When is the earliest you can get Medicare?

Oct 10, 2014 · When should I sign up for Medicare? Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Will I be automatically enrolled in Medicare?

Feb 01, 2021 · When you near your 65th birthday, you will enter what is called your Initial Enrollment Period (IEP). This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

When is the best time to enroll in Medicare?

Feb 26, 2022 · You will be automatically enrolled in Medicare Parts A and B effective the month you turn 65. If you do not receive Social Security benefits, then you will need to sign up for Medicare by calling the Social Security Administration at 800-772-1213 or online at . It is best to do it as early as possible so your coverage begins as soon as you turn 65.

How and when are you supposed to enroll in Medicare?

It is called the Medicare Eligibility Tool. If you already receive benefits from Social Security: If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare …

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Do I automatically get enrolled in Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can I choose not to enroll in Medicare?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

When should someone enroll in Medicare?

65Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

How do I know if I am automatically enrolled in Medicare?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How do I enroll in Medicare for the first time?

Apply online (at Social Security) – This is the easiest and fastest way to sign up and get any financial help you may need. You'll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

What parts of Medicare are mandatory?

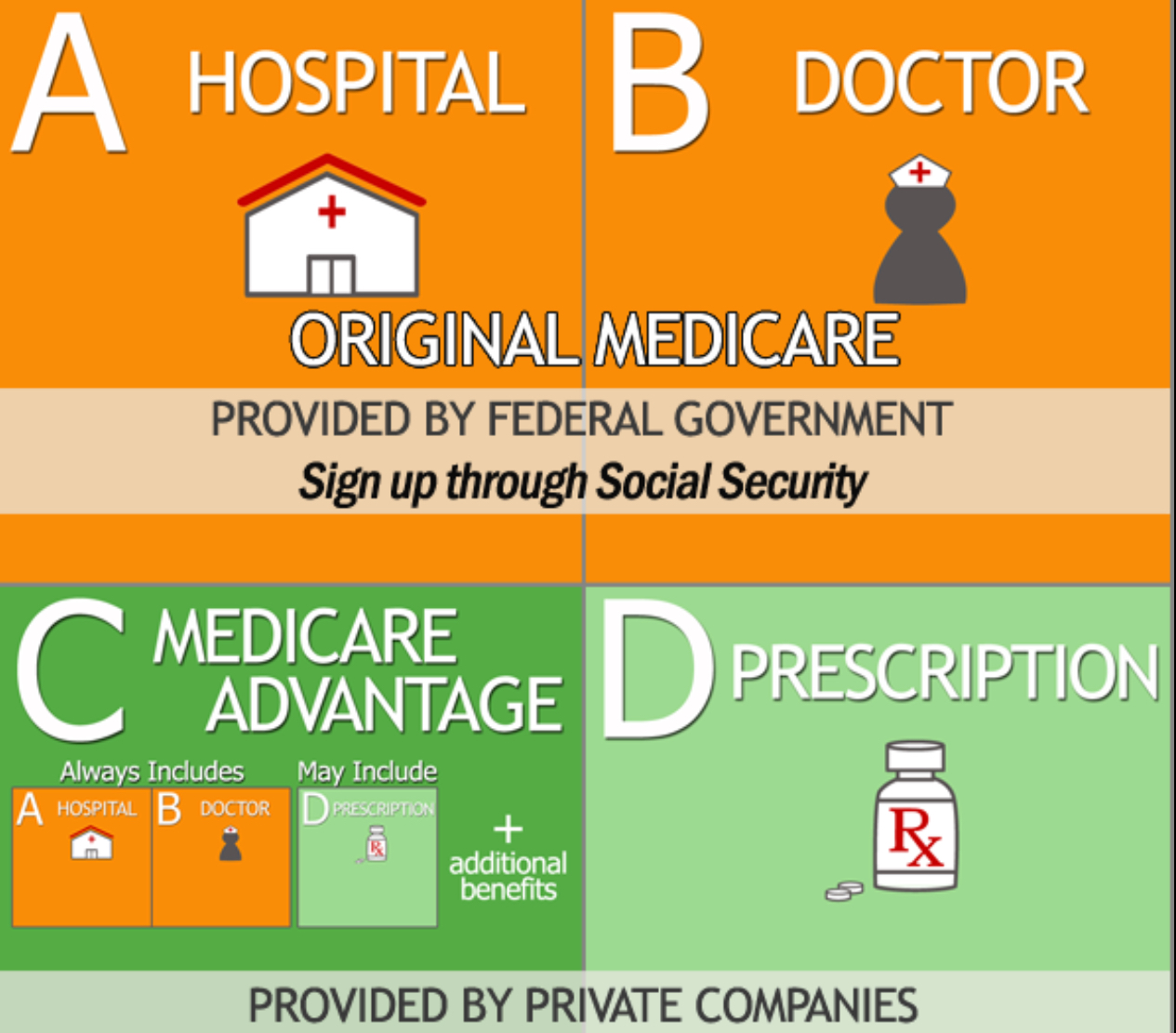

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Do you have to take Medicare if you take Social Security?

No, it isn't mandatory to join Medicare. People can opt to sign up, or not. If you don't qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65.Jan 20, 2022

How do I opt out of Medicare Part A?

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.Oct 27, 2014

What are the 3 enrollment periods for Medicare?

When you turn 65, you have a seven month window to enroll in Medicare. This includes three months before the month you turn 65, your birth month, and three months after the month you turn 65.

What do I need to do before I turn 65?

This quick checklist covers some of the most important things you should review.Prepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.Nov 22, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Do You Have to Sign up For Medicare if You Are Still Working?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Can I Get Social Security and Not Sign up for Medicare?

Yes and no. Medicare Part B is optional. If you’re automatically enrolled in Medicare Part A, you will be automatically enrolled in Part B and then given the option of opting out. You may still continue to receive your Social Security benefits without having Part B.

If you already receive benefits from Social Security

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting the first day of the month you turn age 65. You will not need to do anything to enroll.

If you are not getting Social Security benefits

If you are not getting Social Security benefits, you can apply for retirement benefits online. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213.

If you are under age 65 and disabled

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security or the Railroad Retirement Board for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You will not need to do anything to enroll in Medicare.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.

What happens if you don't sign up for Medicare?

If you choose not to sign up for Medicare Part A when you become eligible, a penalty may be assessed. This penalty depends on why you chose not to sign up. If you simply chose not to sign up when you were first eligible, your monthly premium — if you have to pay one — will increase by 10 percent for twice the number of years that you went without signing up . For example, if you waited two years to sign up, you will pay the late enrollment penalty for 4 years after signing up.

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

How long does it take to enroll in Part D?

This includes three months prior to your 65th birthday, the month of your birthday and then three months after your 65th birthday. Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date.

What happens if you don't sign up for Medicare?

Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage. It’s therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability.

How long can you delay Medicare?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later. When the employer-tied coverage ends, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare.

Can you sell a Medigap policy?

Insurance companies are prohibited from refusing to sell you a Medigap policy or charge higher premiums based on your health or preexisting medical conditions, if you buy the policy within six months of enrolling in Part B. Outside of that six-month window, except in very limited circumstances, they can do both.

Can you delay Medicare enrollment?

You can’t delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA — by definition, these do not count as active employment. Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer.

:max_bytes(150000):strip_icc()/revisedmedicarepartd-4279c4ffaf4047cc81144bf4bb3a28c1.png)