Full Answer

When should you sign up for Medicare Part?

While some people who sign up for Medicare are retired, others are still working. Whatever your situation, you become eligible for Medicare when you reach 65. 2 In fact, if you are already receiving Social Security, you'll be enrolled in Medicare automatically the month you turn 65. 3 The card will arrive in the mail. 4

When can you start applying for Medicare?

You’re first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig’s disease). Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace. Step 1

When do I sign up for Medicare Part?

According to Medicare.gov, you have a seven-month “initial enrollment period” to sign up for Part A, which provides inpatient/hospital ... ll be hit with this penalty every month until you do enroll. Based on 2021 costs, that’s an extra $14.85 ...

How do you sign up for Medicare Part?

Note: When completing the forms CMS-40B and CMS-L564:

- State “I want Part B coverage to begin (MM/YY)” in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer's signature.

- Also submit one of the following forms of secondary evidence:

When can I add Medicare Part A?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you sign up for Medicare, stop your Marketplace coverage so it ends when your Medicare coverage starts.

Can I get Medicare Part A at 62?

You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

Will I automatically be signed up for Medicare Part A?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How many months before I turn 65 should I apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Who qualifies for free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

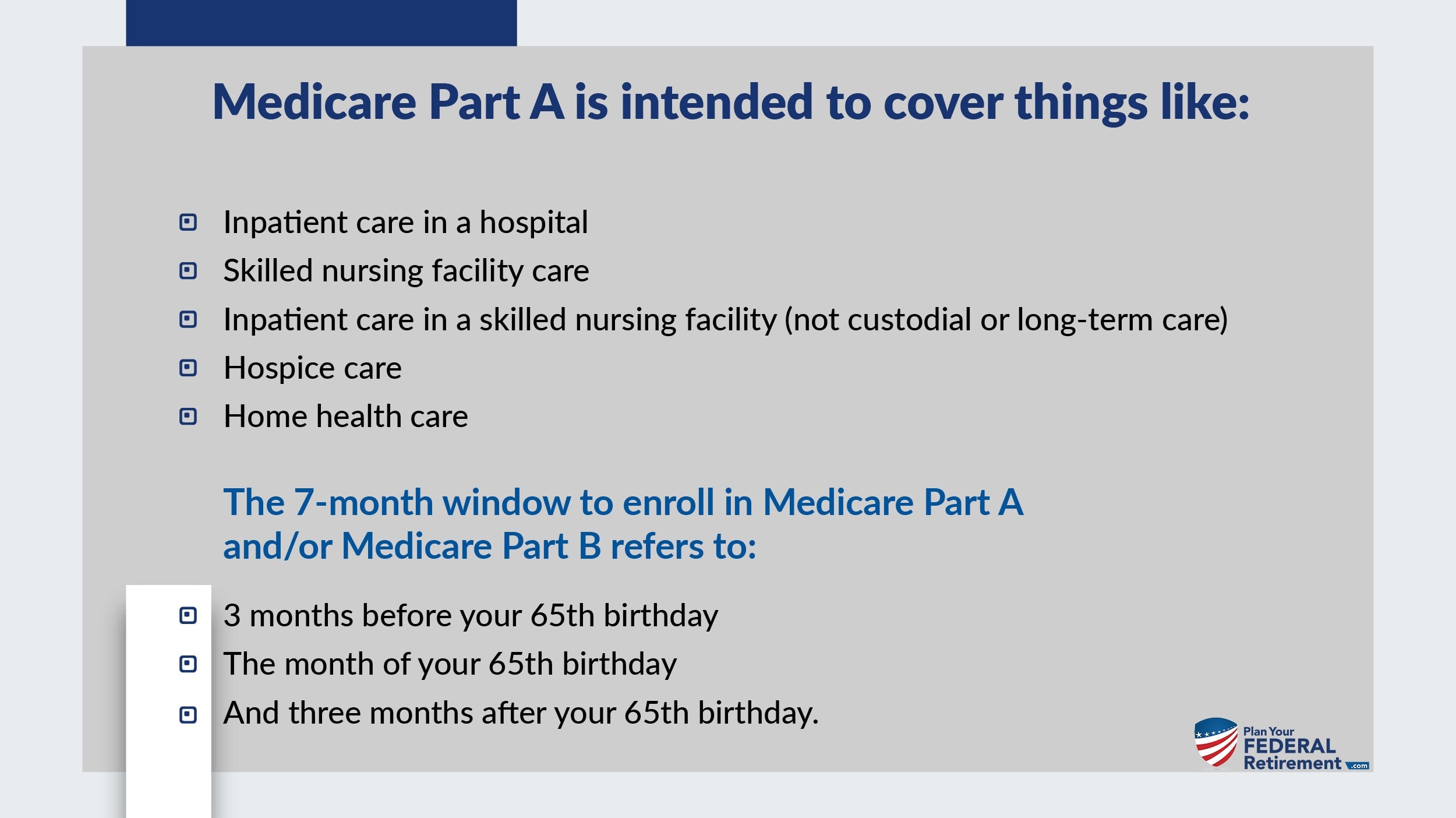

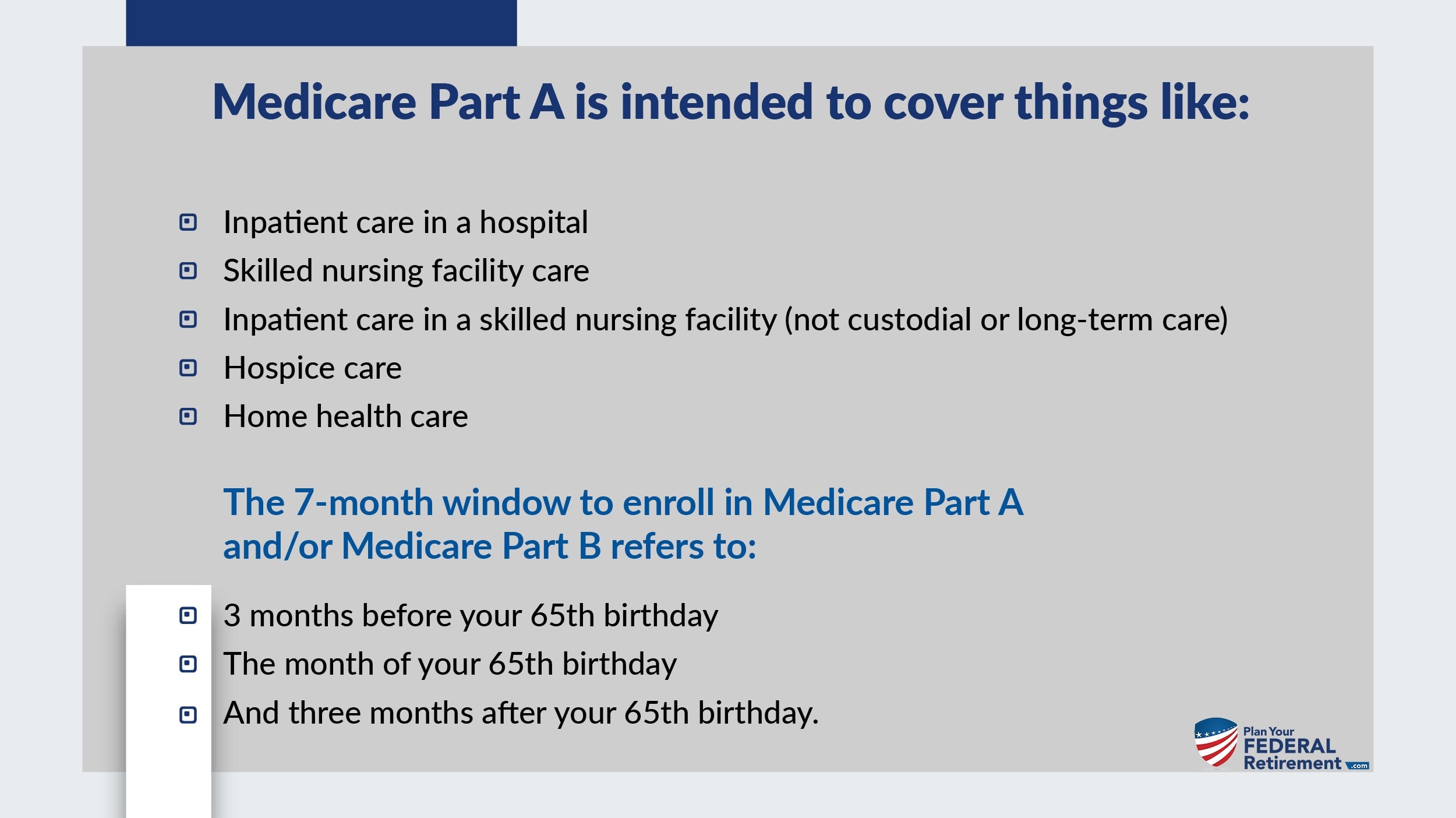

What is included in Medicare Part A?

In general, Part A covers:Inpatient care in a hospital.Skilled nursing facility care.Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)Hospice care.Home health care.

Does Medicare coverage start the month you turn 65?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

What should I be doing 3 months before 65?

You can first apply for Medicare during the three months before your 65th birthday. By applying early, you ensure your coverage will start the day you turn 65. You can also apply the month you turn 65 or within the following three months without penalty, though your coverage will then start after your birthday.

What do I need to do before I turn 65?

11 steps to take if you're turning 65 this yearMake a Social Security plan. ... Get ready for Medicare. ... Medigap or Medicare Advantage? ... Pick the right Medicare Part D plan. ... Consider long-term care insurance. ... Start unlocking new travel deals. ... Get a property tax break. ... Visit the doctor.More items...•

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

What is the best time to apply for Medicare?

Initial Enrollment Period. The initial enrollment period for Medicare is an important time. In fact, your initial enrollment period (IEP) is the best time to apply for Medicare Part A.

When is the best time to get Medicare Part A?

The best time to get Medicare Part A is when first becoming eligible, during the initial enrollment period. Without Medicare Part B, having Part A by itself means no access to Medicare Advantage or Medigap health plans.

How long does the late penalty for Medicare last?

The Part A late penalty lasts for twice the number of full years a person was eligible, but didn’t enroll in Part A. Payment of the penalty starts at the time a late enrollee signs up, and begins Medicare Part A.

What is Medicare Part A?

Medicare Part A Only. Medicare Part A provides hospital insurance, meaning it covers related services, supplies, and the room itself for a hospital stay. With that said, Medicare Part A alone leaves a glaring gap in health coverage: medical services for situations outside of a hospital stay remain entirely uncovered.

What happens if you sign up for Part A and not Part B?

The Part B late penalty adds ten percent to the premium. Then, it multiplies by the number of full years you went without Part B while you were eligible.

Is Medicare Part A premium free?

For most people, Part A is premium-free. Although permissible to sign up for Medicare Part A only, this only comes recommended when group insurance provides medical coverage equal to Part B, or better. Some retirees continue under insurance from an employer or union when first becoming eligible for Medicare. Without any late enrollment penalty, ...

Does Medicare Part A have a stop loss?

In order to protect yourself, know that Medicare Part A sets no annual stop-loss amount. In other words, there is no built-in safety net to protect against excessive financial loss due to hospital expenses. Beyond that, Medicare Part A and Part B do not have a prescription drug insurance benefit.

What is Part A insurance?

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care. You must meet certain conditions to get these benefits.

What does Part B cover?

Part B helps cover medically necessary services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

Does Medicare cover prescription drugs?

Medicare prescription drug coverage is available to everyone with Medicare. Private companies provide this coverage. You choose the Medicare drug plan and pay a monthly premium. Each plan can vary in cost and specific drugs covered. If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other creditable prescription drug coverage, or you don’t get Extra Help, you’ll likely pay a late enrollment penalty. You may have to pay this penalty for as long as you have Medicare drug coverage.

Can I get medicare if I have SSI?

Getting SSI doesn’t make you eligible for Medicare. SSI provides a monthly cash benefit and health coverage under Medicaid. Your spouse may qualify for Medicare when he/she turns 65 or has received disability benefits for 24 months.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.