When can I sign up for Medicare?

Jan 01, 2022 · Generally, you’re first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. Avoid the penalty. If you don’t sign up for Part B when you’re first eligible, you might have to wait to sign up and go months without coverage.

When can I sign up for Medicare Part D drug coverage?

Jun 15, 2020 · The best time to join a Medicare health or drug plan is when you first get Medicare. Signing up when you’re first eligible can help you avoid paying a lifetime Part D late enrollment penalty . If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan.

When does open enrollment start for Medicare drug plans?

When can I sign up? There are specific times when you can sign up for a Medicare Advantage Plan or . Medicare drug coverage, or make changes to your existing Medicare coverage: During your Initial Enrollment Period when you first become eligible for Medicare, or when you turn 65. See page 3. During certain enrollment periods each year.

Can I enroll in a Medicare prescription drug plan anytime?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

Can you enroll in Medicare Part D at any time?

When should I enroll in Medicare Part D?

| If you join | Your coverage begins |

|---|---|

| During one of the 3 months before you turn 65 | The first day of the month you turn 65 |

| During the month you turn 65 | The first day of the month after you ask to join the plan |

What is the 63 day rule for Medicare?

Can I sign up for Medicare 5 months before I turn 65?

What is the best Part D drug plan for 2021?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

Is Medicare Part D worth getting?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

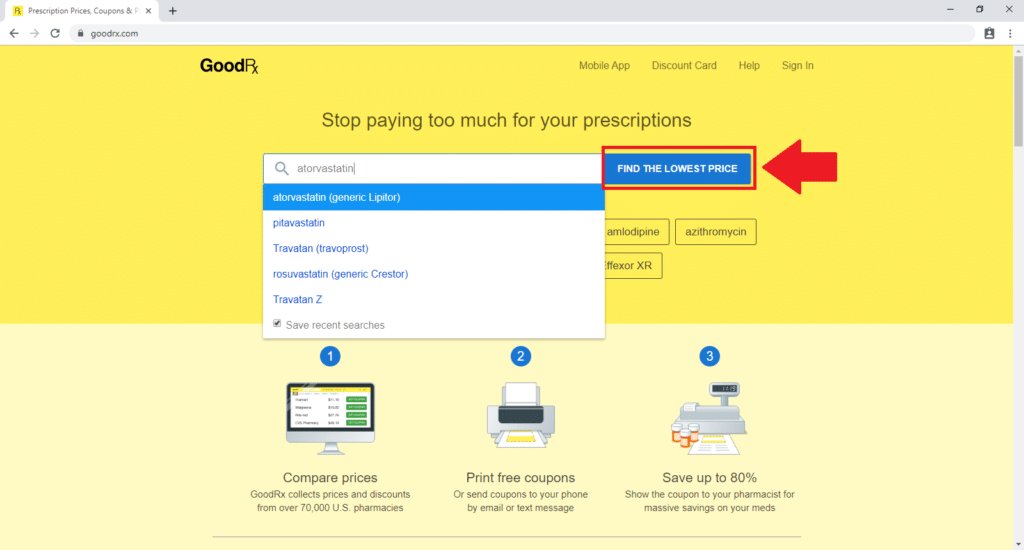

Can you use GoodRx with Medicare Part D?

What does Medicare D cost?

What should I be doing 3 months before 65?

Do you have to sign up for Medicare or is it automatic when you turn 65?

Can I get Medicare at age 62?

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

What is the late enrollment penalty for Medicare?

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage. Creditable prescription drug coverage is coverage (for example, from an employer or union) that’s expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If you have a penalty, you’ll generally have to pay it for as long as you have Medicare drug coverage. For more information about the late enrollment penalty, visit Medicare.gov, or call 1‑800‑MEDICARE (1‑800‑633‑4227). TTY users can call 1‑877‑486‑2048.

What are the special enrollment periods?

When certain events happen in your life, like if you move or lose other insurance coverage, you may be able to make changes to your Medicare health and drug coverage. These chances to make changes are called Special Enrollment Periods. Rules about when you can make changes and the type of changes you can make are different for each Special Enrollment Period.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

When is open enrollment for Medicare?

The annual open enrollment period (Oct. 15 to Dec. 7 each year) when you can join a drug plan for the first time if you missed your deadlines for your IEP or a SEP, or switch from original Medicare to a Medicare Advantage plan, or switch from one Medicare Advantage plan to another, or switch from one Part D drug plan to another.

How to enroll in Medicare Advantage?

Whether you choose a stand-alone Part D drug plan or a Medicare Advantage plan, you must enroll during a designated enrollment period: 1 Your initial enrollment period (IEP), which runs for seven months, of which the fourth is the month of your 65th birthday. 2 A special enrollment period (SEP), which you’re entitled to in certain circumstances:

How long is the IEP?

Your initial enrollment period (IEP), which runs for seven months, of which the fourth is the month of your 65th birthday. A special enrollment period (SEP), which you’re entitled to in certain circumstances: • If you qualify for Extra Help (which provides low-cost Part D coverage to people with limited incomes) or enter or leave a nursing home, ...

What happens if you don't sign up for Medicare?

There’s another reason to think about signing up for Part D: if you don’t sign up when you’re first eligible for Medicare, you might have to pay a late enrollment penalty if you need medications at a later date and decide to sign up. Learn more about the Part D late enrollment penalty.

When is the AEP for Medicare?

The Annual Election Period (AEP), also called Fall Open Enrollment, October 15 – December 7 every year. The 5-Star Special Enrollment Period. You can switch to a Medicare prescription drug plan with a 5-star rating from December 8 one year to November 30 the next Read more about the 5-star special enrollment period.

How does Medicare Part D work?

Medicare Part D comes in two flavors 1 You can sign up for a stand-alone Medicare Part D prescription drug plan to work beside your Medicare Part A and Part B coverage. 2 You can get your Medicare Part A and Part B benefits through a Medicare Advantage Prescription Drug plan. Not every Medicare Advantage plan includes prescription drug benefits, but most do.

Does Medicare Part A include prescriptions?

Original Medicare, Part A and Part B, doesn’t include prescription drug coverage, except in certain cases. Part A usually covers medications given as part of your treatment when you’re a hospital inpatient.

Does Medicare cover home medications?

But when it comes to medications you take at home, Original Medicare doesn’t cover them in most cases. There’s another reason to think about signing up for Part D: if you don’t sign up when you’re first eligible for Medicare, you might have to pay a late enrollment penalty if you need medications at a later date and decide to sign up.

How long does Medicare enrollment last?

The most common enrollment periods are: Your Medicare Initial Enrollment Period. For most people, this is the seven-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and continues three months after that.

Does Medicare cover Part B?

But when it comes to medications you take at home, Original Medicare doesn’t cover them in most cases. There’s another reason to think about signing up for Part D: if you don’t sign up when you’re first eligible for Medicare, ...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

What is extra help?

Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. , you don't pay the late enrollment penalty.