If an applicant’s total monthly income is under the Medicaid limit, they are income eligible. If their monthly income is over the income limit, they are not income eligible. In 2022, the individual income limit for nursing home Medicaid and Medicaid Waivers in most states is $2,523 / month ($30,276 year).

Full Answer

Do I qualify for assistance in paying Medicare premiums?

Nov 16, 2021 · You can qualify for the QMB program if you have a monthly income of less than $1,094 and total resources of less than $7,970. For married couples, the limit is less than $1,472 monthly and less...

How is income counted when applying for Medicaid?

If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application. When you apply …

How do I know if I am eligible for Medicaid?

V. What is the income limit? To get Extra Help in 2013, total annual income must be limited to $16,245 for an individual or $21,855 for a married couple living together. Income limits are subject to change annually based on Federal Poverty Levels (FPLs). The current FPLs are in Appendix A of this document. Changes to income limits can be found at

How does Medicare define income?

Jul 06, 2019 · If you’re a retiree who is drawing Social Security but have additional income, you may be placed into a higher bracket. As of 2019, individuals who report earning more than $85,000 were required to pay more for Medicare Part B (Medical Insurance) premiums. This equates to $170,000 per year for married couples filing jointly.

What is considered income for Medicare?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What income is included in MAGI for Medicare premiums?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

Are Medicare benefits affected by income?

You can get Medicare coverage no matter your income. Keep in mind that: Once you hit certain income levels, you'll need to pay higher premium costs. If your income is more than $91,000, you'll receive an IRMAA and pay additional costs for Part B and Part D coverage.Nov 16, 2021

How does income affect Medicare premiums?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the income-related monthly adjustment amount.

How do you calculate modified adjusted gross income for Medicare?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.Oct 10, 2021

What is the difference between adjusted gross income and modified adjusted gross income?

Modified Adjusted Gross Income (MAGI) in the simplest terms is your Adjusted Gross Income (AGI) plus a few items — like exempt or excluded income and certain deductions. The IRS uses your MAGI to determine your eligibility for certain deductions, credits and retirement plans. MAGI can vary depending on the tax benefit.

Does Social Security count as income for extra help?

We do not count: You should contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) for other income exclusions.

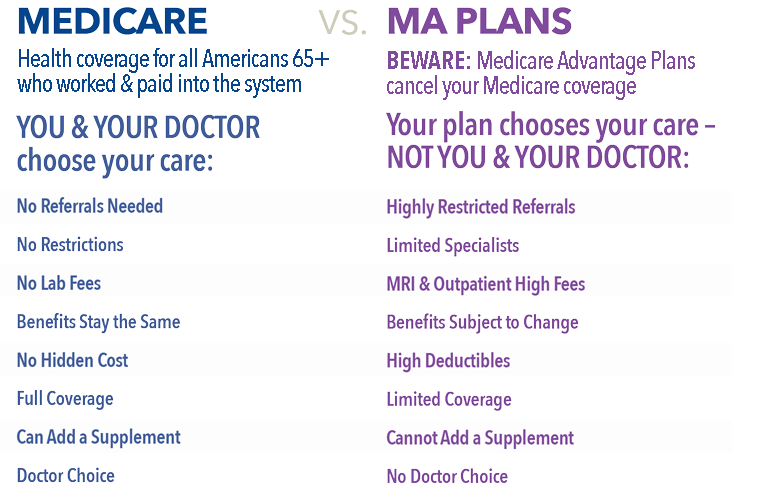

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is the income related monthly adjustment amount?

An income-related monthly adjustment amount, or IRMAA, is an extra Medicare cost added to your Part B and Part D premiums. The Social Security Administration determines whether you're required to pay an IRMAA based on the modified adjusted gross income reported on your IRS tax return from two years prior.

What's your adjusted gross income?

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What do you need to fill out a Marketplace application?

When you fill out a Marketplace application, you’ll need to estimate what your household income is likely to be for the year. Marketplace savings are based on your expected household income for the year you want coverage, not last year’s income. You must make your best estimate so you qualify for the right amount of savings.

Does MAGI include SSI?

Tax-exempt interest. MAGI does not include Supplemental Security Income (SSI) See how to make an estimate of your MAGI based on your Adjusted Gross Income. The chart below shows common types of income and whether they count as part of MAGI.

Do you have to report health insurance changes to the marketplace?

Report income changes to the Marketplace. Once you have Marketplace health insurance, it’s very important to report any income changes as soon as possible. If you don’t report these changes, you could miss out on savings or wind up having to pay money back when you file your federal tax return for the year.

Is Marketplace Savings based on income?

Marketplace savings are based on total household income, not the income of only household members who need insurance. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application.

What is the appeal process for Social Security?

The appeals process enables beneficiaries who disagree with Social Security’s Extra Help determinations to get a new decision by an independent reviewer. The appeals process has just one formal administrative step. Beneficiaries can choose either a hearing by telephone or a case review. Beneficiaries still dissatisfied with Social Security’s final decision can file an action in Federal district court.

Where to mail Social Security form?

This form should be mailed to Social Security at the address on the enclosed postage-paid envelope: Social Security Administration Wilkes-Barre Data Operations Center P.O. Box 1020 Wilkes-Barre, PA 18767-9910

Can Social Security data exchange be used to reconcile income?

The information that is available to us via data exchange may not be current. If this question is answered “Yes,” the response can be used to reconcile discrepancies between the alleged income and the income shown in Social Security’s records without contacting the applicant for verification. A decrease in income could affect the eligibility for and amount of a subsidy.

How much is Medicare Part B?

As of 2019, individuals who report earning more than $85,000 were required to pay more for Medicare Part B (Medical Insurance) premiums. This equates to $170,000 per year for married couples filing jointly. As income levels continue to rise above either $85,000 or $170,000, there is an increase in premium payments for Part B.

What other sources of income count as income?

These forms of income may include capital gains, revenue from a rental property or residual payments for previous works.

Is Social Security income taxed?

In simple cases, Social Security benefits are not taxed and are not counted as income by the Internal Revenue Service (IRS). This means that if Social Security payments are the only means by which an individual subsides, he or she does not need to report the payments as income, and these payments should not effect eligibility for medical benefit ...

What is extra help for Medicare?

Extra Help is the federal program that helps with Part D prescription drug costs if you meet the income and asset requirements. This change helps more people become eligible for MSPs and was a result of the Medicare Improvements for Patients and Providers Act (MIPPA). In 2021, the asset limits for full Extra Help are $9,470 for individuals ...

Why is the MSP limit lower than the extra help limit?

MSP limits appear lower than Extra Help limits because they do not automatically include burial funds. This means that the $1,500 disregard for MSP eligibility typically will not apply unless you prove that you have set aside these funds in a designated account or in a pre-paid burial fund.

What states do not have asset limits for MSPs?

* Alabama, Arizona, Connecticut, Delaware, Mississippi, New York, Oregon, Vermont, and the District of Columbia do not have asset limits for MSPs (as of January 2019).

What is the income limit for Medicaid in 2021?

In 2021, the income limit for long-term care (nursing home Medicaid and home and community-based services Medicaid waivers) in most, but not all states, for a single applicant is $2,382 / month, which equates to $28,584 per year . For regular Medicaid, often called Aged, Blind and Disabled (ABD) Medicaid ...

Who controls Medicaid funds?

In very simple terms, a Medicaid applicant’s income is deposited into the trust and is controlled by a trustee, who is named by the Medicaid applicant. The funds, which no longer count towards Medicaid’s income eligibility, can only be used for very restrictive purposes.

How is income counted for senior married applicants?

The way income is counted varies based on the program for which one is applying and the state in which one resides. In many states, married applicants applying for nursing home Medicaid or a Medicaid waiver are considered as single applicants. This means each spouse is able to have income up to the income limit. In this case, the “name on the check” rule is followed. This means that whichever spouse’s name is on the check is considered to own the income, and it will be counted towards that spouse’s income eligibility.

What documents do you need to apply for medicaid?

Medicaid applicants generally have to provide documentation of their monthly income (earned and unearned) with their Medicaid application. Examples include copies of dividend checks, social security check or award letter, pay stubs, alimony checks, and VA benefits check or award letter.

How much is the Medicaid limit for nursing homes in 2021?

As of 2021, the individual income limit for nursing home Medicaid and Medicaid waivers in most states is $2,382 / month, which equates to $28,854 per year.

How much is the SSI income limit for 2021?

The income limit varies by state, but in most states, either 100% of the SSI Federal Benefit Rate for couples ($1,191 / month in 2021) or 100% of the Federal Poverty Level for a household of two ($1,452 / month in 2021) is used. In order to protect the community spouse from having little to no income, and hence, becoming impoverished, ...

Is the income of a non-applicant spouse considered income?

Therefore, any income of the non-applicant spouse ( often called the community spouse or well spouse) is considered their income, and it will not be counted towards the applicant spouse’s (commonly called the institutionalized spouse) income limit.

What does MAGI mean for Medicaid?

MAGI stands for Modified Adjusted Gross Income. The best way to figure it out is to work through the numbers backward. Start with your gross income, which is your total taxable income.

Does foreign earned income count as MAGI?

Foreign earned income needs to be added back into your gross income to calculate your MAGI. The second factor is exempt interest. When you are filing your income taxes, some interest you may receive throughout the year is exempt from you having to pay taxes on it as part of your income.

Do you have to include TANF income when applying for medicaid?

You do not have to include this income when applying for Medicaid. Types of non-taxable include may include child support, gifts, veterans’ benefits, insurance proceeds, beneficiary payments, AFDC payments, injury payments, relocation pay, TANF payments, workers’ compensation, federal income tax refunds, and SSI payments.

Is AGI the same as MAGI?

For most people, your AGI and your MAGI will actually be the same amount. There are very specific items that are modified to create your MAGI, but they simply don’t apply to all people. The first item is foreign earned income. If you earn money working overseas, it can often be excluded from your gross income when filing your income taxes.