Based on changes contained within this final rule, CMS

Centers for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…

Fiscal year

A fiscal year (or financial year, or sometimes budget year) is a period used for calculating annual ("yearly") financial statements in businesses and other organizations all over the world.

How much do Medicare supplement insurance premiums change with age?

Apr 08, 2021 · In most states, your supplement plan will increase by about 3% every year because of your age. In addition, the insurance companies will increase the rates for everyone in the entire state all at once. The statewide increases are plan specific. For example; in Arizona, Aetna may decide to increase Plan F by 6%, Plan G by 3% and Plan N by 5%.

Will My Medicare supplement rates go up with inflation?

The organization examined expectations for Medicare price increases that could impact buyers of Medigap Plan G policies, According to the organization’s 2021 Medicare Supplement Price Index, a male age 65 can purchase Plan G coverage for as low as $109-monthly in Dallas. “The same Dallas male could pay as much as $242-monthly for virtually ...

What are the Medicare supplement insurance premiums for 2020?

Feb 03, 2022 · The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age. 1. Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2022 are lowest for beneficiaries at ...

What are the benefits of Medicare supplement insurance plans?

Jul 08, 2019 · The average Medicare supplement rate increase that we have seen is between 5 and 8%, yearly, depending on the plan, state, and age. What’s even more confusing is that these three rating methods can look the same unless you drill down into each pricing method over time.

How much do Medicare supplements increase each year?

between 3% and 10% per yearMedicare supplement rate increases usually average somewhere between 3% and 10% per year. And sometimes Medicare supplement rate increases even happen twice in the same year!

Are Medicare supplement plans increasing in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

How much will Medicare Part A premiums increase in 2022?

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

How much did Medicare premiums increase from 2019 to 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the most popular Medicare supplement plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

What changes are coming to Medicare in 2022?

In 2022, some of these new medications and technologies have shaped new Medicare benefits. These benefits include increased telehealth coverage, additional help with insulin costs and the potential coverage of a new Alzheimer's drug.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

Why did my Medicare premium increase for 2022?

The increases in the 2022 Medicare Part B premium and deductible are due to: Rising prices and utilization across the health care system that drive higher premiums year-over-year alongside anticipated increases in the intensity of care provided.

How much money comes out of Social Security check for Medicare?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30....Medicare Part B.Income on Individual Tax ReturnIncome on Joint Tax ReturnMonthly Premium$114,001 to $142,000$228,001 to $284,000$340.205 more rows•Feb 24, 2022

How much did Medicare go up in 2021?

2021 = $148.50 per month. 2020 = $144.60 per month. 2019 = $135.50 per month.

How is modified adjusted gross income for Medicare premiums calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

What is the American Association for Medicare Supplement Insurance?

The American Association for Medicare Supplement Insurance advocates for the importance of planning. The organization makes available a free online directory listing local Medicare insurance agents who can help consumers compare local Medicare Advantage and Medigap plan options. To access the directory and other information, visit their website at www.medicaresupp.org.

How much does Plan G cost in 2021?

According to the organization’s 2021 Medicare Supplement Price Index, a male age 65 can purchase Plan G coverage for as low as $109- monthly in Dallas. “The same Dallas male could pay as much as $242-monthly for virtually identical coverage. If he lived in New York City, the range in monthly premium prices ranges from $268 to $476.”

Is rate increase based on policy usage?

Rate increases are generally based on policy usage but can also take into account medical and healthcare significant changes. “Covid expenses certainly will play a factor,” Slome explains. “So will how insurers anticipate such things as the impact of a newly approved Alzheimer’s medication.”

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

What is the age factor in Medicare?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes , it may be helpful to consider how your age could ...

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

How much is the Part B tax deductible for 2021?

In 2021, the Part B deductible is $203 per year.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

How to limit Medicare supplement price?

1. Choose a large A rated company, that has the financial strength to overcome any blips in the market. 2. Choose a plan that is known for low rate increases, such as the Medicare supplement Plan G or Plan N, with the Medicare supplement Plan N having ...

What are the three pricing methods for Medicare Supplement?

This simply means that there are three pricing methods your company can use to establish your rates: Attained Age rates, Issue-Age rates, and Community rates.

How to find out Medicare supplement company?

Use an Independent Medicare supplement agency like Medicare Solutions Team, we can show you every carriers rate history in your area. Instead of stuffing you into just one carrier, we search the entire market for your Medicare supplement plan 844-528-8688 and can give you the most up to date Medicare supplement company information.

Why does my Medicare premium creep up?

On each anniversary of your policy, your rate will begin to creep up because you are a year older .

Why do insurance companies increase rates over time?

The insurance company may increase rates over time because of inflation or to keep up with health care costs.

Do all Medicare Supplement plans have the same benefits?

Remember, since the government requires all Medicare Supplement plans to have the same benefits from one company to the next, you'll find it easy to compare rates of the plan you like against all the insurance carriers that offer it.

Does Medicare supplement company increase rate?

No mater what Medicare supplement company you go with you are going to get rate increases. There are two types of rate increases, age increase and an inflation increase. The inflation increase has many variables such as the cost of business, claims and other internal company issues.

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

How many standardized benefits are there for Medicare Supplement?

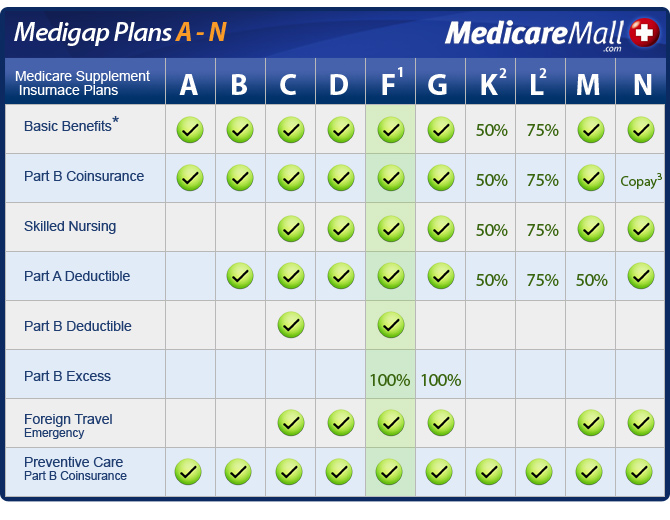

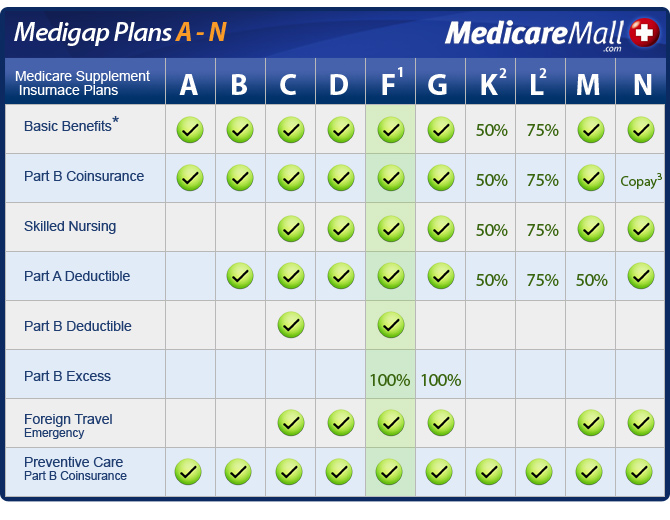

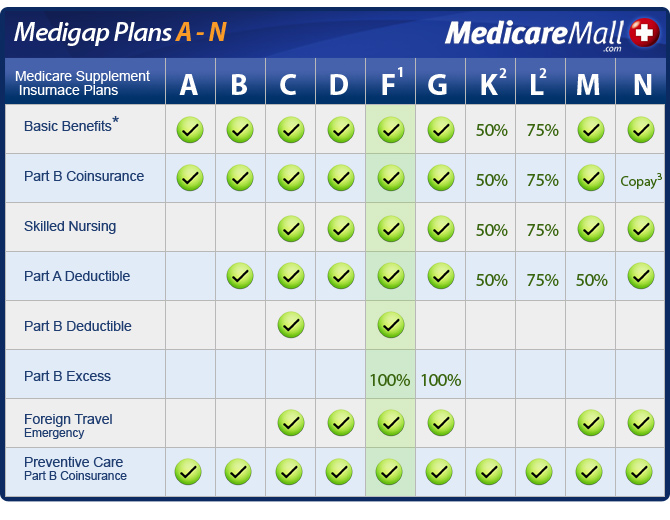

The 9 standardized benefits that may be offered by a Medicare Supplement Insurance plan include the following:

What are the factors to consider when shopping for Medicare Supplement Insurance?

Your unique health coverage needs and budget are important factors to consider as you shop for Medicare Supplement Insurance plans.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much did Medicare increase in 2019?

Based on changes contained within this final rule, CMS estimates that the FY 2019 aggregate impact will be an increase of $820 million in Medicare payments to SNFs, resulting from the FY 2019 SNF market basket update required to be 2.4 percent by the Bipartisan Budget Act of 2018. Absent the application of this statutory requirement, the FY 2019 market basket update factor would have been 2.0 percent which reflects the SNF FY 2019 market basket index of 2.8 percent, reduced by the multifactor productivity adjustment of 0.8 percent. This 2.0 percent update would have resulted in an estimated aggregate increase of $670 million in Medicare payments to SNFs.

What is the final rule for Medicare?

The final rule includes policies that continue a commitment to shift Medicare payments from volume to value, with continued implementation of the SNF VBP and SNF QRP.

What are the Meaningful Measures Initiative?

Meaningful Measures: CMS reviewed the SNF QRP’s measure set in accordance with the Meaningful Measures Initiative to identify how to move the SNF QRP forward in the least burdensome manner possible while continuing to incentivize improvement in the quality of care provided to patients. Specifically, the goals of the SNF QRP and the measures used in the program cover most of the Meaningful Measures Initiative priorities, including making care safer, strengthening person and family engagement, promoting coordination of care, promoting effective prevention and treatment, and making care affordable.

What is SNF VBP?

Background: As required by law, beginning October 1, 2018, the SNF VBP Program will apply either positive or negative incentive payments to services furnished by skilled nursing facilities based on their performance on the program’s readmissions measure. The single claims-based all cause 30-day hospital readmissions measure in the SNF VBP aims to improve individual outcomes through rewarding providers that take steps to limit the readmission of their patients to a hospital. This single measure does not require SNFs to report information in addition to the information they already submit as part of their claims because CMS uses existing Medicare claims information to calculate the measure.

What is PDPM in Medicare?

The new case-mix model, PDPM, focuses on clinically relevant factors, rather than volume-based service for determining Medicare payment, by using ICD-10 diagnosis codes and other patient characteristics as the basis for patient classification. Further, PDPM adjusts Medicare payments based on each aspect of a resident’s care, most notably for Non-Therapy Ancillaries (NTAs), which are items and services not related to the provision of therapy such as drugs and medical supplies, thereby more accurately addressing costs associated with medically complex patients. Finally, PDPM adjusts the SNF per diem payments to reflect varying costs throughout the stay and incorporate safeguards against potential financial incentives to ensure that beneficiaries receive care consistent with their unique needs and goals. In addition to these finalized changes, we also finalized a combined limit on group and concurrent therapy of 25 percent, as we believe that this best ensures that SNF patients will continue to receive the highest caliber of therapy that is best attuned to their individual needs and goals. We will also continue to work with stakeholders to consider potential modifications to this finalized policy for future rulemaking, including whether to adjust the combined limit of 25 percent for concurrent and group therapy to ensure sufficient flexibility for therapists without compromising beneficiary care.

What is the new value based care model?

Promoting Patient Driven Value-based Care: The new model is designed to improve the incentives to treat the needs of the whole patient, instead of focusing on the volume of services the patient receives , which requires substantial paperwork to track over time. CMS also significantly reduced the overall complexity of the PDPM, as compared to RUG-IV or RCS-I, based on stakeholder feedback. The new case-mix classification system (the PDPM) will be effective October 1, 2019 to allow time for education and training of SNFs to prepare for this new model. The improved SNF PPS case-mix classification system moves Medicare towards a more value-based, unified post-acute care payment system that puts unique care needs of patients first while also significantly reducing administrative burden associated with the SNF PPS.

What is the final rule for FY 2019?

Finalized Changes: The FY 2019 final rule discusses updates to policies, including performance and baseline periods for FY 2021 SNF VBP Program year, an adjustment to the SNF VBP scoring methodology, and an Extraordinary Circumstances Exception (ECE) policy.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

What are the factors that affect Medicare Supplement?

It's important to note that several factors can affect the Medicare Supplement plan premiums in 2019, such as gender, smoking status and where you live.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Where are Medicare Part C plans sold?

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

Will Medicare IRMAA increase in 2020?

It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020. This means that fewer people may have to pay the IRMAA, and the adjustment will delay when other beneficiaries are required to pay more for their 2020 Part B premiums.

When did Medicare start reporting QPP?

Beginning in 2017 , all eligible clinicians who may have previously participated in the Medicare Promoting Interoperability Program are now required to report on Quality Payment Program (QPP) requirements. For more information on the QPP, visit this website.

When does CEHRT have to be implemented?

The 2015 Edition CEHRT did not have to be implemented on January 1, 2019. However, the functionality must be in place by the first day of the EHR reporting period. The eligible hospital or CAH must be using the 2015 Edition functionality for the full EHR reporting period.