Your first chance to sign up for Medicare starts three months before your 65th birthday, includes the month you turn 65, and ends three months after the month you turn 65. These seven months are called the Initial Enrollment Period.

- January 1-March 31.

- The f. irst 3 months after you get Medicare. First 3 months after getting Medicare. If you're in a Medicare Advantage Plan, you can make a change as long as it's within the first 3 months you have Medicare. and you're in a Medicare Advantage Plan.

When can I sign up for Medicare?

Special Enrollment Period: Once your Initial Enrollment Period ends, you may have the chance to sign up for Medicare during a Special Enrollment Period (SEP). You can sign up for Part A and or Part B during an SEP if you have special circumstances. The best time to join a Medicare health or drug plan is when you first get Medicare.

Can I still enroll in Medicare Plan F?

People who became eligible for Medicare before 2020: You can still enroll in Plan F, even if you've never had this particular plan before. Or enter your zip code below to request a free Medicare quote. John is 73, and he has end-stage renal disease (ESRD).

Can I Keep my Medicare supplement plan F after January 1 2020?

If you were eligible for Medicare before January 1, 2020 and bought a Medicare Supplement Plan F, you’ll likely be able to keep your plan. Even if you don’t purchase a Medicare Supplement Plan F before January 1, 2020, you might be able to buy Plan F or change insurance companies after this date.

Do I have to sign up for Medicare Part B early?

We mailed you a welcome package with your Medicare card. You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty. How much is the Part B penalty? How do I sign up for Part B?

Can you get Plan F in 2021?

Summary: Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

Can you still enroll in Medicare Part F?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Can I get Plan F after 2020?

If you enrolled in Medicare prior to January 1, 2020, you will remain eligible to apply for Medicare Supplement Plan F at any time in the future. On the other hand, those who became eligible for Medicare after January 1, 2020, will not be able to enroll in Medicare Supplement Plan F or Plan C.

How do I get Medicare F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Is plan F still available in 2022?

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022.

Can I switch from plan N to plan F?

Medicare Supplement Plan N's coverage is very similar to Plan F's, and you can use your Plan N anywhere that you can use your Plan F.

What is Medicare Plan F being replaced with?

Popular Plan F Replacements Include Medicare Supplement Plan G and Plan N. There are no explicit replacements for Plan F – you'll have to choose from a number of existing Medicare Supplement plans.

How much does AARP plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Are Medicare Part F premiums tax deductible?

Are Medicare Plan F premiums tax-deductible? When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out of pocket can also be deducted on your taxes.

Does Plan F have a deductible?

Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of $2,370 for 2021 before the plan pays anything. This amount can go up each year. High-deductible policies have lower premiums, but if you need to use your benefits, you may have higher out-of-pocket costs.

What is the difference between Plan G and Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Does Medicare F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

When is the best time to join Medicare?

The best time to join a Medicare health or drug plan is when you first get Medicare. Signing up when you’re first eligible can help you avoid paying a lifetime Part D late enrollment penalty. If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan.

How to get Medicare if you are not collecting Social Security?

If you’re not already collecting Social Security benefits before your Initial Enrollment Period starts, you’ll need to sign up for Medicare online or contact Social Security. To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period.

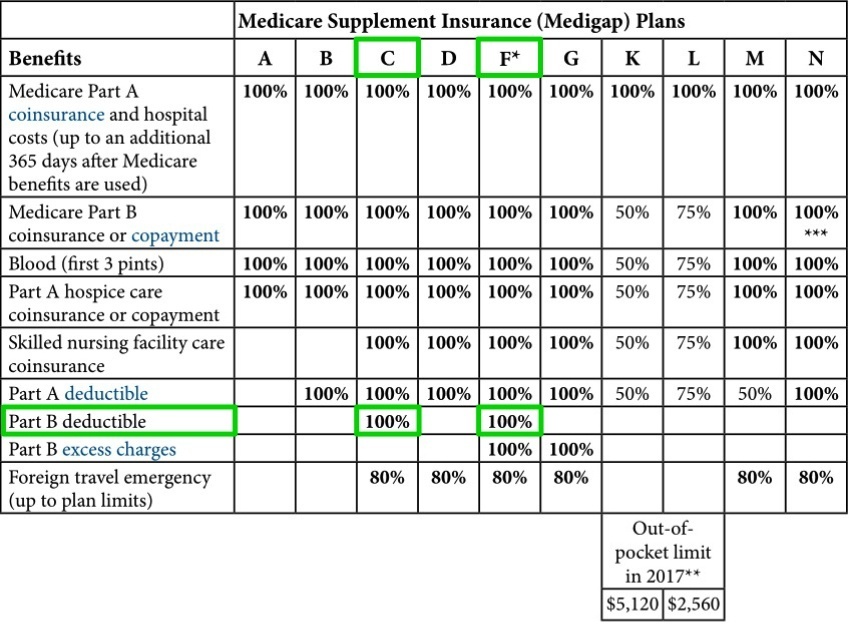

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

How long does Medicare Supplement last?

This is the six-month period that starts the first month when you’re enrolled in Part B and age 65 or older; during this period, you typically have a guaranteed right to enroll in any Medicare Supplement plan of your choice without medical underwriting.

Does Medicare cover Part A coinsurance?

Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. * May be covered if your foreign travel emergency care starts during the first 60 days after leaving the United States and Medicare doesn’t otherwise cover the care.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is Medicare Supplement Plan F?

Licensed Insurance Agent and Medicare Expert Writer. July 29, 2020. Medicare Plan F covers more expenses than other supplement plans, and it's one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

Why did John choose Plan F?

He’s choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury. He has a wife and helps care for two teenage grandchildren, so John needs fixed health care costs each month.

Is Plan F a good Medicare supplement?

As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medica re recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

When will Medicare Supplement Plan F leave the market?

Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

Does Medicare Supplement cover Part A?

Some Medicare Supplement insurance plans can still cover the Medicare Part A deductible, but not the Part B deductible. This only applies to people who became eligible for Medicare January 1, 2020 and later.

Does Medicare Supplement Plan F cover out-of-pocket costs?

If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. It’s the most comprehensive Medicare Supplement insurance plan among the 10 standardized plans available in most states.

Does Medicare Supplement Plan F have a high deductible?

Plan F has a high-deductible version. A Medicare Supplement high-deductible Plan G may now be available in some states.

Is Medicare Supplement Plan F a plan option?

Obviously if you weren’t eligible for Medicare prior to January 1, 2020, Medicare Supplement Plan F won’t be a plan option. Still, you may have choices in Medicare Supplement insurance plans. Make the best coverage decision for yourself. If you have a Medicare Supplement Plan F, you don’t have to take any action because your coverage is still ...

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

-p-800.png)