| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| Up to $85,000 | Up to $170,000 | $121.80 or $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

What is the maximum premium for Medicare Part B?

Nov 10, 2015 · As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

How much are Medicare Part B premiums?

Nov 12, 2015 · Medicare beneficiaries who have Part B premiums withheld from their Social Security checks--about 70% of beneficiaries--will continue to pay $104.90 per month for Part B. If you aren't collecting...

Do I have to pay Medicare Part B premium?

Dec 16, 2020 · Your Part B costs The Medicare Part B premium will remain the same at $104.90 per month for most individuals. The Social Security Administration recently announced that there will be no cost of living increase for 2016. Due to this, most Part B beneficiaries will be “held harmless” from premium increases in 2016, according to the CMS release.

Does Medicaid pay for Part B premium?

7 rows · Dec 12, 2016 · Previous column Next column. How Much You'll Pay for Medicare Part B in 2016. Single Filer Income. Joint Filer Income. 2016 Monthly Premium. Up to $85,000. Up to $170,000. $121.80 or $104.90 ...

What were Medicare Part B premiums in 2016?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the cost of Medicare Part B in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

How much does Medicare Part B go up every year?

2021 Medicare Part B Premiums Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income, up to to $504.90 for the 2021 tax year.

How much will Medicare B go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.Oct 28, 2013

Does Medicare Part B increase every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What are Medicare Part B premiums for 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

See Also -- CALCULATOR: How Much You'll Pay for Medicare in 2016

Medicare beneficiaries who have Part B premiums withheld from their Social Security checks--about 70% of beneficiaries--will continue to pay $104.90 per month for Part B. If you aren't collecting Social Security yet or will enroll in Medicare in 2016, you will have to pay $121.80 per month in 2016.

See Also: 10 Things You Must Know About Medicare

Your income is usually based on your last tax return on file, which would be your 2014 return, for 2016 premiums. But you may be able to get the high-income surcharge reduced or eliminated if your income has decreased since then because of certain life-changing events, such as the death of a spouse, divorce, retirement or reduced work hours.

Learn how this part of the Medicare program works

Retirees rely on Medicare to help them with their healthcare expenses, but getting a better understanding of how the program's different components can be challenging. Medicare Part B plays a key role in the everyday aspects of healthcare, and below, you'll learn more of the specifics of how much Part B costs and what it covers.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

How much is Medicare Part B?

The Medicare Part B premium will remain the same at $104.90 per month for most individuals. The Social Security Administration recently announced that there will be no cost of living increase for 2016.

Do Part B beneficiaries have to pay higher premiums?

Some Part B beneficiaries will have to pay slightly higher premiums. These beneficiaries include those not collecting Social Security benefits, those who are enrolling in Part B in 2016 for the first time, dual-eligible beneficiaries, and those who pay an additional income-related premium.

Will Medicare increase in 2016?

Medicare beneficiar ies will face higher Medicare costs in 2016. Several costs, including the Part A deductible, the Part A inpatient hospital stay co-insurance, and the Part B deductible will increase in 2016, according to a Centers for Medicare & Medicaid Services (CMS) news release .

Will Medicare Part B be held harmless?

Due to this, most Part B beneficiaries will be “held harmless” from premium increases in 2016, according to the CMS release. “Our goal is to keep Medicare Part B premiums affordable,” said Andy Slavitt, CMS Acting Administrator.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

Is there a penalty for late enrollment in Medicare Part A?

Note that beneficiaries who delay enrollment in Medicare Part A after they first become eligible may be subject to a late-enrollment penalty in the form of a higher premium. Medicare Part B has an annual deductible ($166 in 2016).

What is the Medicare budget for 2016?

The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years. The proposals are scored off the President’s Budget adjusted baseline, which assumes a zero percent update to Medicare physician payments. These reforms will strengthen Medicare by more closely aligning payments with the costs of providing care, encouraging health care providers to deliver better care and better outcomes for their patients, and improving access to care for beneficiaries. The Budget includes investments to reform Medicare physician payments and accelerate physician participation in high-quality and efficient healthcare delivery systems. Finally, it makes structural changes in program financing that will reduce Federal subsidies to high income beneficiaries and create incentives for beneficiaries to seek high value services. Together, these measures will extend the Hospital Insurance Trust Fund solvency by approximately five years.

How much money did Medicare spend in 2016?

In FY 2016, the Office of the Actuary has estimated that gross current law spending on Medicare benefits will total $672.6 billion. Medicare will provide health insurance to 57 million individuals who are 65 or older, disabled, or have end-stage renal disease.

What is the 190 day limit for psychiatric services?

Eliminate the 190-day Lifetime Limit on Inpatient Psychiatric Facility Services: The 190-day lifetime limit on inpatient services delivered in specialized psychiatric hospitals is one of the last obstacles to behavioral health parity in the Medicare benefit. Beginning in FY 2016, this proposal would eliminate the 190-day limit and more closely align the Medicare mental health care benefit with the current inpatient physical health care benefit. Many beneficiaries who utilize psychiatric services are eligible for Medicare due to a disability, which means they are often younger beneficiaries who can easily reach the 190-day limit over their lifetimes. Therefore, this proposal would expand the psychiatric benefit and bring parity to the sites of service, while also containing the additional costs of removing the 190-day limit.

5.0 billion in costs over 10 years]

What is a Part D beneficiary?

2/ In Part D only, some beneficiary premiums are paid directly to plans and are netted out here because those payments are not paid out of the Trust Funds. 3/ Includes related benefit payments, including refundable payments made to providers and plans, transfers to Medicaid, and additional Medicare Advantage benefits.

What is the authority for a program to prevent prescription drug abuse in Medicare Part D?

Establish Authority for a Program to Prevent Prescription Drug Abuse in Medicare Part D: HHS requires Part D sponsors to conduct drug utilization review, which assesses the prescriptions filled by a particular enrollee.

How many people are in Medicare Part D in 2016?

In 2016, the number of beneficiaries enrolled in Medicare Part D is expected to increase by about 3.5 percent to 43.7 million , including about 12.6 million beneficiaries who receive the low‑income subsidy.

How much has Medicare saved?

Cumulatively since enactment of the Affordable Care Act, 9.4 million beneficiaries have saved a total of $15 billion on prescription drugs. The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

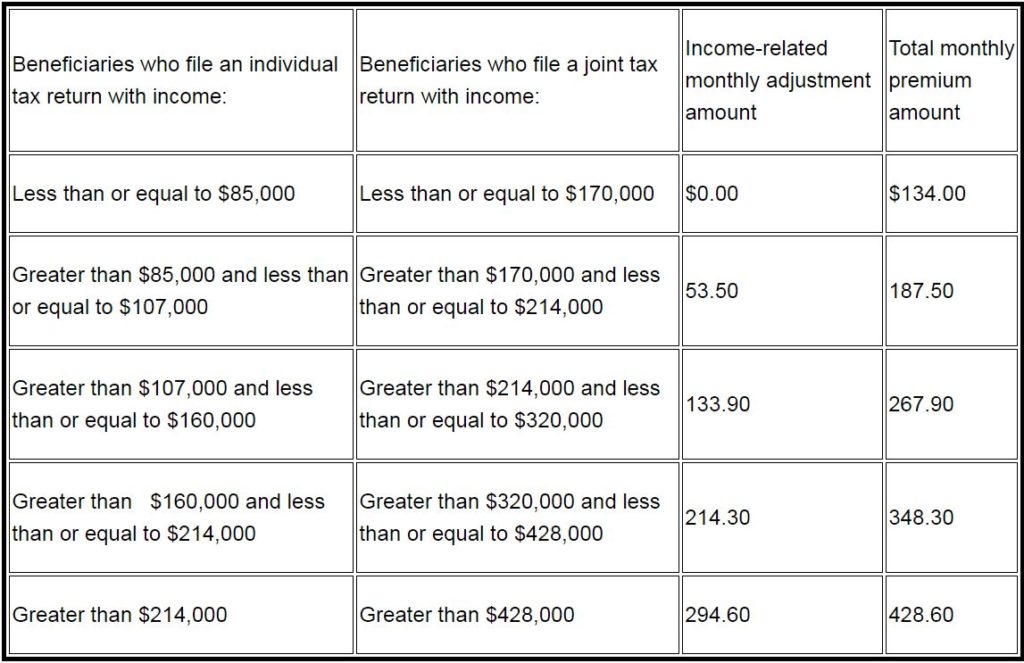

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.