What is the maximum premium for Medicare Part B?

4 rows · When are Medicare premiums due? All Medicare bills are due on the 25th of the month. In ...

What determines your Medicare Part B premium?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the …

How to calculate your Medicare Part B premium?

Nov 25, 2020 · Medicare premiums have various payment due dates. Original Medicare (parts A and B) premiums are due on the 25th day of the month. However, premiums for Medicare Advantage plans, Part D plans, and...

Does Medicaid pay for Part B premium?

Apr 12, 2022 · The standard Part B premium for 2022 is $170.10 to $578.30 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year.

Are Medicare Part B premiums deducted a month in advance?

If you enroll in Medicare before you begin collecting Social Security benefits, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins. This bill will typically be for 3 months' worth of Part B premiums. So, it's known as a quarterly bill.

Are Medicare Part B premiums monthly or quarterly?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Do you have to pay Medicare Part B quarterly?

A person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month. Original Medicare consists of Part A, which is hospitalization insurance, and Part B, which is medical insurance.Nov 25, 2020

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Is Medicare Part B premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How often is Medicare Part B billed?

every 3 monthsHow often will I get a Medicare bill? If you buy only Part B, you'll get a "Medicare Premium Bill" (Form CMS-500) every 3 months. If you buy Part A or if you owe Part D IRMAA, you'll get a “Medicare Premium Bill” every month.

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Did Medicare premiums go up for 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

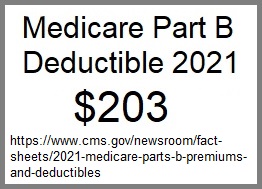

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How often is Medicare Part A premium due?

Help with costs. Summary. A person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month. Original Medicare consists of Part A, which is hospitalization insurance, and Part B, which is medical insurance.

How much is Part B insurance in 2021?

Part B premiums in 2021 are $148.50 per month for people with an income of $88,000 or under. The premiums are higher for individuals with an income that exceeds this amount.

What is Medicare Supplement?

Medicare supplement insurance. Medigap is a Medicare supplement insurance plan that pays 50–100% of the original Medicare (parts A and B) out-of-pocket costs. These plans are available to people enrolled in original Medicare, and there will be a monthly premium to pay. Learn more about how Medigap plans work here.

What is Medicare Advantage?

Medicare Advantage. Instead of enrolling in original Medicare (parts A and B), some people choose to enroll in Part C, or Medicare Advantage. This is an alternative to original Medicare. In that case, a person must pay their Part B premiums in addition to their Medicare Advantage plan costs. Learn more about choosing a Medicare Advantage plan here.

How often do Medicare payments come out?

People who do not get SS or RRB benefits will receive bills for their Medicare premiums. Medicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank’s bill payment service.

What is the average Part D premium for 2020?

In 2020, the average Part D monthly premium base was $32.74 for people with an income of $87,000 or under. As with Part B, the premiums increase in relation to having an income above a certain amount. People can use this online tool to compare various Part D plans.

What happens if you are late on Medicare?

For original Medicare (parts A and B), Medicare will send a person a First Bill. If they are late with payment, they will get a Second Bill, which includes the past-due premium amount and the premium that is due the following month.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What happens to Medicare premiums once you start?

Once your benefits begin, your premiums will be taken directly out of your monthly payments. You’ll also receive bills directly from your plan’s provider if you have any of the following types of plans: Medicare Part C, also known as Medicare Advantage. Medicare Part D, which is prescription drug coverage.

How much is Medicare Part B 2021?

Medicare Part B costs. Most people pay the standard Part B premium. In 2021, that amount is $148.50. If the modified adjusted gross income you reported on your taxes from 2 years ago is higher than a certain limit, though, you may need to pay a monthly IRMAA in addition to your premium.

What does it mean when you receive a Social Security check in August?

This means that the benefit check you receive is for the previous month. For example, the Social Security benefit check you receive in August is for July benefits. The Medicare premium deducted from that check will also be for July.

What is Medicare Part D?

Medicare Part D, which is prescription drug coverage. Medigap, also called Medicare supplement insurance. The structure of these bills and their payment period may vary from insurer to insurer. Social Security and RRB benefits are paid in arrears. This means that the benefit check you receive is for the previous month.

How long does it take to pay Medicare premiums?

If you enroll in Medicare before you begin collecting Social Security benef it s, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins. This bill will typically be for 3 months’ worth of Part B premiums. So, it’s known as a quarterly bill.

How often do you get Medicare payments?

If you have original Medicare and aren’t yet collecting Social Security, you’ll receive a bill from Medicare either monthly or once every 3 months in these cases: If you don’t have premium-free Part A, you’ll receive a monthly bill for your Part A premium.

Do Medicare payments go into advance?

These bills are paid in advance for the coming month or months, depending on the parts of Medicare you’re paying for. If you’re already receiving retirement benefits, your premiums may be automatically deducted from your check. Part C, Part D, and Medigap bills are sent directly from the insurance company that provides your plan.