When deciding between group coverage or Medicare, it is important to know whether or not your employer insurance qualifies as “creditable coverage”. Your Human Resource director or plan administrator should know. There are penalties that may accrue if you do not have “creditable coverage”.

Full Answer

Do I have to sign up for Medicare if my employer?

If your employer has fewer than 20 employees, you must sign up for Medicare when you’re eligible or you may face a late enrollment penalty for Part B when you sign up later. If your employer has 20 or more employees, you can delay signing up without any late enrollment penalties in the future.

Who is eligible for Medicare?

Individuals age 65 and over who currently receive group health plan coverage from their employers are also eligible for Medicare. Depending on the size of the company, these individuals may choose to enroll into Medicare immediately or delay enrollment until a later date.

Do I need Medicare if I have health insurance at work?

If your place of work has fewer than 20 employees, your employer then decides whether you will need to enroll in Medicare and places your current healthcare insurance as a secondary source of coverage. Your Medicare plan would serve as the primary payer in this scenario.

Can I choose employer health benefits instead of Medicare?

Here are the rules for choosing employer health benefits instead of Medicare: If your employer has fewer than 20 employees, you must sign up for Medicare when you’re eligible or you may face a late enrollment penalty for Part B when you sign up later.

Can you have Medicare and employer insurance at the same time?

Thus, you can keep Medicare and employer coverage. The size of your employer determines whether your coverage will be creditable once you retire and are ready to enroll in Medicare Part B. If your employer has 20 or more employees, Medicare will deem your group coverage creditable.

What are the 3 requirements for a member to be eligible for a Medicare?

You're 65 or older.You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.More items...•

Which documents are specifically for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

Can I keep my private insurance and Medicare?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How long does it take to be approved for Medicare?

between 30-60 daysMedicare applications generally take between 30-60 days to obtain approval.

When should you apply for Medicare?

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65.

How long does it take for Medicare enrollment?

We'll process your application. It may take up to 8 weeks to process your application if you apply between July and November. This is because we get a lot of applications at that time.

Is Medicare primary or secondary to employer coverage?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is it better to use Medicare or private insurance?

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Understanding Employer Insurance and Medicare While Still Working ...

If your employer has more than 20 employees, Medicare will pay secondary to your group coverage. With small group insurance, we highly recommend enrolling in both Medicare Part A and Part B as soon as you are eligible.

Small Employer Exception | CMS

How Does Medicare Work With Employer Insurance?

Retiree insurance | Medicare

Should you stay on your employer health insurance or get Medicare ...

What determines if you are a primary or secondary employer for Medicare?

The size of your employer will determine how your Medicare benefits will coordinate with your employer coverage. If you’re aging into Medicare while working for an employer with over 20 employees, your group plan is primary and Medicare secondary.

What Forms Do I Need to Show Creditable Coverage From an Employer?

You will need your employer to fill out the CMS-L564 form . This form is a request for employment information form. Once the employer completes section B of the form, you can send in the document with your application to enroll in Medicare.

What Happens to My Medicare if I Go Back to Work?

Often, you might retire and later go back to work. If you pause your retirement and your large employer offers you group insurance, you can cancel Part B. When you retire again; you can enroll back into Part B with no penalties.

Does Medicare Work With Health Savings Accounts?

When enrolled in any Medicare parts, you CANNOT contribute to a Health Savings Account (HSA). Your employer also can’t contribute to your HSA once your Medicare is active. If you continue to add to your HSA, you could face tax penalties.

What happens if you leave Medicare without a creditable coverage letter?

Without creditable coverage during the time you’ve been Medicare-eligible, you’ll incur late enrollment penalties. When you leave your group health coverage, the insurance carrier will mail you a creditable coverage letter. You’ll need to show this letter to Medicare to protect yourself from late penalties.

How many employees are eligible for creditable insurance?

For your outpatient and medication insurance, a plan from an employer with over 20 employees is creditable coverage. This safeguards you from having to pay late enrollment penalties for Part B and Part D, respectively.

What happens if you don't have Part B insurance?

If you don’t, your employer’s group plan can refuse to pay your claims. Your insurance might cover claims even if you don’t have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs.

Who is eligible for Medicare?

Individuals age 65 and over who currently receive group health plan coverage from their employers are also eligible for Medicare.

How old do you have to be to get Medicare?

Although retirement age usually ranges from 66 to 67 years old, Medicare eligibility for most individuals begins at age 65. Some people who continue to work past age 65 may also have group health plan benefits through their employer. Because of this, it’s possible to have both Medicare and a group health plan after age 65.

How to determine if Medicare is primary or secondary?

Here’s how to know who the primary and secondary payers are in your situation: 1 Medicare is generally the primary payer if the company you work for has fewer than 20 employees. But Medicare becomes the secondary payer if your employer is part of a group health plan with other employers who have more than 20 employees. 2 Medicare is typically the secondary payer if the company you work for has 20 or more employees. In this case, your group health plan is the primary payer and Medicare pays out only after your employer’s plan has paid their portion.

How long do you have to enroll in Medicare after you retire?

Once you retire and give up your employer health benefits, you will have a special enrollment period of 8 months to enroll in Part A and Part B, if you haven’t enrolled already. This special enrollment period begins the month after your employment or group health plan ends. There is no late enrollment penalty for enrolling in original Medicare ...

What happens if you forego Medicare?

If you decide to forego Medicare altogether, you must withdraw completely from any Social Security or RRB benefits you receive. You will also be required to repay any benefits you received up until your withdrawal.

What is the number to call Medicare?

If you’re not sure whether Medicare will be the primary or secondary payer in your situation, you can call 855-798-2627 to speak to someone at Medicare’s Benefits Coordination & Recovery Center.

When do you have to sign up for Medicare?

If you’re under age 65 and eligible for Medicare because of a disability, you’re not required to sign up until you turn 65 years old. But if you’re still receiving group health insurance coverage at that time, the same rules listed above apply.

How Does Medicare Work with Employer Insurance?

Now that you know a little bit more about the pros and cons of employer insurance, next we’ll cover the question: How does Medicare work with employer insurance?

What are the benefits of an employer health plan?

Here are some of the most important benefits of an employer health plan: Your employer pays part of your premiums. Your employer does all of the research and chooses the best plan for you. Your insurance premiums are likely taken out from your pre-tax pay, which will reduce your taxable income. Some employer plans can extend into retirement.

Do you have to be on your employer's health plan to get original Medicare?

As mentioned above, this answer will not apply to everyone. For example, let’s say you’re turning 65’, and you are still on your employer’s health plan. If you want to get the benefits of Original Medicare, you will need to enroll in Medicare via the Social Security Administration.

Can an employer extend retirement?

Some employer plans can extend into retirement.

Can you enroll in Medicare if you are late?

Additionally, enrolling late will not incur a penalty with Medigap plans. You will be able to delay enrollment up until the time that your employer insurance ends. Thus, if your employer insurance allows it or qualifies for it, you can delay both Medicare and Medigap enrollment without penalty (rate increases).

What extra benefits does Medicare not cover?

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services )

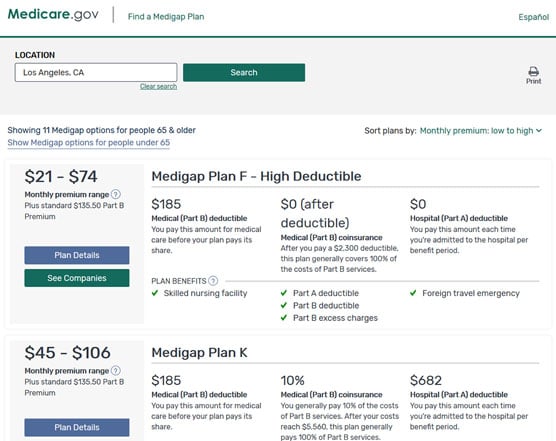

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

How to get free health insurance counseling?

Contact your local State Health Insurance Assistance Program (SHIP) to get free personalized health insurance counseling. SHIPs aren’t connected to any insurance company or health plan.

What is the difference between policies with the same letter sold by different companies?

Price is the only difference between policies with the same letter sold by different companies.

Do you pay monthly premiums for Part B?

Most plans have a monthly premium that you pay in addition to your Part B premium. You’ll also pay other costs when you get prescriptions.

How Does Medicare Work With My Job

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date.

Does Having Both Medicare And Employer Benefits Affect Spousal Coverage

Medicare is individual health insurance coverage, which means that it doesnt include coverage for spouses or dependents. Most group health plans, on the other hand, do include some sort of coverage option for dependents and spouses.

How Generously Subsidized Are My Employer Plan Premiums

Though Medicare Part A, which covers hospital care, is free for most enrollees, Part B, which covers outpatient care, is not. As such, it pays to compare your premium costs under Medicare with what you pay for your employer plan. The standard Part B premium is $144.60 a month right now, and it tends to rise from year to year.

Find Out If Your Group Insurance Changes After You Become Eligible For Medicare

After determining who will be the primary insurer, look to your benefits. In some cases, group insurance works differently once you become eligible for Medicare. Learn if your benefits will change, and then decide if its worth having both types of coverage or delaying enrollment in Part B.

Medicare And Employer Coverage: Coordination Of Benefits

Lets say youre going to keep your employer coverage and also apply for Medicare. Medicare coordinates benefits with your employer coverage. Which insurance pays first? That is which is the primary payer?

What Happens When I Retire

It’s best to understand what your options are once you retire. The first step is to find out if you can keep the coverage you have now when you retire, and whether or not it can be combined with Original Medicare coverage.

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

What are the benefits of getting Medicare while I am working?

If you’re unhappy with your current insurance, you might prefer the Medicare coverage. For example, your private health insurance may restrict you to a small network of doctors, while 99% of nonpediatric physicians accept Medicare. Switching to Medicare may also save you money on out-of-pocket costs versus your existing plan.

What age does Medicare cover?

Medicare is the federal health insurance program that covers people age 65 and older as well as some younger people with disabilities or specific health conditions. If you’re still working at 65 and covered by your employer plan, several factors will affect your Medicare enrollment status:

What happens if you don't have employer based insurance?

If you don’t have employer-based insurance, or your employer has fewer than 20 employees, declining Medicare now means you’ll end up paying higher premiums each month when you do finally enroll:

What happens if you don't have creditable coverage?

The quality of your drug coverage: If your health insurance doesn’t include “ creditable drug coverage ,” as defined by Medicare, you’ll need to purchase a stand-alone drug plan that meets those standards. Going without this level of prescription drug coverage for more than a few months will cause Medicare to charge you a late enrollment penalty on top of your Part D premium after you sign up.

How much is Medicare Part B in 2021?

While Medicare Part A is free, Medicare Part B — which covers doctor visits and outpatient medical supplies — requires you to pay a monthly premium (in 2021, the premium is $148.50 per month for most enrollees; high earners may pay more). If you keep your existing insurance, you could end up paying premiums for two policies, which could get expensive.

How long can you delay Medicare enrollment?

As soon as one of those events occurs, you’ll enter Medicare’s 8-month special enrollment period .

Is Medicare a good option?

Enrolling in Medicare could be a good option if your current workplace coverage doesn’t meet your needs or if you think secondary coverage would be helpful.