Can I still enroll in Medicare Plan F in 2020?

Beginning in 2020, Plans F and C, which cover the Part B deductible, are no longer available to people newly eligible to Medicare after January 1, 2020. If you became eligible for Medicare in 2019 or earlier, however, you can still enroll in Plan F in 2020 and beyond.

What happens to Medicare supplement plan F after December 31?

As a result of this legislation, Medicare beneficiaries who become eligible after December 31, 2019, will not have access to Medicare Supplement Plan F coverage, unless they have a Medicare Part A effective date prior to 2020.

When should I sign up for Medicare Part A?

Generally, you’re first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Is Medigap plan F right for You?

But monthly premiums are typically higher than other plans, so if Plan F has more coverage than you need, this might not be the plan for you. New to Medicare? The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

Can you get plan F in 2021?

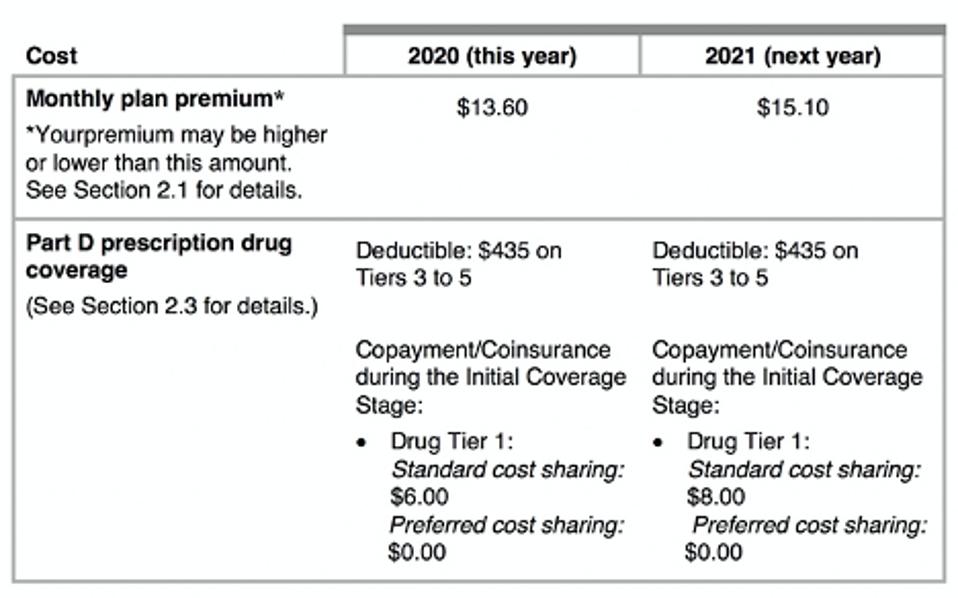

Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of $2,370 for 2021 before the plan pays anything. This amount can go up each year. High-deductible policies have lower premiums, but if you need to use your benefits, you may have higher out-of-pocket costs.

Can you still enroll in Medicare Part F?

Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you can keep your plan.

Is plan F still available in 2022?

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022.

Who qualifies for Medicare Plan F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

Can I enroll in plan F after 2020?

If you enrolled in Medicare prior to January 1, 2020, you will remain eligible to apply for Medicare Supplement Plan F at any time in the future. On the other hand, those who became eligible for Medicare after January 1, 2020, will not be able to enroll in Medicare Supplement Plan F or Plan C.

Why is plan F being discontinued?

So, Why Is Plan F Going Away? Medicare Supplement Plan F is being phased out as a result of “The Medicare Access and CHIP Reauthorization Act of 2015”, also known as MACRA. As a result of MACRA, anybody who becomes eligible for Medicare in 2020 will not be able to purchase Plan F.

Why is plan G better than plan F?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is plan G cheaper than plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

What is the cost of Medicare Part F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more.

How much does AARP plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Are Medicare Part F premiums tax deductible?

Do Medicare premiums reduce taxable income? You can deduct your Medicare and Medigap premiums from your taxes as a below-the-line deduction. This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your adjusted gross income (AGI), you qualify for the deduction.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What coverage does Medicare Plan F offer?

Like other Medicare Supplement plans, Plan F covers Part A and Part B costs that you’d otherwise have to pay out of pocket. To learn what costs other parts of Medicare cover, read our Ultimate Medicare Guide.

What is the most popular Medicare Supplement Plan?

Get Medigap Plan F . As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medicare recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

What is Medicare Supplement?

Medicare Supplement is an additional insurance policy you can buy to help cover costs that Original Medicare (Parts A and B) doesn’t. Medicare Advantage is a way to receive Part A and B, as well as additional benefits such as dental care, eye exams, and prescription drug coverage, all in one package.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

What Other Medicare Supplement Plans Are Similar to Plan F?

People newly eligible for Medicare can’t sign up for Plan F, but they still have options when it comes to other Medigap plans. Here’s a look at what some experts say are the two best alternatives to Plan F.

What is Medicare Part A?

Medicare is the federal health insurance program for older U.S. adults, available starting at age 65. It consists of two main plan options: Medicare Part A covers hospitalization without a premium, and Medicare Part B covers doctor and outpatient care for a monthly premium.

Which Medicare plan provides the most benefits?

Historically, Medicare Plan F provided the most benefits of all the supplemental Medicare plans, says Price. It addresses some of the coverage gaps in Medicare parts A and B, which is why many people thought it was worth the extra premium, he notes.

Is Medicare a complicated plan?

Medicare can be a complicated subject—especially when you dive into all its variations. “A lot of people hear ‘Part A,’ ‘Part B,’ ‘Plan F’ and all these different letters flying around, and they definitely get a little confused,” says Sterling Price, a senior research analyst at ValuePenguin who specializes in health and life insurance.

Is Medicare Supplement Plan G the best option?

Medicare Supplement Plan G is generally the best option for people who are no longer eligible for Plan F, says Price. “It’s very similar to Plan F,” he notes.

Is Medicare Plan F a supplement?

Meanwhile, Medicare Plan F is an example of Medicare Supplement Insurance (Medigap). As its name suggests, Medigap helps fill the gaps that Medicare doesn’t cover. About 25% of people enrolled in Medicare parts A and B are also enrolled in a Medigap policy, research suggests [1].

What does Medicare Plan F cover?

In addition to the deductibles and copayments, Medicare Plan F also covers things like hospice care coinsurance, skilled nursing facility coinsurance, up to three pints of blood, and foreign travel emergency care.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover , says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What is Medigap insurance?

Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

What is the best alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesn’t cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so that’s a good alternative to Plan F.

When is the best time to buy Medicare Supplement?

Although Plan F has been eliminated for new enrollees, Decker explains that the best time to purchase any Medicare supplement is during the initial enrollment period when you first become eligible for Medicare. That begins three months before your 65th birthday and ends three months after. Otherwise, pre-existing health conditions could prohibit you from purchasing a plan later during the annual open enrollment period.

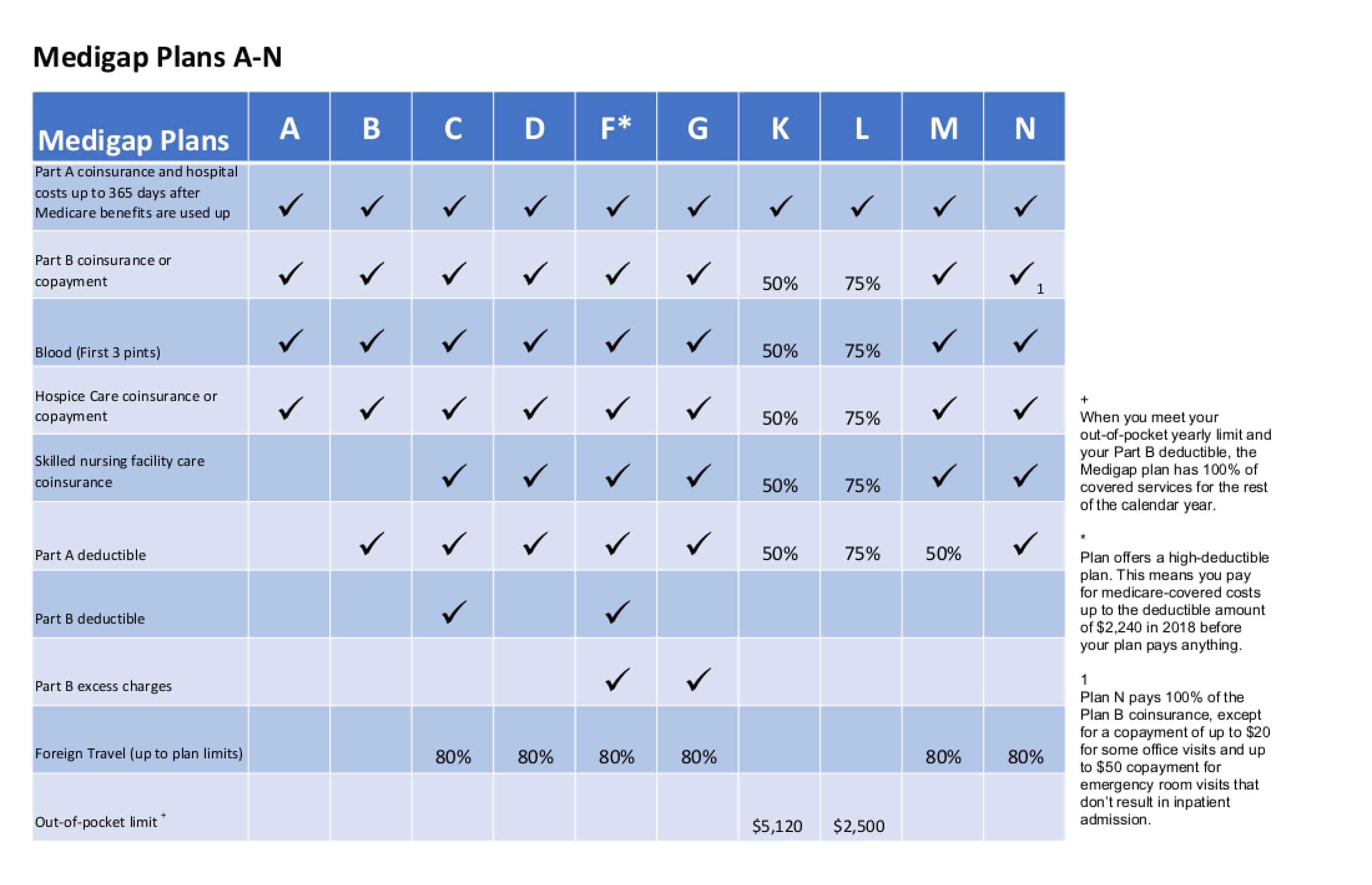

What Does Medicare Supplement Plan F Pay For?

Medicare Supplement Plan F is the only plan that covers all Medicare Supplement insurance benefits . The following are the benefits available with Medicare Supplement plans. “Yes” means that Plan F covers 100% of this benefit.

When will Medicare end?

Print October 28, 2020. New enrollment for Medicare Supplement Plan F for qualified individuals ended on December 31, 2019. But if you’re currently enrolled in Plan F, you have the opportunity to keep your plan or you can compare your options and change plans.

What is the high deductible plan for Medicare?

High-deductible Plan F: The high-deductible version of Medicare Plan F has a lower monthly premium and higher out-of-pocket expenses. You pay for Medicare-covered costs up to the $2,340 ($2,370 in 2021) before the plan begins to pay for anything.

How much does Medicare cover after 90 days?

Yes. If you’re admitted to the hospital for more than 90 days, you pay $682 in coinsurance for each “ lifetime reserve ” coverage day you have.

What does "no" mean in Medicare Supplement?

Sections with “No” means the plan does not cover that benefit. You will notice that Plan C and Plan G are the most similar to Medicare Supplement Plan F in terms of the level of coverage available. The only differences are: Plan C does not cover Part B excess charge while Plan F covers at 100%.

How much is SNF coinsurance?

This benefit helps pay the coinsurance amount for days 21-100 of SNF care, which is $170.50 per day for each benefit period. The plan pays your Part A hospital insurance deductible, which is $1,364 in 2019 for each benefit period. This plan covers the annual Part B medical insurance deductible, which is $185 in 2019.

What is the 20% Medicare benefit?

This benefit helps pay your share of the cost for covered medical services, which is usually 20% of the Medicare-approved amount.

When is Plan F available?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020, or you qualified for Medicare due to a disability before this date).

What Is Medicare Supplement Plan F?

This is due to new legislation that no longer allows Medicare Supplement Insurance plans to cover your Part B deductible ($203 in 2021).

What is a Medigap Plan F?

Medigap Plan F is one of the most popular Medicare supplement policies on the market. It covers a wide range of medical expenses and is offered by many health insurance providers.

How many days does Medicare cover inpatient hospital care?

For inpatient hospital care, you pay nothing for days 0-90. The following 60 days you use are counted against your Medicare Part B lifetime reserve days under. Finally, if you exhaust these, your Plan F coverage will cover the next 365 days.

Why is Plan F going away?

Plan F is going away due to new legislation that no longer allows Medicare Supplement plans to cover Medicare Part B deductibles. Since Plan F (and Plan C) pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

How many Medigap plans are there in 2021?

There are a variety of Medigap plans. As of 2021, there are ten different plans (and in some states, high-deductible versions of Plan F and Plan G).

Does Medicare cover hospice care?

They cover, among other items, the coinsurance and deductibles for hospitalization, hospice care, or skilled nursing services that Medicare does not cover.