Should you buy supplemental health insurance?

When is the best time to get Medicare supplement insurance. One time only. 6 month period. Can't be denied or charged more due to past or present health problems. 6 mo period begins when. 65 or older. Covered under part b. If after 6 mo open enrollment, has to go through medical u/w and can pay higher premium.

Do I need supplemental Medicare insurance?

30. Group life plans sold in Maryland typically contain a conversion option. If the insured elects this option, the new policy. does NOT require evidence of insurability. Once a child is born and covered under a health insurance plan, any reduction in benefits on the newborn is. strictly prohibited. An insurance producer is BEST defined as.

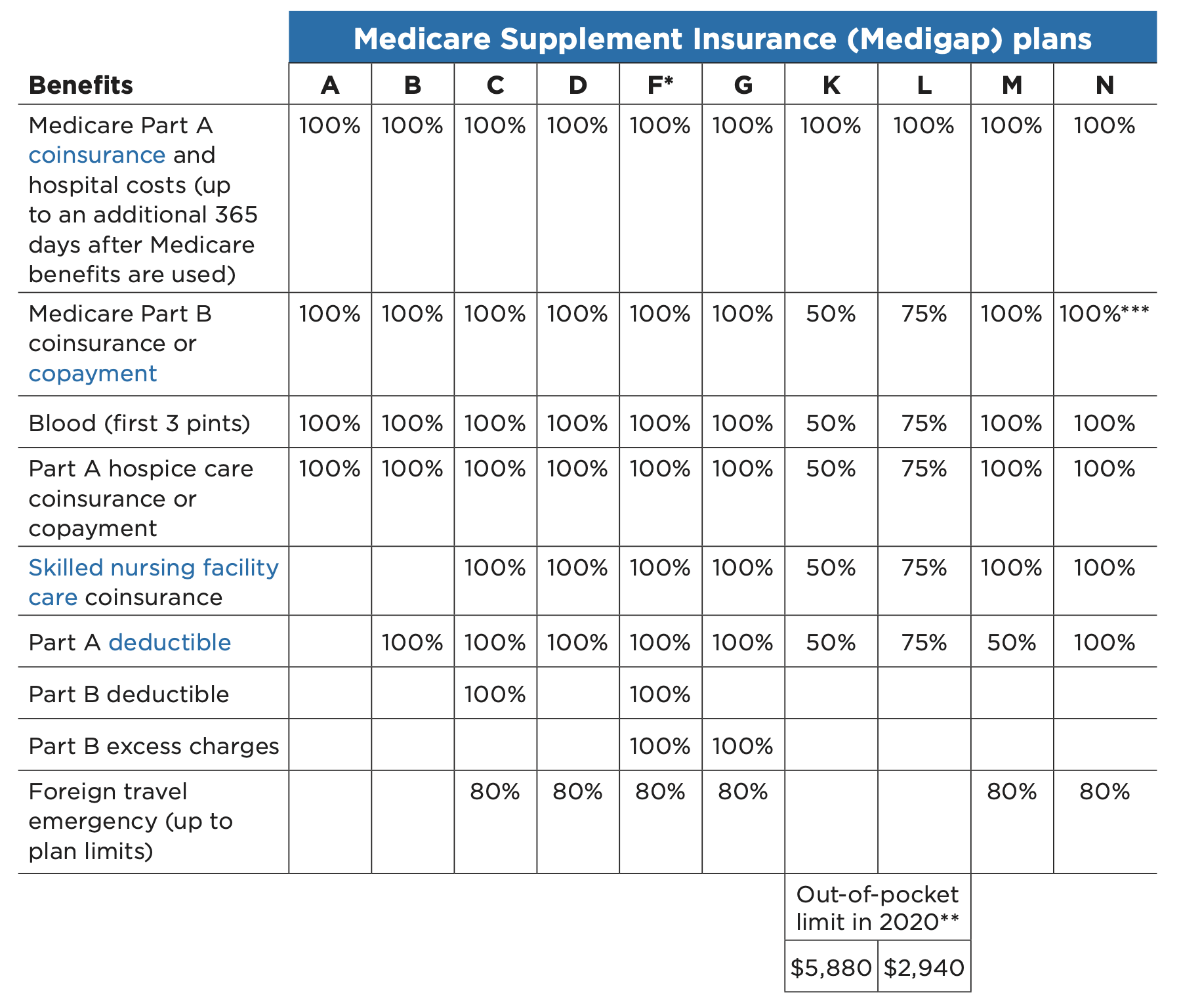

What are the different types of Medicare supplement plans?

If a sale involves replacement of a Medicare Supplement, a Notice Regarding Replacement must be given to the applicant. The replacing insurer cannot establish a new or extend any period for a preexisting condition, waiting period, exclusions, elimination period or probationary period in the new policy. Medigap Ratings

What are the guidelines for Medicare?

All Categories. Business Opportunities (5) . Cars &vehicles (9)

Which of the following actions is required by an agent who is replacing an existing life insurance policy?

When replacing a life insurance policy, an agent must obtain a list of all life insurance to be replaced, give the applicant and the replacing insurer a copy of the "Notice of Replacement" signed by the applicant and the agent, leave a copy of all sales proposals used with the applicant, and send to the replacing ...

When a Medicare supplement insurance policy is replaced the policyowner will have a free look period of?

Key Takeaways. The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the policy without penalties, such as surrender charges.

Which three levels of care are long term care policies provided with?

Care usually is provided in one of three main stages: independent living, assisted living, and skilled nursing. Nursing homes offer care to people who cannot be cared for at home or in the community. They provide skilled nursing care, rehabilitation services, meals, activities, help with daily living, and supervision.Dec 12, 2012

When must the Medicare Supplement Buyer's Guide be presented quizlet?

The insurer must provide a Medicare Supplement Buyer's Guide and an Outline of Coverage at the time of application. LTC policies may define a preexisting condition as: a condition for which advice or treatment was recommended or received within 6 months of the effective date of coverage.

When a Medicare Supplement policy is replaced?

When you switch from one Medicare Supplement insurance plan to another, you typically get 30 days to decide if you want to keep it. This 30-day free look period starts when you get your new Medicare Supplement insurance plan. You'll need to pay the premiums for both your new plan and your old plan for one month.

What is an insurance policy's grace period quizlet?

What is an insurance policy's grace period? Period of time after the premium is due but the policy remains in force.

When can an insurer cancel a Medicare supplement plan quizlet?

An insurer can cancel a Medicare Supplement Plan after the non-payment of premiums. In general the following six minimum standards apply to all policies designated as Medicare supplement insurance, the policy must supplement both part A and Part B of Medicare.

Which of the following types of care is excluded in a long-term care policy?

Most long-term care insurance policies permanently exclude benefits being paid for certain conditions. Watch out for common conditions excluded, such as certain forms of heart disease, cancer or diabetes. Other exclusions include: Mental or nervous disorders, not counting Alzheimer's or other dementia.Aug 10, 2021

Which of the following is covered by Medicare Part B quizlet?

Part B helps cover medically-necessary services like doctors' services, outpatient care, durable medical equipment, home health services, and other medical services.

Which of the following is not covered by Medicare quizlet?

Medicare Part A covers 80% of the cost of durable medical equipment such as wheelchairs and hospital beds. The following are specifically excluded: private duty nursing, non-medical services, intermediate care, custodial care, and the first three pints of blood.

How long is the free look period for a Medicare supplement policy quizlet?

Applicants purchasing a replacement long-term care policy must be provided a 30-day free look period. Agents are not permitted to use high pressure tactics, cold lead advertising or twisting in the sale of LTC and Medigap policies.

How long is the Medicare supplement policy free look period?

30 daysMedigap free-look period You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period." The 30-day free look period starts when you get your new Medigap policy.