Why Advantage plans are bad?

Feb 02, 2022 · The Development of Medicare Advantage The roots of Medicare Advantage go back to the 1970s. At that time, beneficiaries could receive managed care through private insurance companies. It was not until 1997 that the program, then called Medicare Choice, became official with the passing of the Balanced Budget Act.

What companies offer Medicare Advantage plans?

Dec 27, 2021 · Individuals with End-Stage Renal Disease were generally not eligible to enroll in Advantage plans prior to 2021 with the exception of Medicare Advantage ESRD Special Needs Plans, although these are not widely available. But this changed as of the 2021 plans year, as a result of the 21st Century Cures Act.

When can I join a Medicare Advantage plan?

The roots of Medicare Advantage (also known as Medicare Part C) go back to the 1970s. At that time, beneficiaries could receive managed care through private insurance companies. It was not until 1997 that the program, then called “Medicare Choice,” became official with the passing of the Balanced Budget Act.

What are the advantages and disadvantages of Medicare Advantage plans?

In 2019, CMS began allowing Medicare Advantage plans to offer more supplemental benefits, by relaxing the definition of “primarily health-related.” And in 2020, CMS began allowing Medicare Advantage plans to offer additional supplemental benefits to chronically ill enrollees, in an effort to address social determinants of health.

Why were Medicare Advantage plans created?

While initially created with the goals of reducing costs, improving choice, and enhancing quality, risk-based plans — now known as Medicare Advantage plans — have undergone significant policy changes since their inception; these changes have not always aligned with the original policy objectives.Dec 8, 2017

Which president started Medicare Advantage plans?

On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.Dec 1, 2021

What is the difference between Medicare Advantage and Medicare traditional?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

When did Medicare Part C begin?

The Balanced Budget Act of 1997 (BBA) established a new Part C of the Medicare program, known then as the Medicare+Choice (M+C) program, effective January 1999.Dec 1, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Why do doctors dislike Obamacare?

“It's a very unfair law,” said Valenti. “It puts the onus on us to determine which patients have paid premiums.” Valenti said this provision is the main reason two-thirds of doctors don't accept ACA plans. “No one wants to work and have somebody take back their paycheck,” he said.Aug 1, 2019

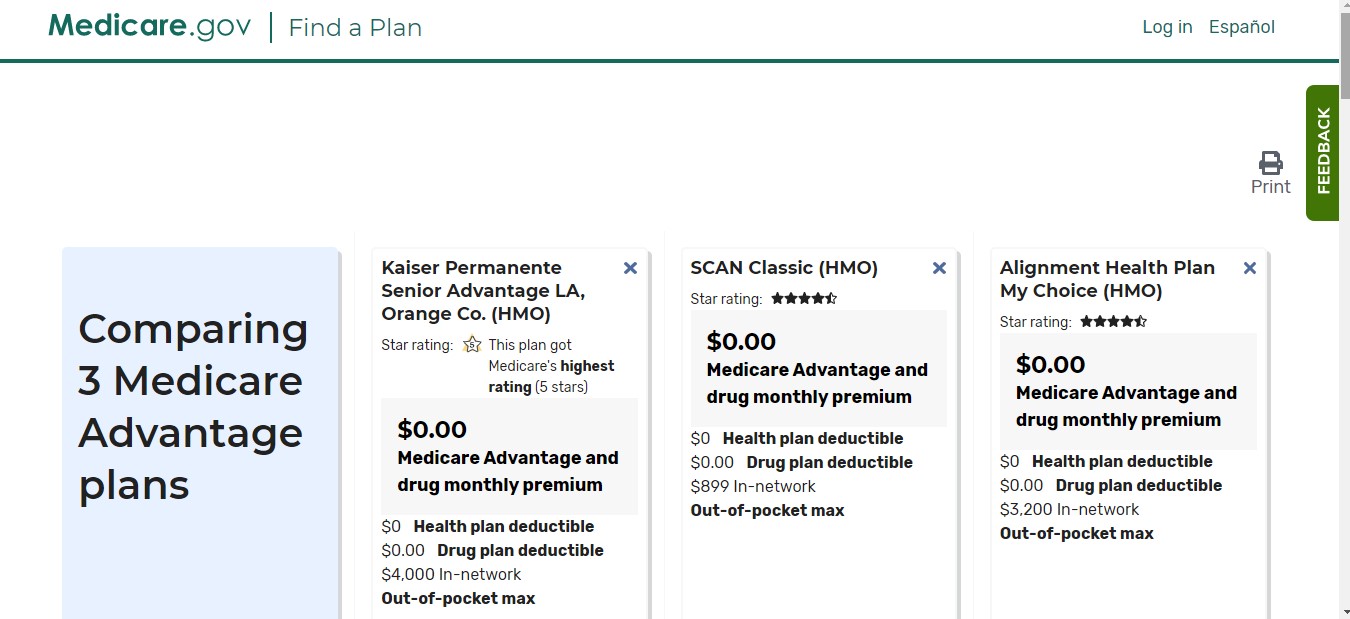

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

How many Medicare Advantage Plans are there in 2022?

3,834 Medicare Advantage plansTotal Number of Plans. In total, 3,834 Medicare Advantage plans are available nationwide for individual enrollment in 2022 – an 8 percent increase (284 more plans) from 2021 and the largest number of plans available in more than a decade (Figure 2; Appendix Table 1).Nov 2, 2021

What percentage of Medicare is Medicare Advantage?

In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).Jun 21, 2021

What does Medicare Part D offer to all seniors eligible for Medicare?

Key Facts. Medicare Part D offers prescription drug coverage to more than 35 million seniors, 11 million of whom are low-income. Before the passage of Part D, seniors spent an average of $2,318 on out-of-pocket drug costs. About 90 percent of Medicare-eligible seniors now have prescription drug coverage.

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures.

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare.

Who Is Eligible To Join Advantage Plans

If you live in the designated service area of the specific plan, and already have Part A and Part B , you may join a Medicare Advantage plan instead of Original Medicare .

Per Beneficiary Expenditure Differences Between Ma And Original Medicare

Medicare-managed care plans may have the potential to provide better quality care at less cost than original Medicare. 5 In fact, prior to the BBA, private plans were paid 95% of the cost of Medicare, in part because of this presumed greater efficiency.

Medicare Advantage Plans May Limit Your Freedom Of Choice In Health Care Providers

With the federally administered Medicare program, you can generally go to any doctor or facility that accepts Medicare and receive the same level of Medicare benefits for covered services. In contrast, Medicare Advantage plans are more restricted in terms of their provider networks.

How Do Msa Plans Work With Medicare Advantage

Typically you will pay your medical bills after you receive care with a dedicated debit card that your MSA plan mails to you.

What Is The Best Medicare Advantage Plan

If youve read this far, youre probably wondering which Medicare Advantage plan is the best. Is it Humana, AARP, Aetna, Blue Cross Blue Shield, Cigna, Wellcare, or Kaiser?

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

When did Medicare start offering capitated health plans?

In the 1970s, less than a decade after the beginning of fee for service (FFS) "Original Medicare," Medicare beneficiaries gained the option to receive their Medicare benefits through managed, capitated health plans, mainly HMOs, as an alternative.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

How many QMBs were there in 2016?

In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level. The ’90s.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

When did Medicare expand?

Over the years, Congress has made changes to Medicare: More people have become eligible. For example, in 1972 , Medicare was expanded to cover the disabled, people with end-stage renal disease (ESRD) requiring dialysis or kidney transplant, and people 65 or older that select Medicare coverage.

How long has Medicare and Medicaid been around?

Medicare & Medicaid: keeping us healthy for 50 years. On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security ...

What is Medicare Part D?

Medicare Part D Prescription Drug benefit. The Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA) made the biggest changes to the Medicare in the program in 38 years. Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans.

What is the Affordable Care Act?

The 2010 Affordable Care Act (ACA) brought the Health Insurance Marketplace, a single place where consumers can apply for and enroll in private health insurance plans. It also made new ways for us to design and test how to pay for and deliver health care.

When was the Children's Health Insurance Program created?

The Children’s Health Insurance Program (CHIP) was created in 1997 to give health insurance and preventive care to nearly 11 million, or 1 in 7, uninsured American children. Many of these children came from uninsured working families that earned too much to be eligible for Medicaid.

Does Medicaid cover cash assistance?

At first, Medicaid gave medical insurance to people getting cash assistance. Today, a much larger group is covered: States can tailor their Medicaid programs to best serve the people in their state, so there’s a wide variation in the services offered.

Abstract

Context: Twenty-five years ago, private insurance plans were introduced into the Medicare program with the stated dual aims of (1) giving beneficiaries a choice of health insurance plans beyond the fee-for-service Medicare program and (2) transferring to the Medicare program the efficiencies and cost savings achieved by managed care in the private sector..

Trailing the Private Sector, 1985–1997

The reason that Medicare expanded to include risk-based private plans was to share the gains realized from managed care in other settings.

Failed Attempt at Savings: 1997–2003

The BBA's goals with respect to Medicare Advantage can be summarized in the following question: Could Medicare Advantage be reformed so that Medicare could participate in the managed care dividend enjoyed by private employers? In the latter half of the 1990s, Republicans (the new congressional majority), centrist Democrats, and some policymakers began to look to Medicare as a source for reducing the deficit ( Oberlander 2003 ).

Medicare Spends Its Way out of Trouble: 2003–2010

The 2003 Medicare Modernization and Improvement Act (MMA) established a larger role for private health plans in Medicare largely based on a shift away from a focus on cost containment and regulation and toward the “accommodation” of private interests (e.g., the pharmaceutical and insurance industries) and an ideological preference for market-based solutions that stemmed from the Republican control of both the executive and legislative branches of government ( Oberlander 2007 ).

Achieving MA's promise? 2010 and Beyond

The ACA, signed into law by President Obama in March 2010, included another major restructuring of the MA program and significant cuts in MA plan payments. Specifically, for 2011, the payment benchmarks against which plans bid are frozen at 2010 levels.

Acknowledgments

The authors gratefully acknowledge funding from the National Institutes on Aging through P01 AG032952, The Role of Private Plans in Medicare. Joseph Newhouse wishes to disclose that he is a director of and holds equity in Aetna, which sells Medicare Advantage plans.

Endnotes

1 Excellent quantitative summaries of the Part C experience are available from the Medicare Payment Advisory Commission (MedPAC), through its annual reports ( http://www.medpac.gov ), and from other researchers (e.g., see Gold 2005, 2007, 2009; Zarabozo and Harrison 2009 ).

When is Medicare open enrollment?

Each year, there’s a Medicare Advantage Open Enrollment Period from January 1 – March 31. During this time, if you’re in a Medicare Advantage Plan and want to change your health plan, you can do one of these: Switch to a different Medicare Advantage Plan with or without drug coverage.

Is Medicare Advantage open enrollment?

The Medicare Advantage Open Enrollment Period isn’t for people who already have Original Medicare. It’s important to understand and be confident in your Medicare coverage choices. If you have a Medicare Advantage Plan and want to change your plan, check out your options today.

What is the evolution of private plans in Medicare?

The Evolution of Private Plans in Medicare: Exhibit 1 - Infogram. Plans were required to submit statements that estimated the cost of providing traditional Medicare benefits and, if their payment rates exceeded those costs, to provide additional benefits to their enrollees equal in actuarial value to the surplus.

What is Medicare Advantage?

These plans, now known as Medicare Advantage or Medicare Part C, operate under risk-based contracts — the plans agree to assume liability for beneficiaries’ health expenses in exchange for a monthly, per-person (also known as capitated) sum.

How long has Medicare been involved with HMOs?

Medicare has involved HMOs since 1966. Because these private plans use salaried physicians, they were originally paid on a reasonable-cost basis for services that Medicare otherwise would have paid on a reasonable-charge basis. 4 Under the 1972 Social Security Amendments, preexisting plans could continue to be paid on a reasonable-cost basis, but new plans would operate on a risk-sharing contract. The expenses of each plan were compared to the adjusted average per capita cost (AAPCC) for their enrollees under traditional Medicare. If the HMO’s costs exceeded the AAPCC, it could carry the excess cost into subsequent years to be offset against any future savings. If the HMO’s costs were lower, up to 20 percent of the difference was shared evenly between the HMO and the government (with the government keeping any additional savings). 5

What is Medicare Modernization Act?

In addition to establishing Medicare Part D, the Medicare Modernization Act of 2003 (MMA) significantly altered how private plans (now renamed Medicare Advantage) were paid. The law limited enrollees to one switch per year during the open enrollment period and allowed plans to include the new drug benefit (MA–PD). 23

How many HMOs were contracted with Medicare in 1979?

By 1979, 65 HMOs were contracting with Medicare, although only one had a risk-sharing contract. 6 Nevertheless, the prospect of an alternative to traditional Medicare spurred continued interest in risk-contracted HMOs within Medicare. 7.

What was the BBA?

The Balanced Budget Act of 1997 (BBA) made significant changes to how Medicare paid risk plans in the new Medicare+Choice (Medicare Part C) program. It scrapped the previous payment formula and largely reduced payment rates to plans. 16 In response to reports of favorable selection, the BBA established new risk-adjustment measures based on health status and an annual enrollment period, with only one switch allowed outside that period. 17

When did HMOs rise?

The Rise of HMOs (1982–1997) The 1972 Amendments gave the Health Care Financing Administration (HCFA) — subsequently renamed the Centers for Medicare and Medicaid Services (CMS) — the authority to conduct demonstrations of payment models that might reduce program spending, improve health care quality, or both.