Why did my Medicare deduction increase?

Jul 14, 2021 · Since 2013, you’ll pay a 3.8% Medicare tax rate on your net investment income when the total amount exceeds the income thresholds. The tax, known as the Net Investment Income tax, will go into the government’s General Fund and not into Medicare. Most people only pay the 2.9% flat tax rate.

Why did Medicare deduction increase?

Jan 04, 2022 · January 4, 2022. Reviewed by John Krahnert. The 2022 Medicare tax rate is 2.9%. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Learn more.

Do Medicare deductions reduce the taxable amount of my income?

Nov 13, 2021 · The 14.5% increase in Part B premiums will take monthly payments for those in the lowest income bracket from $148.50 a month this year to $170.10 in 2022.

What is the maximum income taxed for Medicare?

Apr 26, 2022 · And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022. The standard Medicare Part B premium is also on the rise in 2022. The 2022 Medicare Part B premium is $170.10 per month, which is up from $148.50 in 2021.

Why did my Medicare tax withholding increase?

What is the additional Medicare tax rate for 2021?

| Employee pays | |

|---|---|

| Social Security tax (aka OASDI) | 6.2% (only the first $142,800 in 2021; $147,000 in 2022) |

| Medicare tax | 1.45%. |

| Total | 7.65% |

| Additional Medicare tax | 0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers) |

Did Medicare withholding go up for 2022?

2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).Jan 12, 2022

Who pays the 3.8 Medicare tax?

Will tax brackets change in 2022?

Did FICA increase in 2021?

Why did my taxes go up on my paycheck 2022?

What is the federal tax rate for 2022?

| Tax Rate | Taxable Income (Single) | Taxable Income (Married Filing Jointly) |

|---|---|---|

| 12% | $10,276 to $41,775 | $20,551 to $83,550 |

| 22% | $41,776 to $89,075 | $83,551 to $178,150 |

| 24% | $89,076 to $170,050 | $178,151 to $340,100 |

| 32% | $170,051 to $215,950 | $340,101 to $431,900 |

Did federal payroll taxes change in 2022?

What income is subject to the 3.8 Medicare tax?

What is the additional 3.8 tax?

At what income level does the 3.8 surtax kick in?

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

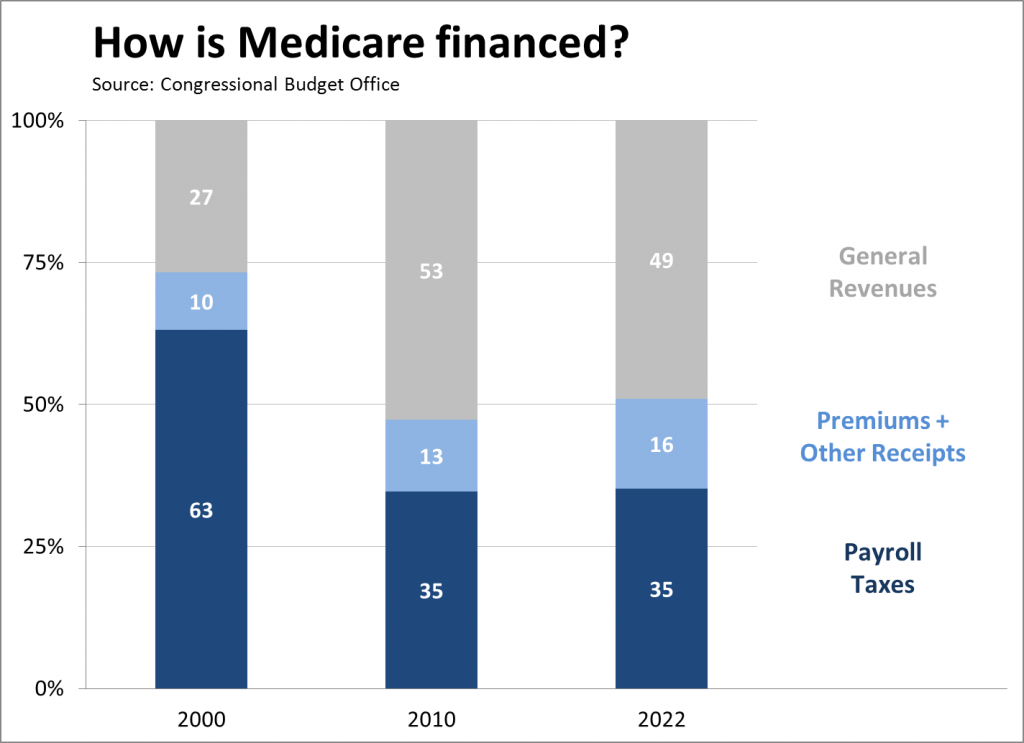

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

When did Medicare tax increase?

The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How much does Medicare pay?

Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings. Self-employed people pay the entire 2.9 percent on their own.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.