How much will I pay for Medicare premiums?

4 rows · Nov 10, 2016 · Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the ...

How should I Pay my Medicare premiums?

Nov 16, 2016 · The monthly Medicare Part B premium in 2017 technically is $134.00, up 10 percent from this year, for people with incomes of $85,000 or less. It’s a big increase, but half as much as the Trustees suggested it might be. More importantly, because Social Security benefits are barely increasing, the vast majority of people with Medicare are seeing a far smaller …

How to pay your Medicare premiums?

Nov 17, 2016 · Last week, the Centers for Medicare & Medicaid Services (CMS) announced the Medicare Part B premiums for 2017. Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month.

Do Medicare recipients pay any premiums?

Dec 17, 2016 · Medicare Premiums in 2017. Posted on December 17, 2016. Medicare premiums, deductibles, and copays for the most part change from year to year and what you actually pay depends on your work history, income and inflation. Read article here…. Notice: The link provided in the text above connects readers to the full content of the referenced ...

What were Medicare premiums in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

What are the Medicare Part B premiums for 2022?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the standard Medicare Part B premium for 2016?

$104.90Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What will Medicare cost in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

How much were Medicare premiums in 2019?

$135.50 per monthThe standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.Jan 3, 2019

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.Oct 28, 2013

What is the Irmaa for 2017?

If Your Yearly Income Is2017 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$53.50$107,001 - $160,000$214,000 - $320,000$133.90$160,001 - $214,000$320,000 - $428,000$214.303 more rows•Jul 31, 2016

Latest News

Medicare premiums, deductibles, and copays for the most part change from year to year and what you actually pay depends on your work history, income and inflation. Read article here…

Medicare Premiums in 2017

Medicare premiums, deductibles, and copays for the most part change from year to year and what you actually pay depends on your work history, income and inflation. Read article here…

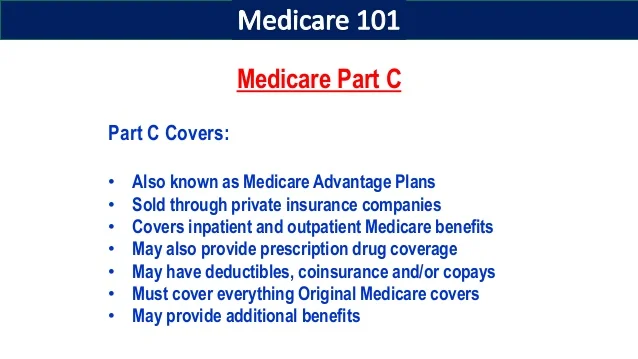

Medicare Advantage

Florida was the clear winner when comparing average Medicare Advantage premiums among states. The Sunshine State’s 2017 Medicare Advantage plans have an average premium of $19.24. North Dakota, in contrast, is over 6 times that amount with an average premium of $120.90.. South Dakota is similarly expensive with an average premium of $111.68.

Medicare Part D

When examining Medicare Part D trends on the state level, we found that lowest average premium was in Hawaii. At $43.95, the Aloha State had an average premium among 2017 Part D plans that is 17% lower than the national average of $53.22. In comparison, California had the highest average premium for their 2017 Part D plans.

Conclusion

Little inflation in 2017 average premium and deductible costs is welcome news for Part D and Medicare Advantage enrollees. However, a close inspection of the data reveals very different Medicare insurance markets across the United States. A combination of factors (e.g.

Author

This report was written by Kev Coleman, Head of Research & Data for HealthPocket. Correspondence regarding this study can be directed to [email protected].

Methodology

Premiums and deductibles for Medicare health and drug plans were obtained from the 2017 MA and PDP Landscape Source Files available at cms.gov on September 22, 2016 ( https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.html?redirect=/PrescriptionDrugCovGenIn/ last accessed on September 22, 2016).

What is the Medicare Part B deductible for 2017?

2017 Medicare Part B (Medical) Monthly Premium & Deductible. CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166.

How much does a Part A premium go up?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. Read more under Medicare Part A Special Enrollment Period.

How much does Medicare Part D cost?

The 2017 Part D plan premiums range from $12 to $179.

What happens if you don't get Part A?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up.

How long do you have to pay for Part A?

For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period.

Do you pay late enrollment penalty?

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a special enrollment period. Example: Mr. Smith’s initial enrollment period ended September 30, 2013. He waited to sign up for Part B until the General Enrollment Period in March 2016.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2017, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

Is Medicare Supplement Plan F still available?

Soon your favorite Medicare Supplement Plan F will no longer be available. Congress has passed legislation that prevents companies from covering the Part B Deductible starting January 1, 2020, making Plans C and F obsolete.

Will seniors pay more for medicare?

All the figures mentioned are approximate. We won’t know for sure until the Centers for Medicare and Medicaid Services (CMS) releases the actual figures next month. Regardless, with rising health care costs, the increasing number of insureds, and new legislation going into effect, seniors will eventually pay more for Medicare coverage. With the already significant out-of-pocket expenses associated with Medicare, action needs to be taken towards finding a long term solution. With it being an election year, it’s surprising how the candidates have not addressed the shoring up of the Federal Medicare Program. However, with all the changes coming shortly, I’m sure it will be a hot topic soon.