What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How much does Medicare Part B plan cost?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

How much does Part B insurance cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

What was the cost of Medicare Part B in 2019?

$135.50Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

What were the Medicare premiums in 2019?

The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.

How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What was the Medicare Part B premium for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the cost of Medicare Part B for 2020?

$144.60 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

How much was the Medicare deduction from Social Security in 2019?

Meanwhile, Medicare Part B premiums will see a slight bump to $135.50 in 2019, up from $134 in 2018. Those premiums are typically deducted from your Social Security check, provided you are receiving both Social Security benefits and are covered by Medicare.

What is the Medicare deduction from Social Security for 2019?

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why am I getting a bill for Medicare Part B?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

How much is Medicare Part B deductible?

There are also deductibles and coinsurance amounts for Medicare Part B. In 2019, the Part B deductible is $185 per year. After you pay that amount out of pocket, Medicare starts providing coverage, and you'll only have to cover the 20% of your costs that Part B doesn't pay.

What is Medicare Part B?

Medicare Part B covers medically necessary outpatient services and treatments. Qualifying events include what's necessary to deal with a disease or medical condition, including diagnosis, cure, prevention, or detection. Doctor visits are covered under Medicare Part B, but you'll find a wide range of services that include diagnostic tests, ...

How much is the Medicare premium per month?

Depending on your income, premiums can be as much as $460.50 per month. For individuals with this income: Or joint filers with this income: Total monthly premium in 2019 will be: $85,000 to $107,000. $170,000 to $214,000. $189.60. $107,000 to $133,500. $214,000 to $267,000.

Is a doctor's visit covered by Medicare?

Doctor visits are covered under Medicare Part B, but you'll find a wide range of services that include diagnostic tests, ambulance services, clinical research, durable medical equipment, mental health services, and even second opinions about key issues like surgery. New Medicare participants get a one-time "Welcome to Medicare" preventive visit.

Does Part B pay for checkups?

After the first visit, you'll also qualify for annual checkups to maintain your wellness. However, there are some things that Part B doesn't pay for.

Is Medicare Part B a financial protection plan?

For doctor visits and other outpatient care, Medicare Part B is an essential part of your financial protection plan. Given the high costs of healthcare, having Part B can be a lifesaver both healthwise and financially.

How much is Medicare Part B 2019?

There are a few other out-of-pocket Part B costs that you may be required to pay in 2019. 2019 Part B deductible. The Medicare Part B deductible for 2019 is $185 for the year. Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in.

What are the costs of Medicare Part B?

What Are the Other 2019 Medicare Part B Costs? 1 2019 Part B deductible#N#The Medicare Part B deductible for 2019 is $185 for the year.#N#Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in. The deductible resets with each new year. 2 2019 Part B coinsurance or copayment#N#After you meet your Part B deductible, you are typically required to pay the Part B coinsurance or copayment for additional Part B services you receive in 2019.#N#Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 3 2019 Part B excess charges#N#If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.#N#These providers are allowed to charge you up to 15 percent more than the Medicare-approved amount for your care. This extra amount is called an “ excess charge ” and you will be responsible for paying it in full.

What is QMB in Medicare?

Qualified Beneficiary Medicare (QMB) Program. This program helps pay for the Medicare Part A and Part B premium, along with deductibles, copayments and coinsurance. Individuals can qualify with monthly incomes lower than $1,061 in 2019, and married couples may qualify with combined incomes of less than $1,430 in 2019.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is a type of private insurance that is used along with Original Medicare (Part A and Part B) to provide coverage for some of Original Medicare's out-of-pocket costs.

What is Part B coinsurance?

Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 2019 Part B excess charges. If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.

What happens if you don't sign up for Medicare Part B?

However, if you do not sign up for Medicare Part B during your Initial Enrollment Period (IEP) and decide you want to enroll in Part B later on, you will be charged a late enrollment penalty for the rest of the time that you have Part B.

How much does the penalty increase for Part B?

The penalty raises your Part B premium by up to 10 percent for each year that you were eligible for Part B but did not sign up. The penalty remains in force for as long as you continue to be enrolled in Part B.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

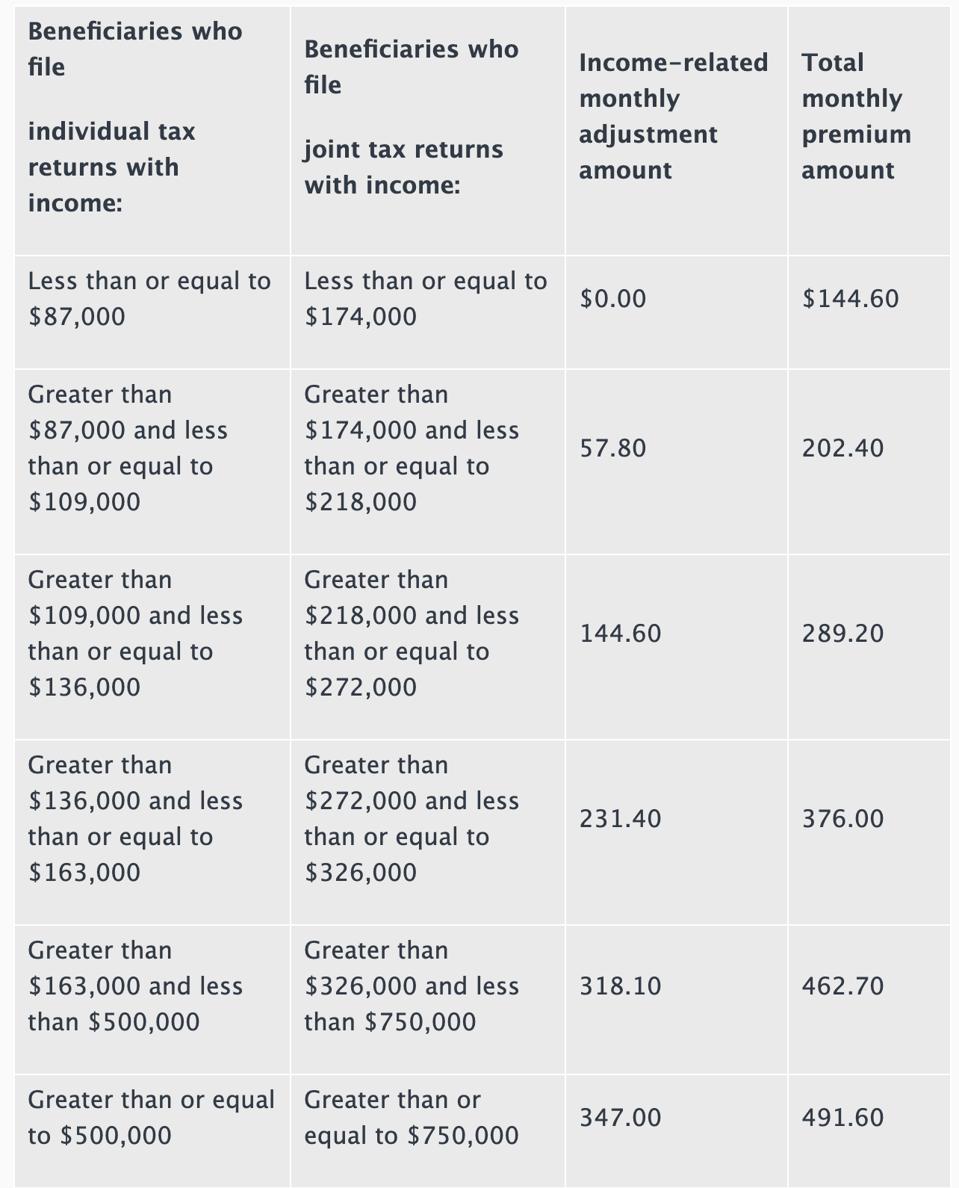

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the out of pocket cost of Medicare Part B?

Other out-of-pocket Part B costs include: The annual Medicare Part B deductible is $203 in 2021. You must pay this amount before Part B benefits begin.

How much is Medicare Part B 2021?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

How much do you have to pay for Medicare after you have met your deductible?

You typically have to pay 20% of the Medicare-approved amount for medical services after your Part B deductible is met. Part B excess charges. Some health care service providers choose not to accept Medicare assignment, which means that they do not accept the Medicare-approved amount as payment in full for their services.

What happens if you don't sign up for Medicare Part B?

In most cases, you will pay a late enrollment penalty if you do not sign up for Medicare Part B when you are first eligible. This penalty will be enforced for the rest of the time that you receive Part B coverage, and could increase by up to 10 percent for each 12-month period that you didn't enroll in Part B once you became eligible.

What is Medicare Part B based on?

For example, your Medicare Part B premium in 2021 is based on your reported 2019 total annual income, and your 2021 premium would be based on your reported 2018 income, and so on.

What happens if a doctor doesn't accept Medicare?

If you receive medical services from a physician who doesn't accept Medicare assignment, they could charge you up to 15 percent more than what Medicare will pay. In this situation, you are responsible for paying the difference in cost, which is referred to as Medicare Part B excess charges.

Do you have to pay Medicare Part B premium?

You'll have to pay the standard premium if you are enrolling in Medicare Part B for the first time. Other reasons you might have to pay the standard Part B premium amount include: In most cases, you will pay a late enrollment penalty if you do not sign up for Medicare Part B when you are first eligible.