The new tax law did a couple of things to affect Medicare costs. Number one, it added a new tier on the top. This won’t affect many people – it’s for people who make $500,000 and above if you’re a single filer or $750,000 for joint filers.

Full Answer

What's in the proposed changes to Medicare?

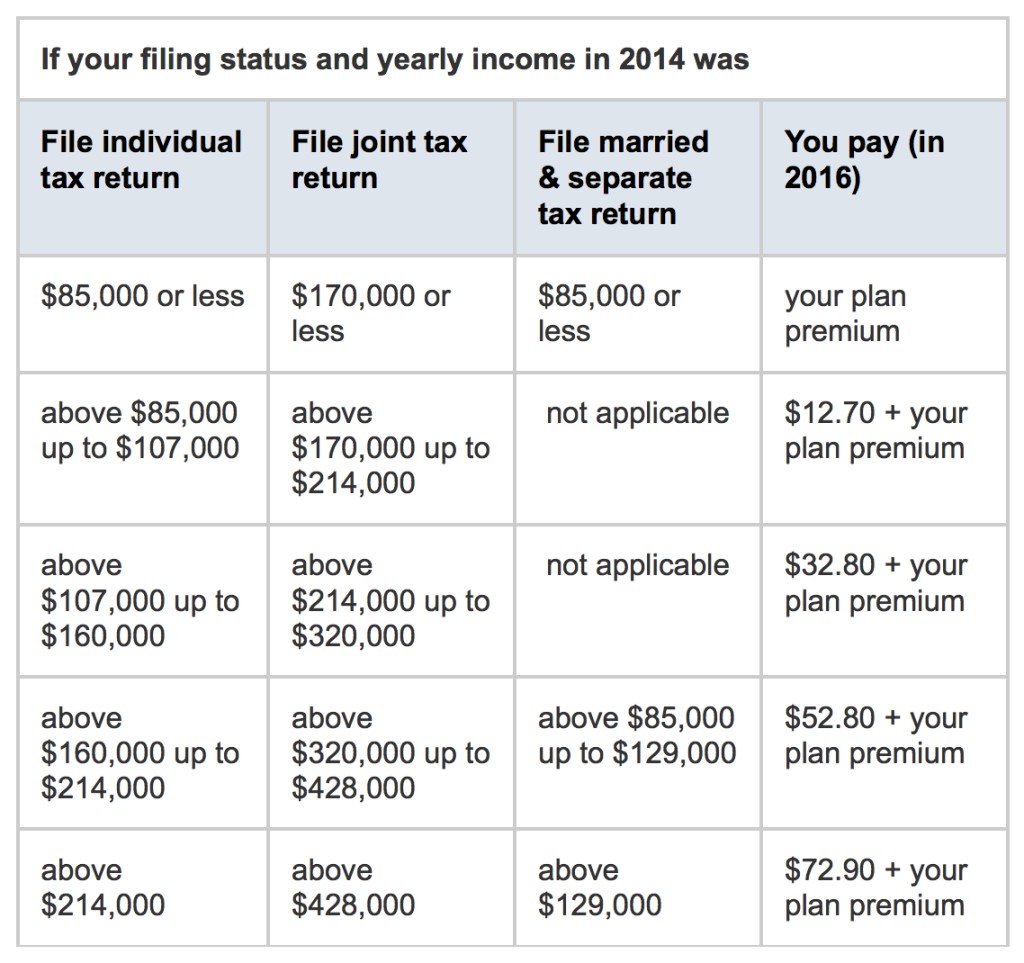

· If you’re a joint filer and you make over $170,000 or if you’re a single filer and make over $85,000, you will be hit with Medicare surcharges. That number, by the way, does include tax-free municipal bond income. The new tax law did a couple of things to affect Medicare costs. Number one, it added a new tier on the top.

What happens if Congress adds benefits to Medicare?

· Because Medicare and Medicaid together accounted for about $1.25 trillion in federal spending in 2016, about 30% of the federal budget, they will be the major targets for deficit reduction.

Will Medicare be covered under the budget plan?

· Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2022 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

Does Medicare Part a deductible increase apply to all enrollees?

· If you worked and paid Medicare taxes for 30 to 39 quarters, you’ll pay $274 a month for Part A in 2022, up from $259 in 2021. If you paid Medicare taxes for 40 quarters or …

:max_bytes(150000):strip_icc()/GettyImages-182800841-5894f4825f9b5874ee438219.jpg)

What is Bidens Medicare expansion?

The Medicare expansion in President Joe Biden's $1.75 trillion spending plan included fewer new benefits than some Democrats had hoped for. Medicare benefits would be expanded to include hearing coverage under a framework for a $1.75 trillion spending plan released by President Joe Biden on Thursday.

What is Medicare and why do we pay taxes to support it?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

Does Medicare premiums reduce Social Security taxable income?

Is Social Security Taxed Before Or After the Medicare Deduction? You may not pay federal income taxes on Social Security benefits if you have low-income. But for most, your Social Security benefits are taxable. That means you'll pay taxes before Medicare premiums are deducted.

What is the new Medicare proposal?

The current proposal calls for vision coverage to begin in 2022, hearing in 2023 and dental benefits in 2028. Vision coverage would include a routine eye exam and fitting services for contact lenses every two years.

What is the additional Medicare tax for 2021?

0.9%2021 updates. 2.35% Medicare tax (regular 1.45% Medicare tax + 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). (Code Sec. 3101(b)(2))

Who pays additional Medicare tax 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much will Social Security take out for Medicare in 2022?

Medicare Part B premium is going up by $21.60 to $170.10. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

How do I get $144 back on my Social Security?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Are Democrats trying to change Medicare?

The latest version of the Democrats' spending plan includes proposals that aim to improve Medicare's prescription drug coverage in several ways. This is in addition to an existing provision to add hearing services to the program's coverage.

Is Medicare going to be expanded?

No state has the power to expand Medicare, as it is a federal program. However, states are able to expand their Medicaid programs within federal guidelines.

Does Medicaid cover dental for adults 2021?

In 2021, forty-six provide coverage for dental services in some capacity. The CHCS undertook a project to understand the dental benefits offered to Medicaid members across the US and divided the types of benefits into three categories: extensive, limited, and emergency.

How will the new tax plan affect health care?

How the New U.S. Tax Plan Will Affect Health Care. It will mean less coverage, less revenue, and a less productive workforce. Summary. Earlier today, the U.S. House of Representatives passed a new tax bill which will eliminate the penalties against people who don’t have health insurance and significantly increase the federal deficit.

How much of the federal budget was spent on Medicare and Medicaid in 2016?

Because Medicare and Medicaid together accounted for about $1.25 trillion in federal spending in 2016, about 30% of the federal budget, they will be the major targets for deficit reduction. There is no guarantee that such efforts will succeed, but if they do, reforms could take a number of directions.

How many Americans will lose health insurance?

But there are also practical questions for American businesses. The 13 million Americans who will lose health insurance and many millions of Medicaid eligible individuals who may lose coverage or benefits are current or potential workers whose health influences their productivity.

Is there a special thing about health care de-stimulus?

There is one special thing about health care de-stimulus, however, that may not be true of other spending cuts . This involves health care’s effects on population and worker health. The scientific literature demonstrates a strong link between having health insurance and health status.

Is a precipitous cut bad for Medicare?

Precipitous cuts, however, could be damaging. In any case, if the nation were to embark on a drive to make the delivery of health care more efficient, Medicare and Medicaid would not be the most promising places to start.

Will Medicaid reforms reduce the size of government?

For Medicaid, reforms would likely lead similarly to fewer people covered, reduced benefits, and/or higher cost-sharing. For conservatives who have long sought to reduce the generosity of entitlements in the United States, these changes would be a welcome way to reduce the size of government.

What age can you get Medicare?

For Medicare, this could include increasing the eligibility age from 65 to 67 or beyond (resulting in fewer covered elderly), caps on spending per beneficiary (possibly reducing covered benefits), or increases in cost-sharing that would lead to beneficiaries using fewer services.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the surtax rate for 2021?

The additional tax (0.9% in 2021) is the sole responsibility of the employee and is not split between the employee and employer. If you make more than $200,000 per year in 2021, the 0.9 percent surtax only applies to the amount you make that is over $200,000.

Who can help with Medicare enrollment?

If you’d like more information about Medicare, including your Medicare enrollment options, a licensed insurance agent can help.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Advantage?

Medicare Advantage is a bundled alternative to Original Medicare that includes all the coverages of Medicare Part A, Part B and usually Part D. Medicare Advantage plans, also called Medicare Part C, often include additional benefits, such as some cost help with dental, vision and hearing care, fitness memberships, over-the-counter allowances and meal delivery.

How many Medicare Advantage plans will be available in 2022?

There are 3,834 Medicare Advantage plans available in 2022, up 8% from 2021. Of the 2022 plans, 59% are health maintenance organization, or HMO, plans, and 37% are preferred provider organization, or PPO, plans.

What is the average Medicare premium for 2022?

The average premium in 2022 for Medicare Advantage plans will be $19 per month, versus $21.22 in 2021. (Note: Medicare Advantage members are still responsible for the Medicare Part B monthly premium, which is $170.10 in 2022.)

How many stars does Medicare Advantage have?

Each year, the Centers for Medicare & Medicaid Services assigns every Medicare Advantage plan a star rating, ranking each plan from best (5 stars) to worst (1 star). These ratings are based on plans’ quality of care and measurements of customer satisfaction, and those ratings can change each year.

How much is Medicare Part B in 2022?

All Medicare members pay a Part B premium, and that is increasing to $170.10 per month in 2022, up from $148.50 in 2021. You may pay a higher premium, depending on your income. For example, those who file taxes individually with a modified adjusted gross income of more than $91,000 (or those who file joint tax returns with a modified adjusted gross income of more than $182,000) will pay an additional $68 to $408.20 per month on top of the Medicare Part B premium.

When is Medicare open enrollment?

Open enrollment for Medicare goes from Oct. 15 to Dec. 7 each year, when Medicare beneficiaries choose their coverage for the next plan year. As Medicare enrollees contemplate their choices for 2022, here are overall Medicare changes to keep in mind.

How much is the Part A deductible for 2022?

The Part A inpatient hospital deductible is increasing to $1,556 in 2022 for each benefit period, up from $1,484 in 2021. Coinsurance is also rising as follows:

What would happen if Congress added benefits?

If Congress adds [those] benefits, it would fill some major gaps in coverage that the program has had since its inception.

What is Part C in Medicare?

Some beneficiaries get limited coverage for dental, vision and hearing if they choose to get their Parts A and B benefits delivered through an Advantage Plan (Part C), which often include those extras. About 40% of beneficiaries are enrolled in Advantage Plans.

Will Medicare make it through the full congressional process?

Although there’s no certainty that everything in the budget plan will make it through the full congressional process, Medicare advocates are hopeful that coverage of the extra benefits will come to fruition.

Will Medicare cover dental and vision?

Coverage for dental, vision and hearing would be provided through original Medicare, if Democrats’ full $3.5 trillion budget plan comes to fruition.

Does Medicare have scant details?

While the plan includes scant details about the proposed Medicare changes, other efforts to expand the program coverage could offer some clues.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

When will Medicare stop allowing C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020.

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

Does Medicare Advantage have a copay?

Many Medicare Advantage plans have low copays and deductibles that don’t necessarily increase in lockstep with the Part B deductible, so their benefits designs have had different fluctuations over the last few years. [Medicare Advantage enrollees pay the Part B premium plus the Advantage plan premium if the plan has a separate premium. Medicare Advantage plans wrap Part A, Part B, usually Part D, and various supplemental coverage together into one plan, with out-of-pocket costs that are different from Original Medicare.]

How will the new dental benefits affect Medicare Part A and its trust fund?

How will the new dental benefits — assuming they remain in the bill — affect Medicare Part A and its trust fund? Strictly speaking, not at all. The new benefits would be a part of Part B of the program, that is, doctors’ charges, rather than Part A, which covers hospital charges. In one respect, it would be its own benefit structure entirely, since, unlike “regular Part B” Medicare, the proposal would have the federal government pay 100% of the benefit’s costs, rather than requiring participants to pay a 25% cost-share premium. It would, in a way, become Medicare Part E.

When will Medicare be exhausted?

At the same time, late last month, the latest Trustees’ Report for Medicare determined that the Medicare Part A Trust Fund will be exhausted in the year 2026, which, if you do the math, is a mere five years from now. At that point, Medicare would have to cut reimbursement rates for doctors by 9%, increasing to 20% in 2045, or even more if the report’s assumptions don’t pan out.