In order to purchase a Medicare Supplement

Medigap

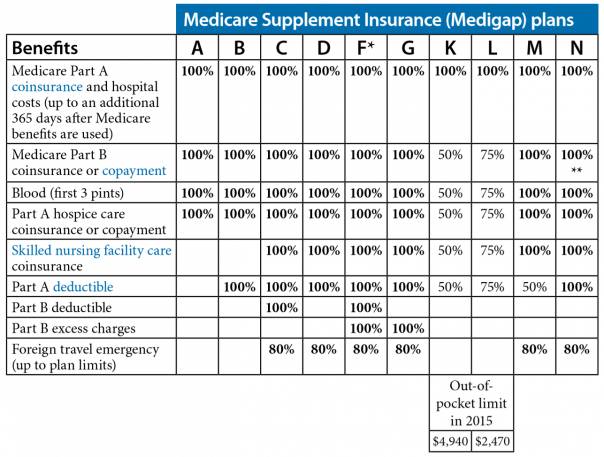

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Are Medicare supplement plans worth it?

Sep 16, 2018 · How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months. This is when you can get any Medicare …

Who is eligible for a Medicare supplement insurance plan?

Are You Eligible for a Medicare Supplement Insurance Plan? Eligibility for Medicare Supplement Insurance has several requirements based on your time of enrollment: You must be enrolled in BOTH Parts A and B at the time of application. You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability).

Is there open enrollment for Medicare supplements?

However, if you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans that cover the Part B deductible (Plan C or F). If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan.

What is the best Medicare supplement insurance plan?

Aug 09, 2018 · When can I enroll in a Medicare Supplement Plan? When newly eligible for Medicare, you enter a seven-month Initial Enrollment Period (IEP) which begins three months before your 65th birthday and ends three months after the month of your birthday.

When can a consumer enroll in a Medicare supplement plan?

Can you add a supplement to Medicare at any time?

Can a Medicare supplement plan be purchased at any time of the year?

What are the criterias of a Medicare supplement plan?

Can I switch from Medicare Advantage to Medicare supplement?

What is the average cost of supplemental insurance for Medicare?

Can Medigap insurance be denied for pre existing conditions?

How long before you turn 65 do you apply for Medicare?

It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Do you have to renew Medicare supplement every year?

You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

How do I get supplemental insurance?

What is the difference between Medicare Advantage and Medicare supplement?

Do you need Medicare Part B to get a supplement?

When Am I Eligible For Medicare Supplement Coverage?

Because Medicare Supplement policies complement your Original Medicare coverage, you must be enrolled in Part A and Part B to be eligible for this...

How Can Enrollment Periods Affect My Eligibility For Medicare Supplement Plans?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this per...

Am I Eligible For A Medicare Supplement Plan If I’M Under Age 65?

Federal law does not require insurance companies to sell Medicare Supplement policies to people under 65, but many states do have this requirement....

Am I Eligible For A Medicare Supplement Plan If I Have A Medicare Advantage Plan?

Medicare Supplement policies don’t work with Medicare Advantage plans. If you decide to switch from Original Medicare to a Medicare Advantage plan,...

Am I Eligible For A Medicare Supplement Plan If I Have Coverage Through Medicaid?

While some beneficiaries may be eligible for both Medicare and Medicaid benefits (also known as “dual eligibles”), Medicaid typically doesn’t work...

How old do you have to be to get Medicare Supplement?

You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability). You must reside in the state in which ...

What is Medicare Supplement Plan?

A Medicare Supplement Plan (also called a Medigap plan) can help pay Medicare Part A and Part B costs, such as deductibles, copayments, and coinsurance. If you’re eligible for a Medicare Supplement Plan, enrollment is a good idea, as these plans take much of the worry out of escalating medical costs by having no cap on the coverage they offer.

What is SEP in insurance?

Included in the SEP category is the SEP for relocation to the U.S. from a foreign country. Supplement Plans require that you show a permanent address within the U.S. or its territories and require state residency at the time of purchase for determination of coverage, cost, and plan availability. They also require that the address be ...

When is the best time to buy a Medigap policy?

The best time to buy a Medigap policy is during your Medigap Open Enrollment Period. OEP is the six-month period that begins on the first day of the month in which you’re 65, or older, and enrolled in Medicare Part B. If you delay Part B coverage, your Medigap OEP will be the six-month period beginning on the first day of ...

When does OEP start?

OEP is the six-month period that begins on the first day of the month in which you’re 65, or older, and enrolled in Medicare Part B. If you delay Part B coverage, your Medigap OEP will be the six-month period beginning on the first day of the month you enroll in Part B. Example 1: If you turn 65 on May 1 and your Part B begins May 1, ...

What is a pre-existing condition?

Medicare defines a pre-existing condition as a health problem you have before the date a new insurance policy starts. In some cases, the Medigap insurance company can refuse to issue the policy based on pre-existing conditions.

How long do you have to wait to buy a Medigap policy?

Under certain circumstances, there is a waiting period of up to six-months for pre-existing conditions for Medigap policies purchased during the OEP.

Does Medicare Supplement Insurance cover Part B?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

What age do you have to be to get Medicare Supplement?

Federal law doesn’t require insurance companies to sell Medicare Supplement insurance plans to people under 65. If you have ESRD, you may not be able to buy the Medicare Supplement insurance plan you ...

How long is the Medicare Supplement open enrollment period?

This period lasts for six months and begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B.

Who sells Medicare Supplement insurance?

Medicare Supplement insurance plans are sold by private health insurance companies, but unlike some other health plans sold by private insurers, Medicare Supplement insurance plans may have eligibility requirements in some situations.

How long does Medicare Part A last?

Medicare Part A and Part B are generally available to citizens of the USA or permanent legal residents for at least five continuous years who have any one of the following qualifications: Aged 65 and older.

How long do you have to be on disability to get Medicare?

Generally you’re eligible for Medicare after receiving disability benefits for 24 months in a row. Diagnosed with Lou Gehrig’s disease (ALS).

Does Medicare cover Medicare Supplement?

Medicare does not cover any Medicare Supplement premium costs. Here are some reasons you may be turned down from a Medicare Supplement insurance plan or pay a higher premium: You have Medicare but you’re under 65. You’re 65 but haven’t enrolled in Medicare Part B. You have a health problem and your Medicare Supplement Open Enrollment Period has ...

Does Medicare cover premiums?

Medicare does not cover any Medicare Supplement premium costs. Here are some reasons you may be turned down from a Medicare Supplement insurance plan or pay a higher premium: You have a health problem and your Medicare Supplement Open Enrollment Period has ended.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. .

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

How old do you have to be to get Medicare Supplement?

In most states you need to be 65 years or older; however, insurance carriers in a few states offer at least one Medicare Supplement to Medicare beneficiaries under 65 years. Anyone who is at least 65 years old and enrolled in Medicare Parts A & B is eligible for Medigap.

How long does Medicare last?

This only happens once in a beneficiary’s lifetime and lasts for 6 months. Those new to Medicare have the best opportunity when it comes to Medigap eligibility. Taking advantage of top-quality coverage at the lowest price is the opportunity every beneficiary has when turning 65.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.