When can I Change my Medicare supplement insurance?

You may be able to buy or change your Medicare Supplement Plan outside of your six-month Medigap Open Enrollment Period, if you have a “guaranteed issue right” – meaning an insurance company can’t refuse to sell you a Medigap policy – in the following situations:

Can My Medicare supplement insurer cancel my policy?

You can cancel your Medicare Supplement insurance plan anytime by calling your insurance company. Keep in mind that when you cancel your plan, you may not be able to get it back and you may not be able to get another Medicare Supplement plan without being subjected to medical underwriting.

Can you change your Medicare supplement insurance anytime?

You can change your Medicare Supplement Insurance (Medigap) plan anytime, but there are a few things you should know before you do so. You can enroll in a Medigap plan during your Medigap Open Enrollment Period. If you apply for or change Medigap plans outside of your Medigap OEP, you may have to go through medical underwriting unless you qualify for a Medicare guaranteed issue right, depending on what state you live in.

Will my Medicaid cancel if I get insurance?

Medicaid is a low-cost health care insurance sponsored by the federal government and administered by the states. As long as you meet the requirements for Medicaid, the government will not cancel your coverage, even if you have private insurance.

Can I cancel my Medicare Supplement at any time?

You can cancel your Medicare Supplement insurance plan anytime by calling your insurance company. Keep in mind that when you cancel your plan, you may not be able to get it back and you may not be able to get another Medicare Supplement plan without being subjected to medical underwriting.

When can an insurer cancel a Medicare Supplement plan?

If you're losing Medigap coverage This means your insurance company can't drop you unless one of these happens: You stop paying your premiums. You weren't truthful on the Medigap policy application. The insurance company becomes bankrupt or insolvent.

Can you change your Medicare Supplement anytime of the year?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Which of the following circumstances would cause a Medicare Supplement policy to be Cancelled?

Which of the following circumstances would cause a Medicare Supplement policy to be cancelled? The insured fails to pay the premium. Failing to pay the premium would cause a Medicare Supplement policy to be cancelled.

Can you suspend a Medigap policy?

If you have Medicare and you're under 65, you can suspend your Medicare Supplement policy at any time while you have employer group health insurance. In order to suspend your Medigap policy, you must call your Medigap insurance company and let them know that you want to suspend your benefits and premiums.

Can you change Medicare Supplement plans with pre-existing conditions?

You can change your Medicare Supplement plan at any time. However, if you're outside of your Medigap Open Enrollment Period or don't have guaranteed issue rights at the time, you'll have to answer underwriting questions and could face denial or increased monthly premiums due to pre-existing conditions.

How often can you change your Medicare supplement?

Is there a time limit or deadline for changing Medicare supplement plans? No there is not. Once your six-month open enrollment period has expired, you can change anytime. However, there's generally no reason to change unless you've had a rate increase and are shopping for a lower rate.

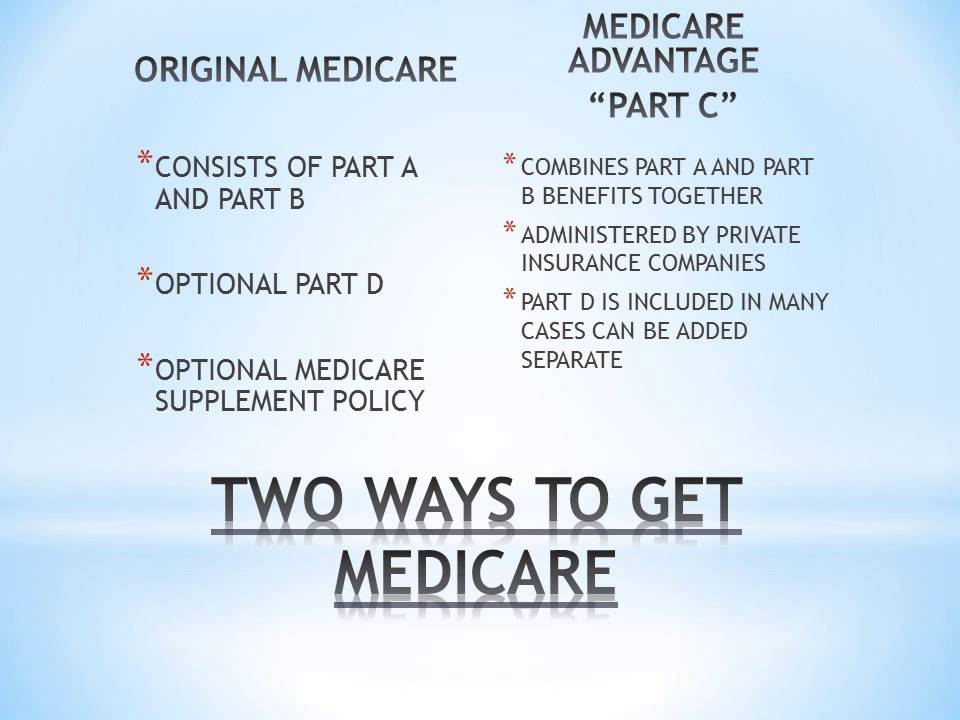

Can you switch from Medicare supplement to advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Can I switch from one Medigap plan to another?

. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have to pay more for your new Medigap policy.

How do I cancel my Unitedhealthcare Medicare Supplement?

Call member services at (800) 926-7602. Always request a confirmation number and put it somewhere safe! You cannot cancel by email. Hold times may sometimes be long, but you can only request cancellation via phone at the customer service number above.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Can I change supplement companies?

You can change your Medicare Supplement company at any time to get a lower premium. Many carriers offer a “rate lock” for the first year of coverage, making this another advantage of switching Medicare Supplement companies. During this rate lock period, you don't need to worry about increases to your premium.

What happens if you cancel your insurance?

When you terminate your policy, in most cases it continues through the month that you have already paid. Some insurance companies offer a refund of unused funds if applicable.

Does Medigap cover coinsurance?

Medigap plans cover some of your out of pocket expenses like copayments, coinsurances, and some deductibles not included in Original Medicare benefits. There are currently several types of Medigap policies available to purchase in most states.

Does cancelling Medigap affect Medicare?

Also, canceling your Medigap policy does not affect your Original Medicare benefits in any way. Canceling, or disenrolling in a Medicare Supplement plan may be easy, but it may not be quite as easy to enroll in a new plan, or to re-enroll in the same plan at a later date.

How to cancel Medicare Part A?

But if you do pay a premium for Part A and wish to cancel it, you may do so by visiting your local Social Security office or by calling 1-800-772-1213 (TTY 1-800-325-0778).

When does Medicare Part C end?

If you wish to cancel your Medicare Part C (Medicare Advantage) plan, here is one option for cancelling your coverage: The Fall Annual Enrollment Period (AEP, sometimes called the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage) lasts from October 15 to December 7 each year.

When is Medicare open enrollment?

Starting in 2019, you can take advantage of the Medicare Advantage Open Enrollment Period, which runs each year from January 1 through March 31. During this time, you can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage. You can also disenroll from your Medicare Advantage plan ...

Your style is your choice. Shouldn't your doctor and your coverage be, too?

The purpose of this communication is the solicitation of insurance. United American Insurance Company is not connected with, endorsed by, or sponsored by the U.S. government, federal Medicare program, Social Security Administration, or the Department of Health and Human Services.

Coverage of your choice with doctors of your choice are included with plans that don't restrict you to networks of specialists

The purpose of this communication is the solicitation of insurance. United American Insurance Company is not connected with, endorsed by, or sponsored by the U.S. government, federal Medicare program, Social Security Administration, or the Department of Health and Human Services.

Why did my medicare plan cancel?

Medigap plan cancellation can happen for a number of reasons, such as: 1. You stopped paying the monthly premium. You were dishonest on the Medicare Supplement insurance application. Your insurance company went bankrupt or became insolvent.

Why would my insurance company drop my Medigap policy?

The second instance when an insurance company can drop your Medigap policy is if you provide inaccurate information on your application. Sometimes, in an attempt to get a lower premium, Medicare beneficiaries lie on their applications.

What happens if your insurance goes bankrupt?

If your insurer goes bankrupt or becomes insolvent, you have a guaranteed issue right that will allow you to enroll in another company’s Medigap policy without medical underwriting. You will not have that same protection if you stop paying your premium or provide inaccurate information to your insurer.

What happens if you don't make your insurance payments?

Regardless of your payment schedule, if you do not make your payments, your insurance company can legally cancel your policy. It is up to the insurance company to determine how many premium payments you can miss before it terminates your coverage.

Can insurance companies cancel Medicare Supplement plans?

Insurance companies are businesses like any other and can become unprofitable. If this occurs, an insurance company might cancel all of its Medicare Supplement plans. Thankfully, if this happens to you, you are protected by a guaranteed issue right.

Medicare Supplements

United American has been a prominent Medicare Supplement insurance provider since Medicare began in 1966. Additionally, we’ve been a long-standing participant in the task forces working on Medicare Supplement insurance policy recommendations for the National Association of Insurance Commissioners.

Insurance Products

When you become a United American policyholder, you gain freedom of choice. Our products allow you to keep your choice of trusted doctors and hospitals.

Group Insurance

United American Insurance Company has been a market leader in providing insurance to employer and union group sponsors for 25 years.

Resources

One of the many things United American is well-known for is our superior customer service. When it comes to your health, we believe education, service, and support are vital. With our experience and stability, we’re the Company that does what it says it will do.

File A Claim

Because of our 50+ years of experience in providing life, supplemental health and Medicare Supplement insurance, United American offers superior customer service to both our agents and customers. Never stress about your claim status with our online claim tracker. Need more help? Let one of our licensed agents assist you.

Contact

At United American, we only provide knowledgeable and licensed agents to service you. Say goodbye to wasted hours spent on hold and bid good riddance to talking to artificial intelligence. Hear a live voice or get one-on-one time with one of our licensed agents today.

What happens if you don't change your Medicare Supplement?

If you don't change Medicare Supplement insurance plans during your Medigap Open Enrollment Period, your insurer can force you to undergo medical underwriting, and they can now assess your health history during the application process and can turn you down if it chooses.

How long do you have to keep Medicare Supplement?

The Medicare Supplement “Free Look” Period. When you switch Medicare Supplement Insurance plans, you generally are allowed 30 days to decide to keep it or not. This 30-day “free look” period starts when your new Medicare Supplement plan takes effect.

What is a Medicare Supplement Plan?

Medigap plans are designed to fill those gaps by supplementing your Original Medicare coverage to pay for certain out-of-pocket costs. A Medicare Supplement plan may pay your coinsurance or copayments from Medicare Part A and Part B.

What to do if you are unhappy with your Medicare Supplement?

If you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter. Call to speak with a licensed insurance agent who can help you compare Medicare Supplement plans in your area. They can help you change plans once you find the best plan for your needs.

How long does it take to enroll in Medigap?

If you do consider enrolling in a Medigap plan Medigap plans, you should try to apply for a plan during your 6-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period is a 6-month period that starts the day you are both 65 years old and enrolled in Medicare Part B.

How long do you have to wait to switch Medigap?

Your insurance company may agree to sell you a new policy with the same basic benefits, but you may have to wait up to six months before the new plan covers any pre-existing health conditions . If any of the above situations apply to you, you can switch Medigap plans without medical underwriting.

Do you have to change your Medicare plan during the open enrollment period?

If you don't change Medicare Supplement insurance plans during your Medigap Open Enrollment Period, ...