What is Medicare Prospective Payment System (PPS)?

Understanding the Medicare Prospective Payment System. The Medicare Prospective Payment System (PPS) was introduced by the federal government in October, 1 1983, as a way to change hospital behavior through financial incentives that encourage more cost-efficient management of medical care.

When did Medicare start paying for hospital inpatient services?

Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospita … In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965.

What was the most significant change in Medicare in 1983?

In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965. Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospita …

When was Medicare invented?

Take a trip into history to learn about Medicare’s inception. When Did Medicare Start? Medicare officially began once President Lyndon B. Johnson signed it into law on July 30, 1965. At slightly more than 60 years old, Medicare has grown and changed in the attempt to meet the needs of its growing population of older and disabled adults.

When did Medicare switch to PPS?

1984The Medicare Case-Mix Index, which increased sharply with the implementation of PPS in fiscal year 1984, has continued to increase, at an annual rate of 3 percent for fiscal years 1984-86.

When did Medicare Move to prospective payment system?

At the beginning of the Medicare program, providers were paid based on fee-for-service. In 1997, many of the Medicare payment systems were converted to prospective payment systems (PPSs).

When did prospective payment system start?

Prospective payment systems are intended to motivate providers to deliver patient care effectively, efficiently and without over utilization of services. The concept has its roots in the 1960s with the birth of health maintenance organizations (HMOs).

What is Medicare PPS?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

What is the difference between FFS and PPS?

Compared to fee-for-service plans, which reward the provider for the volume of care provided and can create an incentive for unnecessary treatment, the PPS payment is based on multiple factors including service location and patient diagnosis.

What are the main advantages of a prospective payment system?

One important advantage of Prospective Payment is the fact that code-based reimbursement creates incentives for more accurate coding and billing. PPS results in better information about what payers are purchasing and this information can be used, in turn, for network development, medical management, and contracting.

What federal law was enacted that fundamentally changed the reimbursement system from a retrospective to a prospective payment system?

The Balanced Budget Act of 1997 (BBA) (Public Law 105–33), which was enacted on August 5, 1997, significantly changed the way Medicare pays for home health services. Until the implementation of the HH PPS on October 1, 2000, HHAs received payment under a retrospective reimbursement system.

Which type of hospital is excluded from the inpatient Prospective Payment System?

rehabilitation hospitalA rehabilitation hospital or unit must meet the requirements specified in § 412.29 of this subpart to be excluded from the prospective payment systems specified in § 412.1(a)(1) of this subpart and to be paid under the prospective payment system specified in § 412.1(a)(3) of this subpart and in subpart P of this part.

Which act resulted in a prospective payment system PPS that issues a predetermined payment for inpatient services?

TEFRATEFRA also enacted a prospective payment system (PPS), which issues a predetermined payment for inpatient services. Previously, reimbursement was generated on a per diem basis, which issued payment based on daily rates.

Is prospective payment system good or bad?

Key Findings Medicare's prospective payment system (PPS) did not lead to significant declines in the quality of hospital care. Mortality rates declined for all patient groups examined, and other outcome measures also showed improvement.

What is a PPS code?

The Centers for Medicare and Medicaid Services (CMS) refers to the Prospective Payment System (PPS) as a “method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount.

Which established the Medicare clinical laboratory fee schedule?

Section 1834A of the Act, as established by Section 216(a) of the Protecting Access to Medicare Act of 2014 (PAMA), required significant changes to how Medicare pays for Clinical Diagnostic Laboratory Tests (CDLTs) under the CLFS.

When did nursing homes get reimbursed?

Until July, 1998, nursing homes used to be reimbursed for care provided to Medicare Part A-covered residents residing in Medicare-certified beds through a retrospective cost-based system. The rate received by a nursing home for a Medicare covered resident was based on three components:

Who was the administrator of the Health Care Financing Administration in 1999?

In an April 28, 1999 letter to the Center for Medicare Advocacy regarding the deleted examples of skilled nursing, Nancy-Ann Min DeParle, the Administrator of the Health Care Financing Administration, also made this important point:

What is the prospective per diem rate for Medicare?

The prospective rate is based upon a case-mix system, with the reimbursement premised upon measuring the type and intensity of the care required by each resident and the amount of resources which are utilized to provide the care required.

Why are SNFs reluctant to accept Medicare?

Many SNFs have informally communicated a reluctance to accept such individuals when Medicare is the apparent payment source, because of the costs involved. As a result, it appears that individuals who have these needs encounter difficulties to obtaining SNF placement.

What are the most critical nursing activities that can invoke Medicare coverage?

Three of the most critical nursing activities that can invoke Medicare coverage included in the administrative criteria are as follows: 1. Overall management and evaluation of an individual's care plan ( 42 CFR 409.33 (a) (1)); 2. Observation and assessment of the patient's changing condition.

Is physical therapy covered by Medicare?

Physical therapy, for example, was covered separately by Medicare based upon a determination regarding medical necessity . There was, therefore, a fiscal incentive for nursing homes to provide such therapy to Medicare Part A covered residents; Capital costs: costs of land, buildings and equipment.

When did Medicare start?

Medicare officially began once President Lyndon B. Johnson signed it into law on July 30, 1965. At slightly more than 60 years old, Medicare has grown and changed in the attempt to meet the needs of its growing population of older and disabled adults.

Why was Medicare established?

The government’s response to the financial ruination occurring throughout the country’s older adult population, Medicare was established to provide coverage for both in-hospital and outpatient medical services.

How many Americans are covered by Medicare?

Ensuring access to inpatient and outpatient medical care, a wide range of specialists and diagnostic services, Medicare currently insures more than 61 million Americans — or more than 18% of the population. Medicare’s coverage continues to expand to give beneficiaries access to the latest testing and treatment options for various conditions.

What is Medicare Supplement?

Today, Medicare is a broad term that can be used to describe Parts A and B, Part C or Medicare Advantage plans, or standalone Part D plans that offer prescription drug coverage. There are also Medicare Supplement policies designed to cover a recipient’s cost share for medical services (usually 20% of the allowed charge).

What percentage of the population had health insurance before Medicare?

Prior to Medicare, Americans who had any form of health insurance accounted for less than half of the population. Citizens and, eventually, every level of government became concerned about the problem unfolding in the country.

Was Medicare available to low income people?

Before Medicare, there was some funding available for low or very low-income Americans, but the problem reached further into the middle and even upper class. Not just a problem for low-income individuals, large medical bills quickly depleted someone's life savings and earned assets, such as homes or businesses.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

When did the Home Health PPS rule become effective?

Effective October 1, 2000, the home health PPS (HH PPS) replaced the IPS for all home health agencies (HHAs). The PPS proposed rule was published on October 28, 1999, with a 60-day public comment period, and the final rule was published on July 3, 2000. Beginning in October 2000, HHAs were paid under the HH PPS for 60-day episodes ...

What is PPS in home health?

The Balanced Budget Act (BBA) of 1997, as amended by the Omnibus Consolidated and Emergency Supplemental Appropriations Act (OCESAA) of 1999, called for the development and implementation of a prospective payment system (PPS) for Medicare home health services.

When will HHAs get paid?

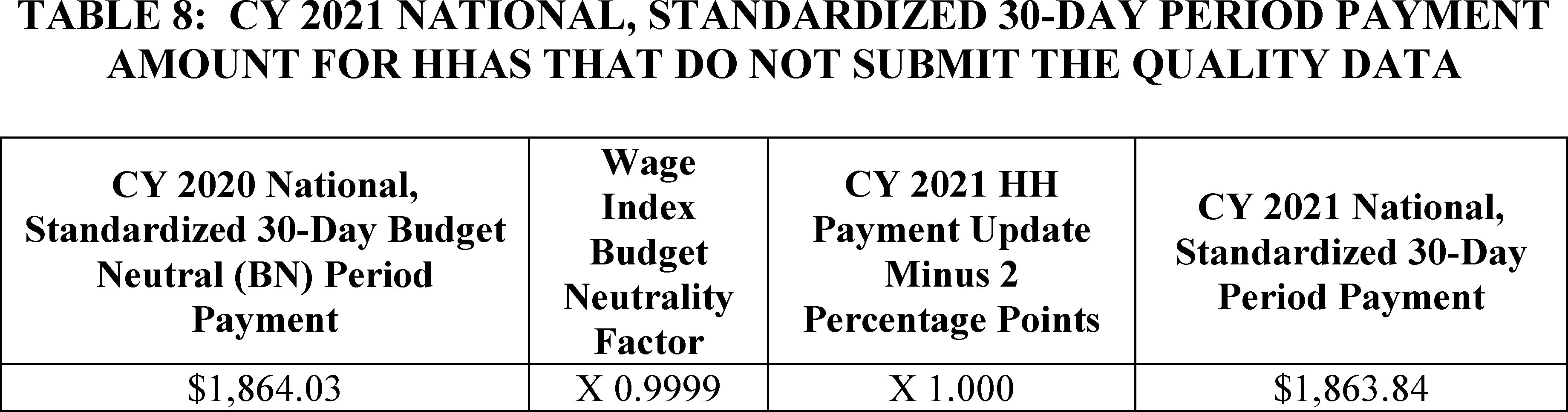

30-Day Periods of Care under the PDGM. Beginning on January 1 2020, HHAs are paid a national, standardized 30-day period payment rate if a period of care meets a certain threshold of home health visits. This payment rate is adjusted for case-mix and geographic differences in wages. 30-day periods of care that do not meet ...

When did Medicare become a prospective payment system?

The Medicare prospective payment system. In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965. Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospita …. ...

When did the Medicare program start?

The program will be phased in over a four-year period that began October 1, 1983. Several types of hospitals and distinct part units of general hospitals are excluded from the system until 1985, when Congress will receive a report on a method of paying them prospectively.

When did Medicare change?

In 1983 Congress adopted the most significant change in the Medicare program since its inception in 1965. Along with measures to ensure the solvency of the Social Security System into the next century, Congress approved a system of prospective payment for hospital inpatient services, whereby hospitals are paid a fixed sum per case according ...

When was the DRG rate published?

Information used to calculate the DRG rates was published September 1, 1983, as part of the interim final regulations. Other third party payers, such as state Medicaid systems and insurance companies, are considering converting to this method of payment, and several have adopted it.

Zipcode to Carrier Locality File

This file is primarily intended to map Zip Codes to CMS carriers and localities. This file will also map Zip Codes to their State. In addition, this file contains an urban, rural or a low density (qualified) area Zip Code indicator.

Provider Center

For a one-stop resource web page focused on the informational needs and interests of Medicare Fee-for-Service (FFS) providers, including physicians, other practitioners and suppliers, go to the Provider Center (see under "Related Links" below).

When was PPS established?

The PPS was established by the Centers for Medicare and Medicaid Services (CMS), as a result of the Social Security Amendments Act of 1983, specifically to address expensive hospital care. Regardless of services provided, payment was of an established fee.

What is PPS in healthcare?

A prospective payment system ( PPS) is a term used to refer to several payment methodologies for which means of determining insurance reimbursement is based on a predetermined payment regardless of the intensity of the actual service provided. It includes a system for paying hospitals based on predetermined prices, from Medicare.