When did Part D of Medicare start?

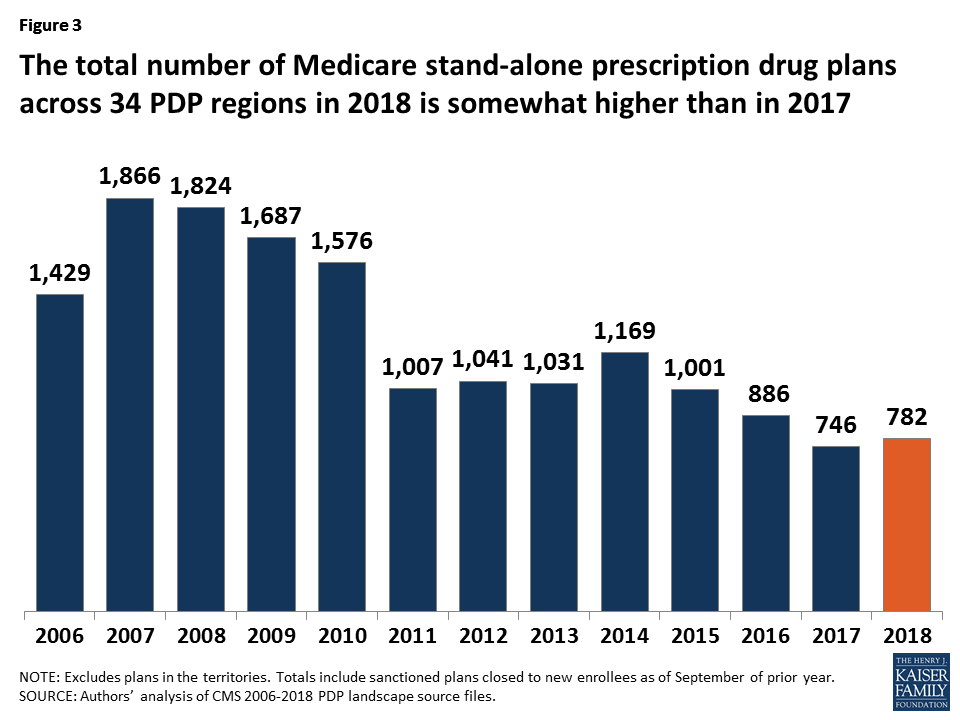

Medicare Part D. Part D was originally proposed by President Clinton in 2000 and enacted as part of the Medicare Modernization Act of 2003 (which also made changes to the public Part C Medicare health plan program) and went into effect on January 1, 2006.

When was Medicare created?

In 1964, former President Lyndon Johnson called on Congress to create the program that is now Medicare. The program was signed into law in 1965.

When did Medicare start bidding for plan payments?

In response to recommendations from MedPAC, beginning in 2006 Medicare started a bidding process for plan payments.

Who was the first US President to sign up for Medicare?

Photo: President Lyndon Johnson (left) signed Medicare into law on July 30, 1965, and made former President Harry S. Truman (right) the first enrollee. Standing behind the two are first ladies Lady Bird Johnson and Bess Truman.

When did Medicare Part D go into effect?

When did Medicare start offering subsidized drug coverage?

What is Medicare Part D?

How much of Medicare is covered by Part D?

How many Medicare beneficiaries are enrolled in Part D?

What is Medicare online tool?

Why did Medicare repeal the Catastrophic Coverage Act?

See more

About this website

When did Medicare Part D benefits begin?

2006The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What President started Medicare Part D?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers.

Is Medicare Part D the same as a PDP?

Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too.

Why did Medicare Part D pass?

Overall, Part D has improved access to prescription drugs for Medicare beneficiaries. Better use of prescription drugs has improved the health of many beneficiaries as well as avoided the need for a number of other health care services, both of which reduced health care costs elsewhere in Medicare.

Why was 1965 such an important year for policy issues?

On July 30, 1965, President Lyndon B. Johnson signed the Social Security Amendments of 1965 into law. With his signature he created Medicare and Medicaid, which became two of America's most enduring social programs. The signing ceremony took place in Independence, Missouri, in the presence of former President Harry S.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

What does PDP mean in Medicare Part D?

Medicare Prescription Drug PlanJoin a Medicare Prescription Drug Plan (PDP).

Can you have a MA plan and a standalone PDP?

Summary: Some Medicare Advantage Plans allow you to choose your own standalone Medicare Part D Prescription Drug plans, while others include a predetermined plan. You cannot have a standalone Medicare Part D plan if your Medicare Advantage plan already includes prescription coverage.

Why do doctors not like Medicare Advantage Plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

Does Medicare Part D have a maximum out-of-pocket?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What is the cheapest Medicare Part D plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Drug coverage (Part D) | Medicare

Part D (Medicare drug coverage) helps cover cost of prescription drugs, may lower your costs and protect against higher costs.

The parts of Medicare (A, B, C, D) - Medicare Interactive

Generally, the different parts of Medicare help cover specific services. Most beneficiaries choose to receive their Part A and B benefits through Original Medicare, the traditional fee-for-service program offered directly through the federal government. It is sometimes called Traditional Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the government pays directly for the ...

Medicare Prescription Drug Eligibility and Enrollment | CMS

This page contains enrollment and disenrollment guidance for current and future contracting Part D plan sponsors and other parties interested in the operational and regulatory aspects of Part D plan enrollment and disenrollment. New! Revisions to the Prescription Drug Plan Enrollment and Disenrollment Guidance and Individual Enrollment Request Form to Enroll in a Part D plan for CY 2021

CMS Releases 2022 Premiums and Cost-Sharing Information for Medicare ...

The Centers for Medicare & Medicaid Services (CMS) released the 2022 premiums, deductibles and other key information for Medicare Advantage and Part D prescription drug plans in advance of the annual Medicare Open Enrollment to help Medicare enrollees decide on coverage that fits their needs.

Medicare costs at a glance | Medicare

Home health care. $0 for home health care services. 20% of the Medicare-approved amount for Durable Medical Equipment (DME) . Hospice care. $0 for hospice care. You may need to pay a copayment of no more than $5 for each prescription drug and other similar products for pain relief and symptom control while you're at home. In the rare case your drug isn’t covered by the hospice benefit, your ...

When did Medicare Supplements become part of Medicare?

Medicare Supplements, also known as Medigap, have been part of Medicare history since 1992. As with most things involving Medicare, changes occurred over the years. There have been plans that were eliminated, as well as new plans introduced.

When did Medicare start discriminating against genetic information?

Another turning point for Medicare came in 2008 with the introduction of the Genetic Information Nondiscrimination Act. This act made it illegal for a health insurance plan provider to discriminate against genetic information.

What is MedicareFAQ?

At MedicareFAQ, our goal is to educate and inform all Medicare beneficiaries to help them find coverage at the most affordable price. We pride ourselves on keeping our clients informed and up to date on any benefit changes. Give us a call today at the number above or fill out our rate comparison form to get the best rates in your area.

What is the Catastrophic Coverage Act?

One of these acts was the Medicare Catastrophic Coverage Act. This act implements several restrictions to further protect consumers, such as out-of-pocket maximums and premiums. During this time, several voluntary guidelines became mandatory standards by the federal government.

When did prescriptions become a point of discussion for coverage?

Prescriptions became a point of discussion for coverage in 2003. The Medicare Prescription Drug Improvement and Modernization Act changed the way Medigap policies treated drugs.

What is Medicare's focus?

The program is beginning to focus on the best interests of its recipients. The name Medicare initially addressed a program that provided medical care for military families as part of the Dependents Medical Care Act in 1956.

How many seniors were covered by Medicare before 65?

Before Medicare, only 60% of seniors over 65 had health coverage. Due to lack of availability and high prices, seniors often paid three times as much for coverage as younger people.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

When did Medicare start offering subsidized drug coverage?

Medicare began offering subsidized outpatient drug coverage in the mid-2000s. In the 2000 presidential election, both the Democratic and Republican candidates campaigned on the promise of using the projected federal budget surplus to fund a new Medicare drug entitlement program. Following his electoral victory, President George W. Bush promoted a general vision of using private health plans to provide drug coverage to Medicare beneficiaries. Rather than demand that the plan be budget neutral, President Bush supported up to $400 billion in new spending for the program. In 2003, President Bush signed the Medicare Modernization Act, which authorized the creation of the Medicare Part D program. The program was implemented in 2006.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is Medicare online tool?

Medicare offers an interactive online tool that allows for comparison of coverage and costs for all plans in a geographic area. The tool lets users input their own list of medications and then calculates personalized projections of the enrollee's annual costs under each plan option. Plans are required to submit biweekly data updates that Medicare uses to keep this tool updated throughout the year.

Why did Medicare repeal the Catastrophic Coverage Act?

However, this legislation was repealed just one year later, partially due to concerns regarding premium increases. The 1993 Clinton Health Reform Plan also included an outpatient drug benefit, but that reform effort ultimately failed due to a lack of public support.

When did Medicare expand?

Over the years, Congress has made changes to Medicare: More people have become eligible. For example, in 1972 , Medicare was expanded to cover the disabled, people with end-stage renal disease (ESRD) requiring dialysis or kidney transplant, and people 65 or older that select Medicare coverage.

How long has Medicare and Medicaid been around?

Medicare & Medicaid: keeping us healthy for 50 years. On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security ...

What is Medicare Part D?

Medicare Part D Prescription Drug benefit. The Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA) made the biggest changes to the Medicare in the program in 38 years. Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans.

When was the Children's Health Insurance Program created?

The Children’s Health Insurance Program (CHIP) was created in 1997 to give health insurance and preventive care to nearly 11 million, or 1 in 7, uninsured American children. Many of these children came from uninsured working families that earned too much to be eligible for Medicaid.

What is the Affordable Care Act?

The 2010 Affordable Care Act (ACA) brought the Health Insurance Marketplace, a single place where consumers can apply for and enroll in private health insurance plans. It also made new ways for us to design and test how to pay for and deliver health care.

When did Medicare start?

Medicare officially began once President Lyndon B. Johnson signed it into law on July 30, 1965. At slightly more than 60 years old, Medicare has grown and changed in the attempt to meet the needs of its growing population of older and disabled adults.

Who Created Medicare?

Though President Johnson signed Medicare into law, former President Harry Truman initially proposed a federal health insurance initiative decades prior. In honor of his contributions to the development of Medicare, the first Medicare recipient was President Harry S. Truman, who was 81 years old at the time.

How many Americans are covered by Medicare?

Ensuring access to inpatient and outpatient medical care, a wide range of specialists and diagnostic services, Medicare currently insures more than 61 million Americans — or more than 18% of the population. Medicare’s coverage continues to expand to give beneficiaries access to the latest testing and treatment options for various conditions.

Why was Medicare established?

The government’s response to the financial ruination occurring throughout the country’s older adult population, Medicare was established to provide coverage for both in-hospital and outpatient medical services.

What percentage of Americans had health insurance before Medicare?

Prior to Medicare, Americans who had any form of health insurance accounted for less than half of the population. Citizens and, eventually, every level of government became concerned about the problem unfolding in the country. Americans who did have some form of insurance through their employer could not afford to continue coverage during retirement and, also due to retirement, struggled to manage basic expenses on a fixed income.

What is Medicare Supplement?

Today, Medicare is a broad term that can be used to describe Parts A and B, Part C or Medicare Advantage plans, or standalone Part D plans that offer prescription drug coverage. There are also Medicare Supplement policies designed to cover a recipient’s cost share for medical services (usually 20% of the allowed charge).

Was Medicare available to low income people?

Before Medicare, there was some funding available for low or very low-income Americans, but the problem reached further into the middle and even upper class. Not just a problem for low-income individuals, large medical bills quickly depleted someone's life savings and earned assets, such as homes or businesses.

Where did the Medicare Part D prescription drug program come from?

Medicare Part D plans have their origin in the Medicare Prescription Drug, Improvement, and Modernization Act which was passed on December 8 , 2003. This law established a voluntary drug benefit for Medicare beneficiaries and created the new Medicare Part D program. In short, the Medicare Modernization Act and the Medicare Prescription Drug Improvement feature gives Medicare beneficiaries, that is seniors and disabled citizens eligible for Medicare access to drug coverage beginning in January of 2006.

Who is responsible for Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) or Medicare is responsible for the administration of the Medicare Part D prescription drug program. Private insurance carriers actually implement the various Medicare Part D plans across the country under the direction of CMS. Top.

What are the basic details of the 2022 Medicare Part D Program?

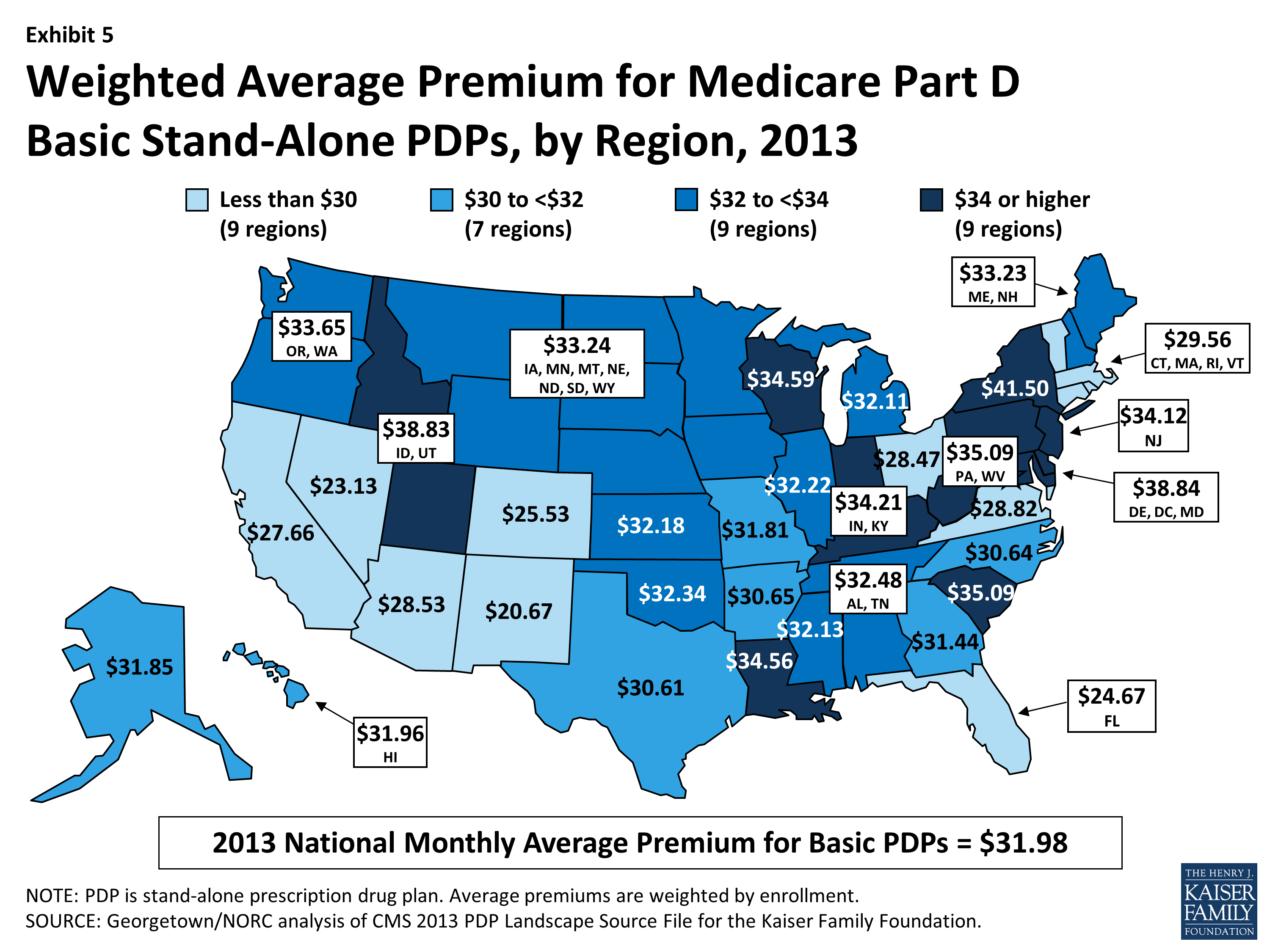

In general, Medicare Part D prescription drug plans provide insurance coverage for your prescription drugs - just like other types of insurance. Your Medicare prescription drug coverage can be provided by a "stand-alone" Medicare Part D plan (only prescription coverage) or a Medicare Advantage plan that includes prescription coverage (or an MA-PD that includes Medicare health and prescription drug coverage). If you join a Medicare Part D prescription drug plan, you will pay a monthly premium ranging from only a few dollars up to over 100 dollars. If you join a Medicare Advantage plan, you may have a $0 premium. Your monthly premiums will vary depending on the benefits of your selected Medicare Part D plan or Medicare Advantage plan and your resident state.

How many Medicare Part D plans are currently available?

There are approximately 40 to 50 Medicare Part D prescription drug plans (or PDPs) available in each state or CMS region.

How much is the deductible for Medicare Part D?

The CMS or Medicare defined standard benefit or model Medicare Part D plan has an annual $480 initial deductible. However, many Medicare Part D plans do not have the initial deductible (or have a $0 deductible) and provide "first dollar" drug coverage.

What is Medicare Part D?

Medicare prescription drug coverage (Part D) helps you pay for both brand-name and generic drugs. Medicare drug plans are offered by insurance companies and other private companies approved by Medicare.

Is Medicare Part D a stand alone plan?

Your Medicare prescription drug coverage can be provided by a "stand-alone" Medicare Part D plan ( only prescription coverage) or a Medicare Advantage plan that includes prescription coverage (or an MA-PD that includes Medicare health and prescription drug coverage). If you join a Medicare Part D prescription drug plan, ...

When did Medicare start?

In 1962, President Kennedy introduced a plan to create a healthcare program for older adults using their Social Security contributions, but it wasn’t approved by Congress. In 1964, former President Lyndon Johnson called on Congress to create the program that is now Medicare. The program was signed into law in 1965.

Who was the first person to receive Medicare?

In recognition of his dedication to a national healthcare plan during his own term, former President Truman and his wife, Bess, were the first people to receive Medicare cards after it was signed it into law. When first introduced, Medicare had only two parts: Medicare Part A and Medicare Part B.

What are some examples of Medicare programs?

Some examples of these programs include the Extra Help program, which helps those with low income pay for their medications, and four different Medicare savings programs to help pay for premiums and other Medicare expenses.

What is a Medigap insurance?

Medigap, also known as Medicare supplement insurance, helps you pay the out-of-pocket costs of original Medicare, like copays and deductibles.

How many people will be covered by Medicare in 2021?

That first year, 19 million Americans enrolled in Medicare for their healthcare coverage. As of 2019, more than 61 million Americans were enrolled in the program.

How does Medicare Advantage work?

Medicare Advantage plans work with a network of providers. Their coverage model is more similar to employer coverage than original Medicare.

What age does Medicare cover?

When Medicare first began, it included just Medicare Part A and Medicare Part B, and it covered only people ages 65 and over. Over the years, additional parts — including Part C and Part D — have been added. Coverage has also been expanded to include people under age 65 who have certain disabilities and chronic conditions.

When did Medicare start to improve?

The first major opportunity for improving Medicare coverage came in 1967 when President Johnson appointed HEW's Task Force on Prescription Drugs. In its final report in 1969, the task force recommended adding such coverage to Medicare. The timing of the report could not have been worse, however. Amid social unrest and political battering over the Vietnam War and his Great Society programs, President Johnson unexpectedly chose not to run for reelection in 1968.

When did Medicare add outpatient drug coverage?

The next opportunity to add an outpatient prescription drug benefit in the Medicare program came in 1993 as part of the health security act proposed by President Bill Clinton (D). Adding a Medicare drug benefit was good policy and good politics: It would be extraordinarily difficult to guarantee comprehensive health benefits, including drugs, to all Americans under age 65 and not to do the same for senior citizens and the disabled, whose needs were generally higher. A new drug benefit might also rally the support of Medicare beneficiaries for the Clinton plan, or at least neutralize potential opposition, given that the plan called for savings in other parts of Medicare as a way to help pay for coverage of uninsured persons under age 65.

What is the Medicare expansion plan?

The proposed expansion of the Medicare program would include an outpatient prescription drug and biologics benefit as well as a guaranteed national benefits package for those under the age of 65. The Medicare drug benefit would become part of Part B, adding $11 per month to the premium. Beneficiaries would pay a $250 annual deductible and 20 percent of the cost of each prescription up to an annual maximum of $1,000. Low-income beneficiaries would receive assistance with cost sharing.

How many Medicare beneficiaries will have private prescription coverage?

At that time, more than 40 million beneficiaries will have the following options: (1) they may keep any private prescription drug coverage they currently have; (2) they may enroll in a new, freestanding prescription drug plan; or (3) they may obtain drug coverage by enrolling in a Medicare managed care plan.

What was the Task Force on Prescription Drugs?

Department of Health, Education and Welfare (HEW; later renamed Health and Human Services) and the White House.

How much did Medicare cut in 1997?

Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 (Balanced Budget Act) cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years (Etheredge 1998; Oberlander 2003, 177–83).

What did President Carter do in his first year in office?

Although President Carter had promised to pursue national health insurance, during his first year in office he turned his attention instead to containing soaring hospital costs ( Starr 1982, 411–4). His proposals in 1977 and 1979 died in Congress amid criticism that they were excessively complex and regulatory, but the issue continued to dominate federal health policy until Congress accepted the Reagan administration's proposals in 1982 and 1983 to establish a prospective payment system for Medicare hospital services ( Oliver 1991 ). Throughout the rest of the 1980s Congress devoted considerable energy to reforming Medicare's payment system for physicians ( Oliver 1993; Smith 1992 ).

How much did Medicare lose in 2010?

A report by the U.S. Government Accountability Office estimated that improper payments totaled $48 billion in FY 2010. This number accounts for roughly one-third of the estimated total improper payments for the Federal Government.

When was the Recovery Audit program enacted?

Under the Patient Protection and Affordable Care Act (ACA) legislation enacted in March 2010, CMS was required to expand the Recovery Audit program to the Medicare Part C (Medicare Advantage) and Part D (Prescription Drug Benefit) programs.

When did CMS start FFS RACs?

Based on the success of the pilot, CMS permanently implemented FFS RACs nationally in 2009. Section 6411 (b) of the Patient Protection and Affordable Care Act (ACA) of 2010 expanded RACs to all Medicare programs and led to CMS’ award of the Part D RAC contract in 2011.

What is RAC in Medicare?

The amendments to the existing Medicare Fee-for-Service (FFS) RAC statute at section 1893 (h) of ACA provide CMS with general authority to enter into contracts with Recovery Audit Contractors (RACs) to identify and reconcile overpayments and underpayments in Medicare Advantage (Part C) and Prescription Drug (Part D) programs.

When did Medicare contracting start?

After the introduction of risk contracting in 1985, the number of Medicare contracts held by health insurers grew, then fell at the end of that decade partly because of market consolidation (e.g., two insurers in a single state merged) ( Physician Payment Review Commission 1995 ), and then grew again during the mid-1990s (see Figure 2 ). Cawley, Chernew, and McLaughlin (2005) found that the entry of HMO plans in a county MA market was positively associated with AAPCC payment levels and negatively associated with Medicare Part A (hospital) spending, thus suggesting that plans avoided counties with relatively sicker Medicare beneficiaries and that their risk adjustment was inadequate. During the mid-1990s, managed care grew rapidly in the private market, and HMOs' participation in Part C was positively associated at the county level with commercial HMO penetration rates ( Welch 1996 ).

When did managed care start?

By the end of the 1990s , managed care in the private sector had evolved from the plans first endorsed by the government through the HMO Act of 1973 and TEFRA, the vertically integrated staff and group model HMOs, to network plans with nonexclusive contracts with many independent providers. Providers' and consumers' resistance to restricted networks and utilization management had spawned a managed care “backlash” that pushed managed care plans to loosen their networks. Thus, whereas Medicare beneficiaries not in TM or PFFS essentially had only the choice of an HMO, private-sector employees could (and did) enroll in one of a broader set of managed care plans, particularly favoring the less restrictive PPO and POS plans ( Figure 7 ). Many larger employers offered their employees a choice of plans that varied in the restrictiveness of provider networks and in the degree to which care was managed. This likely made the shift from indemnity to managed care more palatable to the private sector and hastened the decline of open network fee-for-service plans in that market.

Why did Medicare lose money in the 2000s?

Between 1997 and 2003 Medicare continued to lose money on those beneficiaries who enrolled in MA plans, partly because of the payment floors and partly because of favorable selection into Part C. Indeed, the continued favorable selection overwhelmed the ability of risk adjustment to pay less for less expensive beneficiaries. An analysis of the Medicare Current Beneficiary Survey found that in the early 2000s, MA enrollees were less likely than TM enrollees to report that they were in fair or poor health, that they had functional limitations, or that they had heart disease or chronic lung disease ( Riley and Zarabozo 2006 /2007). But the analysis found no difference in reported rates of diabetes or cancer.

How many Medicare Advantage contracts were there in 2009?

Not surprisingly, Medicare's new-found generosity increased the number of Medicare Advantage contracts, to more than six hundred in 2009 ( Figure 2 ). The number of PFFS plans, in particular, grew over this period as their ability to reimburse providers at TM rates, along with the ratchet in Part C payments, created an opportunity for plans to profit and for large employers with dispersed retirees to obtain better health benefits for them and/or to lower their costs by shifting them from TM to PFFS. Some PFFS payments were thus effectively transferred to employers, who shifted their retirees' health insurance program to Medicare Advantage PFFS plans (which were available at lower premiums than the alternatives). By 2009, 91 percent of beneficiaries had access to an MA coordinated care plan (HMO or PPO) ( Figure 3 ), and all beneficiaries had access to a PFFS plan ( MedPAC 2010c ).

Why did Medicare expand to include risk based private plans?

The reason that Medicare expanded to include risk-based private plans was to share the gains realized from managed care in other settings. Research at the time found that prepaid group practices paid by capitation and serving those under sixty-five could provide more comprehensive coverage at less total expense than conventional health insurance could, largely by economizing on inpatient stays. Manning and colleagues (1985) compared the cost to those participants (all under sixty-five) of the RAND Health Insurance Experiment (HIE) who were randomly assigned to the Group Health Cooperative of Puget Sound (GHC) in Seattle, which also was the site of the earlier Medicare demonstration projects, with those people who were assigned to comparable coverage in fee-for-service care. The overall imputed costs were 28 percent lower at GHC, driven by a 40 percent difference in hospital costs, a finding that was consistent with the nonexperimental comparisons reviewed in influential papers by Luft (1978, 1982). There was no systematic evidence that the HMOs' reductions in use affected health outcomes in the HIE, although the satisfaction of those patients randomly assigned to the HMO was lower than that of those in fee-for-service care, suggesting that traditional indemnity insurance's wide choice of providers was valued ( Newhouse and the Insurance Experiment Group 1993, 306). This difference in satisfaction was not surprising, though, since many of those assigned to the HMO had had the opportunity to join it at work but had refused. Indeed, the satisfaction of a control group of patients who already had selected the HMO as their source of care did not differ from those in the fee-for-service system. Thus, for a substantial number of persons—all those in Seattle whose employers offered a choice of plan and who chose GHC—the loss of utility from the network restrictions was offset by the savings in out-of-pocket costs and premiums in the managed care plans.

How would moving Medicare to a defined contribution model affect the elderly?

Moving Medicare to a defined-contribution model from a defined-benefit model would have profoundly altered its nature. In effect, it would have protected Medicare, meaning (mostly nonelderly) taxpayers, while possibly exposing beneficiaries to higher costs. Opponents worried not only about the possibility of higher cost to the elderly but also about HMOs' restrictions on access to specialists and reductions in inpatient care, which could have adverse effects on the elderly's health. Critics pointed out that the elderly were a more vulnerable population than the privately employed and that inadequacies in the AAPCC's risk-adjustment system would favor selection and the likely overpayment of private plans ( Oberlander 1997 ).

Why are major changes needed in Medicare Advantage?

Conclusions: Major changes in Medicare Advantage's payment rules are needed in order to simultaneously encourage the participation of private plans, the provision of high-quality care, and to save Medicare money.

When did Medicare Part D go into effect?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government.

When did Medicare start offering subsidized drug coverage?

Medicare began offering subsidized outpatient drug coverage in the mid-2000s. In the 2000 presidential election, both the Democratic and Republican candidates campaigned on the promise of using the projected federal budget surplus to fund a new Medicare drug entitlement program. Following his electoral victory, President George W. Bush promoted a general vision of using private health plans to provide drug coverage to Medicare beneficiaries. Rather than demand that the plan be budget neutral, President Bush supported up to $400 billion in new spending for the program. In 2003, President Bush signed the Medicare Modernization Act, which authorized the creation of the Medicare Part D program. The program was implemented in 2006.

What is Medicare Part D?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs.

How much of Medicare is covered by Part D?

In 2019, about three-quarters of Medicare enrollees obtained drug coverage through Part D. Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription drug spending in the United States.

How many Medicare beneficiaries are enrolled in Part D?

Medicare beneficiaries who delay enrollment into Part D may be required to pay a late-enrollment penalty. In 2019, 47 million beneficiaries were enrolled in Part D, which represents three-quarters of Medicare beneficiaries.

What is Medicare online tool?

Medicare offers an interactive online tool that allows for comparison of coverage and costs for all plans in a geographic area. The tool lets users input their own list of medications and then calculates personalized projections of the enrollee's annual costs under each plan option. Plans are required to submit biweekly data updates that Medicare uses to keep this tool updated throughout the year.

Why did Medicare repeal the Catastrophic Coverage Act?

However, this legislation was repealed just one year later, partially due to concerns regarding premium increases. The 1993 Clinton Health Reform Plan also included an outpatient drug benefit, but that reform effort ultimately failed due to a lack of public support.

Overview

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insu…

Program specifics

To enroll in Part D, Medicare beneficiaries must also be enrolled in either Part A or Part B. Beneficiaries can participate in Part D through a stand-alone prescription drug plan or through a Medicare Advantage plan that includes prescription drug benefits. Beneficiaries can enroll directly through the plan's sponsor or through an intermediary. Medicare beneficiaries who delay enrollm…

History

Upon enactment in 1965, Medicare included coverage for physician-administered drugs, but not self-administered prescription drugs. While some earlier drafts of the Medicare legislation included an outpatient drug benefit, those provisions were dropped due to budgetary concerns. In response to criticism regarding this omission, President Lyndon Johnson ordered the forma…

Program costs

In 2019, total drug spending for Medicare Part D beneficiaries was about 180 billion dollars. One-third of this amount, about 120 billion dollars, was paid by prescription drug plans. This plan liability amount was partially offset by about 50 billion dollars in discounts, mostly in the form of manufacturer and pharmacy rebates. This implied a net plan liability (i.e. net of discounts) of roughly 70 billion dollars. To finance this cost, plans received roughly 50 billion in federal reinsur…

Cost utilization

Medicare Part D Cost Utilization Measures refer to limitations placed on medications covered in a specific insurer's formulary for a plan. Cost utilization consists of techniques that attempt to reduce insurer costs. The three main cost utilization measures are quantity limits, prior authorization and step therapy.

Quantity limits refer to the maximum amount of a medication that may be dispensed during a gi…

Implementation issues

• Plan and Health Care Provider goal alignment: PDP's and MA's are rewarded for focusing on low-cost drugs to all beneficiaries, while providers are rewarded for quality of care – sometimes involving expensive technologies.

• Conflicting goals: Plans are required to have a tiered exemptions process for beneficiaries to get a higher-tier drug at a lower cost, but plans must grant medically-necessary exceptions. However, the rule denies beneficiaries the right to reques…

Impact on beneficiaries

A 2008 study found that the percentage of Medicare beneficiaries who reported forgoing medications due to cost dropped with Part D, from 15.2% in 2004 and 14.1% in 2005 to 11.5% in 2006. The percentage who reported skipping other basic necessities to pay for drugs also dropped, from 10.6% in 2004 and 11.1% in 2005 to 7.6% in 2006. The very sickest beneficiaries reported no reduction, but fewer reported forgoing other necessities to pay for medicine.

Criticisms

The federal government is not permitted to negotiate Part D drug prices with drug companies, as federal agencies do in other programs. The Department of Veterans Affairs, which is allowed to negotiate drug prices and establish a formulary, has been estimated to pay between 40% and 58% less for drugs, on average, than Part D. On the other hand, the VA only covers about half the brands that a typical Part D plan covers.