The Medicare enrollment period is:

- You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65.

- If you continue to work past age 65, sign up for Medicare within eight months of leaving the job or group health plan to avoid penalties.

- The six-month Medicare Supplement Insurance enrollment period begins when you are 65 or older and enrolled in Medicare Part B.

Full Answer

When can you enroll in Medicare supplement?

Medicare Supplement Insurance (Medigap) has a six-month open enrollment period (OEP). Your open enrollment period begins when you are both: 65 years old and. Enrolled in Medicare Part B. Unlike the Medicare OEP that happens once every year, you have only one Medigap OEP. If you get Medicare Part B before you turn 65, your Medigap OEP starts the ...

When can you start applying for Medicare?

You’re first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig’s disease). Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace. Step 1

When is the best time to apply for Medicare?

To help you learn all about Medicare health plans enrollment and the best time to enroll, we have put together all the information you need. To answer your question simply, the best time for people to sign up for Medicare is the age of 65, and it is even better if you apply a few months before 65 to avail Medicare as soon as you turn 65.

What is the best medical supplement for Medicare?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

Can I add a Medicare Supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

Can a Medicare Supplement plan be purchased at any time of the year?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

What is deadline for Medicare Supplement?

You can certainly apply for a new Medigap plan during the annual Medicare open enrollment period (October 15 to December 7), but that's no different from any other time of the year.

How long does it take for Medicare Supplement to go into effect?

Your Medicare Supplement Open Enrollment Period starts the first day of the month your Medicare Part B is in effect. For many beneficiaries, this is the first day of the month they turn 65.

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

Can Medigap insurance be denied for pre-existing conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Which is true about Medicare supplement open enrollment?

Which is true about Medicare Supplement Open Enrollment? By federal law, Medicare Supplement Open Enrollment is the first 6 months a consumer is 65 or older and enrolled in Medicare Part B.

What is the birthday rule in Medicare?

The birthday rule is the nickname for a law that allows those who are already on a Medigap plan to switch to another plan without medical underwriting. In CA, they have created an annual window of 60 days after your birthday to switch plans – hence the name “birthday rule.”

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the maximum out-of-pocket for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What is Medicare Supplement Insurance?

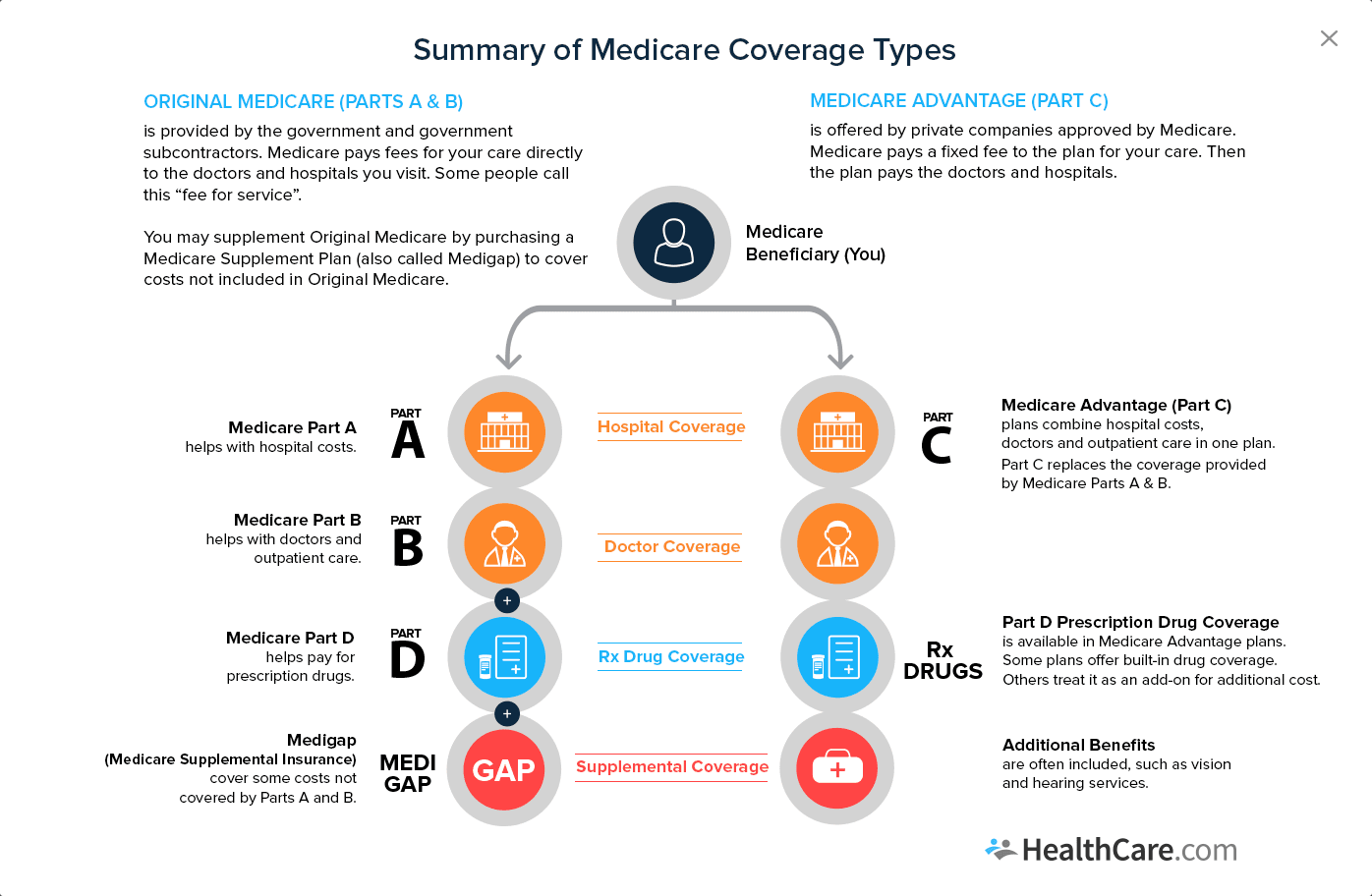

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

What happens if a Medigap policy goes bankrupt?

Your Medigap insurance company goes bankrupt and you lose your coverage , or your Medigap policy coverage otherwise ends through no fault of your own. You leave a Medicare Advantage plan or drop a Medigap policy because the company hasn’t followed the rules, or it misled you.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

What Are Medicare Supplement Plans?

Since 2014, nearly 4 million people have purchased a Medicare Supplement Plan. But what are they, and why are they becoming more popular for people on Medicare?

Who Is Eligible to Enroll in a Medicare Supplement Plan?

Anyone who is eligible for Original Medicare coverage can buy Medicare Supplement Insurance.

When to Apply for Your Medicare Supplement Plan

Purchasing a Medicare Supplement Plan can be a stressful process, but signing up at the right time will ensure:

Medicare Supplement Open Enrollment Period

Your Medicare Supplement Plan Open Enrollment Period (also known as your Medigap Open Enrollment Period) is a one-time six month period when you can sign up for a Medicare Supplement Plan without having to worry about your health status or chronic conditions.

Special Enrollment Periods and Medicare Supplement Plans

Usually, a person will only get one opportunity to benefit from their Medigap Open Enrollment Period.

Applying at Any Time for a Medicare Supplement Plan

You can also purchase Medicare Supplement Insurance outside of your Medicare Supplement Open Enrollment Period, but remember that insurance companies don’t have to accept you as a member.

Choosing the Right Medicare Supplement Plan Can Make All the Difference

It’s also important to consider the type of cover you get when you sign up for a Medicare Supplement Plan.

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

How to know if you have a Medicare Supplement?

To determine whether or not you have a Medicare Supplement plan, check out your insurance card. You’ll likely see the word “Supplement,” also with a “Plan A”, “Plan G”, or another combination of “Plan” and a letter. Wisconsin, Minnesota, and Massachusetts have their own standardization method.

When does Medicare Part B open enrollment start?

Example B: You’re already 65, you sign-up for Medicare Part B and it begins June 1. This means that your Medigap Open Enrollment Period is from June 1 to November 30. If you get Medicare Part B before you turn 65, then your Open Enrollment Period starts the first day of the month you turn 65.

What happens if you miss your chance to enroll in Medicare at age 65?

If you miss your chance to enroll at age 65, then you don’t have to worry about open enrollment just yet. For example – if you’re 66 years old but have never enrolled in Medicare Part B because you are currently covered by an employer health plan – then your Medigap Open Enrollment Period has not yet occurred.

How long does the Medigap open enrollment period last?

covered under Medicare Part B. Your Medigap Open Enrollment Period then lasts for a total of six months.

What happens if you miss the open enrollment deadline?

If you miss your 6-month open enrollment deadline, many insurers will still offer you coverage. However, insurers will be free to deny your application or charge higher monthly payments. In all cases, Medicare Supplement plans are renewable for life once you’ve enrolled in the plan.

What happens if you miss your Medigap enrollment?

If you miss your Medigap Open Enrollment Period, you may be subject to medical underwriting. This means that your application could be denied by the insurance company offering the plan. Your application could also be accepted at a higher price than you were hoping to spend.

How long does Medicare cover a condition?

While your Medicare Supplement plan can’t pick and choose which health issues to cover, your plan can delay coverage for conditions that were diagnosed or treated during the six months before you enroll and for up to six months after you enroll.

When does Medicare Part A start?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday month. Once your Medicare Part A coverage starts, you won’t be eligible for a premium tax credit or other savings for a Marketplace plan. If you kept your Marketplace plan, you’d have to pay full price.

When is open enrollment for Medicare?

During the Medicare Open Enrollment Period (October 15–December 7) , you can review your current Medicare health and prescription drug coverage to see if it still meets your needs. Take a look at any cost, coverage, and benefit changes that'll take effect next year.

What is Medicare health plan?

Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan. Medicare health plans include all Medicare Advantage Plans, Medicare Cost Plans, and Demonstration/Pilot Programs.

What is the health insurance marketplace?

The Health Insurance Marketplace is designed for people who don’t have health coverage. If you have health coverage through Medicare, the Marketplace doesn't affect your Medicare choices or benefits. This means that no matter how you get Medicare, whether through.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare qualify for federal tax?

Important tax information for plan years through 2018. Medicare counts as qualifying health coverage and meets the law (called the individual Shared Responsibility Payment) that required people to have health coverage if they can afford it. If you had Medicare for all of 2018 (or for earlier plan years), check the box on your federal income tax ...

Is it against the law to sell Medicare?

It’s against the law for someone who knows that you have Medicare to sell you a Marketplace plan. During Medicare Open Enrollment, there’s a higher risk for fraudulent activities. Learn how to prevent, spot, and report fraud.