Find affordable Medicare Supplement plans Buying Medigap before turning 65 and why it’s a good idea. Many states allow you to apply for Medigap insurance 6 months before your Part B effective date. For most people entering Medicare at age 65, the Part B effective date is usually the first day of your birthday month.

Full Answer

Can I get Medigap supplemental insurance if I’m under 65?

Oct 20, 2018 · How to apply for Medicare Part A and Part B before age 65 Some people are automatically enrolled in Original Medicare . If you’ve been receiving disability benefits from Social Security or the Railroad Retirement Board (RRB) for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

When is the best time to enroll in a Medicare supplement plan?

Nov 28, 2021 · In most states, Medicaid is available to adults under age 65 if their income doesn’t exceed 138% of the poverty level. For a single person in 2021, that amounts to $17,774 in annual income; for a couple, it’s $24,040.

Can I get Medicare if I am under 65 years old?

Apr 26, 2021 · If you get Medicare Part B before you turn 65, your OEP automatically begins the month you turn 65. Some states have Medigap open enrollment periods for people under 65. If that’s the case, you’ll still get a Medigap OEP when you turn 65, and you'll be able to buy any policy sold in your state.

When do you qualify for Medicare?

Sep 16, 2018 · The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

Can Medicare supplement be purchased anytime of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.Jan 26, 2021

Can I enroll in Medicare 6 months before my 65th birthday?

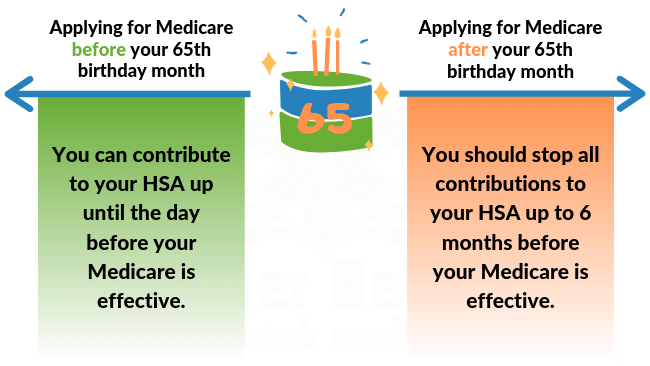

Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security (or the Railroad Retirement Board). Coverage can't start earlier than the month you turned 65.

Can I add Medigap at any time?

You can certainly apply for a new Medigap plan during the annual Medicare open enrollment period (October 15 to December 7), but that's no different from any other time of the year.

Can I buy Medicare at age 62?

Generally speaking, no. You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Does Medicare start on the first day of your birth month?

Your Medicare coverage generally starts on the first day of your birthday month. If your birthday falls on the first day of the month, your Medicare coverage starts the first day of the previous month. If you qualify for Medicare because of a disability or illness, in most cases your IEP is also seven months.

When can I change my Medicare Supplement plan for 2022?

Yes, at any time you can switch from a Medicare Advantage to a Medicare Supplement plan. You have 12 months from when you first enrolled in an Advantage plan to switch back to Original Medicare and pick up a Medigap plan with Guaranteed Issue.

What's the difference between Medigap and Medicare Advantage plans?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the earliest age you can get Medicare?

age 65Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down.

Can I draw Social Security at 62 and still work full time?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

How much is your Social Security reduced if you take it early?

In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

Medicare Eligibility Before Age 65

If you’re under 65 years old, you might be eligible for Medicare: 1. If you receive disability benefits from Social Security or certain disability...

How to Apply For Medicare Part A and Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If you’ve been receiving disability benefits from Social Security or the Railroad Reti...

Medicare Eligibility For Medicare Advantage (Part C) Before 65

After you’re enrolled in Original Medicare, you may choose to remain with Original Medicare (Medicare Part A and Part B) or consider enrollment in...

When Am I Eligible For Medicare Supplement Coverage?

Because Medicare Supplement policies complement your Original Medicare coverage, you must be enrolled in Part A and Part B to be eligible for this...

How Can Enrollment Periods Affect My Eligibility For Medicare Supplement Plans?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this per...

Am I Eligible For A Medicare Supplement Plan If I’M Under Age 65?

Federal law does not require insurance companies to sell Medicare Supplement policies to people under 65, but many states do have this requirement....

Am I Eligible For A Medicare Supplement Plan If I Have A Medicare Advantage Plan?

Medicare Supplement policies don’t work with Medicare Advantage plans. If you decide to switch from Original Medicare to a Medicare Advantage plan,...

Am I Eligible For A Medicare Supplement Plan If I Have Coverage Through Medicaid?

While some beneficiaries may be eligible for both Medicare and Medicaid benefits (also known as “dual eligibles”), Medicaid typically doesn’t work...

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. .

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

How old do you have to be to get Medicare?

Roughly half of Americans—and most Americans under the age of 65— get their health insurance from an employer. 1 At age 65, nearly all Americans become eligible for Medicare . It’s common for people to make the transition from employer-sponsored health coverage directly to Medicare. Depending on the circumstances, ...

What happens if you retire before 65?

Summary. If you retire before age 65, you have several options for health insurance until you reach eligibility for Medicare. Which options you are eligible for and are best for you depend on your individual circumstances. You may enroll in the state health insurance marketplace, continue your employment-related benefits through COBRA ...

What is the health insurance marketplace?

As a result of the Affordable Care Act, every state has a health insurance marketplace/exchange where private individual/family health plans can be purchased. These plans are all guaranteed-issue. This means you can enroll regardless of medical history.

What is the Affordable Care Act?

The Affordable Care Act provides income-based premium tax credits (premium subsidies). These offset a large chunk of the premiums for most people who enroll in health plans through the marketplace. For 2021 and 2022, the American Rescue Plan has made those subsidies larger and more widely available.

Who is Louise Norris?

Louise Norris has been a licensed health insurance agent since 2003 after graduating magna cum laude from Colorado State with a BS in psychology. Nick Blackmer is a fact checker and researcher with extensive background in health content. If you want to retire before age 65 or find yourself forced to retire due to health issues, downsizing, ...

Can You Get Medicare Supplement Insurance If You Are Under 65?

Federal law doesn’t require insurance companies to sell Medicare Supplement Insurance for disabled people under age 65, but some state laws do. If you’re enrolled in Medicare under 65 due to a disability and/or end-stage renal disease (or ESRD), your eligibility for Medicare Supplement Insurance will depend on the state you live in.

Buying Medicare Supplement Insurance Under 65

The regulations regarding Medigap health insurance for disabled people under 65 vary based on your insurance provider and where you live. If you find a company that lets you apply for a Medigap policy under age 65, there are a few things you should be prepared for.

Waiting for Your Open Enrollment Period

Generally, your Medigap open enrollment period begins when you turn 65 and are enrolled in Medicare Part B. During your open enrollment period, you have a wider variety of Medigap plan options to choose from, and companies can’t charge you a higher premium based on your medical history or current health status.

How long do you have to wait to get Medicare Supplement?

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions.

How long does Medicare Supplement open enrollment last?

How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

Does Medigap cover prescriptions?

Since Medigap plans don’t include prescription drug benefits, if you’re enrolled in Original Medicare and want help with prescription drug costs, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan.

Does Medicare Supplement cover out-of-pocket expenses?

Medicare Supplement plans aren’t meant to provide stand-alone health coverage; these plans just help with certain out-of-pocket costs that Original Medicare doesn’t cover. If you’re under 65 and have Medicare because of disability, end-stage renal disease, or amyotrophic lateral sclerosis, your eligibility for Medicare Supplement coverage may ...

Why buy Medigap Before age 65?

Insurance companies can raise premiums at any time. The quotes you receive today may not be the same in two months. Insurance companies can change premiums throughout the year. It’s not industry standard for all Medigap Plans to get a rate increase on January 1.

Choose your Medigap Plan and have peace of mind

You can apply for Medigap before your Medigap Open Enrollment Period starts.

Does buying Medigap early mean you have the best plan?

Let’ say you decide to buy Medigap Plan G while in your Medigap Enrollment Period. A couple weeks later your friend tells you he bought Plan G for $10 less a month.

Learn more about Medicare and move to the next step

Once you have a Medigap Plan in place, you can focus on your Medicare drug plan. This is an important part of completing your Medicare coverage. If you don’t secure a Part D plan, you could be subject to a late enrollment penalty.

What if I wait until the last minute to buy Medigap?

Our recommendation, if you’re turning 65, is to buy Medigap early. But, we know that life happens and sometimes a purchase has to be made at the last minute. We’ve helped people put plans in place the day before their Part B effective date. It can be done. But it’s always nice, if possible, to avoid putting yourself through the stress.

State-by-State Guide to Face Mask Requirements 122 Comments

Following federal guidance, many states dropping mask orders for fully vaccinated people

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

When shopping for health insurance, what is the most important thing to consider?

When shopping for health insurance it’s important to consider your current healthcare needs and any needs you anticipate in the future. It’s also important to consider your budget and what you can afford.

What is short term health insurance?

Another option that you have is to buy short term health insurance. Short term health insurance is an option that you have in most states. It is a cheaper alternative to buying your own individual or family health insurance policy that may help bridge the gap between retiring and enrolling in Medicare.

How long does Cobra last?

COBRA lasts for 18 months after the employee has left the company and it can be extended in some cases. If retiring 18 months before becoming eligible for Medicare, this could be a great option for health insurance for an early retiree. COBRA allows you to keep your current insurance.

Is part time a full time job?

Part-time jobs are typically less demanding than full-time jobs and require less commitment. This could be a great opportunity to delve into a field that you want to know more about, do something you’ve always loved, or turn a hobby into an income stream while getting health insurance coverage before Medicare!

How many employees are required to comply with Cobra?

It’s important to note that only companies with at least 20+ employees must comply with COBRA and that it may be expensive.

What is the cobra law?

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, is a law that allows employees – or an employee’s dependents – to keep their group coverage through their former employer’s health insurance plan.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.