When can I sign up for Medicare Part B?

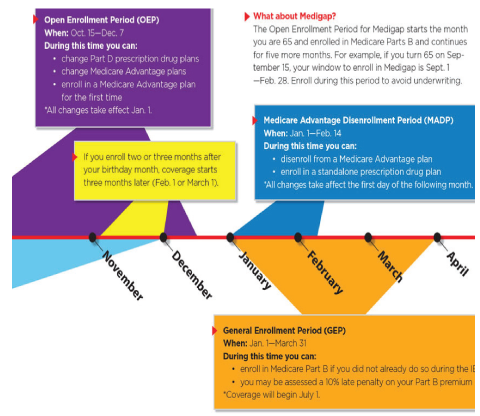

Also, you may have to wait until the General Enrollment Period (from January 1 to March 31) to enroll in Part B. Coverage will start July 1 of that year. Usually, you don't pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.

What is the general enrollment period for Medicare?

The GEP takes place January 1 through March 31 of each year. During this period you can enroll in Medicare Part B. Enrolling during the GEP means your coverage will start on July 1. Until that time, you will not be covered by Medicare. Enrolling in Medicare during the GEP means you may have to pay a Part B premium penalty.

What is special enrollment period for Medicare Part B?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

Do you qualify for Medicare Part B extra help?

You may also qualify for Extra Help to pay for your Medicare prescription drug coverage. Your Initial Enrollment Period ended December 2016. You waited to sign up for Part B until March 2019 during the General Enrollment Period.

What happens if I miss the Medicare enrollment deadline?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

Can Medicare Part B be added at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

What happens if someone misses their opportunity to enroll in Medicare during their initial enrollment period or special enrollment period?

A Special Enrollment Period is only available for a limited time. If you don't sign up during your Special Enrollment Period, you'll have to wait for the next General Enrollment Period and you might have to pay a monthly late enrollment penalty.

What is the Part B late enrollment penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How do I add Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

What is my Medicare Part B effective date?

When does Medicare start?If you sign up for Medicare Part A and/or Medicare Part B in this month:Your coverage starts:The month you turn 651 month after you sign up1, 2 or 3 months after you turn 65The first day of the month after you sign upDuring the Jan 1-March 31 General enrollment periodJuly 11 more row

How is Medicare Part B penalty calculated?

Calculating Lifetime Penalty Fees Calculating your Part B penalty is fairly straightforward. You simply add 10% to the cost of your monthly premium for each year-long period you didn't have Medicare. It's simple to get a snapshot of what you will have to pay each month.

What is the Medicare initial enrollment period?

Initial Enrollment Period – a 7-month period when someone is first eligible for Medicare. For those eligible due to age, this period begins 3 months before they turn 65, includes the month they turn 65, and ends 3 months after they turn 65.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Who determines late enrollment penalty?

Currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($33.37 in 2022) by the number of full, uncovered months that you were eligible but didn't enroll in Medicare drug coverage and went without other creditable prescription drug coverage.

Can I delay Medicare Part B if I am still working?

Once you enroll in any part of Medicare, you won't be able to contribute to your HSA. If you would like to continue making contributions to your HSA, you can delay both Part A and Part B until you (or your spouse) stop working or lose that employer coverage.

How long do you have to enroll in Part A if you missed the signup deadline?

If you already have been enrolled in Part A and have had “creditable” drug coverage up until now — which could be the case with a small employer plan — and only missed your signup deadline for Part B, you’d get a two-month special enrollment period to get Part D coverage once you lose the workplace plan, Roberts said.

When do you sign up for Medicare?

Generally speaking, you are supposed to sign up for Medicare during a seven-month window that starts three months before your 65th birthday month and ends three months after it. However, if you meet an exception — i.e., you or your spouse have qualifying group insurance at a company with 20 or more employees — you can put off enrolling.

What is the late enrollment penalty for Part D?

For Part D prescription drug coverage, the late-enrollment penalty is 1% of the monthly national base premium ($33.06 in 2021) for each full month that you should have had coverage but didn’t. Like the Part B penalty, this amount also generally lasts as long as you have drug coverage.

When will Social Security honor a written request for enrollment?

And while you shouldn’t wait until the last minute to enroll during this current three-month period, the Social Security Administration will honor a written request for enrollment if the mail is stamped by March 31, said Elizabeth Gavino, founder of Lewin & Gavino and an independent broker and general agent for Medicare plans.

How much is Part B premium for 2021?

For each full year that you should have been enrolled in Part B but were not, you could face paying 10% of the monthly Part B standard premium ($148.50 for 2021). The amount is tacked on to your monthly premium, generally for as long as you are enrolled in Medicare.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

Medicare Expert Q&A: What Happens if You Miss Your Medicare Enrollment Deadline?

Medicare expert Christian Worstell answers the question of how to sign up for Medicare if you miss your enrollment deadline.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

When does Medicare enrollment end?

Medicare’s Annual Enrollment Period begins each year on October 15th and ends December 7th. Coverage from enrollment during this timeframe begins on the first day of the following year, January 1st.

What is a special enrollment period?

Special Enrollment Period. Special enrollment periods are activated when a recipient experiences certain qualifying changes to their existing health care coverage. For Parts A and B, a special, penalty-free enrollment period can begin before or following the loss of private health insurance provided by an employer with 20 or more employees, ...

How long do you have to be on Medicare to get disability?

If you receive Social Security Disability Insurance (SSDI) payments, you can enroll in Medicare after you receive payments for 2 years. You become eligible for enrollment starting 3 months before you receive your 25th disability payment and this initial enrollment period lasts ...

When does Medicare start for Lou Gehrig's disease?

If a recipient is diagnosed with Lou Gehrig’s Disease (ALS), Medicare coverage can begin from the date of their first SSDI payment.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

When do you enroll in Medicare?

The first time most people can enroll in Medicare is during their Initial Enrollment Period (IEP). This 7-month period begins three months before the month in which you turn 65 and ends three months after. But, what if you miss your IEP?

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

When can I enroll in Medicare Part A and Part B?

Your next opportunity to enroll in Part A and Part B will be during the General Enrollment Period, January 1-March 31. Coverage becomes effective July 1. Then, between April 1 and June 30, you can enroll in a stand-alone Part D prescription drug plan and a Medigap policy or a Medicare Advantage plan with drug coverage (MA-PD).

How long does Medicare enrollment last?

This is a seven-month period beginning three months before and ending three months after the month of the 65th birthday.

How much is the penalty for late enrollment in 2021?

A Part B penalty for every full year (12 months) you delayed enrollment: That penalty is 10% of the standard Part B premium or $14.85 in 2021 added to the monthly premium of $148.50 for new beneficiaries.

How much is the Part D penalty in 2021?

A Part D penalty for every month you were without creditable drug coverage: That is 1% of the standard Part D premium or $0.3306 in 2021, also added to the monthly plan premium.

Do you have to take action on a group health plan?

FYI: Those who have a group health plan, related to current employment in a company with 20 or more employees, do not have to take action during the Initial Enrollment Period . If they have continuous coverage from age 65 until giving up the group plan, with no gaps of eight or more months, they can qualify for a Special Enrollment Period (SEP).

Does 65 Incorporated offer Medicare enrollment?

65 Incorporated offers one-on-one Medicare Enrollment consultations. With this service, you'll make the best decisions for your unique needs while also avoiding costly and potentially permanent Medicare mistakes.