How often can I change Medicare plans?

When you switch from one Medicare Supplement insurance plan to another, you typically get 30 days to decide if you want to keep it. This 30-day free look period starts when you get your new Medicare Supplement insurance plan. You’ll need to pay the premiums for both your new plan and your old plan for one month.

What is the deadline for switching Medicare plans?

Feb 02, 2022 · When you switch Medicare Supplement Insurance plans, you generally are allowed 30 days to decide to keep it or not. This 30-day “free look” period starts when your new Medicare Supplement plan takes effect. To qualify, you need to pay the premiums for both your new plan and your old plan for one month.

How often do Medicare supplemental insurance plans change?

Jan 12, 2020 · You can sign up for a Medicare Supplement plan when you are both 65 years of age and enrolled in Medicare Part B. You cannot be rejected for a Medicare supplement plan if you are enrolled in Original Medicare Parts A and B and if you are purchasing the plan during your six months open enrollment period which begins the month that you turn 65 years old, or you …

When can I Cancel my Medicare supplement insurance plan?

Dec 31, 2021 · Medicare Advantage and Medicare Part D have annual election open-enrollment each year between Oct. 15 and Dec. 7th, where you can seamlessly switch from one plan to another. Medicare Supplement plans, on the other hand, do not have an annual switching period. You may have heard that switching Medigap is difficult.

When can you change Medicare Supplement Plans?

You can change your Medicare Supplement Plan at any time. However, if you have health issues that could cause a rate increase of denial of coverage...

What is the Medicare free look period?

Most companies will allow you a free-look period for thirty days when you can examine and use your plan. If you find your plan unsatisfactory, you...

Can Medicare Supplement Insurance plan be Cancelled?

Generally, no. Your insurance company cannot cancel your Medicare Supplement insurance plans unless you don't make your premium payments or the ins...

Can I change my Medicare Part D plan anytime?

You can change from your current Part D plan to a different one during the Medicare open enrollment period, which runs from October 15 to December...

What happens if you don't change your Medicare Supplement?

If you don't change Medicare Supplement insurance plans during your Medigap Open Enrollment Period, your insurer can force you to undergo medical underwriting, and they can now assess your health history during the application process and can turn you down if it chooses.

When do insurance companies send out notices of changes to Medicare?

Every September, insurance companies must send out a Medicare Annual Notice of Change (ANOC) letter to Medicare beneficiaries. This letter tells you of any changes to your rates. If your rates go up, you may want to consider looking for a new policy.

How to avoid medical underwriting?

The main way to avoid medical underwriting is if you have a Medicare Supplement insurance guaranteed-issue right. Some guaranteed-issue rights occur when: Your Medigap insurance company went bankrupt or ended your policy through no fault of your own.

What is a Medicare Supplement Plan?

Medigap plans are designed to fill those gaps by supplementing your Original Medicare coverage to pay for certain out-of-pocket costs. A Medicare Supplement plan may pay your coinsurance or copayments from Medicare Part A and Part B.

What to do if you are unhappy with your Medicare Supplement?

If you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter. Call to speak with a licensed insurance agent who can help you compare Medicare Supplement plans in your area. They can help you change plans once you find the best plan for your needs.

How long do you have to keep Medicare Supplement?

The Medicare Supplement “Free Look” Period. When you switch Medicare Supplement Insurance plans, you generally are allowed 30 days to decide to keep it or not. This 30-day “free look” period starts when your new Medicare Supplement plan takes effect.

How long does it take to enroll in Medigap?

If you do consider enrolling in a Medigap plan Medigap plans, you should try to apply for a plan during your 6-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period is a 6-month period that starts the day you are both 65 years old and enrolled in Medicare Part B.

Can I Change Medigap Plans After My Open Enrollment Period

How and When Can you Change your Medicare Supplement Plan | Medigap plans can be changed anytime!

Whats The Difference Between Medicare Advantage And Medicare Supplement

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

When Can You Change Your Medicare Supplement Plan

Already enrolled in a Medicare Supplement plan but want to know how and when you can change it? Read our guide to learn more about this process with tips you should be aware of.

Medigap And Medicare Advantage

If you have a Medicare Advantage plan, its illegal for an insurance company to sell you a Medigap policy. But if you switch to MA after youve purchased a Medigap policy, youll probably want to drop your policy since you cant use it to supplement your MA plan.

How Can I Change Medicare Supplement Insurance Plans

To change Medicare Supplement insurance plans, call the insurance company thats selling the plan you want. If they accept your application, call your current Medicare Supplement insurance company and ask how to end your coverage with your current plan.

When And How Can You Change Medicare Plans

Each Medicare plan and insurance product we carry has been independently decided on and reviewed by means of our editorial team along side our partners at Medicare Expert USA. If you make a purchase the usage of the hyperlinks incorporated, Health.com may be compensated.

Meet With A Sales Agent

Make an appointment with a licensed insurance agent/producer in your area

Reasons to Consider Changing Your Medicare Supplement Plan

As was mentioned earlier, when Medicare beneficiaries purchase a Medicare Supplement plan, the decision on which plan to purchase is based on the healthcare services you generally need at that time and your budget for purchasing coverage.

Is it Possible to avoid Medical Underwriting outside of the Open Enrollment Period?

The short answer is YES but you must be eligible under one of the following qualifiers:

Can I switch from a Medicare Supplement to a Medicare Advantage Plan?

Yes, you can switch from your Medigap plan to a Medicare Advantage plan between October 15 and December 7, which is the annual enrollment period.

When can I switch from Medicare Advantage to Medigap?

You can switch from Medicare Advantage to Medigap (Medicare Supplement insurance) and maintain your guaranteed-issue rights only if you signed up for Medicare Advantage during your Initial Enrollment Period — the seven months before, during, and after you become eligible for Medicare at age 65.

When can I remove my Medicare Advantage plan?

Outside of this time frame, you can remove a Medicare Advantage plan only during the Fall Open Enrollment Period, from October 15 to December 7 each year , and only if you are switching back to Original Medicare. You may also be able to add a Medigap policy during this time.

How long does it take to switch Medigap to another?

Regardless of your circumstances, if you switch from one Medigap policy to another, you will get a 30-day “free look” period to explore a new plan before you drop your existing plan. During this time, you will need to pay the premiums for both policies.

What is Medicare Supplement?

Medicare Supplement ( or Medigap) insurance provides coverage for copayments, coinsurance, deductibles, and other expenses not covered by Original Medicare ( Medicare Part A hospital insurance and Medicare Part B medical insurance). Medicare Supplement policies are provided by private insurance companies that contract with the federal government.

When is the best time to enroll in Medigap?

Ultimately, the best time to enroll in a Medigap plan is during your Open Enrollment Period, which is the seven-month time frame before and after you first become eligible for Medicare at age 65. You may find some exceptions to this, though.

How long do you have to have a medical underwriting process before you can get a new insurance?

If you’ve had your policy for less than six months and you have a preexisting health condition, you can apply for a new policy anytime within the first six months of coverage. After that time, the insurance provider will likely need to complete a medical underwriting process before selling you a different plan.

Can I change my Medigap plan?

You can change a Medigap plan at any time. Depending on risks associated with your past or current health conditions, if you apply outside of your Initial Enrollment Period window, which begins when you first become eligible for Medicare, the insurance provider could charge a higher premium or deny your application altogether.

How long do you have to pay for Medigap?

People must pay for both policies that month until they decide at the end of 30 days whether to leave the old policy and stay with the new one, according to the government’s Medicare website on changing Medigap plans.

What happens if you no longer have a guaranteed issue right?

In other situations, if you no longer have a guaranteed issue right, you can apply for the Medigap policy of your choice, but with restrictions you had not faced before.

Does Plan G cover Part B?

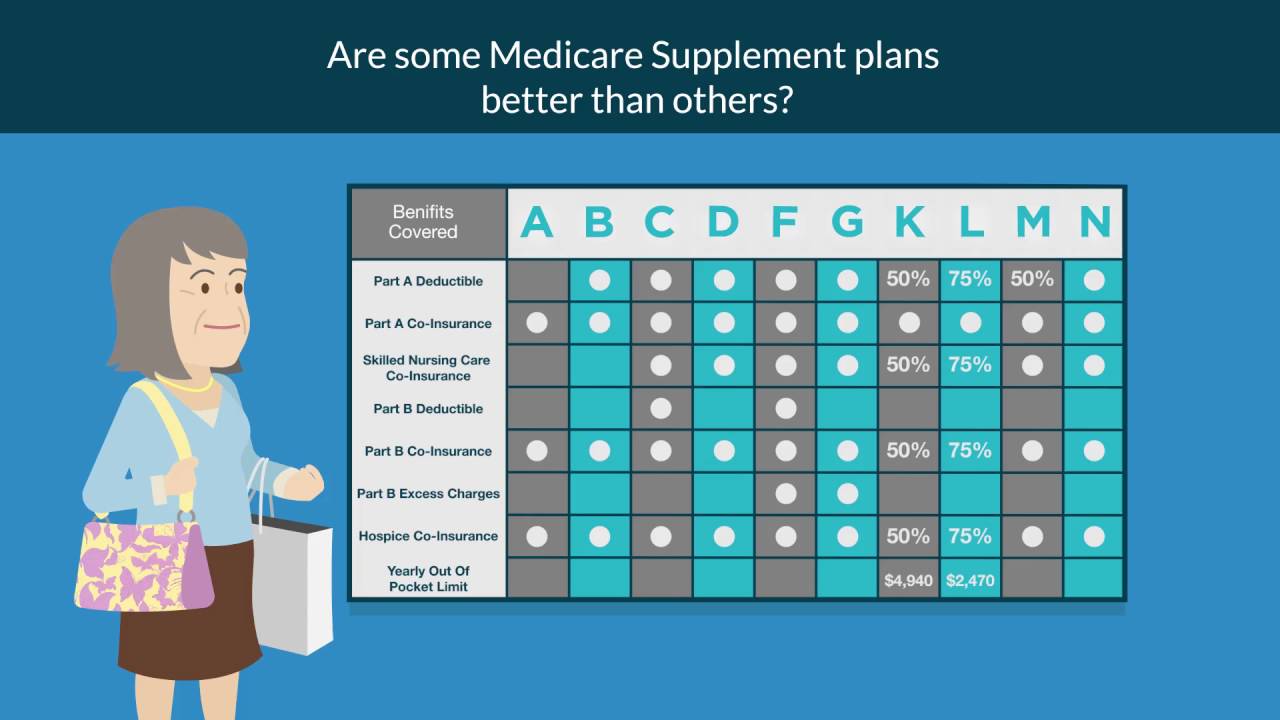

Plan G, though, does not cover the Part B deductible. Some of the plans – C, D, F, G, M, and N – cover skilled nursing facilities; two don’t at all and two others cover a percentage. Only Plans F and G cover Part B excess charges.

Is there an open enrollment period for Medicare Part D?

Except in a handful of states, there aren’t annual open enrollment periods for making the switch, and the restrictions are many. Many people are confused by this because there is a period in fall each year when you can change aspects of your coverage, such as Medicare Part D drug plans. But things work differently with Medigap policies.

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

What happens if you buy a Medigap policy before 2010?

If you bought your policy before 2010, it may offer coverage that isn't available in a newer policy. If you bought your policy before 1992, your policy: Might not be a Guaranteed renewable policy. May have a bigger Premium increase than newer, standardized Medigap policies currently being sold. expand.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

Can you exclude pre-existing conditions from a new insurance policy?

The new insurance company can't exclude your Pre-existing condition. If you've had your Medigap policy less than 6 months: The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...

When does Medicare kick in?

If you make a change during the Medicare Advantage Open Enrollment Period, your new Medicare benefits will kick in on the first day of the month following your enrollment. For example, if you make a change to your Medicare Advantage plan at any point during the month of January, your new coverage will take effect on February 1.

When does Medicare open enrollment end?

Any changes that you make will take effect on January 1 of the following year. Medicare Advantage Open Enrollment Period. This open enrollment period applies to recipients who are currently using a Medicare Advantage plan. This period lasts from January 1 to March 31 each year, and during this time, you can make one change to your healthcare ...

When is the Medicare election period?

Annual Election Period. From October 15 to December 7 each year is the Annual Election Period. This period is also referred to as the Annual Enrollment Period. During this time, you can elect to make changes to your Medicare coverage.

How many enrollment periods are there for Medicare Supplements?

Just like Medicare has special enrollment periods throughout the year, Medicare Supplements have a special window where you need to purchase a plan.There is really only one Enrollment period for Medicare Supplements. It is referred to as the Initial Enrollment Period.

How many Medicare Supplement plans are there in every state?

Rates and availability will vary by company. Many companies will also add extra benefits to the products to distinguish themselves from competitors. There are 10 Medicare Supplement plans on the market in every state but 4.

What does Medicare Supplement cover?

Medicare Supplements cover the costs not covered by Original Medicare Part A & Part B. For a refresher, remember Part A covers hospitalization and Part B is essentially health coverage for doctors and specialist visits.

Why am I not happy with my Medicare Supplement?

You are not happy with your insurance company. This could be due to customer service or claims handling. You are not happy with the premiums you are paying. Switching Medicare Supplement plans is easy. However, make sure you are not losing benefits or coverages when switching companies or to a different plane.

What is the excess charge for Medicare Part B?

Excess charges can be substantial. Under traditional Medicare, doctors are allowed to charge an extra 15% to the patient beyond the portion that Medicare reimburses. Plan F will pick up that extra 15% charge.

How much is deductible for Plan G?

A High Deductible Plan G was introduced in 2020. Currently, you need to hit a $2,370 deductible before coverage begins with Plan G. The benefit is that premiums are much lower compared to the original Plan G. If you are a healthy senior with few medical expenses, this may be a plan to consider.

What is Plan A?

Plan A. Plan A is the most basic plan you can purchase. All other plans build off of the coverage offered by Plan A. Plan A covers Part A Medicare co-insurance, including an extra 365 days of hospital costs.Part B 20% co-insurance is covered, along with three pints of blood and Part A hospice care.