What is the current Medicare premium amount?

Nov 12, 2021 · The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much will my Medicare premiums be?

6 rows · Feb 15, 2022 · If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per ...

How to calculate Medicare premiums?

plan premium. 2022 Part D national base beneficiary premium— $33.37. This amount is used to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in the table above. The national base beneficiary premium amount can change each year. If you pay a late enrollment penalty, these amounts may be higher.

Why is my Medicare so expensive?

Nov 12, 2021 · the increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by covid-19, and prior congressional action in the continuing appropriations act, 2021 that limited the 2021 medicare part b monthly premium increase during the …

What will the Medicare premium be for 2022?

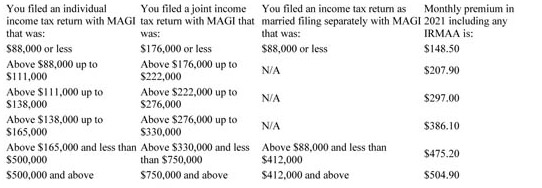

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Will Medicare premiums go down in 2022?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

Will Medicare Part B premium go up in 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

Will Social Security get a raise in 2022?

Cost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022.

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

How Much Will SSI checks be in 2022?

SSI amounts for 2022 The monthly maximum Federal amounts for 2022 are $841 for an eligible individual, $1,261 for an eligible individual with an eligible spouse, and $421 for an essential person.