First-time Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

What is Medicare Part D eligibility for prescription drugs?

Medicare Part D eligibility depends greatly on Part A enrollment. Medicare Part D provides extra coverage to beneficiaries for the costs of prescription drugs. For many, prescription medications are vital to maintaining a healthy lifestyle.

When can I sign up for Medicare Part D drug coverage?

You can sign up for a Part D drug plan or a Medicare Advantage plan between April 1 and June 30 to begin receiving drug coverage under it on July 1. Note that you cannot get Part D drug coverage outside of these specified enrollment periods.

When can I switch to a part D drug plan?

• If you qualify for Extra Help (which provides low-cost Part D coverage to people with limited incomes) or enter or leave a nursing home, you can join a Part D drug plan or switch to another at any time of the year.

Should I enroll in a Medicare Part D plan?

If you have Medicare Part A and/or Part B and you do not have other drug coverage ( creditable coverage ), you should enroll in a Part D plan. This is true even if you do not currently take any prescription drugs.

What makes you eligible for Medicare Part D?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

Can I add Medicare Part D at anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Can you be turned down for Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

What are the four stages of Medicare Part D?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.

Who is most likely to be eligible to enroll in a Part D prescription drug plan?

You are eligible for Medicare Part D drug benefits if you meet the qualifications for Medicare eligibility, which are: You are age 65 or older. You have disabilities. You have end-stage renal disease.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Who has the best Medicare Part D plan?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Can you be denied a Part D plan?

Depending on the reason for the denial, you may be entitled to request an Exception (Coverage Determination); to obtain your drug. If your Coverage Determination is denied, you have the right to Appeal the denial. There are several reasons why your Medicare Part D plan might refuse to cover your drug.

How are Part D premiums determined?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is Stage 2 of Medicare Part D?

In Stage 2, you pay your copay and we pay the rest. You stay in Stage 2 until the amount of your year-to-date total drug costs reaches $4,430. Total drug costs include your copay and what we pay.

What is the 2022 Part D deductible?

What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

Why is Medicare Part D important?

For many, prescription medications are vital to maintaining a healthy lifestyle. The costs of medications can drain finances, Medicare Part D prescription helps those who need assistance with medications .

What happens if you don't enroll in Medicare Part D?

If you don’t enroll when you’re first eligible and don’t have creditable coverage, you could face a late enrollment penalty. Let’s take a closer look at using an example. Tip: Medicare Plan D and Part D aren’t the same things.

How does Medicaid work with Medicare Part D Plans?

Medicaid provides coverage for individuals and families that have low incomes or limited resources. Not all will qualify for Medicaid coverage in addition to Medicare coverage.

How long do you have to change your plan if you are no longer eligible for Part D?

If you’re no longer eligible for Extra Help for the following year, you will have a 3-month window to change plans. This period starts either the date you’re notified or when you’re no longer eligible;

Do all Medicare beneficiaries qualify for Medicaid?

Not all will qualify for Medicaid coverage in addition to Medicare coverage. Medicare beneficiaries with full Medicaid benefits are dually eligible. The majority of beneficiaries that are dual-eligible have very low income and significant health care needs. Dual eligible beneficiaries now automatically have Part D.

Is it necessary to take prescriptions on a regular basis?

For many seniors, taking prescription drugs on a regular basis is not optional. Patients who have regular medication needs should be sure to enroll as soon as Medicare Part D eligibility begins. Unexpected or not, the cost of medications can be financially exhausting, Part D plans provide you with a much lower cost for the same quality ...

Can Medicare delay Part D?

Delaying Part D When Eligible. Medicare may add a Part D Late Enrollment Penalty to your Part D premium each month you have Part D coverage. Unless you enroll in a Part D plan when you’re first eligible during your IEP. As we grow older our chances of needing prescriptions will often increase. If you have no creditable prescription drug coverage, ...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What happens if you delay Medicare Part D?

If you delay enrollment in Part D for any amount of time and find that you need drug coverage later, you will incur a premium penalty . Note: If you are enrolled in Medicaid and become eligible for the Medicare drug benefit, you will usually be automatically enrolled in a Medicare Part D plan and pay no premium for it.

Do you have to have Medicare Part A and Part B?

If you have Medicare Part A and/or Part B and you do not have other drug coverage ( creditable coverage ), you should enroll in a Part D plan. This is true even if you do not currently take any prescription drugs.

What is Medicare Part D?

Medicare Part D plans are offered by private companies to help cover the cost of prescription drugs. Everyone with Medicare can get this optional coverage to help lower their prescription drug costs. Medicare Part D generally covers both brand-name and generic prescription drugs at participating pharmacies.

Why Join a Medicare Drug Plan?

Even if you don’t take a lot of prescription drugs now, you should still consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when you are first eligible, and you don’t have other creditable prescription drug coverage (for example from an employer or union that is expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage), you will likely pay a late enrollment penalty (higher premiums) if you join later.

What is the gap in Medicare?

The Medicare Prescription Drug Coverage Gap (the “Doughnut Hole”) Most Medicare Part D plans have a coverage gap, sometimes called the “Doughnut Hole.”. This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for the drugs, up to a yearly limit.

How to learn more about Medicare?

You can learn more about the Original Medicare Plan and the Medicare program by reading “Medicare & You”, the official government handbook about Medicare. You will need the free Adobe® Reader® software to download the files.

When does Medicare 7 month period end?

When you are first eligible for Medicare (the 7-month period begins 3 months before the month you turn age 65, includes the month you turn age 65, and ends 3 months after the month you turn age 65).

Is a discount card considered a prescription?

Note: Discount cards, doctor samples, free clinics, drug discount Web sites, and manufacturer’s pharmacy assistance programs are not considered prescription drug coverage and are not considered creditable coverage. Avoid the late-enrollment penalty. Join when you first become eligible.

When does the annual enrollment period start?

The Annual Enrollment Period, between October 15-December 7. Your coverage will begin on January 1 of the following year, as long as the plan gets your enrollment request by December 31. Anytime, if you qualify for Extra Help or if you have both Medicare and Medicaid.

When does Medicare start?

A general enrollment period (Jan. 1 to March 31 each year), if you missed your deadline for signing up for Medicare (Part A and/or Part B) during your IEP or an SEP. In this situation Medicare coverage will not begin until July 1 of the same year in which you enroll.

What happens if you don't sign up for Part D?

If you fail to sign up during one of these time frames, you face two consequences. You will be able to enroll in a Part D plan only during open enrollment, which runs from Oct. 15 to Dec. 7, with coverage beginning Jan. 1. And you will be liable for late penalties, based on how many months you were without Part D or alternative creditable coverage since turning 65, which will be added to your Part D drug premiums for all future years.

When is open enrollment for Medicare?

The annual open enrollment period (Oct. 15 to Dec. 7 each year) when you can join a drug plan for the first time if you missed your deadlines for your IEP or a SEP, or switch from original Medicare to a Medicare Advantage plan, or switch from one Medicare Advantage plan to another, or switch from one Part D drug plan to another.

What is Medicare Part D?

Medicare Part D provides prescription drug coverage for both generic and brand name prescription drugs. Prescription drug coverage also provides protection for people who are dealing with high drug costs and from unexpected prescription drug bills.

How long do you have to be in Medicare to be eligible for Medicare?

Eligibility for Medicare Part D begins three months prior to ones 65th birthday and also continues three months after. Regardless of medical history and income level, if you are at a minimum of three months away from your 65th birthday, you are eligible.

How to reduce the need for maintenance medications?

Any opportunity that you can take to minimize the need for maintenance drugs means that you are saving money on both costly premiums and on out-of-pocket expenses. Not all elderly people require the use of prescription medications and surely there are others that need it. With regular exercise and a balanced diet, one can achieve a healthier lifestyle.

Is Medicare Part D covered by generic drugs?

Both brand name and generic drugs are covered. To ensure that certain medications you are currently taking or may be required to take in the future is covered; you will want to check the Medicare Part D Drug Formula.

Do you have to enroll in Part D if you are not eligible?

If you are eligible for the Part D plan and have not enrolled yet , it is highly recommended that you do so early on. Whether you are in the best shape of your life or not, unexpected changes can happen where prescription medication is needed.

Do elderly people need maintenance drugs?

Any opportunity that you can take to minimize the need for maintenance drugs means that you are saving money on both costly premiums and on out-of-pocket expenses. Not all elderly people require the use of prescription medications and surely there are others that need it.

What is Medicare drug plan?

These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have

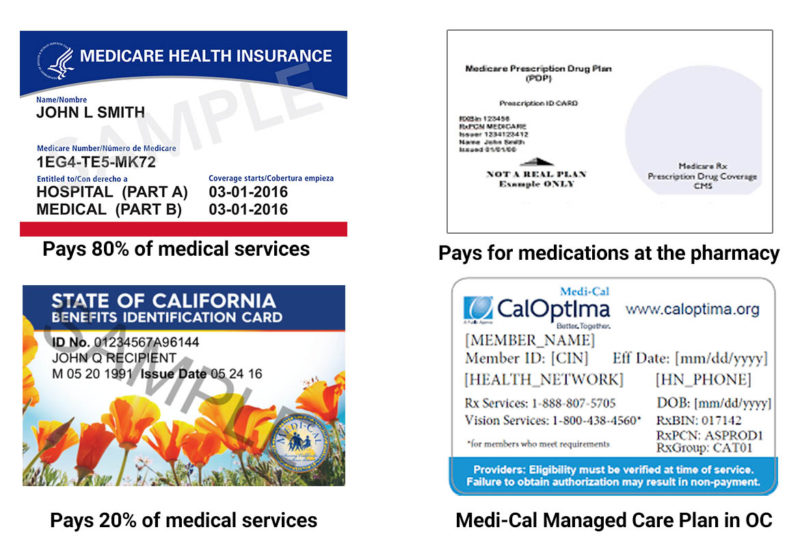

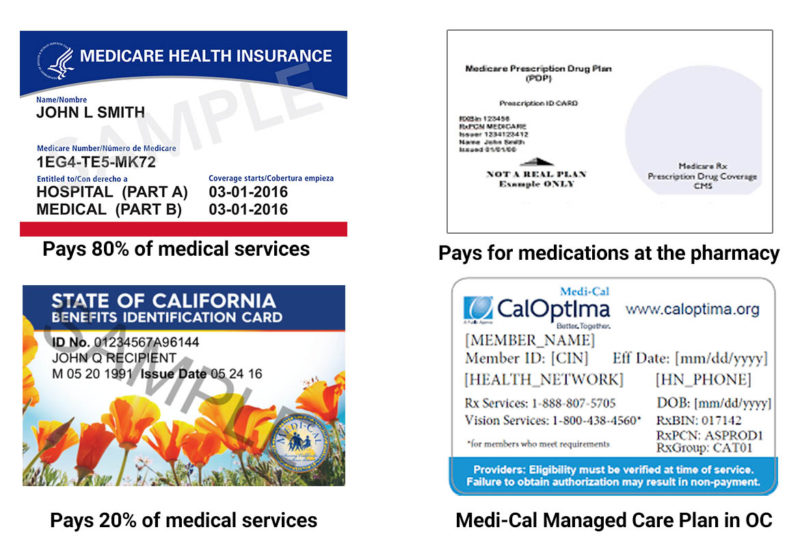

What do you give when you join a Medicare plan?

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

How to compare Medicare Advantage plans?

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...