Age for Receiving Full Social Security Benefits

| Birth Year | Full Retirement Age |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

How and when you should enroll in Medicare?

Sign up for Parts A and B of Medicare

- I’m already receiving Social Security retirement benefits. ...

- I’m signing up during my initial enrollment period , the three months before to the three months after the month you turn 65. ...

- I’m signing up during a special enrollment period , a time you can enroll in Medicare outside the initial enrollment period when certain conditions are met. ...

How and when are you supposed to enroll in Medicare?

- You have no other health insurance

- You have health insurance that you bought yourself (not provided by an employer)

- You have retiree benefits from a former employer (your own or your spouse’s)

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

What is the full retirement age for Medicare?

- If you were born on January 1 st, you should refer to the previous year.

- If you were born on the 1 st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. ...

- You must be at least 62 for the entire month to receive benefits.

- Percentages are approximate due to rounding.

What is the initial enrollment period for Medicare?

You can sign up for Medicare only at certain times. You can enroll during your seven-month initial enrollment period, which starts on the first day of the month three months before the month you turn 65 and lasts through the three months after ...

Can you get both Social Security and Medicare?

SOCIAL SECURITY, MEDICAID AND MEDICARE Medicare is linked to entitlement to Social Security benefits. It is possible to get both Medicare and Medicaid. States pay the Medicare premiums for people who receive SSI benefits if they are also eligible for Medicaid.

Can I get Medicare at 62?

En español | No, you can't qualify for Medicare before age 65 unless you have a disabling medical condition.

Do you get Medicare at 62 or 65?

1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare.

Does everyone automatically get Medicare at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Is it better to retire at 62 or 67?

Don't worry, retiring at 62 and claiming your benefits until you're 67 does have its benefits. Retirees who begin collecting Social Security at 62 instead of the full retirement age can expect their monthly benefits to be 30% lower. Delaying claiming until the age of 67 will result in a larger monthly check.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is the maximum Social Security benefit at age 62?

$2,364The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364.

What is the average Social Security benefit at age 62?

According to payout statistics from the Social Security Administration in June 2020, the average Social Security benefit at age 62 is $1,130.16 a month, or $13,561.92 a year.

Can I get AARP health insurance at 62?

Full AARP membership is available to anyone age 50 and over.

How soon before you turn 65 should you apply for Social Security?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

What is full retirement age?

Full retirement age is the age when you can start receiving your full retirement benefit amount. The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960, until it reaches 67.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How many credits do you need to qualify for Medicare?

Work credits. To meet the work requirement, you or your spouse need to have earned 40 work credits. Work credits are awarded once you’ve earned $1,410. You can earn a maximum of four work credits a year. This means 10 years of work will normally qualify you for full Medicare benefits.

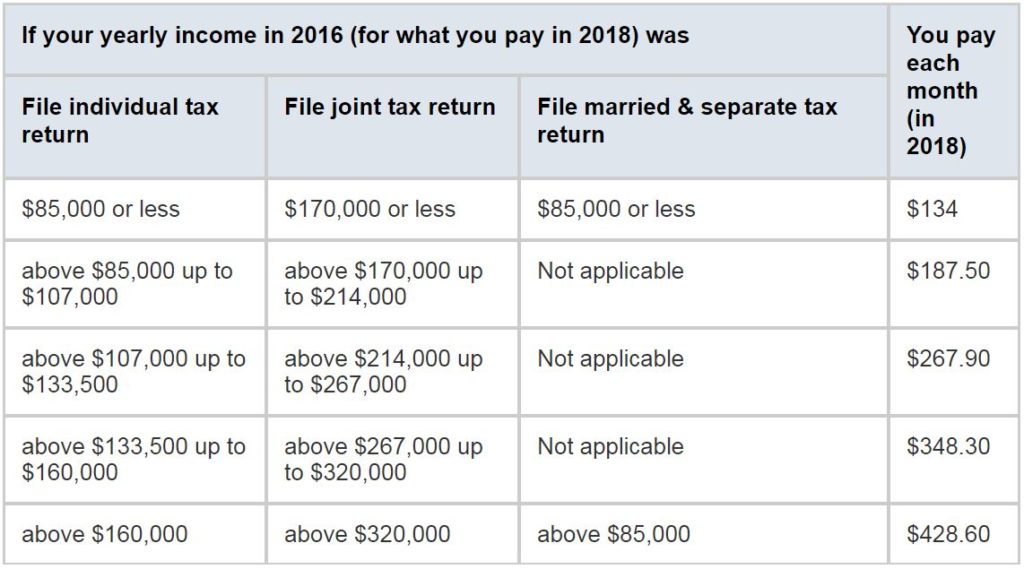

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Part C plans are sold by private insurance companies who contract with Medicare to provide coverage. Generally, Advantage plans offer all the coverage of original Medicare, along with extras such as dental and vision services.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How much can my spouse get from my retirement?

Your spouse can also claim up to 50 percent of your benefit amount if they don’t have enough work credits, or if you’re the higher earner. This doesn’t take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

When will Medicare start in 2021?

For example, if you turn 65 on July 4, 2021, the enrollment window opens on April 1. If you are receiving Social Security benefits, the Social Security Administration, which handles Medicare enrollment, will send you an information package and your Medicare card at the start of the sign-up period. You’ll be automatically enrolled in Medicare Part A ...

Why do I have to be on SSDI?

You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig’s disease. (The two-year requirement is waived in this case.) You suffer from end-stage renal disease. Otherwise, your initial enrollment period for Medicare begins three months before the month of your 65th birthday.

How long do you have to sign up for Medicare if you don't sign up?

Here’s why you need to be on top of your deadline: If you don’t sign up during those seven months , you may be subject to a permanent surcharge once you do enroll. You’ll find more information on sign-up periods in Medicare publications on enrolling in Part B and Part D.

What is the FRA age for Medicare?

Keep in mind. The Medicare eligibility age of 65 no longer coincides with Social Security’s full retirement age (FRA) — the age when you qualify for 100 percent of the Social Security benefit calculated from your lifetime earnings. FRA was long set at 65 but it is gradually going up . For people born in 1955, it is 66 years and 2 months;

How long is Medicare for a person born in 1955?

For people born in 1955, it is 66 years and 2 months; it settles at 67 for people born in 1960 or later. Even if you don’t qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

Does Social Security automatically sign you up for Medicare at 65?

But you should be aware of the enrollment deadlines, as Social Security will not sign you up automatically at 65 for “traditional Medicare” — Part A (hospitalization) and Part B (health insurance) — as it typically does for people already collecting Social Security benefits.

Can you deny Medicare if you have a preexisting condition?

Your Part D provider cannot deny coverage even if you are in poor health or have a preexisting condition. You can choose between paying Medicare directly or having Part D costs deducted from your Social Security payment.