According to the Congressional Budget Office, the move could save the postal retirement and health programs about $5.6 billion through 2031 while adding $5.5 billion in costs to Medicare during that span, and probably much more in later years.

Full Answer

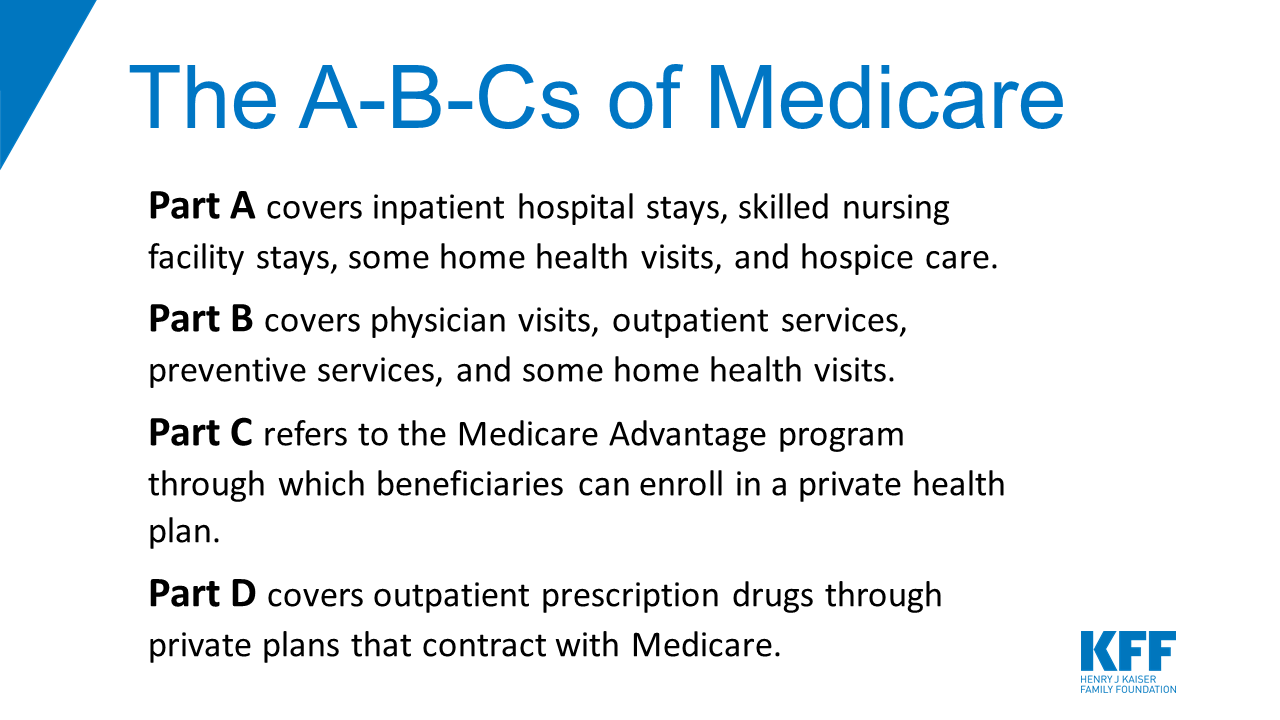

Could Medicare have had health benefits?

In addition, the authors caution that Medicare may well have had health benefits that their analysis cannot detect, such as improvements in health status, even without mortality improvements.

Is Medicare cost-sharing going up in 2022?

But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more. The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the program’s history.

Do market-wide changes in health insurance affect health spending?

As a result, the impact on health spending of market-wide changes in health insurance may be disproportionately larger than what the estimates from individuals' changes in health insurance would suggest.

Does Medicare Part a deductible increase apply to all enrollees?

The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible. How much is the Medicare Part A coinsurance for 2022?

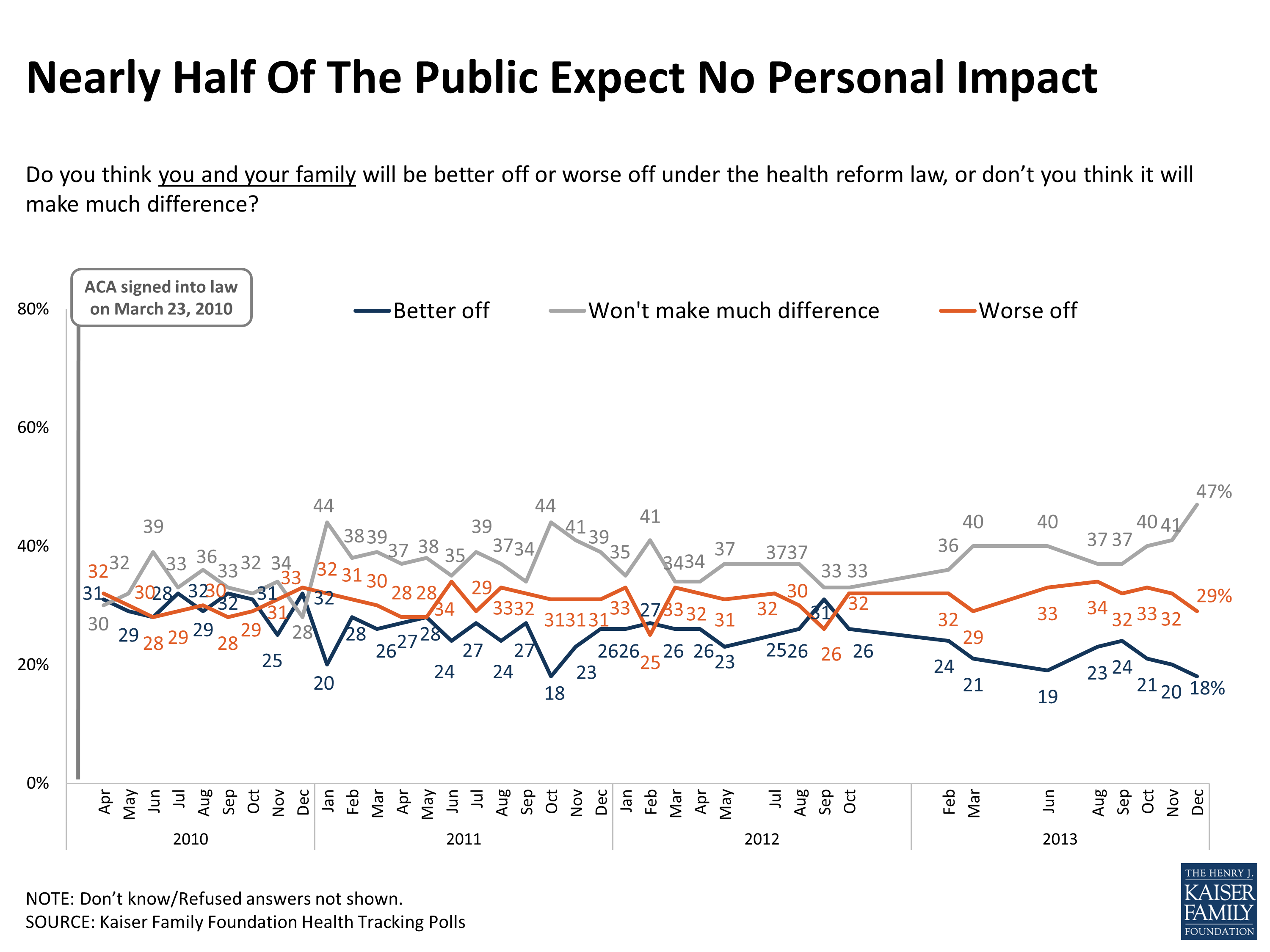

What impact is the Affordable care Act expected to have on Medicare?

The ACA made myriad changes to Medicare. Some changes improved the program's benefits. Others reduced Medicare payments to health care providers and private plans and extended the financial viability of the program. Still others provided incentives and created programs to encourage the system to provide better care.

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

What challenges will Medicare face in the future?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries.

What is the future of Medicare Advantage?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

What will Medicare cost me in 2022?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What are some of the biggest challenges with Medicare today?

Top concerns for Medicare beneficiaries: Part B, appeals and affordable medications. The top concerns of Medicare enrollees include navigating Part B, appealing Medicare Advantage (MA) denials and affording meds, according to an annual report from the Medicare Rights Center.

Will Part B premiums be reduced?

Your Medicare Part B premiums won't be reduced this year, the government has announced.

What happens when Medicare runs out in 2026?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is Congress trying to cut Medicare Advantage plans?

Most of Congress warns CMS against any Medicare Advantage cuts, calls for benefit flexibility. A large swath of House and Senate lawmakers is pushing the Biden administration not to install any cuts to Medicare Advantage (MA) plans in the coming 2023 rates.

Will Medicare ever go away?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

How much will health insurance premiums increase in 2021?

Unlike 2017 and 2018, 11 when individual market health insurance premiums increased significantly, average pre-subsidy premiums increased by less than 3% nationwide for 2019, were essentially flat for 2020, 12 and increased only slightly for 2021, with a median increase of just 1.1%. 13

When is the second chance to enroll in health insurance?

Second Chance to Enroll or Make a Plan Change: Runs Through August 15, 2021 in Most States. Because of the ongoing COVID pandemic and the expanded subsidies created by the American Rescue Plan, people are being given a second chance to enroll in health coverage for 2021 or switch to a different plan. In most states, this enrollment window continues ...

What is the maximum out of pocket limit for catastrophic health insurance in 2021?

Catastrophic plans have deductibles that are equal to the maximum out-of-pocket limit, so all catastrophic plans in 2021 have deductibles of $8,550. The maximum out-of-pocket limits apply to all non- grandfathered, non- grandmothered health plans, including large group plans and self-insured plans.

What is the maximum out of pocket limit for a single person in 2021?

In 2021, the maximum out-of-pocket limit for a single person is $8,550 (the limit for a family is always twice as much). 10 Health plans can have out-of-pocket caps that are smaller than that amount, but not larger. Catastrophic plans have deductibles that are equal to the maximum out-of-pocket limit, so all catastrophic plans in 2021 have ...

What is the income cap for the American Rescue Plan?

The American Rescue Plan has made several important changes to 2021 health insurance subsidies: The income cap (normally 400% of the poverty level) for subsidy eligibility has been eliminated for 2021 and 2022. People with income above 400% of the poverty level can qualify for a premium subsidy if the cost of the benchmark plan would otherwise be ...

When will the ACA be free?

Millions of Uninsured Americans are Eligible for Free ACA Health Insurance. November 24, 2020. U.S. Department of Health and Human Services. Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2021; Notice Requirement for Non-Federal Governmental Plan.

Will Medicare change in 2021?

For people who get their insurance from large employers, Medicare, or Medicaid (taken together, that's most of the population), 22 the changes for 2021 were generally the same sort of changes that happen each year. Medicaid work requirements had been gaining traction in GOP-led states in recent years.

What is the evidence that the introduction of Medicare was associated with faster adoption of then-new cardiac technologies?

Consistent with this, Finkelstein presents suggestive evidence that the introduction of Medicare was associated with faster adoption of then-new cardiac technologies. Such evidence of the considerable impact of Medicare on the health care sector naturally raises the question of what benefits Medicare produced for health care consumers.

How much does Medicare cost?

At an annual cost of $260 billion, Medicare is one of the largest health insurance programs in the world. Providing nearly universal health insurance to the elderly as well as many disabled, Medicare accounts for about 17 percent of U.S. health expenditures, one-eighth of the federal budget, and 2 percent of gross domestic production.

Why is there a discrepancy in health insurance?

Finkelstein suggests that the reason for the apparent discrepancy is that market-wide changes in health insurance - such as the introduction of Medicare - may alter the nature and practice of medical care in ways that experiments affecting the health insurance of isolated individuals will not. As a result, the impact on health spending ...

What was the spread of health insurance between 1950 and 1990?

Extrapolating from these estimates, Finkelstein speculates that the overall spread of health insurance between 1950 and 1990 may be able to explain at least 40 percent of that period's dramatic rise in real per capita health spending. This conclusion differs markedly from the conventional thinking among economists that the spread ...

When did Medicare start?

Medicare's introduction in 1965 was, and remains to date, the single largest change in health insurance coverage in U.S. history. Finkelstein estimates that the introduction of Medicare was associated with a 23 percent increase in total hospital expenditures (for all ages) between 1965 and 1970, with even larger effects if her analysis is extended ...

Does market wide change in health insurance increase market demand for health care?

For example, unlike an isolated individual's change in health insurance, market wide changes in health insurance may increase market demand for health care enough to make it worthwhile for hospitals to incur the fixed cost of adopting a new technology.

Will Medicare follow suit?

But, the problem is unlikely to end with that. When Medicare arrives at a decision, private payers often follow suit, as the National Bureau of Economic Research has documented. If history repeats itself, it might not be long before more insurance companies follow the CMS’s lead on payments.

Can a physician cut back on time on their payroll?

The American Medical Association and the American Academy of Family Physicians are among the many professional organizations that have expressed concern that the new reimbursement rules will cause healthcare employers to cut back on the amount of time doctors on their payroll can spend with patients. After all, if a five-minute visit pays the same as a 50-minute visit, and the overall result is less income generated per hour, one way to compensate is to add more patients to the schedule.

Why are Medicare Advantage plans more efficient?

Advocates of the privatization of Medicare claim that Medicare Advantage plans are more efficient because the plans receive a set payment for each enrollee, what’s known as a capitation payment. “They pay for all of the enrollee’s healthcare out of that payment and they get to keep the remainder,” Huckfeldt said.

How much will Medicare premiums drop in 2020?

The Centers for Medicare & Medicaid Services (CMS) also expects Medicare Advantage premiums to drop by 23 percent from 2018 to 2020.

Why is Medicare Advantage so difficult to compare to Medicare Advantage?

Comparing traditional Medicare to Medicare Advantage is difficult, because even Medicare Advantage plans vary among themselves in terms of quality and cost. To help older adults make smarter healthcare choices, the executive order will push for them to have access to “better quality care and cost data.”.

What is value based care?

However, some healthcare professionals welcomed the order’s emphasis on “ value-based care ,” in which providers are paid for the quality of care they provide rather than how many services they bill for. Because of the lack of detail in the executive order, it’s difficult to say what effect this will have on Medicare.

What is the executive order for Medicare?

Written by Shawn Radcliffe on October 10, 2019. Share on Pinterest. An executive order aimed at “strengthening” Medicare is mainly focused on providing older adults with more Medicare Advantage plans and options. Getty Images.

Do PAs get paid by Medicare?

The American Academy of Nurse Practitioners and the American Academy of PAs were both supportive of the order’s proposal for fewer practice restrictions on these providers, reports MedPage Today. The order also recommends that providers be paid by Medicare based on the services provided rather than their occupation.

Does Medicare Advantage have fewer hospital stays?

There is research showing that this payment model works. Some studies show that Medicare Advantage enrollees have fewer hospital stays and lower mortality rates compared to people with traditional Medicare.

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's Covid-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

How much would a 4% tax rate bring in?

Raising that tax rate to 4% (and including in the tax base income from some small businesses and limited partnerships) would bring in more than $490 billion in new revenue for the trust fund over 10 years, estimates Richard Frank, professor of health economics at Harvard Medical School and Thomas McGuire, professor of health economics, Harvard University.

When will the Congressional Budget Office deplete?

Last September, the Congressional Budget Office (CBO) forecast depletion in 2024. In February 2021, the CBO pushed back that date to 2026 due to improved prospects for stronger economic growth and higher employment rates.

Is Medicare insolvency a new issue?

Medicare Insolvency Issues Aren't New. The Medicare Hospital Insurance Trust Fund has actually confronted the risk of insolvency since Medicare began in 1965 because of its dependence on payroll taxes (much like Social Security).