When does the Medicare coverage gap close?

Sep 16, 2018 · You may want to have your new Medicare Supplement policy go into effect at the same time your Medicare Advantage coverage ends to avoid breaks in your coverage. You can apply as early as 60 days before your Medicare Advantage coverage ends and no later than 63 days after your plan coverage ends.

Does Medicare have a coverage gap for prescription drugs?

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D). If you joined a Medicare Advantage Plan when you were first eligible for Medicare, you can choose from any Medigap policy. Some states provide additional special rights.

What is the Medicare Part D coverage gap?

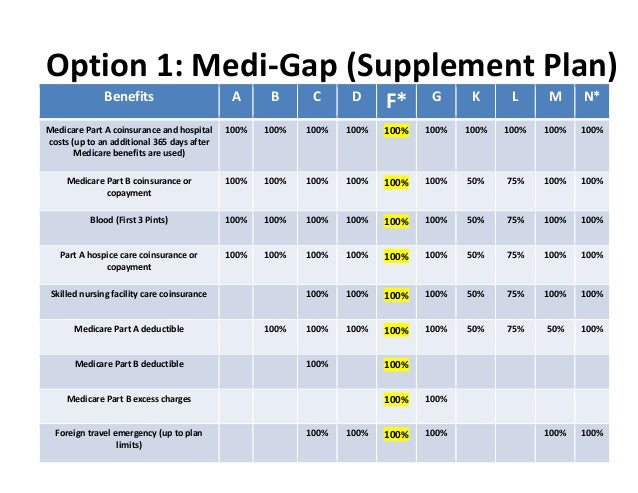

However, if you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans that cover the Part B deductible (Plan C or F). If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan.

When can I sign up for Medicare Part G?

Dec 12, 2019 · The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage Prescription Drug plans pay for prescription drug costs. This gap will officially close in 2020, but you can still reach this out-of-pocket threshold where your medication costs may change.

What is the difference between Medicare gap and Medicare Advantage?

Can I change Medicare supplement plans anytime?

Can I switch from Medicare Advantage to Medigap without underwriting?

Can you be denied a Medicare supplement plan?

When can I switch from Medigap to Medicare Advantage?

Do you have to renew Medicare supplement every year?

Are you automatically disenrolled from Medicare Advantage to Medigap?

Does Medigap have an out of pocket maximum?

Can you switch back and forth between Medicare Advantage and Medigap?

What pre-existing conditions are not covered?

Does Medigap have pre-existing conditions?

Can I be turned down for Medicare Part D?

When Am I Eligible For Medicare Supplement Coverage?

Because Medicare Supplement policies complement your Original Medicare coverage, you must be enrolled in Part A and Part B to be eligible for this...

How Can Enrollment Periods Affect My Eligibility For Medicare Supplement Plans?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this per...

Am I Eligible For A Medicare Supplement Plan If I’M Under Age 65?

Federal law does not require insurance companies to sell Medicare Supplement policies to people under 65, but many states do have this requirement....

Am I Eligible For A Medicare Supplement Plan If I Have A Medicare Advantage Plan?

Medicare Supplement policies don’t work with Medicare Advantage plans. If you decide to switch from Original Medicare to a Medicare Advantage plan,...

Am I Eligible For A Medicare Supplement Plan If I Have Coverage Through Medicaid?

While some beneficiaries may be eligible for both Medicare and Medicaid benefits (also known as “dual eligibles”), Medicaid typically doesn’t work...

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

Does Medicare Supplement cover out-of-pocket expenses?

Medicare Supplement plans aren’t meant to provide stand-alone health coverage; these plans just help with certain out-of-pocket costs that Original Medicare doesn’t cover. If you’re under 65 and have Medicare because of disability, end-stage renal disease, or amyotrophic lateral sclerosis, your eligibility for Medicare Supplement coverage may ...

How long does Medicare Supplement open enrollment last?

How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

When is the best time to enroll in Medicare Supplement?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period — for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

How long do you have to wait to get Medicare Supplement?

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions.

Does Medigap cover prescriptions?

Since Medigap plans don’t include prescription drug benefits, if you’re enrolled in Original Medicare and want help with prescription drug costs, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you leave Medicare Advantage?

If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a " trial right. " . Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare Supplement Insurance cover Part B?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How to calculate out of pocket expenses?

The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: 1 Your prescription drug plan’s yearly deductible 2 The amount you pay for your prescription medications 3 The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.

Does Medicare have a deductible?

The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below). Initial coverage phase: After you’ve reached the deductible, you’ll enter the initial coverage phase, where you will pay ...

Do manufacturer discounts count towards catastrophic coverage?

Additionally, manufacturer discounts for brand-name drugs count towards reaching the spending limit that begins catastrophic coverage. If your plan requires you to get your prescription drugs from a participating pharmacy, make sure you do so, or else the costs may not apply towards getting out of the coverage gap.

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

Can you compare a Medigap policy?

As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used .

What is Medicare Select?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be less.

What is issue age rated?

Issue-age-rated (also called “entry age-rated”) How it’s priced. The premium is based on the age you are when you buy (when you're "issued") the Medigap policy. What this pricing may mean for you. Premiums are lower for people who buy at a younger age and won’t change as you get older.

Why do premiums go up?

They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

What is medical underwriting?

medical underwriting. The process that an insurance company uses to decide, based on your medical history, whether to take your application for insurance, whether to add a waiting period for pre-existing conditions (if your state law allows it), and how much to charge you for that insurance.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is the Medicare Supplement Plan G deductible for 2021?

With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

How much is Medicare Part B deductible for 2021?

With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible. However, the premiums for Plan G tend to be considerably less than that of Plan F.