When can I enroll in Medicare?

If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan. During this time each year, you can also drop or switch your plan coverage. It’s important to understand when you can enroll in Medicare and be confident in your choices.

When should I sign up for Medicare Secondary Payer?

If your current insurance would become a secondary payer to Medicare, you should sign up during your initial enrollment period, which is the seven-month period that begins three months prior to the month you'll turn 65.

What is the eligibility age for Medicare in the US?

Follow @TMFMathGuy This article was updated on April 9, 2018, and originally published on July 16, 2017. The standard eligibility age for Medicare in the United States is 65.

When should I sign up for Medicare Part D?

Signing up when you’re first eligible can help you avoid paying a lifetime Part D late enrollment penalty. If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan. During this time each year, you can also drop or switch your plan coverage.

What is the plan year for Medicare?

During the 7‑month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65. (January 1–March 31). Sign up for a Medicare Advantage Plan (with or without drug coverage). Between April 1–June 30.

How many months before your 65th birthday should you apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

What was the 2017 Medicare Part B premium?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What are all the election periods for Medicare?

Initial Enrollment Period You have a seven-month window to join – from three months before the month you turn 65, through your birthday month and three months after the month you turn 65.

Does Medicare automatically start at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What should I be doing 3 months before 65?

You can first apply for Medicare during the three months before your 65th birthday. By applying early, you ensure your coverage will start the day you turn 65. You can also apply the month you turn 65 or within the following three months without penalty, though your coverage will then start after your birthday.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What was the Medicare Part B premium for 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

Is Medicare Part B premium adjusted annually?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Do you have to re enroll in Medicare every year?

In general, once you're enrolled in Medicare, you don't need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan.

Can you join Medicare mid year?

If you miss your first chance, generally you have to wait until fall for Medicare's annual Open Enrollment Period (October 15–December 7) to join a plan. During this time each year, you can also drop or switch your plan coverage.

Do you have to renew Medicare supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

How Medicare Works With Your Other Insurance

When you have more than one insurance provider, there are certain rules that determine who pays what it owes first and who pays based on the remain...

Who Can Delay Signing Up For Medicare?

So, whose insurance remains the primary payer? In a nutshell, if you have coverage through your or your spouse's current employment, and the employ...

Who Should Sign Up at 65, Even If They Have Other Insurance?

This leaves a fairly long list of other types of insurance that become secondary payers to Medicare. Therefore, if you're turning 65 and any of the...

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

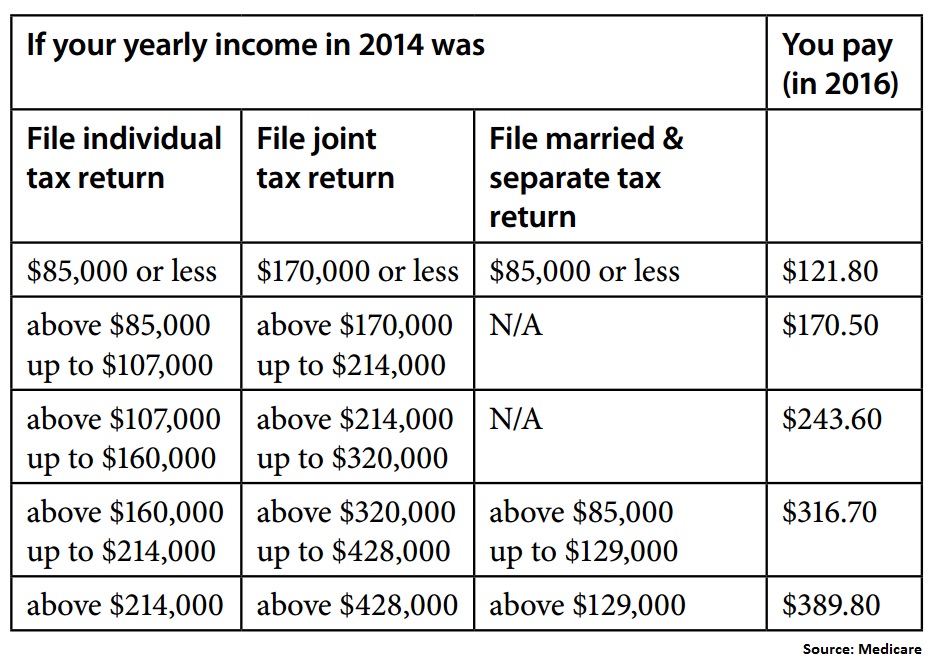

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.

How long do you have to sign up for Medicare if you are still working?

Once the employment or your employer-based health coverage ends, you'll have eight months to sign up for Medicare Part B ...

What is the age limit for Medicare?

The standard eligibility age for Medicare in the United States is 65. However, many people don't know if they need to sign up for Medicare if they already have other health insurance coverage, such as through a job, a spouse's employer, from their former employer, or through COBRA.

What happens if you don't sign up for Medicare Part B?

If one of these situations applies to you and you don't sign up for Medicare Part B during your initial enrollment period, you could face permanently higher premiums when you do. The Motley Fool has a disclosure policy. Prev. 1. 2. 3.

How much does Medicare Part B cost?

On the other hand, Medicare Part B has a monthly premium you'll have to pay ($134 per month for most new beneficiaries in 2018), which is why it can make sense to delay signing up if it's not going to be your primary insurance.

Can Medicare be a primary payer?

Depending on the type of insurance you have (group coverage, retiree coverage, COBRA, marketplace coverage, etc.), Medicare can either be the primary or the seconda ry payer. If Medicare would be a secondary payer to your current insurance, you can delay signing up for Medicare Part B.

Does Medicare pay for seniors who don't have other insurance?

How Medicare works with your other insurance. When you have more than one insurance provider, there are certain rules that determine who pays what it owes first and who pays based on the remaining balance. For seniors who don't have other insurance, Medicare is obviously the primary payer.

Do you have to get Medicare if you are retired?

Retired service members must get Medicare Part B when eligible in order to keep their TRICARE coverage. (Note: If you're still on active duty, you don't have to enroll in Medicare until after you retire.) You have veterans' benefits. You have coverage through the healthcare marketplace or have other private insurance.

Already on Medicare

Open enrollment is from Oct. 15 to Dec. 7. With a few exceptions, such as a move out of state, you can only switch plans during this period. You can also change from an Advantage plan to original Medicare during a “disenrollment” period from Jan. 1 to Feb. 14.

New to Medicare

If you’re turning 65, aren’t getting Social Security benefits and don’t have employer-based insurance: You need to enroll in Medicare Part B during your initial enrollment period (IEP) to avoid penalties. Your seven-month IEP begins three months before the month you turn 65 and lasts until three months after.

Last-chance options

If you missed your IEP or SEP, you can still apply for Medicare coverages during the next general enrollment period, which runs from Jan. 1 to March 31. But coverage won’t begin until July, and you’ll be subject to late penalties.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

How long does it take to sign up for Medicare?

You can do so the Medicare website at www.medicare.gov and it should take most people 10 minutes or less. Alternatively, you can call (1-800-772-1213) or visit a Social Security office about three months before your 65th birthday to sign up for Medicare.

When did Medicare become a national program?

It wasn't until 1965, though, that President Johnson signed Medicare into law, and the program took effect in 1966. Medicare recently had close to 58 million enrollees.

What is the IEP for Medicare?

That's the "Initial Enrollment Period" (IEP). Missing it can be very costly, as you may face more expensive premiums for the rest of your life. Specifically, your part B premiums (which cover medical services, but not hospital services) can rise by 10% for each year that you were eligible for Medicare but didn't enroll.

How long does it take for a 401(k) to start?

If you enroll within the three months following the month you turn 65, coverage will start within three months. To have your coverage start as soon as possible, sign up within the three months preceding the month of your 65th birthday.

How much does a 65 year old spend on healthcare?

After all, it's estimated by the folks at Fidelity Investments that a 65-year-old couple will, on average, spend about $260,000 out of pocket on healthcare expenses during their retirement -- and that's including expenses covered by Medicare.

Can you enroll in Medicare if you are late?

Well, it's true with Medicare, anyway. Some people can enroll late and not face a penalty. Those who are volunteering abroad, for example, get to delay, as do those who are still working, with employer-provided healthcare coverage, at age 65 -- if their employer has 20 or more employees.

Is Medicare a good retirement?

For most of us, Medicare is or will be a critical component of a good retirement. Learn more about it so that you can make the most of it. Selena Maranjian owns shares of Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool has a disclosure policy.

When is the best time to join Medicare?

The best time to join a Medicare health or drug plan is when you first get Medicare. Signing up when you’re first eligible can help you avoid paying a lifetime Part D late enrollment penalty. If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan.

How to get Medicare if you are not collecting Social Security?

If you’re not already collecting Social Security benefits before your Initial Enrollment Period starts, you’ll need to sign up for Medicare online or contact Social Security. To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period.