Medicare Prescription Drug, Improvement, and Modernization Act

The Medicare Prescription Drug, Improvement, and Modernization Act, also called the Medicare Modernization Act or MMA, is a federal law of the United States, enacted in 2003. It produced the largest overhaul of Medicare in the public health program's 38-year history.

Full Answer

Will My Medicare premiums be based on my previous year’s income?

MACRA also extended the QI program for certain low-income members’ Part B premium payments (among other extensions of Medicaid and CHIP – related programs). Premiums for Part B have increased in recent years, after declining in 2012 and then remaining steady for the next three years. When Medicare Part B debuted, enrollees’ premiums were set at $3 per month.

When did Medicare start?

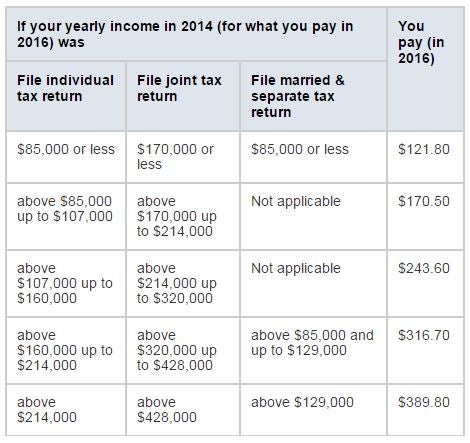

Nov 12, 2021 · Medicare Part B Income-Related Monthly Adjustment Amounts. Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B. The 2022 Part B total premiums for high-income beneficiaries are shown in the following table:

When did Medicare Part B premiums go up?

Dec 13, 2021 · 2020 Medicare Part B Premiums . Medicare Part B premiums for 2020 increased by $9.10 from the premium for 2019. The 2020 premium rate started at $144.60 per month and increased based on your income to up to $491.60 for the 2020 tax year. Your premium depended on your MAGI from your tax return two years before the current year (in this case, 2018).

How does the Medicare premium work?

Feb 15, 2022 · If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2022 may be based on your reported income in 2020.

Has Medicare premiums always been based on income?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What year income is used to determine Medicare premiums?

The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.Dec 2, 2021

When Did Medicare Start Irmaa?

2003IRMAA was first enacted in 2003 as a provision of the Medicare Modernization Act. This provision applied only to high-income enrollees of Medicare Part B. In 2011, IRMAA was expanded under the Affordable Care Act to include high-income enrollees of Medicare Part D as well.Nov 11, 2021

When was the last time Medicare Part B increased?

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the projected 2016 increase.

Is Social Security included in modified adjusted gross income?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

Are Medicare premiums recalculated every year?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

What will Irmaa be in 2022?

How much are Part B IRMAA premiums?Table 1. Part B – 2022 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or less$170.10> $91,000 – $114,000> $182,000 – $228,000$238.10> $114,000 – $142,000> $228,000 -$284,000$340.203 more rows

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

Did Medicare premiums go up for 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Are Medicare Part B premiums going up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

When did Medicare start limiting out-of-pocket expenses?

In 1988 , Congress passed the Medicare Catastrophic Coverage Act, adding a true limit to the Medicare’s total out-of-pocket expenses for Part A and Part B, along with a limited prescription drug benefit.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

How does the population age affect Medicare?

As the population ages, the ratio of employed workers (who support Medicare through taxes) to retirees (who receive the benefits from those taxes) continues to shrink. The cost of health care continues to rise.

What percentage of Medicare Part B funding came from beneficiaries?

Approximately 27 percent of Medicare Part B funding in 2017 came from beneficiaries’ premiums. Nearly 71 percent of Part B funding in 2017 came from general revenue, which consists mostly of federal income taxes. Increasing the Part B premium by only a small percentage for each beneficiary can raise tens of millions of dollars for ...

How to save money on Medicare?

If you’re concerned about the rising cost of Medicare, you can consider a few options that may be able to help you save on your out-of-pocket Medicare costs: 1 Medicare Savings Programs are available to qualified Medicare beneficiaries who have limited incomes and financial resources. These programs can help cover specific Medicare premiums, deductibles and/or coinsurance costs. 2 Medicare Supplement Insurance plans (also called Medigap) can provide coverage for certain Medicare out-of-pocket expenses. While Medigap plans don’t cover the Part B premium, some plans may help cover the Medicare Part B deductible, copayments and other expenses. 3 Medicare Advantage plans (Medicare Part C) provide all the same benefits as Medicare Part A and Part B (Original Medicare).#N#Most Medicare Advantage plans also offer extra benefits such as dental, vision and prescription drug coverage. You must still pay your Medicare Part B premium, but the money you can potentially save on other covered health care costs can help you better afford your Part B premium.

How much does Medicare Part B coinsurance go up?

Medicare Part B coinsurance costs tend to remain steady at 20 percent of the Medicare-approved amount for a medical service or item, but that 20 percent share can go up as related health care industry costs increase each year. There are a number of contributing factors to why Medicare costs go up each year, such as:

How much is the Part B premium?

The premium went up even more for higher income earners who pay an income-related monthly adjustment amount (IRMAA), with the most expensive Part B premium increasing from $428.60 per month in 2018 to $460.50 per month in 2019.

Does Medicare Part B go up every year?

Does the Medicare Part B premium go up every year? The Part B premium is hardly the only Medicare cost that will go up every year. The Medicare Part A (hospital insurance) premium also increases annually for those who are required to pay it. Medicare Part A and Part B deductibles typically increase each year, as well.

Does Medicare go up or down each year?

Your Medicare premiums aren’t the only thing that will go up each year : your Social Security benefit payment will typically also increase each year. The Social Security Administration (SSA) uses the consumer price index for workers (CPI-W) to make annual adjustments to benefit payment amounts.

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

Medicare Part B Part D Irmaa Premium Brackets

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

What are the proposed changes to Medicare?

Several policymakers and groups have proposed modifications to Medicare’s current income-related premiums, including the Obama Administration as part of the President’s Fiscal Year (FY) 2013 and FY 2014 budgets , the Bipartisan Policy Center (BPC), the Center for American Progress (CAP), and the Moment of Truth Project (headed by Erskine Bowles and Alan Simpson, co-chairs of the National Commission on Fiscal Responsibility and Reform) (see Table 1 for a detailed comparison of these proposals). Each of the proposals increases the share of beneficiaries that would be required to pay the income-related Part B and D premiums relative to current law, up to 10 percent of all beneficiaries (CAP), 15 percent (initially) (Moment of Truth), 17 percent (BPC), and 25 percent (President’s FY 2013 and 2014 budgets). The CAP, Moment of Truth, and President’s budget proposals also increase the share of premiums that would be paid by higher-income beneficiaries. The President’s FY 2014 proposal also expands the number of levels of income-related premium payments. This analysis focuses on the parameters outlined in the President’s FY 2014 budget proposal. Under this proposal, the current freeze on income thresholds enacted in the ACA would be extended beyond 2019 until 25 percent of beneficiaries pay an income-related premium. In addition, beginning in 2017, this proposal would increase the lowest income-related premium percentage by five percentage points, from 35 percent to 40 percent; increase the highest amount from 80 percent to 90 percent; and expand the number of tiers of income-related premiums from four under current law (35, 50, 65, and 80 percent) to nine (40, 46.5, 53.0, 59.5, 66.0, 72.5, 79.0, 85.5, and 90.0 percent). The proposal also lowers the income threshold for those paying the highest income-related premium amount from $214,000 to $196,000 (see Table 1 for the income amounts corresponding to the income-related premium percentages under current law and the President’s proposal). This analysis determines the year in which 25 percent of beneficiaries would pay income-related premiums under the President’s proposal, converts the income thresholds in that year into 2013 dollars, and estimates the increase in premiums that higher-income beneficiaries would pay based on the proposed income thresholds and higher premium percentages. The analysis incorporates estimates and projections from the DYNASIM microsimulation model developed by researchers at the Urban Institute (see Methodology below for details).

What percentage of Medicare beneficiaries will pay income related premiums in 2030?

In 2030, 18.9 percent of all Medicare beneficiaries (14.0 million) would pay an income-related premium, compared to 7.2 percent (5.3 million) under current law—an increase of 8.7 million beneficiaries who would be paying higher premiums that year. In 2036, 25.4 percent of all Medicare beneficiaries ...

How much is Medicare Part B?

For most beneficiaries, Part B premiums are set to equal 25 percent of the projected annual Part B expenditures per enrollee ages 65 and over and the remaining 75 percent of Part B program costs is funded by general revenues.

How much is Part D insurance in 2022?

Based on projections, the income-related Part D premium is estimated to range from $78 to $177 per month in 2022, assuming a national average premium of $57 per month that year and no change in current law ( Table 4 ). 24.

Do Medicare Part D plans have to pay higher premiums?

Part D Premiums. Higher-income Medicare beneficiaries enrolled in Part D prescription drug plans are also required to pay higher Part D premiums as a result of changes made in the ACA. In the years after the Medicare Part D benefit was implemented in 2006, but prior to 2011, premiums varied by drug plan but all enrollees in the same plan within ...

Will Medicare income be indexed in 2020?

In 2020 and subsequent years, the income thresholds will once again be indexed to inflation as if they had not been frozen between 2011 and 2019. Under current law12: In 2013, 5.0 percent of Part B enrollees (2.4 million beneficiaries) are estimated to pay the income-related Part B premium. 13. The share of Medicare beneficiaries required ...

Will Medicare drop out of Part B?

In addition, there is some possibility that such changes could lead some higher-income beneficiaries to drop out of Medicare Part B and instead self-insure, which could result in higher premiums for all others who remain on Medicare if the dropout group is large and relatively healthy.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.