Full Answer

Do you have to pay Social Security tax on Medicare income?

Social Security Tax Exemptions Pretax deductions that are excluded from Medicare tax are typically exempt from Social Security tax as well. Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none.

Are Medicare wages the same as Social Security wages?

Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none. If you have multiple jobs that collectively put you over the wage limit, you may get a refund for over-withheld Social Security tax.

What is Social Security tax/Medicare tax and self employment?

Social Security Tax / Medicare Tax and Self-Employment. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

How much is Medicare tax withheld from your pay?

Medicare tax is withheld at the rate of 1.45% of gross wages after subtracting for any pre-tax deductions that are exempt, just as with Social Security. Medicare is assessed at this flat rate and there's no wage base, so the amount withheld is usually equal to the amount for which an employee is liable. 10

What wages are exempt from Social Security and Medicare tax?

High-income earners In 2021, every dollar of taxable income someone makes above $142,800 ($137,700 in 2020) will effectively be exempt from Social Security taxes. For example, someone making a taxable income of $300,000 in 2020 will pay Social Security taxes on 6.2% of just $142,800, which comes out to $8,853.60.

Are all wages subject to Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Are any wages not subject to Medicare tax?

There is no wage base limit for Medicare tax. All your covered wages for the year are subject to Medicare tax. Only the Social Security tax has a wage base limit — $147,000 for 2022.

How do I know if my wages are subject to Social Security tax?

Employees pay 6.2% of gross earnings as the Social Security tax, and employers must match this amount. Only the first $137,700 in compensation annually is subject to the Social Security tax as of 2020. The threshold is $142,800 in 2021. Earnings over this wage base are tax-free for the remainder of the year.

What is excluded from Medicare wages?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

Why is Social Security not deducted from my paycheck?

Some workers are exempt from paying Social Security taxes if they, their employer, and the sect, order, or organization they belong to officially decline to accept Social Security benefits for retirement, disability, death, or medical care.

What are considered Medicare wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

What is the difference between wages and Medicare wages?

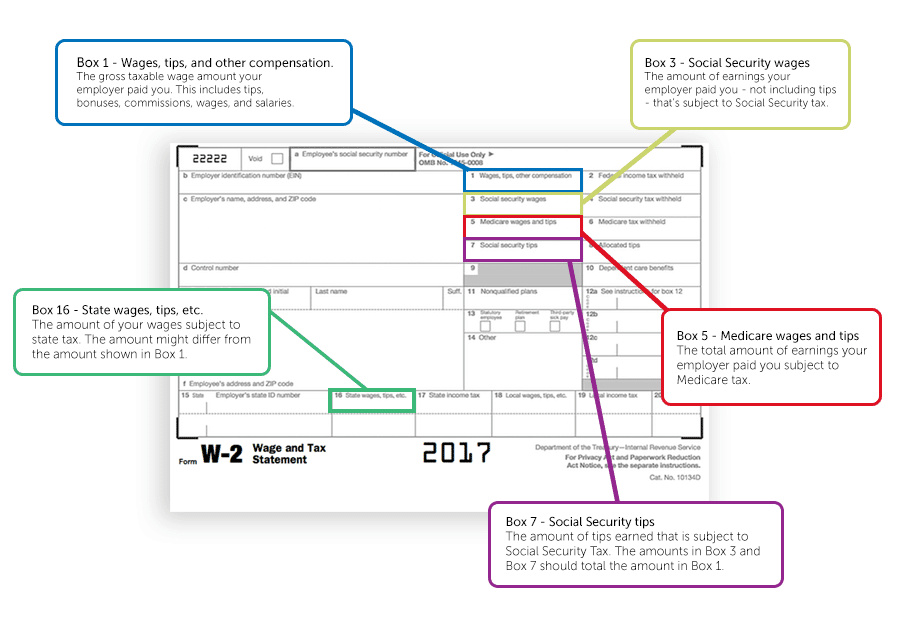

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

What is exempt from FICA taxes?

FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college or university where the student is pursuing a course of study. Whether the organization is a school, college or university depends on the organization's primary function.

Why does my W-2 not have Social Security wages?

Social Security wages should be in box 3 and the Social Security Taxes withheld should be in box 4 of the W-2. Contact your employer for either an explanation of why there are no SS wages or taxes withheld or to get a corrected W-2.

What is considered wages for Social Security?

Wages are the same for SSI purposes as for the social security retirement program's earnings test. (See § 404.429(c) of this chapter.) Wages include salaries, commissions, bonuses, severance pay, and any other special payments received because of your employment.

What is the income limit before Social Security is taxed?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much Medicare tax do I have to pay if I make more than the threshold?

If you make more than the below thresholds, you’ve got to pony up 2.35% in Medicare taxes (1.45% standard + 0.9% additional). The semi good news is if you’re self-employed, the employer Medicare rate stops at 1.45% and is exempt from the additional 0.9% even if you make more than these thresholds.

Why is it important to look at the bright side of higher Social Security and Medicare taxes?

It’s important to always look at the bright side of higher Social Security and Medicare taxes. 1) The more taxes we pay in , the higher the chance we’ll actually receive the full amount of Social Security and Medicare promised to us.

How much will the FICA tax be in 2021?

So the reality is that a $142,800 a year laborer will have to pay $8,853.60 in Social Security tax plus $2,070.60 in Medicare tax for a total of $10,924.20 in 2021. The maximum income for FICA tax will continue to go up each year.

What is the maximum amount of Social Security income in 2021?

Income Types Not Subject To Social Security Tax: Earn More Tax Efficiently! The government gonna knock you out! The maximum amount of earnings subject to the 6.2% Social Security payroll tax climbed to a record $142,800 in 2021, up from $132,900 in 2019. In other words, those lucky enough to have jobs and earn $142,800 or more will have ...

What is the tax rate on long term gains?

The tax rate on long-term (more than one year) gains is 15%, except for high-income taxpayers ($400,000 for singles, $450,000 for married couples) who must pay 20% . High-rate taxpayers will typically pay the healthcare surtax as well, for an all-in rate of 23.8%. Qualified dividends have a tax rate of 15%.

How much will retired people get in 2040?

However, at the current rate, retired citizens will only get about 75% of the expected payout by 2040. But of course, you can’t forget about Medicare, which is 1.45% of all income earned. And Medicare doesn’t have an income cap. So the reality is that a $142,800 a year laborer will have to pay $8,853.60 in Social Security tax plus $2,070.60 in ...

How many people will pay Social Security taxes in 2021?

Out of the estimated 173 million workers who will pay Social Security taxes in 2021, about 12 million (7%) will be paying more. But as I’ve shown you before, anybody who makes between $100,000 – $200,000 and lives in a large city is considered middle class.

What is the tax rate for Social Security?

Together, the Social Security and Medicare programs make up the Federal Insurance Contributions Act (FICA)tax rate of 15.3%. Currently, the Social Security taxis 12.4% — half of which is paid by the employer, with the other 6.2% paid by the worker through payroll withholding.

Do public employees have Social Security?

These days, most public employees have Social Security coverage — and thus pay into the system out of their paychecks — but there are still a few exceptions. These include public workers who participate in a government pension plan comparable to Social Security. In addition, federal workers, including members of Congress, ...

Is high income taxed in 2020?

High-income employeesare not technically exempt from Social Security taxes, but part of their income is. In 2020, every dollar of taxable income someone makes above $137,700 will effectively be exempt from Social Security taxes.

Do students who work at university pay Social Security?

Currently enrolled students who work at their university can be exempt from Social Security taxes. The exemption, though, only covers income earned from that job; any earnings from a second job off-campus will be subject to all taxes. The student exemption covers medical residents as well.

Do children under 18 have to pay Social Security?

Children under 18 who work for their parents in a family-owned business also do not have to pay Social Security taxes. Likewise, people under 21 who work as housekeepers, babysitters, gardeners or perform similar domestic work are exempt from this tax. 3) Employees of Foreign Governments and Nonresident Aliens.

Does not paying into Social Security increase your take home pay?

The Bottom Line. Although not paying into the Social Security program can increase your take-home pay, it can also lead to less supplemental income in retirement.

Do religious groups pay Social Security taxes?

However, there are certain groups of taxpayers for which Social Security taxes do not apply, including: 1) Religious Organizations. Members of some religious groups can be exempt from paying in to Social Security under certain circumstances.

Is self employment taxed as wages?

Self-Employment Tax. Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Do you pay Social Security taxes to one country?

The agreements generally make sure that social security taxes (including self-employment tax) are paid only to one country. You can get more information on the Social Security Administration's Web site.

Do non-residents pay taxes on self employment?

However, nonresident aliens are not subject to self-employment tax. Once a nonresident alien individual becomes a U.S. resident alien under the residency rules of the Internal Revenue Code, he/she then becomes liable for self-employment taxes under the same conditions as a U.S. citizen or resident alien. Note: In spite of the general rules ...

Do Social Security and Medicare taxes apply to wages?

social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer.

Can you make Social Security payments if no taxes are due?

Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Do you have to deduct taxes on Social Security?

Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

What is the wage limit for Social Security in 2021?

After their income hits a certain level, their Social Security withholding stops for the year. Officially known as the wage base limit, the threshold changes every year. The 2021 wage limit for paying FICA taxes is $142,800, versus the $137,700 limit in 2020. 1 .

What is the FICA tax rate for 2021?

FICA includes both Social Security and Medicare, the federal health insurance program for Americans 65 and over. 1 . As of 2021, your wages up to $142,800 ($137,700 for 2020) are taxed at 6.2% for Social Security, and your wages with no limit are taxed at 1.45% for Medicare. Your employer matches those amounts and sends the total to ...

Do you have to pay Social Security if you were hired in 1984?

Workers covered by the CSRS are not required to pay Social Security taxes, nor will they receive Social Security benefits. However, those covered by the FERS are part of the Social Security system and contribute to it at the current tax rate. 6

Do you have to contribute to Social Security 2020?

Updated Dec 23, 2020. Of all the taxes that come out of your paycheck, none may be as inescapable as those that go to Social Security. Whether you're salaried or self-employed, you must generally contribute throughout your entire working life. There are, however, a few exceptions, which we'll cover here.

Do state employees pay Social Security?

State or local government employees, including those working for a public school system, college, or university, may or may not pay Social Security taxes. If they're covered by both a pension plan and Social Security, then they must make Social Security contributions.

Do non-resident aliens pay Social Security?

Although nonresident aliens employed in the U.S. normally pay Social Security tax on any income they earn here, there are some exceptions. Mostly, these apply to foreign government employees, students, and educators living and working in the country on a temporary basis and possessing the correct type of visa.

Do you have to pay both halves of your taxes?

If you work for yourself, you have to pay both halves because you are, in effect, both employee and employer. This is known as SECA, or the Self Employed Contributions Act, tax. 2 .

What is the Medicare tax rate?

Medicare tax is withheld at the rate of 1.45% of gross wages after subtracting for any pre-tax deductions that are exempt, just as with Social Security. Medicare is assessed at this flat rate and there's no wage base, so the amount withheld is usually equal to the amount for which an employee is liable.

What is the tax rate for Social Security?

The Social Security tax is withheld at a flat rate of 6.2% on gross wages after subtracting any pre-tax deductions that are exempt from Social Security taxation. Not all gross wages are subject to this tax.

What is withholding allowance?

Withholding allowances used to correspond with the number of personal exemptions that taxpayers were entitled to claim on their tax returns for themselves, their spouses, and their dependents, but the Tax Cuts and Jobs Act (TCJA) eliminated personal exemptions from the tax code in 2018. The IRS rolled out a revised Form W-4 for ...

How much Medicare surtax is required for 2020?

Earnings subject to this tax as of 2020 depend on your filing status. You must pay the surtax on earnings over: $125,000 for married taxpayers who file separate returns.

What is federal tax withholding 2021?

Updated April 09, 2021. Employers are required to subtract taxes from an employee's pay and remit them to the U.S. government in a process referred to as "federal income tax withholding.". Employees can then claim credit on their tax returns for the amounts that were withheld. Employers are required to withhold federal income ...

Why are some workers incorrectly classified by their employers as independent contractors rather than employees?

Their earnings would not have any tax withheld in this case because independent contractors are responsible for remitting their own estimated taxes to the IRS as the year goes on.

What is the maximum amount of Social Security withheld in 2021?

An annual wage base limit caps earnings that are subject to withholding for Social Security at $142,800 in 2021, up from $137,700 in 2020. 4 Income over this amount isn't subject to Social Security withholding. 5 .

What is Medicare tax?

Medicare tax by definition goes to fund the federal insurance program for elderly and disabled people. It's deducted from your paychecks along with Social Security tax, which pays for that federal program, as well as ordinary federal and state income tax.

What is the Social Security tax rate?

The Social Security tax rate is 6.2 percent payable by the employee and 6.2 percent payable by the employer. Self-employed people must pay what is called self-employment tax, which includes the employee and employer portions of Social Security and Medicare taxes, so they pay a 15.3 percent tax rate.

How much is pretax for Medicare?

Also, amounts you receive for educational assistance under your employer’s program earn you a pretax deduction; up to $5,250 annually is exempt from Medicare tax. If a pretax deduction is excluded from Medicare tax, subtract it from your gross wages before subtracting the tax. For example, if you earn $2,000 semi-monthly ...

Where is Medicare tax withheld on W-2?

Your employer puts your annual Medicare wages in Box 5 of your W-2 and Medicare tax withheld for the year in Box 6. The amount shown in Box 5 does not include pretax deductions which are exempt from Medicare tax. Your last pay stub for the year may show a different year-to-date amount for Medicare wages than your W-2.

What is a pretax benefit?

Pretax benefits include those offered under a cafeteria – or Section 125 – plan, such as medical, dental, vision, life, accident and disability insurance; and flexible spending accounts such as dependent care, and health savings and adoption assistance reimbursement accounts.

Is Medicare tax exempt from Social Security?

Pretax deductions that are excluded from Medicare tax are typically exempt from Social Security tax as well. Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none. If you have multiple jobs that collectively put you over the wage limit, you may get a refund for over-withheld Social Security tax

Is pretax income tax exempt from Medicare?

Deductions from your wages used to pay for your employer-sponsored benefits reduce your income and are excluded from taxes. In many cases, pretax deductions are exempt from Medicare tax; however, this isn’t always the case.