When did Part D of Medicare start?

Medicare Part D. Part D was originally proposed by President Clinton in 2000 and enacted as part of the Medicare Modernization Act of 2003 (which also made changes to the public Part C Medicare health plan program) and went into effect on January 1, 2006.

When did the Medicare Advantage plans start?

When Did Medicare Advantage Plans Start? Medicare Advantage plans are private plans that date back to 1966. Medicare Advantage plans were higher-risk contracts; the policies agreed to take responsibility for their members’ health costs. Part C was to provide healthcare at an affordable rate while offering more benefits than Parts A and B offers.

When can I Change my PDP for Medicare?

If after the first time you enroll you decide to change your PDP, you can do so each year during the Medicare Annual Enrollment Period, which begins October 15 and ends December 7.

What are Medicare Prescription Drug Plans (PDPs)?

Medicare Prescription Drug Plans (sometimes called “PDPs”) add prescription drug coverage to Original Medicare, some Medicare Private Fee-for-Service (PFFS) Plans, some Medicare Cost Plans, and Medicare Medical Savings Account (MSA) Plans. 2.

When did Medicare Part D benefits begin?

January 1, 2006Introduction. The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) became law in December 2003. Among other provisions, the MMA created the Part D drug benefit, which became available to Medicare beneficiaries on January 1, 2006.

When were parts C and D added to Medicare?

Medicare Part C, also known as Medicare Advantage, became law in 1982 , and its original name was Medicare+Choice. The United States Congress added Medicare Part D in 2003 to cover outpatient prescription medications.

What President started Medicare Part D?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers.

Is Medicare Part D the same as a PDP?

Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B)

Do you need Medicare Part D if you have Part C?

Can you have both Medicare Part C and Part D? You can't have both parts C and D. If you have a Medicare Advantage plan (Part C) that includes prescription drug coverage and you join a Medicare prescription drug plan (Part D), you'll be unenrolled from Part C and sent back to original Medicare.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

When did Medicare start paying for prescriptions?

Bush signs the Medicare Modernization Act, which establishes a prescription drug (Part D) benefit available to all Medicare beneficiaries (beginning in 2006) and replaces the Medicare+Choice program with the Medicare Advantage program, making additional types of private plans available and substantially increasing ...

Why was Medicare Part D established?

Background. The Medicare program was enacted in 1965 to provide subsidized health coverage for the elderly and disabled. The program initially covered hospital stays (Part A) and physician office visits (Part B), and Medicare paid for the prescription drugs used in those settings.

What does PDP mean in Medicare?

Medicare Prescription Drug PlanMedicare Cost Plan Join a Medicare Prescription Drug Plan (PDP).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the deductible of a PDP plan?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2022, the Medicare Part D deductible can't be greater than $480 a year.

When did Medicare start discriminating against genetic information?

Another turning point for Medicare came in 2008 with the introduction of the Genetic Information Nondiscrimination Act. This act made it illegal for a health insurance plan provider to discriminate against genetic information.

What act made sure any pre-existing conditions that had exclusion from the previous policy were also excluded from the new

Under the Consolida ted Appropriations Act of 2001, these users were able to purchase new supplemental coverage. This act made sure any pre-existing conditions that had exclusion from the previous policy were also excluded from the new plan.

What is the Catastrophic Coverage Act?

One of these acts was the Medicare Catastrophic Coverage Act. This act implements several restrictions to further protect consumers, such as out-of-pocket maximums and premiums. During this time, several voluntary guidelines became mandatory standards by the federal government.

What was the last act passed in the nineties?

The last act to be passed in the nineties was the Omnibus Consolidated and Emergency Supplemental Appropriation Act of 1999. The most important part of this act called on the providers that paid for these specific plans. With the passing of this act, they were now subject to civil penalties.

What Is PDP?

Also called Part D coverage, PDP is a standalone plan that offers only prescription drug coverage. Older adults and disabled individuals who receive Medicare benefits are at risk of going into debt to ensure access to life-saving prescription medication.

When Did Part D Start?

Standalone prescription drug plans are a result of Part D, which was signed into law by President George W. Bush. The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) led to the expansion of Medicare coverage to include outpatient prescription drugs for the first time in history.

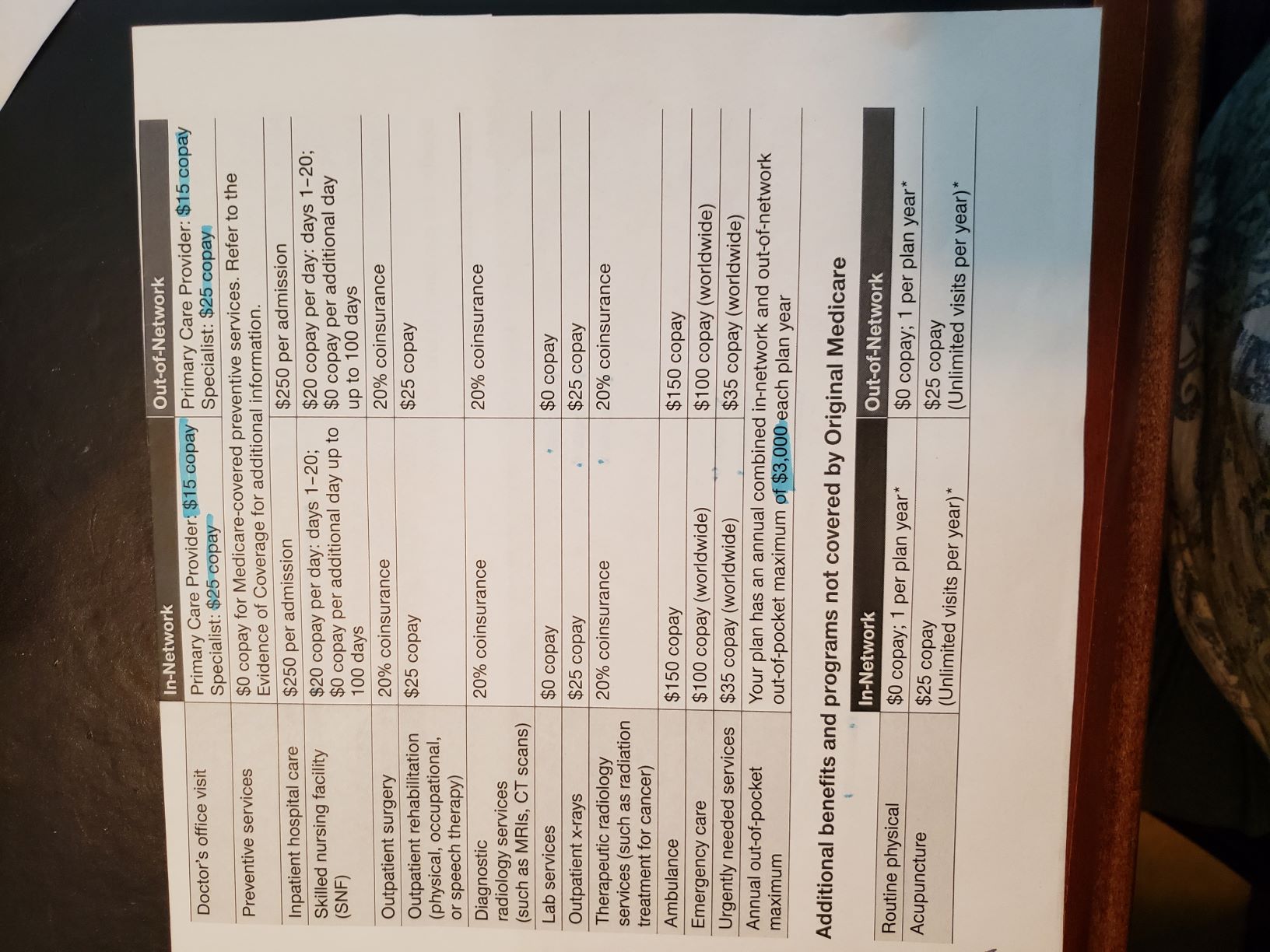

What Is the Difference Between PDP and PPO?

Since the launch of Medicare Advantage plans, many Part C plans are designed with both in and out-of-network benefits. Plan types that offer benefits for both network and non-network providers are PPOs (Preferred Provider Organization). A PPO is not the same as a PDP.

Is Part D Coverage Required?

Part D coverage through Medicare is not required, but drug coverage, in general, is highly recommended because the cost of brand name drugs can vary greatly. Though not a requirement, drug coverage through Part D should be attained as soon as possible.

Do I Have to Pay LEP?

If you are unable to show proof of creditable coverage for prescription drugs, LEP will be added to your monthly premium and is a required fee. Should you feel the decision to apply an LEP is unwarranted, you do have appeal rights as established by the Centers for Medicaid and Medicare Services (CMS).

Do I Have to Use Certain Pharmacies With a PDP?

Most pharmacies accept Medicare, but the PDP you're enrolled in may have preferred pharmacies. Filling your prescriptions at a preferred pharmacy may result in lower out-of-pocket drug costs. You may also be eligible for mail-order prescriptions depending on your plan. Check with your PDP carrier to confirm pharmacy network status and drug costs.

What Are the Stages of Part D Coverage?

PDP policies are structured into four coverage phases. Here is a quick breakdown of each:

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

What is Medicare Part D cost utilization?

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is part D coverage?

Part D coverage excludes drugs or classes of drugs that may be excluded from Medicaid coverage. These may include: Drugs used for anorexia, weight loss, or weight gain. Drugs used to promote fertility. Drugs used for erectile dysfunction. Drugs used for cosmetic purposes (hair growth, etc.)

What is a Part D benefit?

Beneficiary cost sharing. Part D includes a statutorily-defined "standard benefit" that is updated on an annual basis. All Part D sponsors must offer a plan that follows the standard benefit. The standard benefit is defined in terms of the benefit structure and without mandating the drugs that must be covered.

Who is responsible for Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) or Medicare is responsible for the administration of the Medicare Part D prescription drug program. Private insurance carriers actually implement the various Medicare Part D plans across the country under the direction of CMS. Top.

What is Medicare Part D?

Medicare prescription drug coverage (Part D) helps you pay for both brand-name and generic drugs. Medicare drug plans are offered by insurance companies and other private companies approved by Medicare.

Does Medicare cover prescription drugs?

In general, Medicare Part D prescription drug plans provide insurance coverage for your prescription drugs - just like other types of insurance. Your Medicare prescription drug coverage can be provided by a "stand-alone" Medicare Part D plan (only prescription coverage) or a Medicare Advantage plan that includes prescription coverage ...

Does Medicare have a deductible?

Some Medicare Part D or Medicare Advantage plans have an initial deductible where you pay 100% of your pre scription costs before your Part D prescription drug coverage or benefits begin.

What is a PDP plan?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug ...

Can you get PDP with Medicare?

A PDP can be purchased by beneficiaries with Original Medicare coverage (with or without a Medigap plan) and – in some cases –by Medicare Advantage (MA) beneficiaries who don’t have a prescription drug benefit included in their MA plan.

When did Medicare start?

In 1962, President Kennedy introduced a plan to create a healthcare program for older adults using their Social Security contributions, but it wasn’t approved by Congress. In 1964, former President Lyndon Johnson called on Congress to create the program that is now Medicare. The program was signed into law in 1965.

When did Medicare expand to include people with disabilities?

The addition of coverage for people with disabilities in 1972. In 1972, former President Richard Nixon expanded Medicare coverage to include people with disabilities who receive Social Security Disability Insurance. He also extended immediate coverage to people diagnosed with end stage renal disease (ESRD).

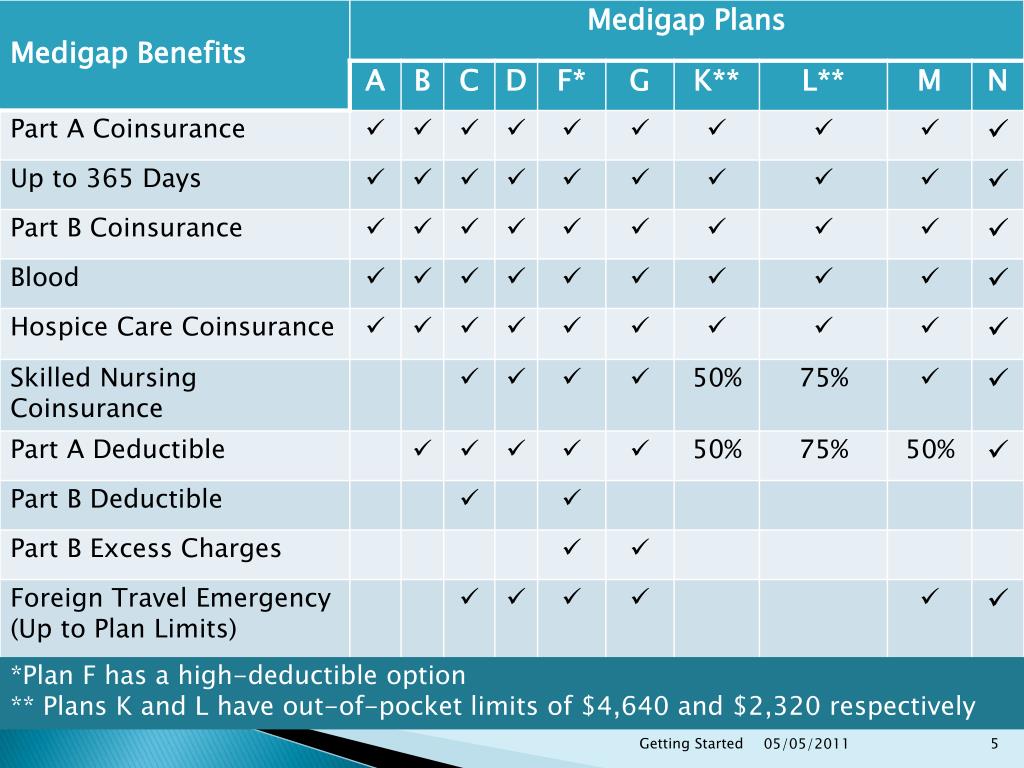

What is a Medigap plan?

Medigap, also known as Medicare supplement insurance, helps you pay the out-of-pocket costs of original Medicare, like copays and deductibles. These plans are sold by private insurance companies. However. starting in 1980, the federal government began regulating them to ensure they meet certain standards.

How many people will be covered by Medicare in 2021?

That first year, 19 million Americans enrolled in Medicare for their healthcare coverage. As of 2019, more than 61 million Americans were enrolled in the program.

What age does Medicare cover?

When Medicare first began, it included just Medicare Part A and Medicare Part B, and it covered only people ages 65 and over. Over the years, additional parts — including Part C and Part D — have been added. Coverage has also been expanded to include people under age 65 who have certain disabilities and chronic conditions.

What was Medicare Part A and Part B?

Just like today, Medicare Part A was hospital insurance and Medicare Part B was medical insurance. Most people don’t pay a premium for Part A but do need to pay one for Part B. In 1966, the monthly Part B premium was $3. Trusted Source.

What are the two parts of Medicare?

When first introduced, Medicare had only two parts: Medicare Part A and Medicare Part B. That’s why you’ll often see those two parts referred to as original Medicare today. Parts A and B looked pretty similar to original Medicare as you may know it, although the costs have changed over time.

How much did Medicare cut in 1997?

Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 (Balanced Budget Act) cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years (Etheredge 1998; Oberlander 2003, 177–83).

Who raised the issue of prescription drug coverage in Medicare?

When the proposal was finalized at a meeting of the president, HEW secretary Eliot Richardson, and Assistant Secretary for Planning and Evaluation Lewis Butler, the issue of prescription drug coverage in Medicare was raised at the request of Commissioner of Social Security Robert Ball.

How many Medicare beneficiaries will have private prescription coverage?

At that time, more than 40 million beneficiaries will have the following options: (1) they may keep any private prescription drug coverage they currently have; (2) they may enroll in a new, freestanding prescription drug plan; or (3) they may obtain drug coverage by enrolling in a Medicare managed care plan.

How much does Medicare pay for Part D?

The standard Part D benefits would have an estimated initial premium of $35 per month and a $250 annual deductible. Medicare would pay 75 percent of annual expenses between $250 and $2,250 for approved prescription drugs, nothing for expenses between $2,250 and $5,100, and 95 percent of expenses above $5,100.

What was the Task Force on Prescription Drugs?

Department of Health, Education and Welfare (HEW; later renamed Health and Human Services) and the White House.

How long have seniors waited for Medicare?

Seniors have waited 38 years for this prescription drug benefit to be added to the Medicare program. Today they are just moments away from the drug coverage they desperately need and deserve” (Pear and Hulse 2003). In fact, for many Medicare beneficiaries, the benefits of the new law are not so immediate or valuable.

How much money would the federal government save on medicaid?

The states would be required to pass back to the federal government $88 billion of the estimated $115 billion they would save on Medicaid drug coverage. It prohibited beneficiaries who enrolled in Part D from buying supplemental benefits to insure against prescription drug expenses not covered by the program.

When did Medicare Supplement Plans start?

The history of Medicare Supplement Plans – Medigap insurance takes us back to 1980. What began as voluntary standards governing the behavior of insurers increasingly became requirements. Consumer protections were continuously strengthened, and there was a trend toward the simplification of Medicare Supplement Plans – Medigap Insurance reimbursements whenever possible. During the 1980s the federal government first provided a voluntary certification option for Medicare Supplement, or Medigap Insurance, insurers in Section 507 of the Social Security Disability Amendments of 1980 , commonly known as the “Baucus Amendment.” In order to meet the Baucus Amendment’s voluntary minimum standards, the Medicare Supplement plan was required to:

When did Medicare become standardized?

The second group of plans, labeled Plan A through Plan J, were standardized and became effective in a state when the terms of Omnibus Budget Reconciliation Act of 1990 were adopted by the state, mainly in 1992. Shopping for Medicare insurance can be overwhelming.

What was the unintended consequence of the Omnibus Budget Reconciliation Act?

Therefore, The Omnibus Budget Reconciliation Act had the unintended consequence of insurance companies refusing to sell Medicare Supplement Insurance – Medigap insurance, policies to Medicare beneficiaries who had any other type of private non-Medicare insurance coverage regardless if the other coverage was very limited.

What is Medicare Select Supplement?

The Medicare SELECT Supplement plans provided a managed-care option for beneficiaries with reimbursement within a limited network. The Act to Amend the Omnibus Budget Reconciliation Act of 1990, ...

What was the Omnibus Budget Reconciliation Act of 1990?

It was during the 1990’s The Omnibus Budget Reconciliation Act of 1990 replaced some voluntary guidelines with federal standards. Specifically, the The Omnibus Budget Reconciliation Act of 1990 did the following: Provided for the sale of only 10 standardized Medicare Supplement Plans – Medigap Insurance (in all but three states); ...

What is a felony in Medicare?

The Medicare and Medicaid Patient and Program Protection Act of 1987 provided that individuals who knowingly and willfully make a false statement or misrepresent a medical fact in the sale of a Medicare Supplement Plans – Medigap Insurance Insurance, policy are guilty of a felony. The Omnibus Budget Reconciliation Act of 1987 permitted ...

What is Medicare Part D?

Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B) doesn't provide prescription drug coverage.

How to get a PDP?

Enrolling in a Part D Prescription Drug Plan. To get a PDP plan, you will have to enroll directly with the plan provider. Unless you qualify for a Special Enrollment Period due to working past 65, it’s best to enroll in Part D when you’re first eligible for Medicare. This will be during your Initial Enrollment Period.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Can I combine my PDP with my Medicare?

Can I Combine a PDP Plan with Other Medicare Coverage? Yes, you can combine Medicare coverage parts with a Part D plan. A stand-alone PDP can work with Original Medicare (Parts A & B) and certain types of Medicare Advantage plans such as Medicare Medical Savings Account plans without drug coverage or Private Fee-for-Service plans. ...

Can you have a stand alone Medicare plan?

You can have a stand-alone prescription drug plan with certain types of Medicare Advantage plans so long as the plan: Can’t offer coverage for prescription drugs. Chooses not to offer coverage for prescription drugs. If after the first time you enroll you decide to change your PDP, you can do so each year during the Medicare Annual Enrollment ...

Overview

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insu…

Program specifics

To enroll in Part D, Medicare beneficiaries must also be enrolled in either Part A or Part B. Beneficiaries can participate in Part D through a stand-alone prescription drug plan or through a Medicare Advantage plan that includes prescription drug benefits. Beneficiaries can enroll directly through the plan's sponsor or through an intermediary. Medicare beneficiaries who delay enrollm…

History

Upon enactment in 1965, Medicare included coverage for physician-administered drugs, but not self-administered prescription drugs. While some earlier drafts of the Medicare legislation included an outpatient drug benefit, those provisions were dropped due to budgetary concerns. In response to criticism regarding this omission, President Lyndon Johnson ordered the forma…

Program costs

In 2019, total drug spending for Medicare Part D beneficiaries was about 180 billion dollars. One-third of this amount, about 120 billion dollars, was paid by prescription drug plans. This plan liability amount was partially offset by about 50 billion dollars in discounts, mostly in the form of manufacturer and pharmacy rebates. This implied a net plan liability (i.e. net of discounts) of roughly 70 billion dollars. To finance this cost, plans received roughly 50 billion in federal reinsur…

Cost utilization

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

Quantity limits refer to the maximum amount of a medication that may be dispensed during a gi…

Implementation issues

• Plan and Health Care Provider goal alignment: PDP's and MA's are rewarded for focusing on low-cost drugs to all beneficiaries, while providers are rewarded for quality of care – sometimes involving expensive technologies.

• Conflicting goals: Plans are required to have a tiered exemptions process for beneficiaries to get a higher-tier drug at a lower cost, but plans must grant medically-necessary exceptions. However, the rule denies beneficiaries the right to reques…

Impact on beneficiaries

A 2008 study found that the percentage of Medicare beneficiaries who reported forgoing medications due to cost dropped with Part D, from 15.2% in 2004 and 14.1% in 2005 to 11.5% in 2006. The percentage who reported skipping other basic necessities to pay for drugs also dropped, from 10.6% in 2004 and 11.1% in 2005 to 7.6% in 2006. The very sickest beneficiaries reported no reduction, but fewer reported forgoing other necessities to pay for medicine.

Criticisms

The federal government is not permitted to negotiate Part D drug prices with drug companies, as federal agencies do in other programs. The Department of Veterans Affairs, which is allowed to negotiate drug prices and establish a formulary, has been estimated to pay between 40% and 58% less for drugs, on average, than Part D. On the other hand, the VA only covers about half the brands that a typical Part D plan covers.