But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF). With original Medicare, there’s no cap on what you can spend out of pocket (unless you have supplemental insurance like Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

How much are healthcare out of pocket costs?

Feb 15, 2022 · If you only paid between 30 and 39 quarters worth of Medicare taxes (7.5 to 9.75 years) you will be required to pay a premium of $274 per month. If you paid fewer than 30 quarters worth of Medicare taxes, your monthly Part A premium could be as high as $499. Part B The standard Medicare Part B premium is $170.10 per month.

How much is health insurance out of pocket cost?

Medicare Out of Pocket Costs for Part A and Part B. Medicare Part A and Part B will generally pay 80% of hospital and doctor expenses. Most people pay only $170.10 a month (in 2022) for their Part B premium. The remaining 20% is Medicare out of pocket costs that you are responsible for, and why a Medicare Supplement plan (Medigap) is recommended.

How much did you pay out of pocket?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

How much does Medicare take out of your paycheck?

Nov 15, 2021 · Part B: $170.10 monthly for 2022 (automatically deducted from Social Security benefit payments). Individuals with an annual income of more than $91,000 pay a higher premium. Part C (Medicare Advantage) : $170.10 monthly for the Part B premium for 2022, plus any additional premium set by the insurer.

How much do Medicare patients pay out-of-pocket?

A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

Does Medicare reimburse for out-of-pocket?

Since Medicare Advantage is a private plan, you never file for reimbursement from Medicare for any outstanding amount. You will file a claim with the private insurance company to reimburse you if you have been billed directly for covered expenses.

What percent of healthcare spending is out-of-pocket?

Out of pocket spending declined 3.7% to $388.6 billion in 2020, or 9 percent of total NHE. Federal government spending for health care grew 36.0% in 2020, significantly faster than the 5.9% growth in 2019. This faster growth was largely in response to the COVID-19 pandemic.Dec 15, 2021

Can a doctor charge more than Medicare allows?

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare. Some doctors accept the Medicare rate while others choose to charge up to the 15% additional amount.

Who pays the 20% of a Medicare B claim?

When an item or service is determined to be coverable under Medicare Part B, it is reimbursed at 80% of a payment rate approved by Medicare, known as the “approved charge.” The patient is responsible for the remaining 20%.

What is the average out-of-pocket maximum?

How much is a typical out-of-pocket max? For those who have health insurance through their employer, the average out-of-pocket maximum is $4,039. The out-of-pocket maximum for plans on the health insurance marketplace is usually higher than plans through an employer.Nov 17, 2021

Which plan will have the highest out-of-pocket costs?

Health plans with very low insurance premiums — like a catastrophic plan or high-deductible health plan (HDHP) — tend to have higher out-of-pocket maximums. Catastrophic coverage is a special type of health insurance plan available only to people under 30 or people with a hardship exemption.

What is the average medical expenses per month?

The national average premium in 2020 for single coverage is $448 per month, for family coverage, $1,041 per month, according to our study. A Bronze plan may be right for you if your primary goal is to protect yourself financially from the high cost of a serious illness or injury and still pay a modest premium.Jan 21, 2022

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How many days can you use Medicare?

Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

What happens if you can't leave your home?

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there. The Specified Low-Income Medicare Beneficiary (SLMB) program helps pay only for Part B premiums, not the Part A premium or other cost sharing.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

How many days does Medicare pay for hospitalization?

Medicare only pays for 90 days of hospitalization, but it gives you an extra 60 “lifetime reserve days” for your entire lifetime. These are additional days Medicare pays for hospitalization if you need more than 90 days in the hospital. If you use all these up, you will have to pay out-of-pocket for hospitalization. Free Medicare Help.

How much is Medicare Part A 2021?

Most people don’t pay a premium for Medicare Part A, but the standard premium for Part B is $148.50 in 2021. You may have to pay a premium for a Medicare. Advantage plan or Medicare Part D prescription drug coverage. There are also deductibles and coinsurance that add to your out-of-pocket costs.

What is a Part D plan?

The standard Part D premium adds this income-related monthly adjustment amount (IRMAA). Part D is an optional coverage that anyone on Medicare can sign up for.

What is Medicare Supplemental Insurance?

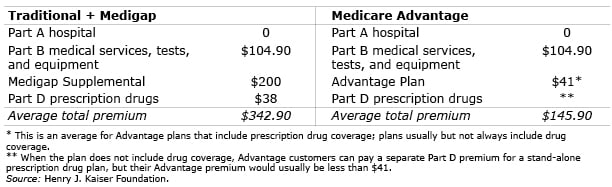

Medicare supplemental insurance, also known as Medigap, are private plans you can buy to cover some of the out-of-pocket costs of Medicare Part B. These are different from Medicare Advantage plans. The average monthly premium for Medigap was $175 per month, according to a 2017 study published by Harvard University.

How many parts are there in Medicare?

There are four parts to Medicare — Parts A through D — as well as supplemental insurance, also called Medigap, which affect your out-of-pocket costs. Important Medicare Cost Definitions.

Does Medicare pay monthly premiums?

Medicare Part A, which provides hospital insurance, charges no monthly premium to anyone who paid Medicare taxes through their employer for at least ten years. Those who haven’t worked that long have to pay premiums for Part A coverage.

What is coinsurance in medical?

Coinsurance. This is usually measured as a percentage of your doctor, hospital or other medical bill. Coinsurance is a cost you may have to pay for your share of medical services even after you’ve paid your deductibles.

What is the maximum amount you can pay out of pocket for Medicare?

In 2018, the Medicare Advantage out of pocket maximum was $6,700. Some Medicare Advantage plans may have lower out ...

How much does Medicare cost monthly?

Some Medicare Advantage plans have monthly premiums as low as $0. If you pay more than $0, for example $104 a month for your Medicare Advantage plan, that amount will not count towards reaching your Medicare Advantage out of pocket maximum.

What is Medicare premium?

What is a Medicare premium? A Medicare premium is amount you pay to have Medicare coverage, whether or not you use covered services. Most types of Medicare coverage may charge you a monthly premium, including Medicare Part B (Original Medicare), Medicare Part D, Medicare Supplement plans, and Medicare Advantage plans.

What are some examples of out of pocket expenses?

Examples of costs that generally count towards your out of pocket maximum would include for example: Other copayments that generally count towards your out of pocket maximum include emergency room copayments, coinsurance for X-rays and radiology, copayments for outpatient rehabilitation, and coinsurance for durable medical equipment.

What is coinsurance in health insurance?

Any care you get out of network, including doctor visits and hospital stays. A coinsurance you pay for a prescription drug. The cost for a cosmetic procedure or other type of service not covered by your plan. Medical bills you paid in a previous year.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medigap coverage good?

The coverage is so good you’ll never spend $5,000 a year on medical bills. Sure, the premium is a little higher, but the benefits are more significant. If high medical bills are your concern, consider choosing Medigap.

Does Medicare cover surgery?

Medicare doesn’t have a limit on the amount you can spend on healthcare. But, they do cover a portion of most medical bills. Yes, there is some help, but 20% of $100,000+ surgery or accident could be bank-breaking. But, there are options to supplement your Medicare. Some options have a maximum limit. Yet, some options don’t.