Is there still a donut hole in Medicare?

· By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan.

How to avoid the Medicare Part D Donut Hole?

· The Medicare Part D donut hole has been closing in recent years due to provisions in the Affordable Care Act (ACA), also known as Obamacare. The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump.

When does Medicare coverage based on ESRD end?

When Does the Medicare Donut Hole End? The coverage gap ends when you reach the catastrophic coverage limit for the year. In 2021, this amount is $6,550. The good news is that the donut hole essentially closed in 2020, so that even when you hit the coverage gap, you won’t pay more than 25% of the cost of prescription drugs.

What happens when Medicare coverage ends?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole. However, even after the coverage gap is gone, everyone on Part D will still have the same level of cost sharing — about 25 percent — from the …

Is the donut hole ending in 2021?

Key takeaways: The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs.

What year does the donut hole go away?

2020How does the donut hole work? The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

Will there be a Medicare donut hole in 2022?

In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

How long do you stay in the donut hole with Medicare?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Will the donut hole ever end?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

How do you get out of the Medicare donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

What is the amount of the donut hole for 2022?

If you find yourself in the Medicare donut hole and want out, you'll need to hit your out-of-pocket threshold. Once you meet this cost, which is $7,050 in 2022, you will only have to pay 5% of your prescription drug costs or $3.70 for generic drugs and $9.20 for brand-name drugs—whichever is greater.

Do Medicare Advantage plans cover the donut hole?

Some people ask: Do Medicare Advantage plans cover the donut hole? If you choose to include Medicare prescription drug coverage in your Medicare Advantage plan, it will still have a donut hole just like a regular Part D plan. Medicare Advantage does not cover any additional Part D costs during the coverage gap.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does SilverScript have a donut hole?

With SilverScript, you have access to more than 65,000 pharmacies, as well as many preferred pharmacies. The SilverScript Plus plan has no deductible and more coverage during the Part D donut hole, while the SilverScript Choice and SilverScript SmartRx plans offer lower monthly premiums.

What is the Medicare Part D donut hole?

The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug cost...

What happens in the donut hole coverage gap in 2020?

Once you enter the donut hole in 2020, your Part D plan’s coverage becomes more limited. In 2020, you’ll pay no more than 25 percent of the price f...

What happens when the donut hold goes away in 2020?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastr...

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

Is the donut hole closing?

However, since the introduction of the Affordable Care Act, the donut hole has been closing. Although the donut hole is being phased out, in 2021 you’ll still have to pay a certain percentage OOP once Medicare reaches its coverage limit. In 2021, you must pay 25 percent of the cost for both generic and brand-name drugs while you’re in ...

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What percentage of Medicare Part D patients are covered by generic drugs?

After Part D began, about 60 to 70 percent of eligible people without prescription drug coverage enrolled. Both brand-name and generic drugs are covered in Medicare Part D plans. At least two drugs in commonly prescribed drug categories are included on the list of covered medications, which is called a formulary.

Is generic drug covered by Medicare?

Both brand-name and generic drugs are covered in Medicare Part D plans. At least two drugs in commonly prescribed drug categories are included on the list of covered medications, which is called a formulary. However, the specific drugs covered in your Part D plan can vary from year to year.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

When did the Medicare donut hole go away?

Did the Medicare Donut Hole Go Away in 2020? The Medicare Donut Hole closed in 2019 for brand name drugs and disappeared in 2020 for generic drugs. Learn how this may affect your Part D costs.

Is the Medicare donut hole closing?

The Medicare Part D donut hole has been closing in recent years due to provisions in the Affordable Care Act (ACA), also known as Obamacare. The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump.

What happened to the Medicare donut hole in 2020?

What happened in the donut hole coverage gap in 2020? The Medicare donut hole coverage gap shrunk to its final cost level in 2020. We'll explain more below about what this means for your coverage. The Medicare donut hole is one of four coverage levels (coverage periods) that are in a Part D prescription drug plan.

What is the deductible period for Medicare?

The deductible period. Some (but not all) Medicare Part D plans have a deductible, which is the amount of money you must spend on covered drugs before your Medicare drug plan coverage kicks in. For example, if you have a Part D plan with a $200 deductible, you’re required to pay the first $200 of costs for covered drugs in a calendar year out ...

Does Medicare Part D have a deductible?

Some (but not all) Medicare Part D plans have a deductible, which is the amount of money you must spend on covered drugs before your Medicare drug plan coverage kicks in. For example, if you have a Part D plan with a $200 deductible, you’re required to pay the first $200 of costs for covered drugs in a calendar year out of your own pocket.

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

How can Medicare help avoid the donut hole?

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help (see below).

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

Social Security & Medicare

You are leaving AARP.org and going to the website of our trusted provider. The provider’s terms, conditions and policies apply. Please return to AARP.org to learn more about other benefits.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

When did the donut hole close?

In 2011, the government took several actions that started to close the donut hole. These included: 2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole.

Does Medicare have to pay for prescription drugs in 2020?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

What is a donut hole?

The term donut hole refers to the way a person needs to pay for coverage. A person pays a specified amount for their prescription drugs, and once they meet this deductible, their plan takes over the funding. However, when the plan has paid up to a specified limit, the person has reached the donut hole.

What happens when you pay a prescription drug deductible?

A person pays a specified amount for their prescription drugs, and once they meet this deductible, their plan takes over the funding . However, when the plan has paid up to a specified limit, the person has reached the donut hole.

What happens when you pay up to a donut hole?

Once they reach this point, a person has to start paying for their medications again until they reach another specified amount. After this, their plan takes over payment once again.

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

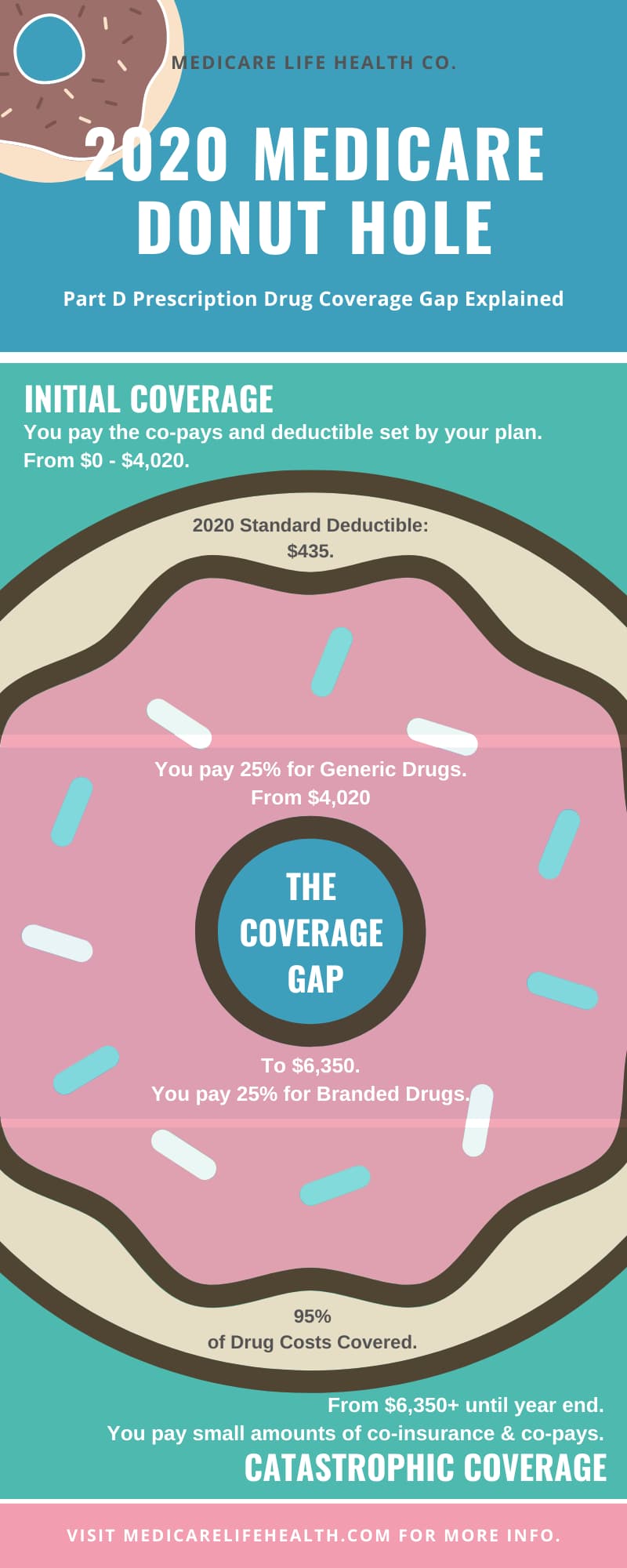

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

Does coinsurance affect coverage gap?

Costs like copayments, coinsurance, and deductibles can vary greatly from plan to plan and may affect your chances of entering the coverage gap. Remember, your risk of entering the coverage gap depends, in part, on how high your out-of-pocket costs are. It may be helpful to research Medicare plan options that could save you money.

How much is the Donut Hole Discount for Medicare Part D?

Does the Donut Hole go away… in 2020 is now called the Donut Hole Discount Donut Hole Discount: Part D enrollees will receive a 75 % Donut Hole discount on the total cost ...

Is the Donut Hole going away?

When Healthcare Reform began, the Donut Hole slowly began to close but was never intended to go completely away. In the past, one had to pay 100% of the cost of the prescription for brand-name drugs when one would hit the “Donut Hole” and now the cost is a whopping 25% of the brand-name and generic drugs.

How much does Medicare pay for prescription drugs in 2020?

In 2020, the prescription drug manufacturer must pay 70% and the Medicare Part D plan must pay 5% and the Medicare beneficiary must pay 25% until the out of pocket cost reaches $6,350. Below are the Medicare Part D costs before and after reaching the “Donut Hole” discount:

What is the new Part D cost for 2020?

Part D changes for 2020 are: will be increased by $20 from $415 in 2019 to $435 in 2020. Out-of-Pocket threshold cost: or (TrOOP) will increase from $5,100 in 2019 to $6,350 in 2020.

How much is the out of pocket threshold for Medicare?

Out-of-Pocket threshold cost: or (TrOOP) will increase from $5,100 in 2019 to $6,350 in 2020. begins once you reach your Medicare Part D plan’s initial coverage limit ($4,020 in 2020) and ends when you spend a total of $6,350 out-of-pocket in 2020.

What is the Donut Hole discount?

Now the Donut Hole is called the “Donut Hole” discount and that discount is 25% of the cost for both brand-name and generic prescriptions. When Healthcare Reform began, the Donut Hole slowly began to close but was never intended to go completely away. In the past, one had to pay 100% of the cost of the prescription for brand-name drugs ...

What is the Part D deduction for 2020?

Part D changes for 2020 are: Initial Deductible: will be increased by $20 from $415 in 2019 to $435 in 2020. Initial Coverage Limit: will increase by $200 from $3,820 in 2019 to $4020 in 2020 where the 2020 “Donut Hole”. Out-of-Pocket threshold cost: or (TrOOP) will increase from $5,100 in 2019 to $6,350 in 2020. Coverage Gap (Donut Hole):

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .

What Is the Medicare Part D Donut Hole?

The “donut hole” refers to a coverage gap that exists in Medicare prescription drug coverage. When you’re in the donut hole coverage gap, your Medicare drug plan pays a limited amount of the drug costs for generic drugs and brand name drugs.

How does the donut hole affect beneficiaries?

Let’s say your Medicare drug plan has a coinsurance requirement of 10%. During the initial coverage phase, you will be responsible for 10% of the cost of your prescriptions.

Did the Donut Hole Go Away in 2020?

The Medicare donut hole started shrinking and was set to close to its current rate in 2020, due to provisions in the Affordable Care Act (also known as ACA or Obamacare), which was signed into law in 2010 by President Barack Obama.