any of the following life-changing events: the death of a spouse. marriage, divorce, or annulment. retirement, reduced work income, or loss of job for one or both spouses. loss of income-producing property due to event beyond your control. loss or decrease in a pension.

What is Medicare Part B based on?

Your Medicare Part B premium amount (and the Part D premium) is based on the Modified Adjusted Gross Income ( MAGI) on your tax return from two years ago — the most recent federal tax return the IRS provides to Social Security.

Can you appeal Medicare premium?

Besides the shock of Part B premiums to Medicare newcomers, the jump in your Part B premium after a one-time financial transaction can also cause distress. You can appeal your increased Medicare premium if you experienced a life-changing event that caused your income to decrease.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

When will Medicare stop allowing C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020.

FY21 proposed rules issued for IRFs, SNFs, hospice

CMS also recently issued a series of proposed rules, not related to COVID-19, to establish FY21 payment and policies for post-acute care providers.

About the Author

is based in the Washington, D.C., office. Follow Rich on Twitter: @rdalyhealthcare

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.