How often can I change Medicare plans?

You’ll need the following information:

- Your Medicare number

- The policy and group numbers of your current plan

- The dates you want changes to take effect (if you’re in a special enrollment period)

What to know when selecting a Medicare plan?

• Know your network. The right plan will offer you support in navigating a complex health care system, saving you time and money. Seek out a plan that offers you a team of providers that will commit to getting to know your needs and delivering coordinated care. If you have favorite doctors or pharmacies, make sure they are within your network.

When is the deadline for changing Medicare plans?

You have until January 15, 2022 to change plans. Outside of Open Enrollment, you can change plans if you have a life event that qualifies you for a Special Enrollment Period.

How and when to change Medicare plans?

- New York and Connecticut have guaranteed issue rights at all times.

- Maine allows beneficiaries to switch to a plan with equal of fewer benefits at any time.

- In California and Oregon, you may switch Medigap plans during your birth month every year without medical underwriting.

Can you switch from medical to Medicare?

To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins. To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

Can I get Medicare at age 62?

What Are the Age Requirements for Medicare? Medicare is health insurance coverage for people age 65 and older. Most people will not qualify for Medicare at age 62. At age 62, you may meet the requirements for early retirement but have not met the requirements for Medicare coverage.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

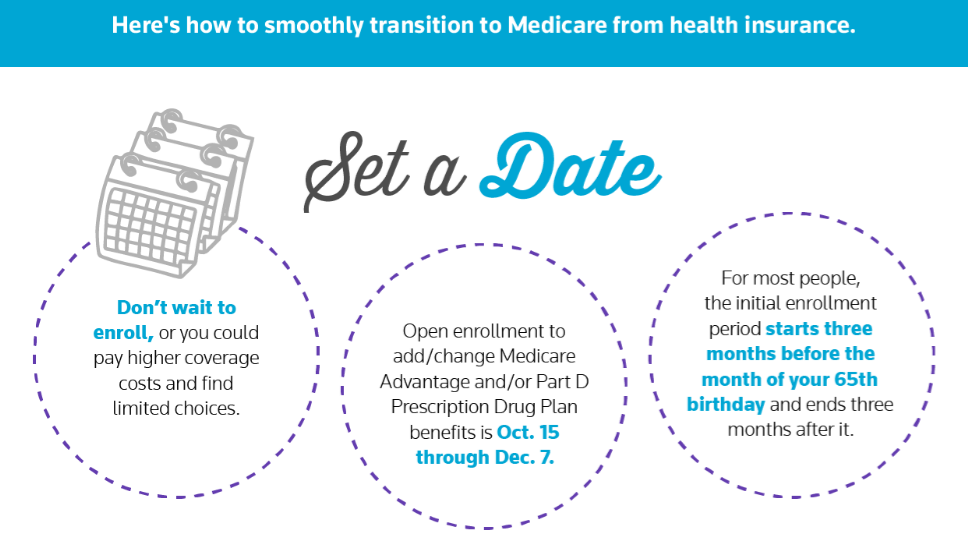

What happens if you enroll in Medicare after the initial enrollment period?

Also, if you enroll in Medicare after your Initial Enrollment Period, you may have to pay a late enrollment penalty. It’s important to coordinate the date your Marketplace coverage ends with the effective date of your Medicare enrollment, to make sure you don’t have a break in coverage.

Why is it important to sign up for Medicare?

It’s important to sign up for Medicare when you’re first eligible because once your Medicare Part A coverage starts, you’ll have to pay full price for a Marketplace plan. This means you’ll no longer be eligible to use any premium tax credit or help with costs you might have been getting with your Marketplace plan.

Is it too soon to switch to Medicare if you turn 65?

If you have a health plan through the Health Insurance Marketplace® and will soon have Medicare eligibility, it’s not too soon to start planning for your coverage to switch.

Can I cancel my Medicare Marketplace coverage for myself?

If you and your spouse (or other household members) are enrolled on the same Marketplace plan, but you’re the only one eligible for Medicare, you’ll cancel Marketplace coverage for just yourself. This way any others on the Marketplace application can keep Marketplace coverage. Find out how here.

When does Medicare open enrollment start?

You may also switch from Medicare Advantage to Original Medicare (and a Medicare Part D prescription drug plan, if you want one) during the Medicare Advantage Open Enrollment Period, which runs from January 1st to March 31st each year.

Can Medicare Advantage charge a higher premium?

Even if they choose to cover you, they can charge you a higher monthly premium than those who enrolled when they were first eligible. The exception to this rule is if you have a guaranteed issue right. Examples of guaranteed issue rights include: You move outside of your Medicare Advantage plan's service area.

When will Medicare open enrollment end?

A: For 2021 coverage, open enrollment (also known as the annual election period) for Medicare Advantage and Medicare Part D ended on December 7, 2020.

How many months do you have to sign up for Medicare?

If you sign up for Medicare during the general enrollment period, you have three additional months (April – June) during which you can select a Part D plan or a Medicare Advantage plan.

How many Medicare Advantage plans will be available in 2021?

For 2021, there are a total of 28 plans that have a five-star rating. Most are Medicare Advantage plans, but the list includes two stand-alone Part D plans and two Medicare cost plans.

When is the special enrollment period for Medicare?

The federal government allows a special enrollment period, after the end of the general enrollment period, for people who live in (or rely on enrollment help from someone who lives in) an area that’s experienced a FEMA-declared major disaster or emergency. For 2021 coverage, there are several states and several partial states where this special enrollment period is available. Eligible enrollees who make a Medicare Advantage or Part D plan selection during this special enrollment period will have coverage effective January 1, 2021.

When will Medicare Advantage coverage start in 2021?

Eligible enrollees who make a Medicare Advantage or Part D plan selection during this special enrollment period will have coverage effective January 1, 2021.

When is Medicare Part B coverage guaranteed?

If you’re within the six-month open enrollment window that begins as soon as you’re at least 65 and enrolled in Medicare Part B, the coverage is guaranteed issue. That is also the case if you’re in a special enrollment period triggered by a qualifying event.

Does Medicare Advantage last longer than the disenrollment period?

As of 2019, this window replaced the Medicare Advantage Disenrollment Period that was available in prior years. It lasts twice as long and provides more flexibility than the disenrollment period did, as it also allows Medicare Advantage enrollees the option to switch to a different Medicare Advantage plan.

When can I switch to Medicare Advantage?

In that case, you can switch to that plan between December 8 and November 30 — which includes allows you to switch into that plan any time not covered by Open Enrollment. Not all areas have a five-star plan available , and you’re only allowed to make this switch one time over the course of the period.

When is Medicare open enrollment?

From October 15 – December 7 is Medicare Open Enrollment. That means you can join Original Medicare or drop it during that time. You can also elect to switch between Original Medicare and Medicare Advantage plans during this period, and select or change your Medicare Part D prescription drug coverage. When evaluating Medicare plans, it’s important to note that many Medicare Advantage plans include Part D coverage — those plans are generally referred to as MAPD Plans.

What is a special enrollment period?

People that live in an area that has experienced an officially declared major weather disaster or emergency may be able to qualify for a special enrollment period. These may include hurricanes, wildfires, tropical storms and other disasters, and special enrollment periods may be restricted to affected counties.

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

What happens if you buy a Medigap policy before 2010?

If you bought your policy before 2010, it may offer coverage that isn't available in a newer policy. If you bought your policy before 1992, your policy: Might not be a Guaranteed renewable policy. May have a bigger Premium increase than newer, standardized Medigap policies currently being sold. expand.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

Can you exclude pre-existing conditions from a new insurance policy?

The new insurance company can't exclude your Pre-existing condition. If you've had your Medigap policy less than 6 months: The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...