What is the Medicare payroll deduction for taxes?

· When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program.

When did Medicare start?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

When did Medicare Part D go into effect?

· The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965. 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Who pays the payroll tax on Medicare?

· Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their …

When did payroll deductions start?

Key Takeaways. Withholding tax is income tax collected from wages when an employer pays an employee. The beginnings of withholding tax date back to 1862, when it was used to help fund the Civil War. Employees complete IRS Form W-4 to determine how much the employer should withhold from each paycheck.

What year did FICA start?

1935Social Security is funded by payroll taxes collected through the Federal Insurance Contributions Act (FICA), which are commonly referred to as "FICA taxes”. They are what fund Social Security Disability. The Federal Insurance Contributions Act was enacted in 1935 as a tax provision of the Social Security Act.

Do all employees pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

How much did the employee contribute to Medicare?

The Medicare tax rate is 1.45% of an employee's wages. Again, Medicare is an employer and employee tax. You must withhold 1.45% from an employee's pay and contribute a matching 1.45%. Altogether, Medicare makes up 2.9% of the FICA tax rate of 15.3%.

When did FICA become effective?

The Financial Intelligence Centre Act 38 of 2001 (FICA) came into effect on 1 July 2003. FICA was introduced to fight financial crime, such as money laundering, tax evasion, and terrorist financing activities.

Why was FICA established?

What is FICA? FICA is an abbreviation for the Financial Intelligence Centre Act 38 of 2001 (as amended). The Act was instituted in order to fight financial crime such as money laundering, fraud, tax evasion, terrorist financing activities and identity theft.

Who is exempt from paying Medicare tax?

The Internal Revenue Code also grants an exemption from Social Security and Medicare taxes to nonimmigrant students, scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other nonimmigrants temporarily present in the United States in F-1, J-1, M-1, Q- ...

Can you opt out of paying Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

Why is Medicare being taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Why are my Medicare wages higher than my regular wages?

Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents your entire compensation from your job.

How is Medicare deduction calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay. 2

How much is deducted from Social Security for Medicare?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Who created FICA?

The FICA Spiritual History Tool, created by Dr. Christina Puchalski in 1996, in collaboration with three primary care physicians (Drs.

Who made FICA?

A: The Social Security Act was signed by FDR on 8/14/35. Taxes were collected for the first time in January 1937 and the first one-time, lump-sum payments were made that same month.

Why is FICA important?

FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

Who pays 7.65% of taxable income to Social Security?

employerYour employer will withhold 7.65% in Social Security and Medicare taxes on your $97,000 in earnings. You must pay 15.3% in Social Security and Medicare taxes on your first $50,000 in self-employment earnings, and 2.9% in Medicare tax on the remaining $1,000 in net earnings.

When did Medicare start limiting out-of-pocket expenses?

In 1988 , Congress passed the Medicare Catastrophic Coverage Act, adding a true limit to the Medicare’s total out-of-pocket expenses for Part A and Part B, along with a limited prescription drug benefit.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

What is a QMB in Medicare?

These individuals are known as Qualified Medicare Beneficiaries (QMB). In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level.

When was the Omnibus Reconciliation Act passed?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight.

When did Medicare start covering kidney failure?

In 1972 , President Richard M. Nixon signed into the law the first major change to Medicare. The legislation expanded coverage to include individuals under the age of 65 with long-term disabilities and individuals with end-stage renal disease (ERSD). People with disabilities have to wait for Medicare coverage, but Americans with ESRD can get coverage as early as three months after they begin regular hospital dialysis treatments – or immediately if they go through a home-dialysis training program and begin doing in-home dialysis. This has served as a lifeline for Americans with kidney failure – a devastating and extremely expensive disease.

How much has Medicare per capita grown?

But Medicare per capita spending has been growing at a much slower pace in recent years, averaging 1.5 percent between 2010 and 2017, as opposed to 7.3 percent between 2000 and 2007. Per capita spending is projected to grow at a faster rate over the coming decade, but not as fast as it did in the first decade of the 21st century.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Does NIIT go directly to Medicare?

The irony is that the NIIT actually goes into the government's General Fund, not directly to Medicare.

Is investment income subject to Medicare?

There was a time when investment income wasn't subject to the Medicare tax, but that changed with the Affordable Care Act as well.

Is Medicare a part of self employment?

Medicare as Part of the Self-Employment Tax. You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

How is Medicare funded?

Like Social Security benefits, Medicare’s Hospital Insurance program is funded largely by employment taxes. If you work “under the table” you won’t pay into these systems. That’s why payroll tax withholding, although it takes a chunk out of your take-home pay, is actually providing you with something in return for those lost dollars in your paychecks.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the current Social Security tax rate?

The current Social Security tax is 12.4% with employees and employers each paying 6.2%. Today, the Medicaretax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

How to get help with Medicare taxes?

If you need help with medicare taxes or any other financial issue, consider working with a financial advisor, who will walk you through everything you need to know. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

Is Medicare tax the same as NIIT?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income. That’s because the 0.9 percent Additional Medicare Tax applies to wages, compensation and self-employment income over the $200,000 limit, but it does not apply to net investment income.

Who introduced the first payroll tax?

Payroll Taxes in the Early United States. The first income tax in the United States was introduced by Abraham Lincoln during the US Civil War. It was designed to help finance the rising costs of the Civil War. After the war was over, the tax was repealed.

What is payroll tax?

A payroll tax, like most other types of taxes, is calculated as a percentage of the salaries that employers pay their staff. There are two broad types of payroll taxes in the world today, including: -Withholding Tax: Taxes that employers are required to withhold from employees’ wages. These taxes are also known as pay-as-you-earn (PAYE) ...

How much is payroll tax?

Today, the average American’s payroll tax sits at 12.4%. Half of that is paid by you (the employee) and is deducted from your paycheck. The other half is paid by your employer. Those who are self-employed need to pay the full 12.4% (because they’re considered both the employer and the employee).

What is taxable income?

During this phase, taxable income was considered to be your gross income minus all exemptions, deductions, and personal exemptions. Gross income included “all income from whatever source”. Certain income was subject to tax exemption, including both personal exemptions and business deductions.

Which amendment paved the way for payroll tax?

In any case, the 16th Amendment paved the way for the payroll tax we know today.

Which amendment allowed for Americans to be charged an income tax?

It passed the 16th Amendment, which allowed for Americans to be charged an income tax. The early income tax was similar to modern income tax: Americans were charged a certain tax rate based on their income. However, in the early days of the income tax, fewer than 10% of Americans were required to pay income tax.

Why didn't the US government tax people?

However, it couldn’t tax these people because of the pesky US Constitution.

When did Medicare+Choice become Medicare Advantage?

These Part C plans were initially known in 1997 as "Medicare+Choice". As of the Medicare Modernization Act of 2003, most "Medicare+Choice" plans were re-branded as " Medicare Advantage " (MA) plans (though MA is a government term and might not even be "visible" to the Part C health plan beneficiary).

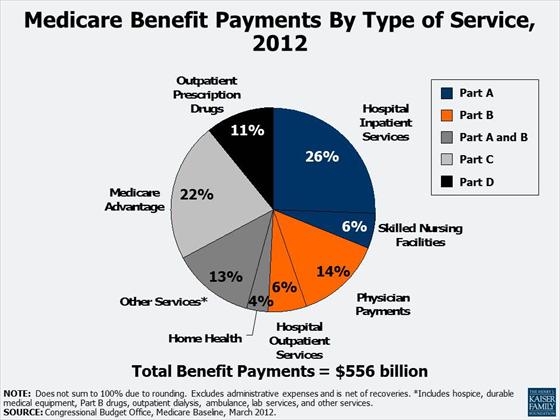

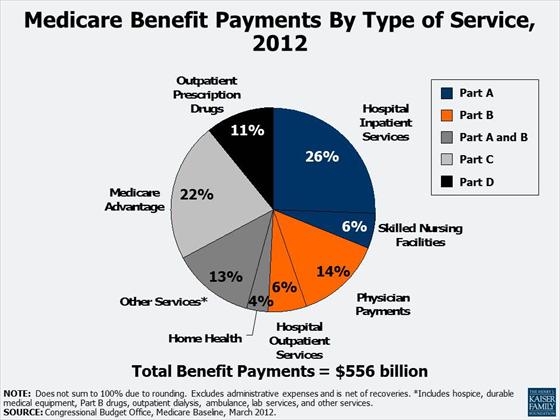

How is Medicare funded?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

How long does Medicare cover hospital stays?

The maximum length of stay that Medicare Part A covers in a hospital admitted inpatient stay or series of stays is typically 90 days . The first 60 days would be paid by Medicare in full, except one copay (also and more commonly referred to as a "deductible") at the beginning of the 60 days of $1340 as of 2018.

What is Medicare Part A?

Part A covers inpatient hospital stays where the beneficiary has been formally admitted to the hospital, including semi-private room, food, and tests. As of January 1, 2020, Medicare Part A had an inpatient hospital deductible of $1408, coinsurance per day as $352 after 61 days' confinement within one "spell of illness", coinsurance for "lifetime reserve days" (essentially, days 91–150 of one or more stay of more than 60 days) of $704 per day. The structure of coinsurance in a Skilled Nursing Facility (following a medically necessary hospital confinement of three nights in row or more) is different: zero for days 1–20; $167.50 per day for days 21–100. Many medical services provided under Part A (e.g., some surgery in an acute care hospital, some physical therapy in a skilled nursing facility) is covered under Part B. These coverage amounts increase or decrease yearly on the first day of the year.

When will Medicare cards be mailed out?

A sample of the new Medicare cards mailed out in 2018 and 2019 depending on state of residence on a Social Security database.

How old do you have to be to get Medicare?

Eligibility. In general, all persons 65 years of age or older who have been legal residents of the United States for at least five years are eligible for Medicare. People with disabilities under 65 may also be eligible if they receive Social Security Disability Insurance (SSDI) benefits.

Who is responsible for Medicare eligibility?

The Social Security Administration (SSA) is responsible for determining Medicare eligibility, eligibility for and payment of Extra Help/Low Income Subsidy payments related to Parts C and D of Medicare, and collecting most premium payments for the Medicare program.

When did Medicare payroll tax become law?

The Medicare payroll tax was added when President Lyndon Johnson signed the landmark seniors’ health security program into law in 1965 . Over the years, Congress has adjusted FICA rates to account for demographic changes in America’s workforce and senior population.

How much does Medicare pay for self employed?

There’s an additional 1.45% payroll contribution for Medicare by both employers and employees. Self-employed individuals pay the full 15.3 percent. FICA stands for Federal Insurance Contribution Act, a 1935 law enacted in conjunction with Social Security to establish the program’s funding mechanism.

Why is FICA payroll tax diverted?

Diverting FICA payroll taxes for other uses threatens the future solvency of Social Security at a time when these programs need more, not less revenue. It also undercuts the “earned benefit” nature of Social Security, even if payroll tax contributions are backfilled with general federal revenues.

Why did Trump call for eliminating payroll taxes?

President Trump has repeatedly called for eliminating payroll taxes as a means of stimulating the economy during the Coronavirus pandemic.

Who said "with those taxes in there, no damn politician can ever scrap my Social Security program"?

President Roosevelt famously said of the FICA taxes: “We put those payroll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions…. With those taxes in there, no damn politician can ever scrap my Social Security program.”.

What is FICA deduction?

You have probably noticed those deductions on your paycheck stub marked “FICA.” These are the payroll taxes that fund Social Security and Medicare Part A hospitalization benefits. FICA deductions are the lifeblood of these programs. They’re the reason we call Social Security and Medicare “earned benefits” — because Americans make payroll contributions throughout their working lives to be eligible for financial and health benefits for themselves and their families upon retirement, disability or death. All wage earners contribute a 6.2% payroll tax for Social Security with a 6.2% employer match. There’s an additional 1.45% payroll contribution for Medicare by both employers and employees. Self-employed individuals pay the full 15.3 percent.

What is the cap on Social Security?

Social Security payroll contributions are currently capped at $137,700 in annual income, meaning that any wages above that cap are exempt. Growing income inequality over the past few decades has increased the amount of income not subject to payroll contributions. As the years go by, high earners have been contributing less of their income to the system. In fact, people earning $1 million or more annually stop paying into Social Security in February, while most other workers contribute for the entire calendar year.