Full Answer

When did Medicare Part B and Part D premiums go up?

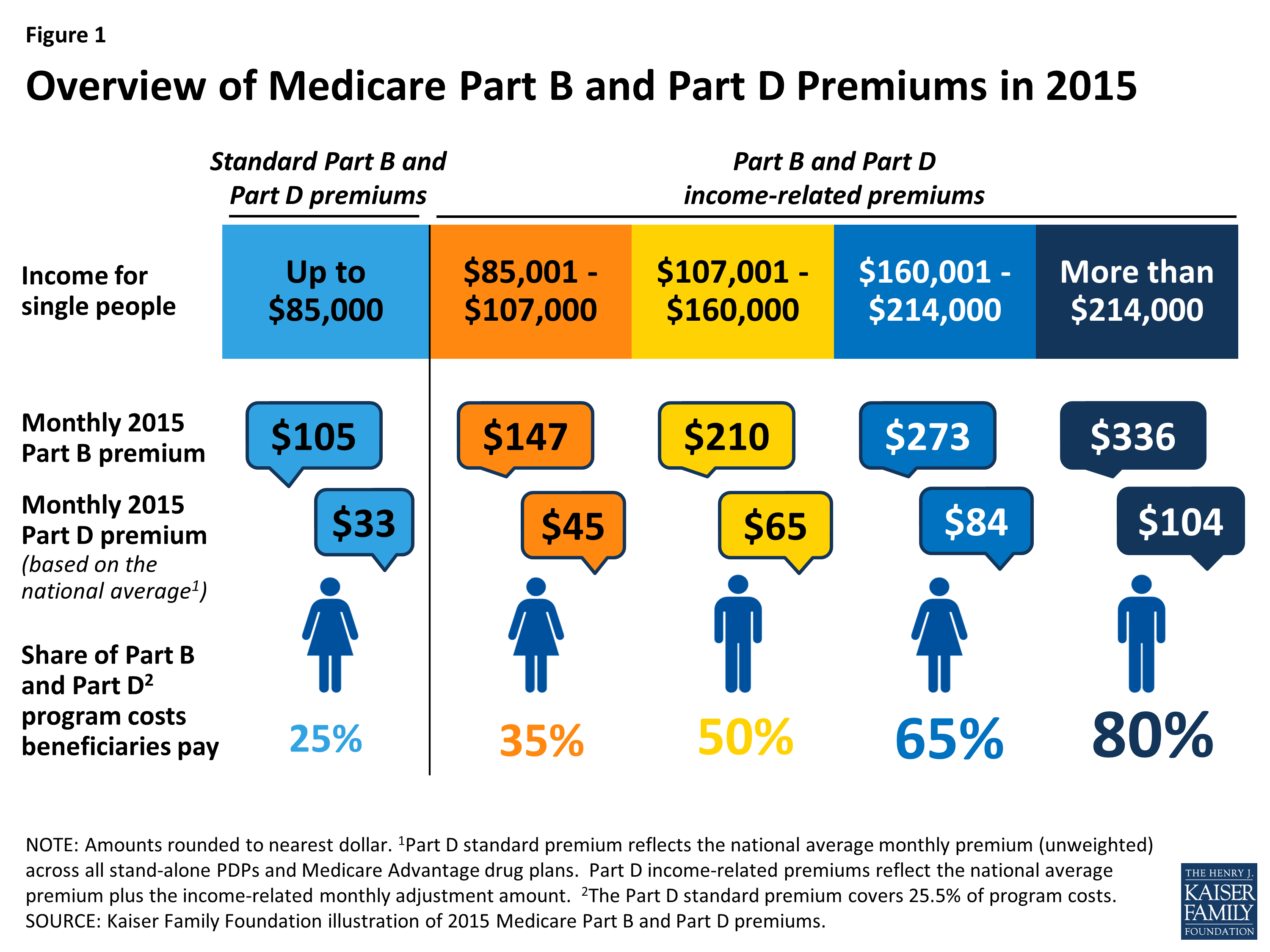

People on Medicare with incomes above $85,000 for individuals and $170,000 for couples are currently required to pay higher premiums for Medicare Part B and Part D. These premiums were first required for Part B in 2007 and for Part D in 2011, and have been modified over time, with the latest change taking effect in 2019 (Figure 1).

What was the monthly premium for Medicare Part B in 1966?

Just like today, Medicare Part A was hospital insurance and Medicare Part B was medical insurance. Most people don’t pay a premium for Part A but do need to pay one for Part B. In 1966, the monthly Part B premium was $3. In 2021, the Part B premium is $148.50.

Will My Medicare premiums be higher because of my higher income?

Will my Medicare premiums be higher because of my higher income? Some people with higher income may pay a larger percentage of their monthly Medicare Part B and prescription drug costs based on their income. We call the additional amount the income-related monthly adjustment amount.

What did Medicare cover when it first began?

When Medicare first began, it included just Medicare Part A and Medicare Part B, and it covered only people ages 65 and over. Over the years, additional parts — including Part C and Part D — have been added. Coverage has also been expanded to include people under age 65 who have certain disabilities and chronic conditions. How did Medicare begin?

When did Medicare B Irmaa start?

2007What is IRMAA? The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

Do high-income earners pay more for Medicare?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare.

When did Medicare premiums increase?

November 12, 2021The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

What year is Medicare premium based on?

To determine your 2022 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2021 for tax year 2020. Sometimes, the IRS only provides information from a return filed in 2020 for tax year 2019.

What is the Magi for Medicare for 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

How do I stop Irmaa?

Reducing your MAGI (Modified Adjusted Gross Income) will help you reduce or avoid IRMAA in future years. To appeal IRMAA in 2022, you will need to file Form SSA-44. From 2007 to 2021, IRMAA bracket increases have ranged from 4.73% – 8.02%. The official 2023 IRMAA brackets will be announced later this year.

Why did Medicare premiums go up for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Why has Medicare become more expensive in recent years?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Will the 2022 Medicare premium be reduced?

Medicare Part B Premiums Will Not Be Lowered in 2022.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

When did Medicare start?

In 1962, President Kennedy introduced a plan to create a healthcare program for older adults using their Social Security contributions, but it wasn’t approved by Congress. In 1964, former President Lyndon Johnson called on Congress to create the program that is now Medicare. The program was signed into law in 1965.

When did Medicare start paying the same amount?

Before 1988, everyone paid the same amount for Medicare, regardless of income. Today people with higher incomes might pay more, while people with lower incomes might pay less. This change began in 1988 with the creation of programs to help lower-income enrollees pay for their Medicare premiums and other costs.

What is a Medigap plan?

Medigap, also known as Medicare supplement insurance, helps you pay the out-of-pocket costs of original Medicare, like copays and deductibles. These plans are sold by private insurance companies. However. starting in 1980, the federal government began regulating them to ensure they meet certain standards.

How many people will be covered by Medicare in 2021?

That first year, 19 million Americans enrolled in Medicare for their healthcare coverage. As of 2019, more than 61 million Americans were enrolled in the program.

What age does Medicare cover?

When Medicare first began, it included just Medicare Part A and Medicare Part B, and it covered only people ages 65 and over. Over the years, additional parts — including Part C and Part D — have been added. Coverage has also been expanded to include people under age 65 who have certain disabilities and chronic conditions.

What was Medicare Part A and Part B?

Just like today, Medicare Part A was hospital insurance and Medicare Part B was medical insurance. Most people don’t pay a premium for Part A but do need to pay one for Part B. In 1966, the monthly Part B premium was $3. Trusted Source.

When did Medicare expand to include people with disabilities?

The addition of coverage for people with disabilities in 1972. In 1972, former President Richard Nixon expanded Medicare coverage to include people with disabilities who receive Social Security Disability Insurance. He also extended immediate coverage to people diagnosed with end stage renal disease (ESRD).

What was the original Medicare?

Original Medicare included two related healthcare insurance programs. The first was a hospital insurance plan to give coverage for hospitalization and related care. The second was a medical insurance plan to provide coverage of doctor visits and other health services that the hospital plan did not cover.

When did Obama sign the ACA?

On March 23, 2010#N#Trusted Source#N#, President Barack Obama signed the Patient Protection and Affordable Care Act (ACA) into law. This act prevented insurance companies from denying coverage or charging more for coverage based on a person’s health. The bill also expanded Medicare’s preventive and drug services.

What is Medicare Part C?

These plans were called Medicare Part C, also known as Advantage plans.

Is Medicare for all a voting age?

of voting age favor expanding the current Medicare program to include every person in the country. This concept, called Medica re for All, could involve trading higher taxes for lower out-of-pocket healthcare costs.

Will Medicare run out of money in 2026?

Due to the rising number of older adults in the U.S., the agency is facing monetary challenges. The trust fund that pays for Part A will run out of money in 2026 , according to a report by the Congressional Research Service.

What are the proposed changes to Medicare?

Several policymakers and groups have proposed modifications to Medicare’s current income-related premiums, including the Obama Administration as part of the President’s Fiscal Year (FY) 2013 and FY 2014 budgets , the Bipartisan Policy Center (BPC), the Center for American Progress (CAP), and the Moment of Truth Project (headed by Erskine Bowles and Alan Simpson, co-chairs of the National Commission on Fiscal Responsibility and Reform) (see Table 1 for a detailed comparison of these proposals). Each of the proposals increases the share of beneficiaries that would be required to pay the income-related Part B and D premiums relative to current law, up to 10 percent of all beneficiaries (CAP), 15 percent (initially) (Moment of Truth), 17 percent (BPC), and 25 percent (President’s FY 2013 and 2014 budgets). The CAP, Moment of Truth, and President’s budget proposals also increase the share of premiums that would be paid by higher-income beneficiaries. The President’s FY 2014 proposal also expands the number of levels of income-related premium payments. This analysis focuses on the parameters outlined in the President’s FY 2014 budget proposal. Under this proposal, the current freeze on income thresholds enacted in the ACA would be extended beyond 2019 until 25 percent of beneficiaries pay an income-related premium. In addition, beginning in 2017, this proposal would increase the lowest income-related premium percentage by five percentage points, from 35 percent to 40 percent; increase the highest amount from 80 percent to 90 percent; and expand the number of tiers of income-related premiums from four under current law (35, 50, 65, and 80 percent) to nine (40, 46.5, 53.0, 59.5, 66.0, 72.5, 79.0, 85.5, and 90.0 percent). The proposal also lowers the income threshold for those paying the highest income-related premium amount from $214,000 to $196,000 (see Table 1 for the income amounts corresponding to the income-related premium percentages under current law and the President’s proposal). This analysis determines the year in which 25 percent of beneficiaries would pay income-related premiums under the President’s proposal, converts the income thresholds in that year into 2013 dollars, and estimates the increase in premiums that higher-income beneficiaries would pay based on the proposed income thresholds and higher premium percentages. The analysis incorporates estimates and projections from the DYNASIM microsimulation model developed by researchers at the Urban Institute (see Methodology below for details).

What percentage of Medicare beneficiaries will pay income related premiums in 2030?

In 2030, 18.9 percent of all Medicare beneficiaries (14.0 million) would pay an income-related premium, compared to 7.2 percent (5.3 million) under current law—an increase of 8.7 million beneficiaries who would be paying higher premiums that year. In 2036, 25.4 percent of all Medicare beneficiaries ...

How much is Medicare Part B?

For most beneficiaries, Part B premiums are set to equal 25 percent of the projected annual Part B expenditures per enrollee ages 65 and over and the remaining 75 percent of Part B program costs is funded by general revenues.

How much is Part D insurance in 2022?

Based on projections, the income-related Part D premium is estimated to range from $78 to $177 per month in 2022, assuming a national average premium of $57 per month that year and no change in current law ( Table 4 ). 24.

Do Medicare Part D plans have to pay higher premiums?

Part D Premiums. Higher-income Medicare beneficiaries enrolled in Part D prescription drug plans are also required to pay higher Part D premiums as a result of changes made in the ACA. In the years after the Medicare Part D benefit was implemented in 2006, but prior to 2011, premiums varied by drug plan but all enrollees in the same plan within ...

Will Medicare income be indexed in 2020?

In 2020 and subsequent years, the income thresholds will once again be indexed to inflation as if they had not been frozen between 2011 and 2019. Under current law12: In 2013, 5.0 percent of Part B enrollees (2.4 million beneficiaries) are estimated to pay the income-related Part B premium. 13. The share of Medicare beneficiaries required ...

Will Medicare drop out of Part B?

In addition, there is some possibility that such changes could lead some higher-income beneficiaries to drop out of Medicare Part B and instead self-insure, which could result in higher premiums for all others who remain on Medicare if the dropout group is large and relatively healthy.

What percentage of Medicare premiums will increase?

As a result, the number and share of beneficiaries paying the top 85 percent level of income-related premiums will increase as the number of people on Medicare continues to grow in future years and as their incomes rise.

When will Medicare pay 85 percent of the cost?

The most recent change to Medicare’s income-related premiums was incorporated in the Bipartisan Budget Act of 2018 (BBA). This change will affect beneficiaries with incomes above $500,000 ($750,000 for married couples) by requiring them to pay 85 percent of program costs beginning in 2019, up from 80 percent prior to 2019.

How much is Part B premium?

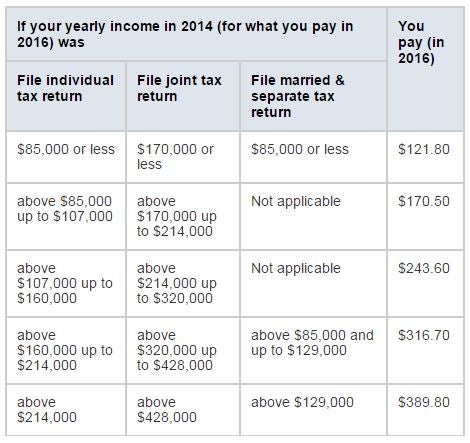

In 2019, Part B premiums for higher-income beneficiaries range from $189.60 per month for individuals with annual incomes above $85,000 up to $107,000 who are required to pay 35 percent of program costs, to $460.50 per month for individuals with incomes above $500,000 who are required to pay 85 percent of program costs (Figure 2).

How much is Part B insurance?

In 2019, the Part B standard monthly premium is $135.50, up from $134 in 2018; for Part D, the national average monthly premium for 2019 is $33.19, but actual monthly premiums for stand-alone Part D drug plans vary across plans and regions from a low of $10.40 to a high of $156.

What is the Medicare premium for 2019?

In 2019, the Part B standard monthly premium is $135.50, up from $134 in 2018; for Part D, the national average monthly premium ...

When did the Part D premium start?

The Part D income-related premium was established by the Affordable Care Act (ACA) in 2010 and took effect in 2011. Under this provision, Part D enrollees with higher incomes were required to pay an income-related premium surcharge in addition to the monthly premium for their chosen Part D plan. The Part D income-related surcharge is calculated as ...

Does Medicare pay monthly premiums?

Medicare’s Income-Related Premiums Under Current Law and Changes for 2019. For several years, Medicare beneficiaries with relatively high incomes have been required to pay income-related monthly premiums for Part B, which covers physician and other outpatient services, and for Part D, which covers outpatient prescription drugs.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.