Navigating Medicare enrollment: What you need to know for 2018

- • Part A covers inpatient hospital care, nursing home care, hospice and a few other services like at-home care. These...

- • Part B covers outpatient hospital care, doctor bills, physical therapy and more services. Part B is optional and costs...

- • There is another alternative: Medicare Advantage health plans,...

Full Answer

What are the 3 requirements for Medicare?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

At what income do you lose Medicare?

Does everyone automatically get Medicare at 65?

Does Medicare cover dental?

What are Medicare Parts A & B?

Does Medicare look at your bank account?

Does Social Security count as income for Medicare premiums?

What is deducted from your monthly Social Security check?

How long before you turn 65 do you apply for Medicare?

It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Does Medicare start on birthdays?

Are you automatically enrolled in Medicare Part B?

How does this affect me?

If you have higher income, you’ll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. They call the additional amount the income-related monthly adjustment amount (IRMAA). Here’s how it works:

How does Social Security determine if I must pay higher premiums?

The standard Part B premium amount in 2018 will be $134 (or higher depending on your income). However, some people who get Social Security benefits pay less than this amount ($130 on average). You’ll pay the standard premium amount (or higher) if:

Which tax return does Social Security use?

To determine your 2018 income-related monthly adjustment amounts (IRMAA), use your most recent federal tax return. Generally, this information is from a tax return filed in 2017 for tax year 2016. Sometimes, the IRS only provides information from a return filed in 2016 for tax year 2015.

What if my income has gone down?

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

Monthly Medicare premiums for 2018

The standard Part B premium for 2018 is $134.00. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What if I disagree?

If you disagree with the decision about your income-related monthly adjustment amount (IRMAA), you have the right to appeal. The fastest and easiest way to file an appeal of your decision is by visiting www.socialsecurity.gov/disability/appeal. You can file online and provide documents electronically to support your appeal.

How many people are covered by Medicare?

Others would continue working well past age 70 to try to keep their employer health insurance. Today Medicare covers over 61 million people. There are over 900,000 providers nationwide.

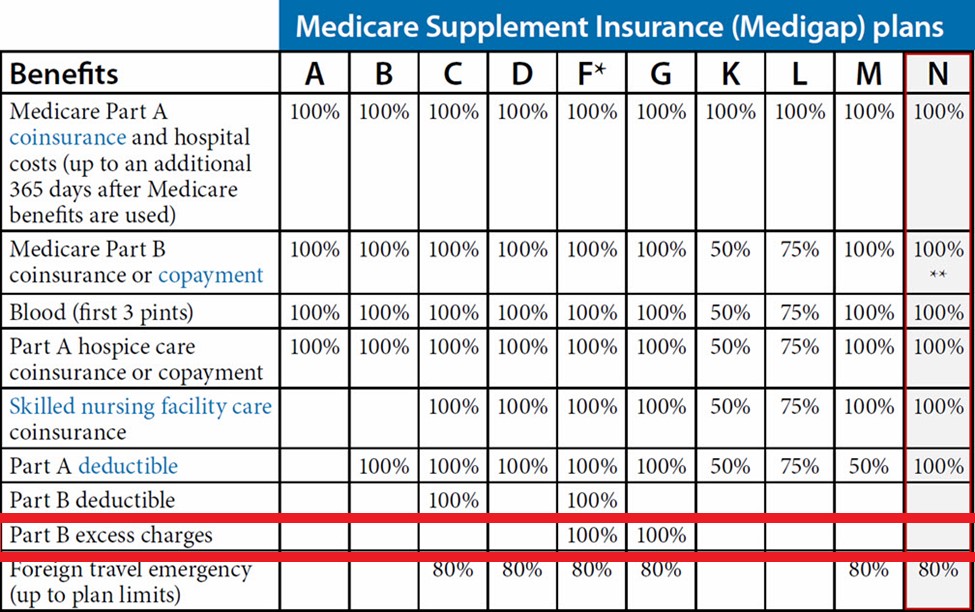

What is the most comprehensive Medicare plan?

The most comprehensive plan currently on the market is Medigap Plan F.

How to contact Medicare for free?

Do you need help with learning about Medicare? If so, contact us at 1-855-732-9055 for free help from our team of Medicare experts. We are licensed in 48 states and ready to help you.

When did Medicare add Part D?

In 2006, Medicare also added the Part D program which has helped to reduce the costs of our patient prescription medications for millions of beneficiaries.

Is there a health insurance program for seniors?

It hasn’t always been around here in the U.S. either. Prior to 1965, there were very few options for health insurance for seniors. Many people relied on friends, family and charity to help them pay for their medical costs after they retired. Others would continue working well past age 70 to try to keep their employer health insurance.