When is the earliest you can get Medicare?

Nov 24, 2021 · While you can start receiving Social Security payments as early as age 62, the longer you wait, the more you will receive on a monthly basis. Even if you decide to wait until age 67 or older to begin receiving Social Security, you can opt to get Medicare at age 65 or even younger under certain conditions.

When can you start collecting Medicare?

The IRS specifies requirements to determine if you qualify for Medicare tax deduction. Firstly, your eligible medical expenses should exceed 7.5 percent of your AGI (adjusted gross income). Then, add all the costs of the unreimbursed Medicare coverage and other health expenses to see if you’ve contributed enough to qualify for the tax deduction.

How and when you should enroll in Medicare?

Dec 01, 2021 · How Electronic Claims Submission Works: The claim is electronically transmitted in data “packets” from the provider's computer modem to the Medicare contractor's modem over a telephone line. Medicare contractors perform a series of edits. The initial edits are to determine if the claims in a batch meet the basic requirements of the HIPAA ...

When you should enroll in Medicare?

Oct 12, 2020 · To select the claim you want to cancel type in the Medicare Beneficiary ID number and enter the 'from and thru' dates of the claim. Access the claim you want to cancel by placing "S" in the SEL field and press enter. This takes you to the claim inquiry screen, claim page 01 where you can begin to cancel the claim.

Can I get Medicare at age 62?

Generally speaking, no. You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

What is the earliest age you can claim Medicare?

65You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security (or the Railroad Retirement Board). Coverage can't start earlier than the month you turned 65.

When can I get Medicare if I was born in 1963?

If you are born from 1960 and later, you will reach full retirement age at 67. You will automatically receive Medicare benefits, if you receive Social Security Retirement benefits at age 65. Starting Social Security at age 62 will not get you Medicare until you reach 65.

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

What Medicare tax deductions can you get each year?

Medicare costs can exceed what you have planned for each month. Fortunately, you might be able to claim some of your Medicare costs as deductions. These deductions provide you with a tax break, allowing you to reduce your tax obligation for the year.

List of Allowable Expenses for Medicare Coverage

You can obtain detailed records of eligible expenses by visiting the IRS website. The following are some examples of popular health services and benefits that are considered allowable expenses as a Medicare beneficiary.

How do the income limits for Medicare tax deductions work?

The IRS specifies requirements to determine if you qualify for Medicare tax deduction. Firstly, your eligible medical expenses should exceed 7.5 percent of your AGI (adjusted gross income). Then, add all the costs of the unreimbursed Medicare coverage and other health expenses to see if you’ve contributed enough to qualify for the tax deduction.

What expenses do not qualify for Medicare tax deduction?

The IRS provides a comprehensive list of tax-deductible medical expenses. You should, however, be aware of any payments that don’t fit your bills. Reimbursable Medicare expenses, for instance, are ineligible for a tax deduction.

Does supplemental insurance impact the Medicare tax deductions you can take?

Medicare supplementary insurance (also called Medigap policy) can assist you when you have significant out-of-pocket expenses. This additional coverage can fill the gaps left by original Medicare’s (Parts A and B) deductibles, copays, and coinsurance.

Is it possible to deduct Medicare Part B premiums from Social Security tax-free?

Typically, Part B premiums are automatically extracted from your Social Security health benefits. These premiums may be used to cover doctor visits, outpatient hospital services, and certain types of medical supplies.

Are Medicare premiums deductible monthly?

Medicare consists of four elements: Parts A, B, C (Medicare Advantage), and Part D. The type of additional coverage (if any) you select determines the cost of your monthly premiums.

What is Medicare contractor edit?

Medicare contractors perform a series of edits. The initial edits are to determine if the claims in a batch meet the basic requirements of the HIPAA standard. If errors are detected at this level, the entire batch of claims would be rejected for correction and resubmission.

Can a provider purchase software?

Providers can purchase software from a vendor, contract with a billing service or clearinghouse that will provide software or programming support, or use HIPAA compliant free billing software that is supplied by Medicare carriers, DMEMACs and A/B MACs.

Why do I have to cancel my Medicare claim?

Some reasons for cancelling a claim include: Cancel a claim with incorrect information and process a new claim with corrected information. Wrong patient / Medicare Beneficiary ID number. Cancel a duplicate claim that was entered in error.

Can I cancel my MSP claim?

MSP Claims can be cancelled electronically or through DDE / FISS. You may only cancel a finalized claim, status location P B9997, that as appeared on your remit tance advice. The cancel claim must be made on original paid claim.

How much of your Medicare premiums are deductible?

Your unreimbursed medical and dental expenses, including premiums, deductibles, copayments and other Medicare expenses, may be deductible to the extent that they exceed 7.5% of your adjusted gross income.

How much can you deduct for long term care insurance?

For tax year 2020, the maximum tax deduction for long-term care premiums for people ages 61 to 70 is $4,350 per person; for age 71 and up, the limit is $5,430.

Who is John Rossheim?

About the author: John Rossheim is an editor and writer specializing in health care and workforce trends. His work has appeared in The Washington Post and on MSN, Monster and dozens of other websites. Read more. On a similar note...

Is long term care deductible on Medicare?

Other health care expenses may be deductible. Medicare recipients may incur a variety of medical expenses that their insurance does not cover, from long-term care to lodging during a trip to receive medical care. Some of these expenses may be tax deductible, within limits.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

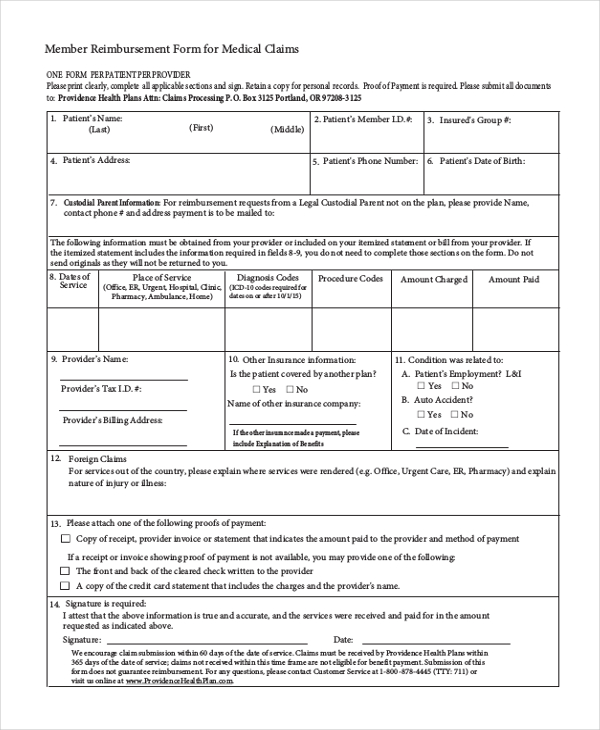

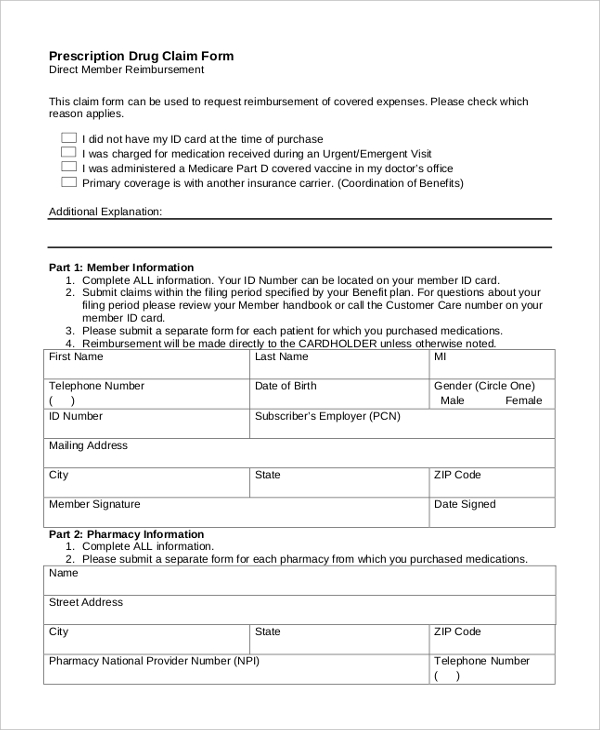

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

What is an itemized bill?

The itemized bill from your doctor, supplier, or other health care provider. A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare.

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. , these plans don’t have to file claims because Medicare pays these private insurance companies a set amount each month.

How old do you have to be to get Medicare?

Medicare eligibility at age 65. You must typically meet two requirements to receive Medicare benefits: You are at least 65 years old. You are a U.S. citizen or a legal resident for at least five years. In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security ...

How long do you have to be a resident to qualify for Medicare?

Medicare eligibility chart - by age. - Typically eligible for Medicare if you're a U.S. citizen or legal resident for at least 5 years. - If you won't be automatically enrolled when you turn 65, your Initial Enrollment Period begins 3 months before your 65th birthday.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium can be as high as $458 per month. Let’s say Gerald’s wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

What is the Social Security retirement rate at 65?

Your Social Security retirement benefits will be reduced to 93.3% if you take them at age 65. - Not typically eligible for Medicare, unless you receive SSA or RRB disability benefits or have ALS or ESRD.

Is Medicaid based on income?

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children. Learn more about the difference between Medicare and Medicaid.

Can a 65 year old spouse get Medicare?

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they haven’t yet qualified based on their own work history. For example, Gerald is 65 years old, but he doesn’t qualify for premium-free Part A because he did not work the minimum number ...

Who can help you compare Medicare Advantage plans?

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans (Medicare Part C) that are available where you live.

What is deductible medical expenses?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies. The IRS provides a list of deductible medical expenses. The list includes some items you might not expect.

What is the AGI for taxes?

The AGI is your gross income minus adjustments, such as student loan interest, retirement account contributions, and alimony payments. Another example is work-related moving expenses.

What is the purpose of standard deductions?

The purpose of standard tax deductions is to allow taxpayers to claim the standard amount set by the IRS. They can claim this amount for the deduction if they haven’t itemized deductible expenses. This amount changes by year, and the IRS website has a tool you can use to calculate your standard deduction.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

What is considered self employed by the IRS?

To qualify as self-employed by the standards of the IRS, you must be one of the following: A sole proprietor or independent contractor in a trade or business. A member of a partnership in a trade or business. Otherwise in business for yourself.

Can you deduct Medigap premiums?

Although the cost of Medigap premiums is subject to tax deductions, not all expenses are deductible. Medigap premiums are considered a medical expenditure and follow the guidelines for this type of deduction. Medical expenses are only deductible if they’re itemized by the taxpayer in their personal income tax returns.

Can Medicare be deducted from taxes?

Your Medicare and Medigap premiums can be deducted from your taxes as a below the line deduction. This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your Adjusted Gross Income (AGI), you qualify for the deduction.