Full Answer

Who is eligible for a Medicare supplement insurance plan?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

When can you sign up for Medicare supplement insurance?

You can apply for a Medicare Supplement plan anytime, as long as you have Medicare Part A and Part B. But if it’s after your OEP, the insurance company can look at your medical history and ask you questions about your health conditions. The company can charge you more, or even reject you, if you have a health problem.

Is there open enrollment for Medicare supplements?

Medicare open enrollment lasts from October 15 to December 7 each year ... Medicare Part D and Medicare Supplement insurance, so it’s your job to educate and help them determine which coverage combination best addresses their needs.

When is open enrollment for Medicare?

This is separate from the regular Medicare Open Enrollment Period that runs each year from October through December. Specifically, this open enrollment period is just for people who are enrolled in a Medicare Advantage plan. This open enrollment period is not intended for enrolling in Medicare Part A or Medicare Part B for the first time.

Can a Medicare Supplement plan be purchased at any time of the year?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

When can a consumer enroll in a Medicare Supplement plan?

Sign up for a Medicare Advantage Plan (with or without drug coverage) or a Medicare drug plan. During the 7‑month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

What is deadline for Medicare Supplement?

You can certainly apply for a new Medigap plan during the annual Medicare open enrollment period (October 15 to December 7), but that's no different from any other time of the year.

Can Medicare supplements be sold year round?

If you'd prefer to avoid CMS red tape, then Medicare Supplements are the products to sell. Plus, there's no annual enrollment so you can sell them year-round!

When can you switch from Medicare Advantage to a Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Can you switch Medicare Supplement plans anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is true about Medicare Supplement open enrollment?

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

What is the birthday rule in Medicare?

California: The birthday rule in California applies to all residents who already have a Medigap policy. Most importantly, the rule starts 30 days before their birthday and ends 60 days following. During this time, policyholders can change to any plan of equal or lesser benefit with the carrier of their choice.

Do Medicare Supplement plans cover pre-existing conditions?

The pre-existing condition waiting period “ This means that you may have to pay all your own out-of-pocket costs for your pre-existing condition for up to six months. After the waiting period, the Medicare Supplement insurance plan may cover Medicare out-of-pocket costs relating to the pre-existing condition.

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you shorten the waiting period for a pre-existing condition?

It's possible to avoid or shorten waiting periods for a. pre-existing condition. A health problem you had before the date that new health coverage starts. if you buy a Medigap policy during your Medigap open enrollment period to replace ".

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What age do you have to be to get Medicare Supplement?

Disabled Under 65 . In 27 states, Medicare Supplement Insurance companies are required to sell policies to people under age 65 who receive Medicare benefits because of a qualifying disability or medical condition.

Do you have to have Medicare to be under 65?

State laws vary, but some states only require insurance companies to offer certain plans to people under 65. For example, Texas only requires companies to offer Medigap Plan A, which is the least comprehensive plan available. If you live in a different state, you may be denied altogether. Only the 27 states above are required to offer any Medicare ...

Do you pay more for Medigap than over 65?

You will probably pay more for your plan than people over 65. Some states require insurance companies to sell you a Medigap policy for the same price as people over 65, but most states allow companies to charge you more if you are under 65 and disabled. You may have to settle on a less comprehensive plan. State laws vary, but some states only ...

When does Medicare Part A start?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday month. Once your Medicare Part A coverage starts, you won’t be eligible for a premium tax credit or other savings for a Marketplace plan. If you kept your Marketplace plan, you’d have to pay full price.

When is open enrollment for Medicare?

During the Medicare Open Enrollment Period (October 15–December 7) , you can review your current Medicare health and prescription drug coverage to see if it still meets your needs. Take a look at any cost, coverage, and benefit changes that'll take effect next year.

What is Medicare health plan?

Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan. Medicare health plans include all Medicare Advantage Plans, Medicare Cost Plans, and Demonstration/Pilot Programs.

What is the health insurance marketplace?

The Health Insurance Marketplace is designed for people who don’t have health coverage. If you have health coverage through Medicare, the Marketplace doesn't affect your Medicare choices or benefits. This means that no matter how you get Medicare, whether through.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare qualify for federal tax?

Important tax information for plan years through 2018. Medicare counts as qualifying health coverage and meets the law (called the individual Shared Responsibility Payment) that required people to have health coverage if they can afford it. If you had Medicare for all of 2018 (or for earlier plan years), check the box on your federal income tax ...

Is it against the law to sell Medicare?

It’s against the law for someone who knows that you have Medicare to sell you a Marketplace plan. During Medicare Open Enrollment, there’s a higher risk for fraudulent activities. Learn how to prevent, spot, and report fraud.

Step 1 – Decide which benefits you want, then decide which of the Medigap plans A–N meet your needs

Decide which benefits [glossary] you need and want while considering your current and future health care needs. You might not be able to switch policies later.

Step 4 – Buy the Medigap policy

Once you decide on the insurance company and the Medigap policy you want, you should apply. The insurance company must give you a clearly worded summary of your Medigap policy. Make sure you read it carefully. If you don't understand it, ask questions.

You may not be guaranteed Medigap coverage

Lora Shinn has been writing about personal finance for more than 12 years. Her articles have also been published by CNN Money, U.S. News & World Report, and Bankrate, among others.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance or Medigap is sold by private insurance companies. You must be enrolled in both Parts A and B to be eligible for a policy. It’s not an option if you have a Medicare Advantage plan, and coverage is for one person only (spouses need to purchase Medigap separately).

Can You Be Denied Medigap Coverage?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

Denial of Medigap Policy Renewal

In most cases your renewal is considered guaranteed and cannot be dropped, however there are certain circumstances when the insurance company can decide not to renew your Medigap policy:

How Do You Get Medigap Coverage?

The best time to get Medigap coverage is during your once-per-lifetime Medigap open enrollment period. This period lasts for six months, beginning the first month you are enrolled in Medicare Part B and are at least 65. 10

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

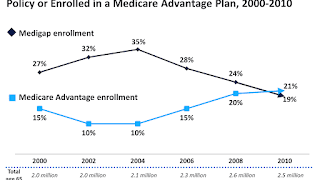

Medigap and Medicare Advantage

If you have a Medicare Advantage (MA) plan, it’s illegal for an insurance company to sell you a Medigap policy. But if you switch to MA after you’ve purchased a Medigap policy, you’ll probably want to drop your policy since you can’t use it to supplement your MA plan.