What is the maximum premium for Medicare Part B?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much are Medicare Part B premiums?

Nov 12, 2021 · The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly premium increase during the COVID-19 …

When does Medicare Part B premium start?

Medicare Part B (Medical Insurance) Costs. Part B monthly premium. Most people pay the standard Part B monthly premium amount ($170.10 in 2022). Social Security will tell you the exact amount you’ll pay for Part B in 2022. You pay the standard premium amount if: You enroll in Part B for the first time in 2022.

Does Medicaid pay for Part B premium?

Nov 12, 2021 · The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much is Part B insurance in 2021?

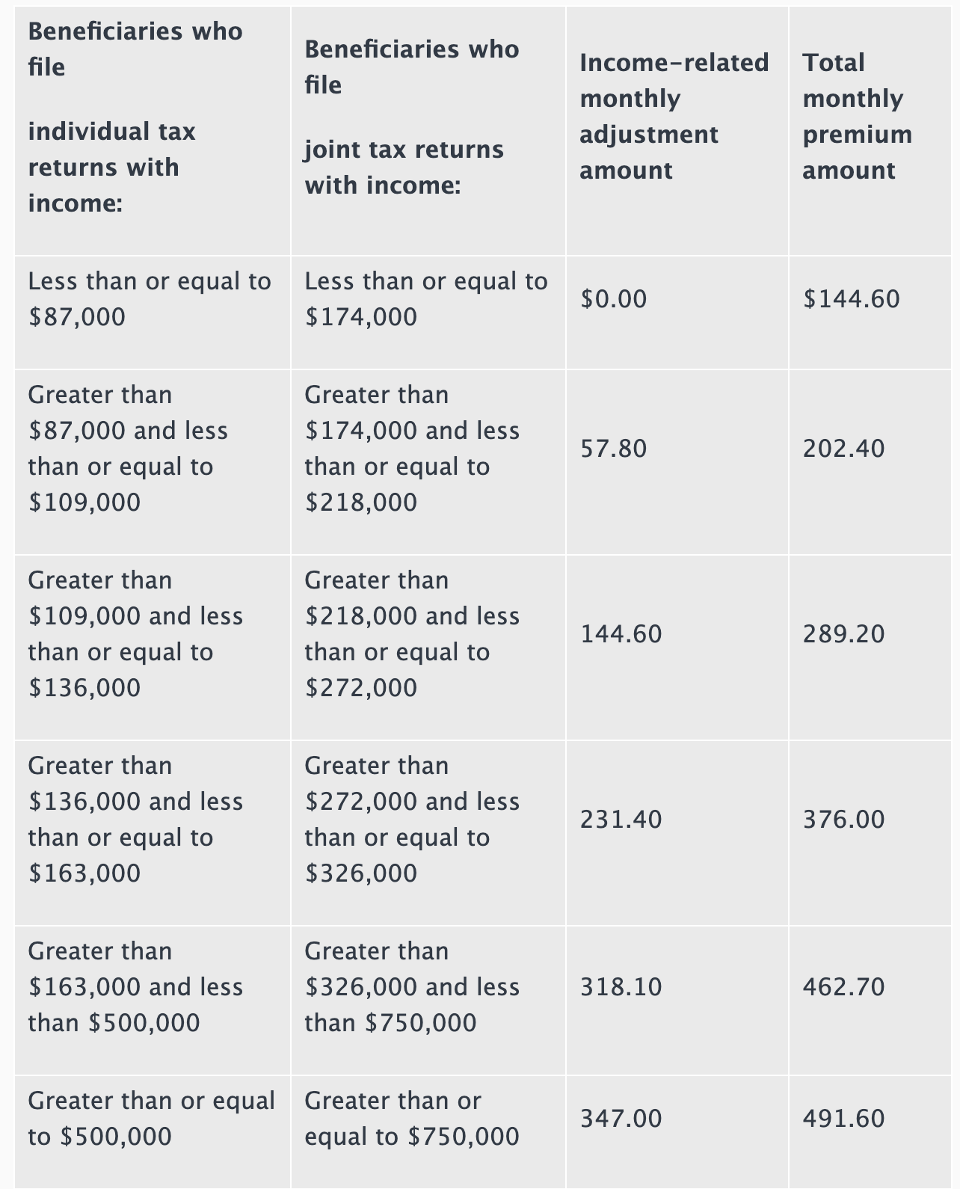

The monthly Part B premiums that include income-related adjustments for 2021 will range from $207.90 to $504.90, depending on the extent to which an ...

How much is the Part B premium?

Total monthly Part B premium amount. Less than or equal to $88,000. Less than or equal to $176,000. $0.00.

What information does SSA use for 2021?

To make the determinations, SSA uses the most recent tax return information available from the Internal Revenue Service. For 2021, that will usually be the beneficiary’s 2019 tax return information. If that information is not available, SSA will use information from the 2018 tax return. Railroad retirement and social security Medicare beneficiaries ...

What percentage of Medicare beneficiaries pay the larger premiums?

CMS estimates that about 7 percent of Medicare beneficiaries pay the larger income-adjusted premiums. Beneficiaries in Medicare Part D prescription drug coverage plans pay premiums that vary from plan to plan. Part D beneficiaries whose modified adjusted gross income exceeds the same income thresholds that apply to Part B premiums also pay ...

Why do Medicare beneficiaries pay less than Medicare?

Some Medicare beneficiaries will pay less than this amount because, by law, Part B premiums for current enrollees cannot increase by more than the amount of the cost-of-living adjustment for social security (railroad retirement tier I) benefits.

Why Could the Premium Change?

According to the Washington Post, this is the first time that Medicare has considered a change to its premiums after announcing its annual figures. But this year’s Part B premium rise – the largest dollar amount increase in program history – has been an unusual situation.

How Much Will the New Part B Premium Be?

It is currently unclear how much beneficiaries could see their Part B premium decrease if Medicare does opt to make a change to this year’s amounts. But the updated premium could be significantly lower.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

What is the income used to determine IRMAA?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA. As if it’s not complicated enough for not moving the needle much, ...

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.