What is Medicare Part D eligibility for prescription drugs?

Medicare Part D eligibility depends greatly on Part A enrollment. Medicare Part D provides extra coverage to beneficiaries for the costs of prescription drugs. For many, prescription medications are vital to maintaining a healthy lifestyle.

When can I sign up for Medicare Part D drug coverage?

You can sign up for a Part D drug plan or a Medicare Advantage plan between April 1 and June 30 to begin receiving drug coverage under it on July 1. Note that you cannot get Part D drug coverage outside of these specified enrollment periods.

When can I switch to a part D drug plan?

• If you qualify for Extra Help (which provides low-cost Part D coverage to people with limited incomes) or enter or leave a nursing home, you can join a Part D drug plan or switch to another at any time of the year.

Should I enroll in a Medicare Part D plan?

If you have Medicare Part A and/or Part B and you do not have other drug coverage ( creditable coverage ), you should enroll in a Part D plan. This is true even if you do not currently take any prescription drugs.

When do you have to enroll in Medicare Part D?

When is Medicare Part D enrollment?

What is Medicare Supplement?

What are the different types of Medicare coverage?

What is Medicare Part D?

What is the right Medicare plan for you?

How long does it take for Medicare to pay late enrollment penalty?

See more

About this website

What makes you eligible for Medicare Part D?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

When can you enroll in Medicare Part D?

The first opportunity for Medicare Part D enrollment is when you're initially eligible for Medicare – during the seven-month period beginning three months before the month you turn 65. If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65.

Can Medicare Part D be added at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What are the four stages of Medicare Part D?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.

Who is most likely to be eligible to enroll in a Part D prescription drug plan?

You are eligible for Medicare Part D drug benefits if you meet the qualifications for Medicare eligibility, which are: You are age 65 or older. You have disabilities. You have end-stage renal disease.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

How can I avoid Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Is there an out of pocket maximum for Medicare Part D?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What is Stage 2 of Medicare Part D?

In Stage 2, you pay your copay and we pay the rest. You stay in Stage 2 until the amount of your year-to-date total drug costs reaches $4,430. Total drug costs include your copay and what we pay.

What is the 2022 Part D deductible?

What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

How many stages do Part D plans have?

four different phasesThere are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price for your covered prescription drugs. Once you have met the deductible, the plan will begin to cover the cost of your drugs.

CMS releases 2022 Medicare Advantage and Part D Rate Announcement

Today, the Centers for Medicare & Medicaid Services (CMS) announced 2022 Medicare Advantage (MA) and Part D rates three months earlier than usual providing Medicare health and prescription drug plans more time to consider this information as they prepare and finalize their bids for 2022, which are due June 7, 2021.

Drug coverage (Part D) | Medicare

Part D (Medicare drug coverage) helps cover cost of prescription drugs, may lower your costs and protect against higher costs.

2022 | CMS

July 29, 2021 announcement of 2022 Part D National Average Monthly Bid Amount, Medicare Part D Base Beneficiary Premium, Part D Regional Low-Income Premium Subsidy Amounts, Medicare Advantage Regional Benchmarks, and Income Related Monthly Adjustment Amounts Regional Rates and benchmarks, Part D Low Income Premium Subsidy Amounts 2022 Regional PPO EGWP rates 2022 MA rate book 2022 Rate ...

What Medicare Part D drug plans cover | Medicare

Plans offering Medicare drug coverage under Part D may immediately remove drugs from their formularies after the Food and Drug Administration (FDA) considers them unsafe or if their manufacturer removes them from the market.

Projected Medicare Premiums for 2022

The clock is ticking, and it’s coming! If you’re still wondering about the context, we are talking about the Medicare open enrollment period and medicare premiums. It’s the time for which every Medicare policyholder waits for the whole year-round.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Why is Medicare Part D important?

For many, prescription medications are vital to maintaining a healthy lifestyle. The costs of medications can drain finances, Medicare Part D prescription helps those who need assistance with medications .

What happens if you don't enroll in Medicare Part D?

If you don’t enroll when you’re first eligible and don’t have creditable coverage, you could face a late enrollment penalty. Let’s take a closer look at using an example. Tip: Medicare Plan D and Part D aren’t the same things.

How long do you have to change your plan if you are no longer eligible for Part D?

If you’re no longer eligible for Extra Help for the following year, you will have a 3-month window to change plans. This period starts either the date you’re notified or when you’re no longer eligible;

Is it necessary to take prescriptions on a regular basis?

For many seniors, taking prescription drugs on a regular basis is not optional. Patients who have regular medication needs should be sure to enroll as soon as Medicare Part D eligibility begins. Unexpected or not, the cost of medications can be financially exhausting, Part D plans provide you with a much lower cost for the same quality ...

Can Medicare delay Part D?

Delaying Part D When Eligible. Medicare may add a Part D Late Enrollment Penalty to your Part D premium each month you have Part D coverage. Unless you enroll in a Part D plan when you’re first eligible during your IEP. As we grow older our chances of needing prescriptions will often increase. If you have no creditable prescription drug coverage, ...

Do I need a Medicare Advantage plan if I have supplemental insurance?

But if you have a Medicare Advantage plan that includes Part D, you can’t have a separate Part D plan.

Do dual eligible beneficiaries have Part D?

Dual eligible beneficiaries now automatically have Part D . Before Part D began, the Medicaid program provided drug coverage for dual-eligible beneficiaries. If a dual eligible beneficiary wants to make changes to their plan or benefits, they may do so but only at certain times of the year.

What is Medicare Part D?

Medicare Part D plans are offered by private companies to help cover the cost of prescription drugs. Everyone with Medicare can get this optional coverage to help lower their prescription drug costs. Medicare Part D generally covers both brand-name and generic prescription drugs at participating pharmacies.

When does the annual enrollment period start?

The Annual Enrollment Period, between October 15-December 7. Your coverage will begin on January 1 of the following year, as long as the plan gets your enrollment request by December 31. Anytime, if you qualify for Extra Help or if you have both Medicare and Medicaid.

What is the gap in Medicare?

The Medicare Prescription Drug Coverage Gap (the “Doughnut Hole”) Most Medicare Part D plans have a coverage gap, sometimes called the “Doughnut Hole.”. This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for the drugs, up to a yearly limit.

Is a discount card considered a prescription?

Note: Discount cards, doctor samples, free clinics, drug discount Web sites, and manufacturer’s pharmacy assistance programs are not considered prescription drug coverage and are not considered creditable coverage. Avoid the late-enrollment penalty. Join when you first become eligible.

Do you have to live in the service area of Medicare?

You must also live in the service area of the Medicare drug plan you want to join. Important Note for Medicare Beneficiaries with Employer or Union Coverage: If you have employer or union coverage, call your benefits administrator before you make any changes, or before you sign up for any other coverage.

Does Part D have a deductible?

Part D plans may have a monthly plan premium and a yearly deductible. These vary from plan to plan. You pay a portion of your drug costs, including a copayment or coinsurance. Costs vary depending on which drug plan you choose. Coverage options, including drug coverage, may vary from plan to plan.

Does Medicare cover generic drugs?

Whatever plan you choose, Medicare drug coverage will help you by covering brand-name and generic drugs at pharmacies that are convenient for you. Each Part D plan has a formulary – a list of medications the plan will cover. This list may also be referred to as a drug list, prescription drug list (PDL), or a covered medications list (CML).

What happens if you delay Medicare Part D?

If you delay enrollment in Part D for any amount of time and find that you need drug coverage later, you will incur a premium penalty . Note: If you are enrolled in Medicaid and become eligible for the Medicare drug benefit, you will usually be automatically enrolled in a Medicare Part D plan and pay no premium for it.

Do you have to have Medicare Part A and Part B?

If you have Medicare Part A and/or Part B and you do not have other drug coverage ( creditable coverage ), you should enroll in a Part D plan. This is true even if you do not currently take any prescription drugs.

How long does Medicare Part D last?

Whether you choose a stand-alone Part D drug plan or a Medicare Advantage plan, you must enroll during a designated enrollment period: Your initial enrollment period (IEP), which runs for seven months, of which the fourth is the month of your 65th birthday.

When can I enroll in Part D?

You will be able to enroll in a Part D plan only during open enrollment, which runs from Oct. 15 to Dec. 7, with coverage beginning Jan. 1. And you will be liable for late penalties, based on how many months you were without Part D or alternative creditable coverage since turning 65, which will be added to your Part D drug premiums ...

When does Medicare start?

A general enrollment period (Jan. 1 to March 31 each year), if you missed your deadline for signing up for Medicare (Part A and/or Part B) during your IEP or an SEP. In this situation Medicare coverage will not begin until July 1 of the same year in which you enroll.

When can I sign up for Medicare Advantage?

You can sign up for a Part D drug plan or a Medicare Advantage plan between April 1 and June 30 to begin receiving drug coverage under it on July 1. Note that you cannot get Part D drug coverage outside of these specified enrollment periods. At other times, you cannot just sign up when you need medications, no matter how urgently your medical ...

When is open enrollment for Medicare?

The annual open enrollment period (Oct. 15 to Dec. 7 each year) when you can join a drug plan for the first time if you missed your deadlines for your IEP or a SEP, or switch from original Medicare to a Medicare Advantage plan, or switch from one Medicare Advantage plan to another, or switch from one Part D drug plan to another.

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

Does Medicare change drug coverage?

The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options. If you have (or are eligible for) other types of drug coverage, read all the materials you get from your insurer or plan provider.

When do you have to enroll in Medicare Part D?

For most people, you first become eligible to enroll in Medicare Part D from 3 months before your 65 th birthday to 3 months after your birthday. When you find a plan to join, you’ll need to provide your unique Medicare number and the date you became eligible.

When is Medicare Part D enrollment?

Medicare Part D enrollment. The Medicare Part D enrollment period takes place each year form April 1 to June 30. If you enrolled in coverage for Medicare parts A or B and want to add Part D, you can enroll during this period the first time. After this, to change Part D plans, you must wait for open enrollment to come around again.

What is Medicare Supplement?

Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums.

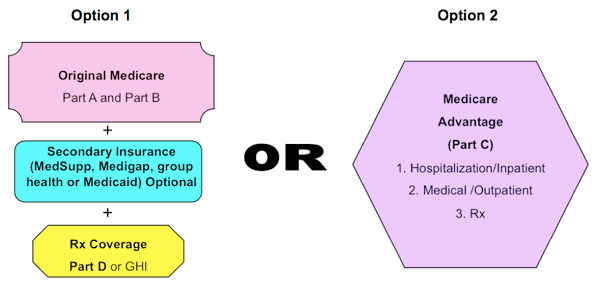

What are the different types of Medicare coverage?

What are the Medicare prescription drug coverage options? 1 Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans’ formulary, or drug list. If your doctor wants a drug covered that’s not part of that plan’s list, they’ll need to write a letter of appeal. Each nonformulary medication coverage decision is individual. 2 Part C (Advantage plans). This type of plan can take care of all your medical needs (parts A, B, and D), including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies. 3 Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

What is Medicare Part D?

Medicare Part D is an important benefit that helps pay for prescription drugs not covered by original Medicare (parts A and B). There are private medication plans that you can add to your original Medicare coverage, or you can choose a Medicare Advantage plan (Part C) with drug coverage.

What is the right Medicare plan for you?

The right plan for you depends on your budget, medication costs, and what you want to pay for premiums and deductibles. Medicare has a tool to help you compare plans in your area looking ahead to 2020. Part D. These plans cover prescription medications for outpatient services.

How long does it take for Medicare to pay late enrollment penalty?

Medicare adds on a permanent 1 percent late enrollment penalty to your premiu if you don’t enroll within 63 days of your initial eligibility period. The penalty rate is calculated based on the national premium rate for the current year multiplied by the number of months you didn’t enroll when you were eligible.